Stocks Aren’t Cheap

/

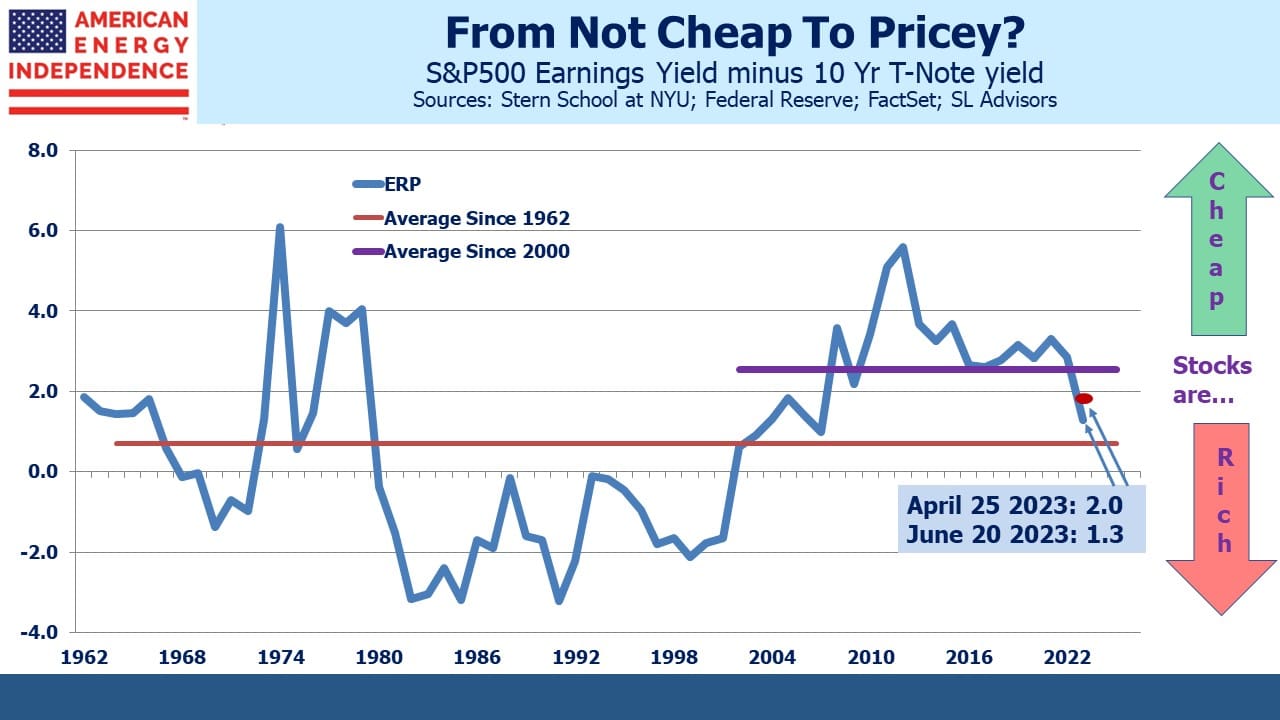

The Equity Risk Premium (ERP) is a measure of the relative attractiveness of stocks versus bonds. It compares the earnings yield on stocks with the interest rate on ten year treasury notes. For much of the past decade it’s shown stocks to be relatively attractive compared to the average relationship going back to 1962 – of no particular significance also my entire lifetime.

Quantitative Easing (QE), first unveiled with acute insight by Fed chair Ben Bernanke during the Great Financial Crisis (GFC) and abused by successive Fed chairs ever since, made bonds unattractive. QE has evolved from a unique solution to a banking crisis into a form of partial Federal debt monetization. The problems facing regional banks trace their roots to many banks mistakenly concluding that if the Fed was loading up on long term bonds that must make it acceptable to do so. This suspension of critical thinking exposed the absence of competent risk management. America’s more than 4,000 banks have a greater need of chief risk officers than the pool of qualified candidates can supply.

Since the founding of your blogger’s firm, SL Advisors, in 2009, stocks have represented the only meaningful source of return. Bonds have had some good years because the Fed has more or less adopted permanent QE, at least judging from their balance sheet. Repeated promises to kick the QE narcotic habit have done little more than impose a brief pause in the inexorable growth of the central bank’s bond holdings.

The Fed’s eventual zeal to vanquish inflation has over the past year or so improved the relative appeal of bonds. But fixed income investors must still compete with return-insensitive foreign central banks, pension funds with inflexible investment mandates that require bonds, and our own Federal Reserve with its bloated [$8TN] in holdings. Bonds are a long way from cheap. Ten year yields of 3.75% remain inadequate compared with long term inflation unlikely to return to 2% and a Debt:GDP ratio heading relentlessly up. But some might agree that yields on shorter maturities justify the discerning investor in considering modest exposure. Treasury bill yields above 5% almost seems like a fair return, provoking nostalgic recollections of the time value of money and the “float” banks make on the days required in processing checks.

Last year we responded to the lethargy with which Charles Schwab Bank and its peers raise deposit rates by sweeping client cash into two year treasury notes. More recently our Florida homeowners’ association moved its funds in excess of working capital out of a parsimonious 2% bank “savings” account and into the glorious bounty of 5.25% 90-day treasury bills.

In April when we last examined the ERP, we concluded that stocks were not cheap. Behavioral finance teaches that overconfidence afflicts too many investors. Opinions come with much wider confidence intervals than are usually acknowledged. Humility among investors is acquired while learning this, if fortunate at only modest expense. There are many ways to value the market, some of which probably make it appear cheap. The ERP is not a secret.

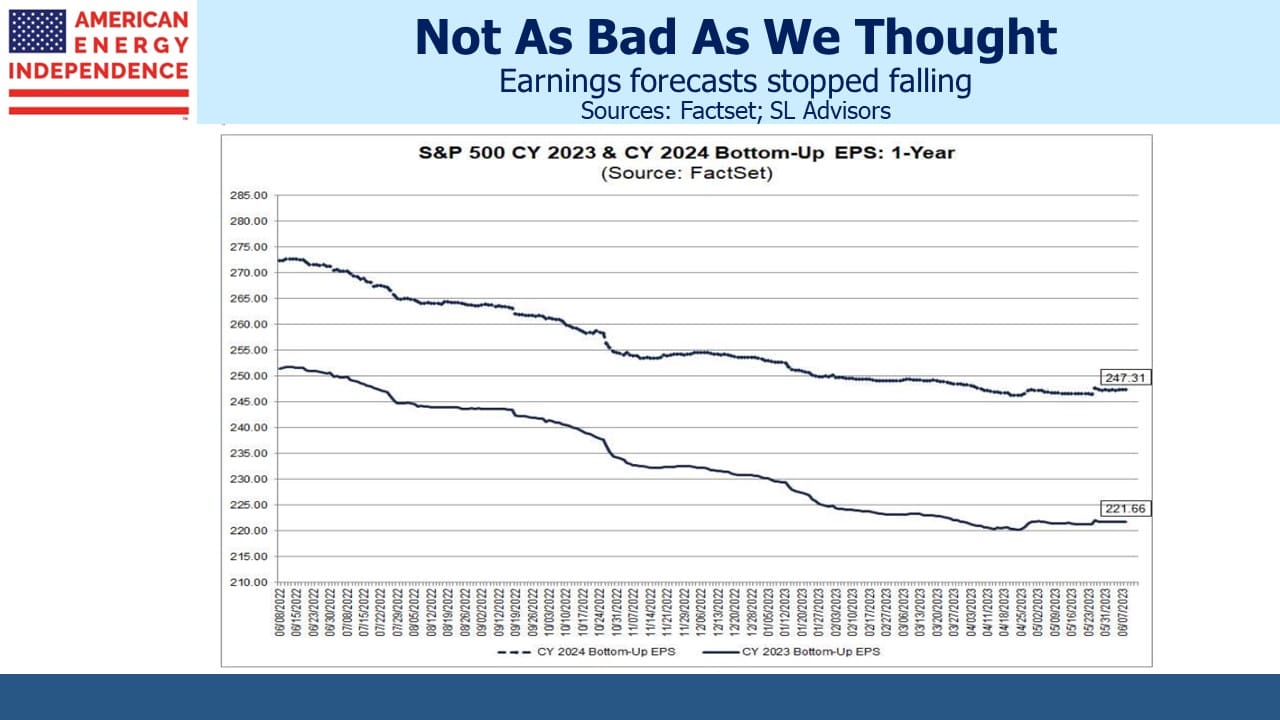

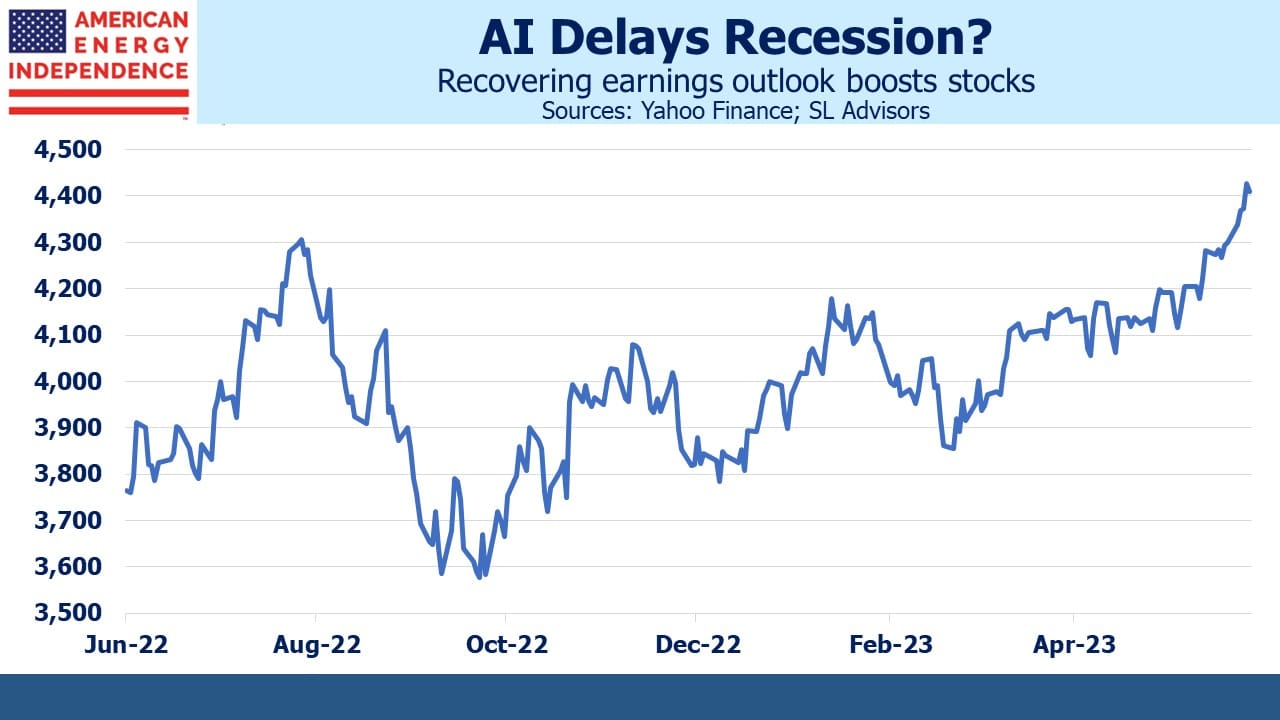

Since April, earnings forecasts have stopped falling. This stabilization has offered hope that the recession promised for later this year will be postponed, helping propel stocks higher. The yield curve has similarly responded. At one point during the demise of Silicon Valley Bank, traders were betting on a Fed Funds rate below 3% by the end of next year, suggesting a cut of almost 2%. More recently, Fed chair Powell’s warning of a couple of years before rates come down left many unconvinced. But traders have shown him enough respect that the ignominy of a premature capitulation on inflation has been quietly shelved.

Stocks have looked beyond the end of declining earnings forecasts and anticipate upward revisions. Expected growth in profits for next year has moved above 10%. However, when stock prices and bond yields rise together, the inevitable casualty is equity valuation. Whatever you thought in April, an S&P500 at 4,400 is less appealing than the 4,100 of two months ago.

We’re not about to eschew stocks to become bond investors. There’s no alternative to equities for investors who wish to preserve their capital’s purchasing power. Tactically switching out of stocks and back in requires two good timing decisions. Taxes on realized gains make it even harder.

At the risk of repeating an admonition frequently offered on this blog, midstream energy infrastructure stocks remain dirt cheap. Ample dividend coverage, continued financial discipline and pipeline tariffs that are often linked to inflation make this a sector whose entry needs no skill at market timing. We’re not selling anything.

But for the investor with cash to invest in the broader market, we’d suggest that the need for action is not urgent. Today’s entry point is likely to be available again, and perhaps better ones too.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!