The Pragmatic Energy Transition

/

The BP Statistical Review of World Energy used to be a fact-based compilation of useful data. Skimming through the 2016 version, it recounts what happened and comments on likely trends. In recent years it has unfortunately degenerated into a political document. The historic data remains useful, but its implausible forecasts are there to defend itself against woke climate cops accusing it of burning up the planet.

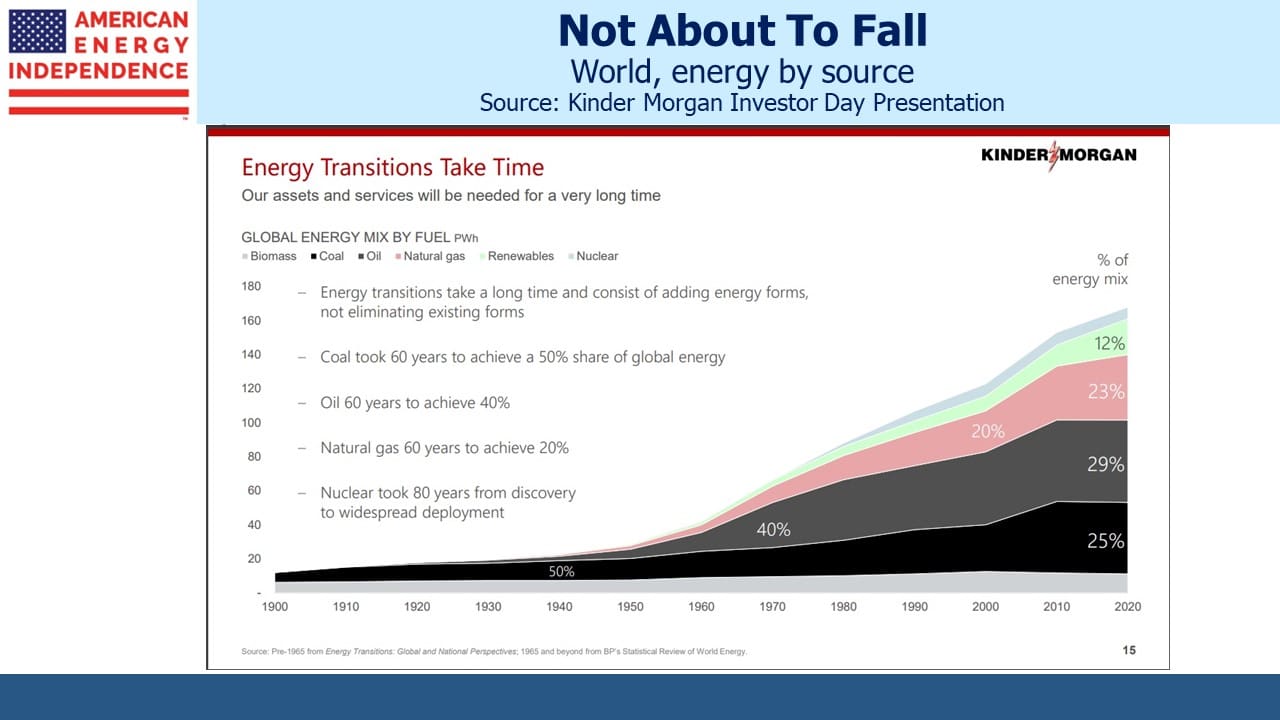

BP can point to its Net Zero and Accelerated scenarios which show global CO2 emissions immediately declining from 40 Gigatonnes (GT) to reach 9 and 4 GTs respectively by 2050. This shows they’re on board with global energy consumption dropping by a third or a fifth, at odds with over a hundred years of history. The emerging world’s insatiable desire to raise living standards and energy use will somehow be ameliorated by a dramatic increase in efficiency improvements. Nobody who has studied the issue takes this seriously.

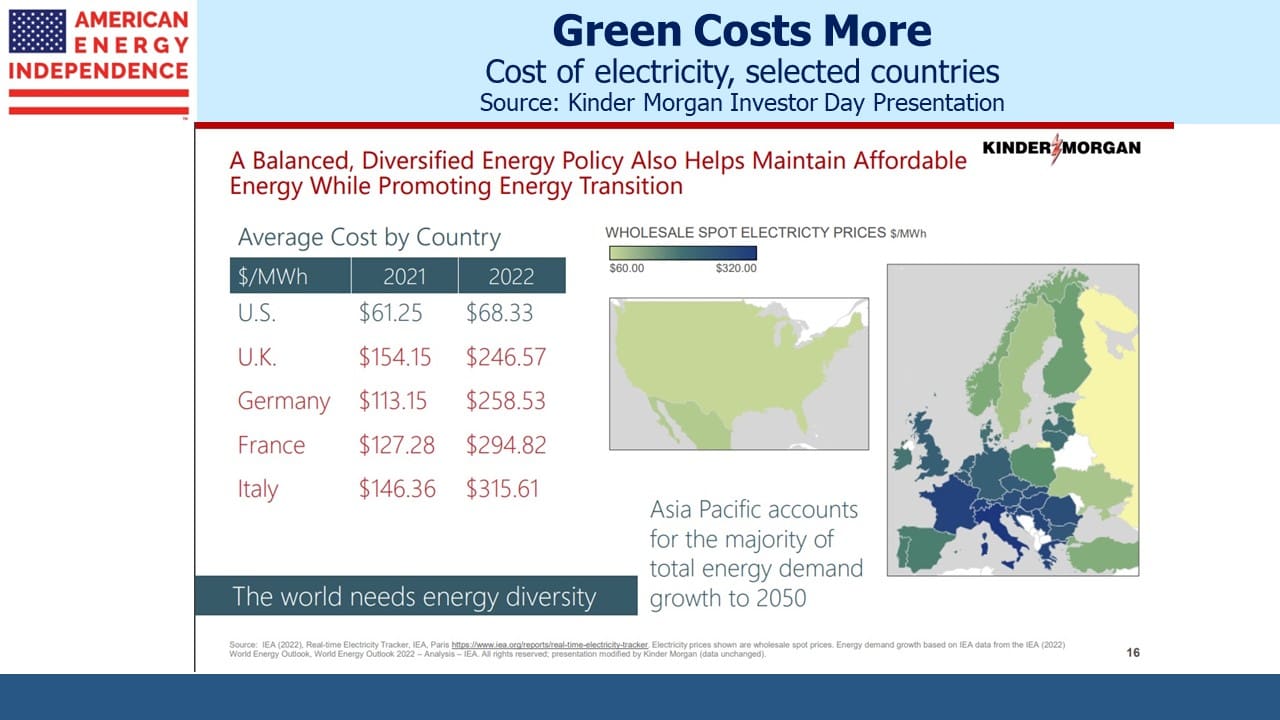

If you accept that solar and wind are better for the environment, they are certainly not more efficient. They are much less energy dense which means they require more land. Long distance transmission lines move power from lightly populated areas where it’s produced to cities where it’s needed. Batteries or natural gas power plants provide back up for weather-induced intermittency. More renewables means higher energy costs, possibly a price worth paying, and a choice made most clearly in western Europe.

BP can wave this document at the climate extremists who reject everything but solar and wind, to show that they are directionally aligned if not yet in the same place. Net Zero and Accelerated are climate sound bites.

But the executive summary then adds, “These scenarios are not predictions of what is likely to happen or what BP would like to happen.”

BP neither wants nor expects Net Zero or Accelerated? So why include them? It’s how big energy companies deflect their left-wing critics while delivering the energy the world needs in the form it wants, at considerable profit last year. What BP puts in its energy outlook doesn’t reflect its assumptions when investing capital, allowing them to act differently than they speak.

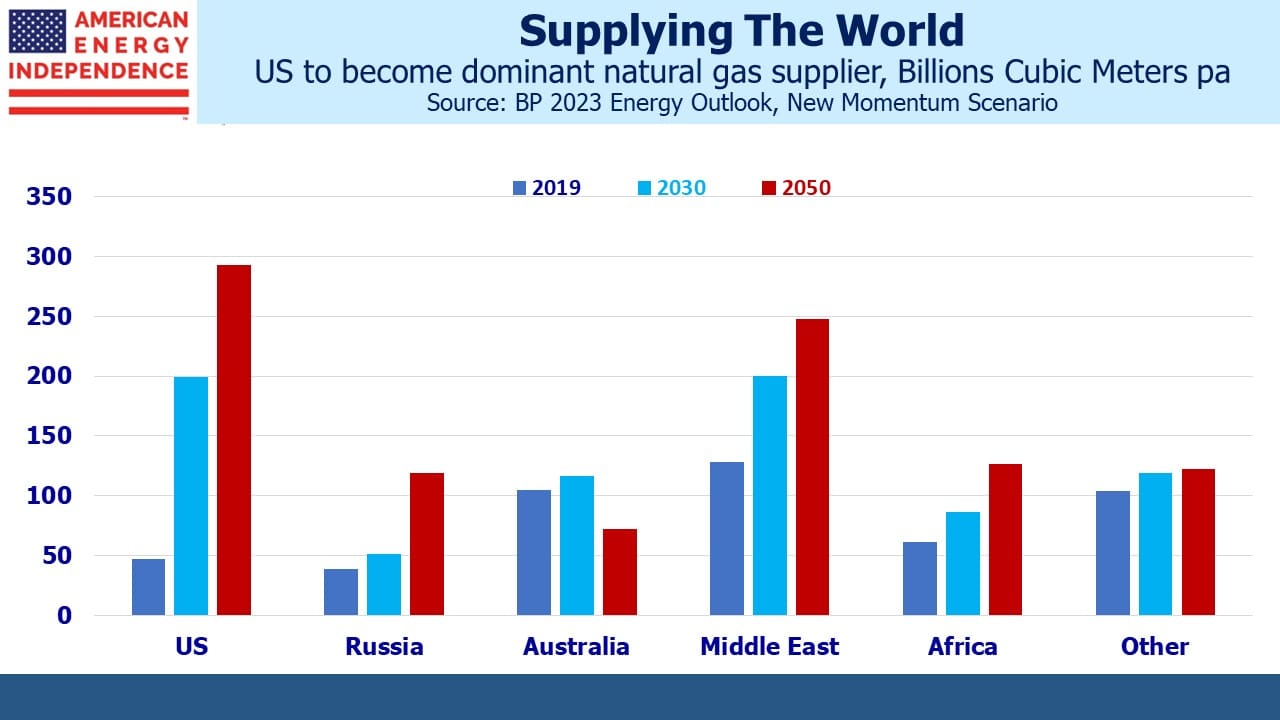

New Momentum, the third and only realistic scenario BP offers, is based on current trends and plausible policies. It’s the only one worth considering.

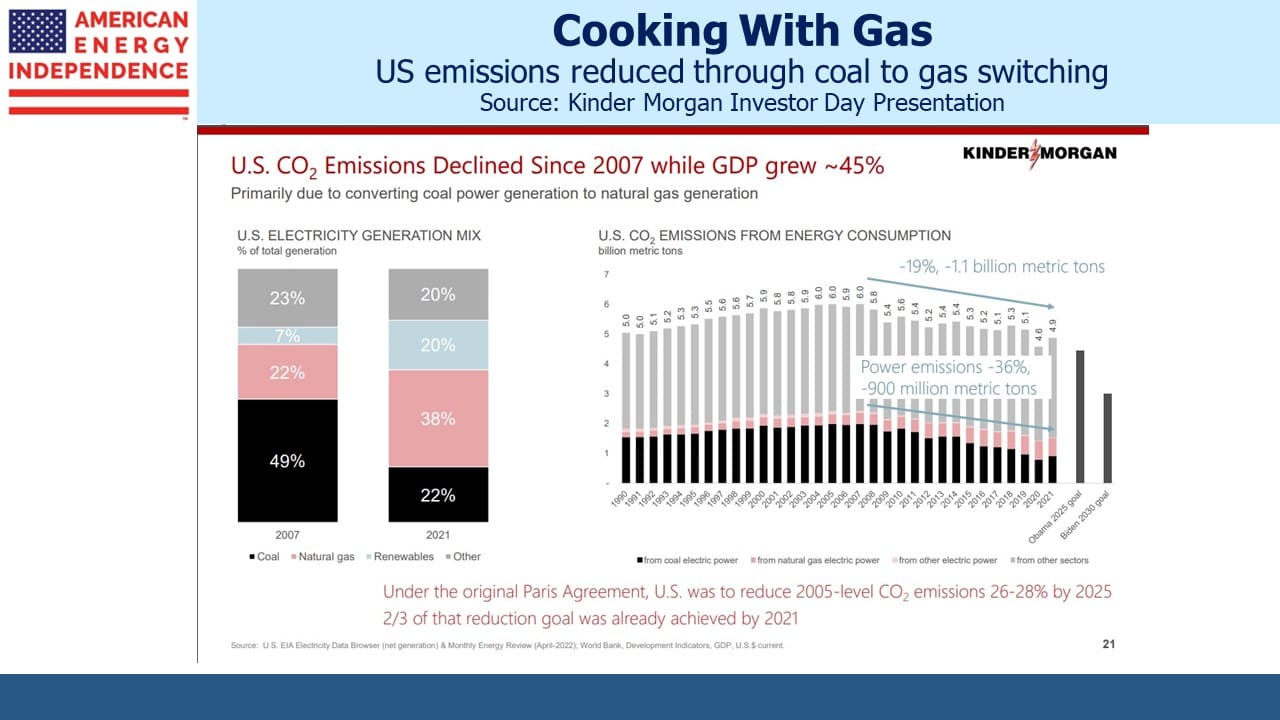

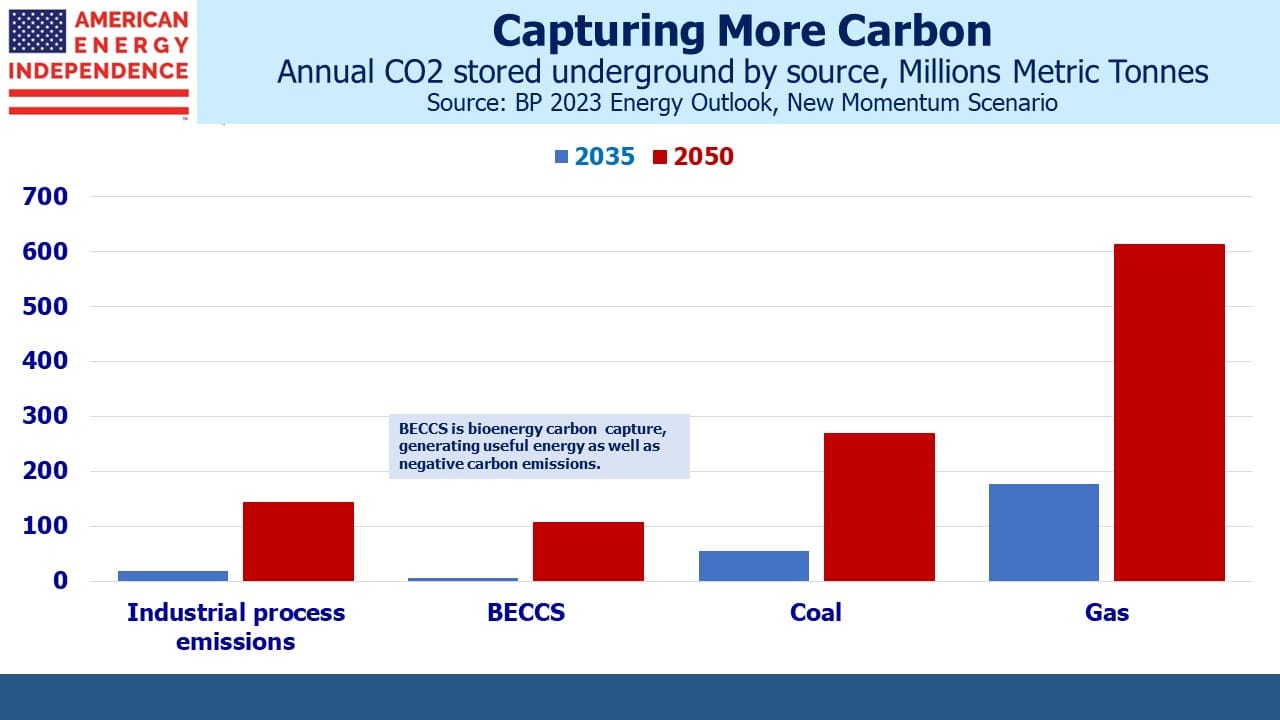

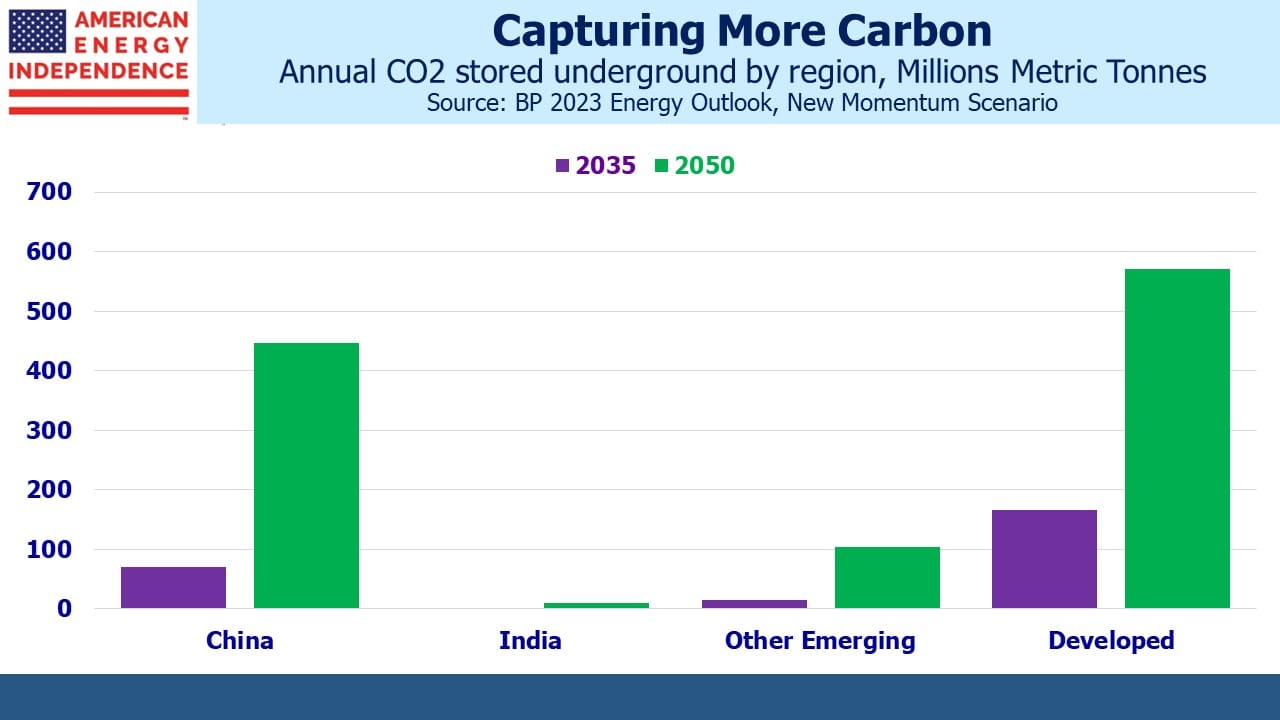

We think the world will reduce greenhouse gas emissions with cleaner energy (coal to gas switching), increased use of other forms of reliable energy (nuclear; hydrogen), carbon capture and new technologies such as additives for cattle feed (see How Seaweed Can Fight Global Warming).

Solar and wind will assuredly grow but don’t offer the reliable long term cash flows available in infrastructure. The reality of investment results caused BP to slow its planned reduction in fossil fuel production from 40% to 25% by 2030 amid disappointing returns on renewables. Shell plans to keep renewables at about 14% of capex, flat with last year.

Duke Energy is taking a $1.3BN impairment loss on the sale of its renewables business. Dominion Energy recorded a $1.5BN impairment on its unregulated solar business. Exxon has slashed funding for Viridos Inc, a company in La Jolla, CA that makes environmentally friendly fuels from algae. This initiative was once among Exxon’s highest profile in its Low Carbon Solutions unit. They now see better opportunities in carbon capture and hydrogen.

The outlook for practical climate change solutions is improving. Growth in natural gas trade will temper coal consumption and offers the world’s best chance to reduce emissions if emerging countries follow what the US has done. The Inflation Reduction Act increased the tax credits for carbon capture. This is causing much greater take-up than the Congressional Budget Office (CBO) forecast, so Credit Suisse believes the $3BN ten year cost the CBO originally forecast is likely to be over $50BN (see US Oil And Gas Production Growing).

Enbridge has 10-15 hydrogen projects underway in Ontario and Quebec. They’re developing a hydrogen and ammonia production/export facility near Corpus Christi, TX. Converting renewable energy into clean-burning liquids that can be transported via pipeline or ship to power plants seems more viable than a grid that’s overly dependent on sunny and windy weather. It pushes the intermittency problem back to a production facility, doesn’t rely on batteries or require extensive new transmission lines.

Midstream is transitioning beyond fossil fuel infrastructure to play a critical role in reducing emissions. The fear of stranded assets is receding in favor of repurposed assets that gain a longer useful life and a higher net present value.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

It’s amazing how many media writers want to know Advisors (my) opinion about ESG Investing, they were the ones pontificating about our planets problems. Following, basically, their 1st year of pushing the theory on those responsible for investing Other Peoples’ money, the track record is awful. I’m surprised at the number of “Advisors”, (actually concerned about the number of advisors) at my BD who took big hits because they thought ESG investing was the “right thing to do”. Hopefully, the loss of both clients and fees will teach them to invest appropriately – when the time is right.

I personally like the idea of Hydrogen as an energy source, more than any other source, and will some day – with a full scale assault, invest clients funds into companies who are operating successfully as free markets often allow for. Grabbing stocks in their infancy is much riskier – certainly not for the faint of heart, or those clients looking for viable/secure income to live off of.