Confronting Asymmetric Risks

/

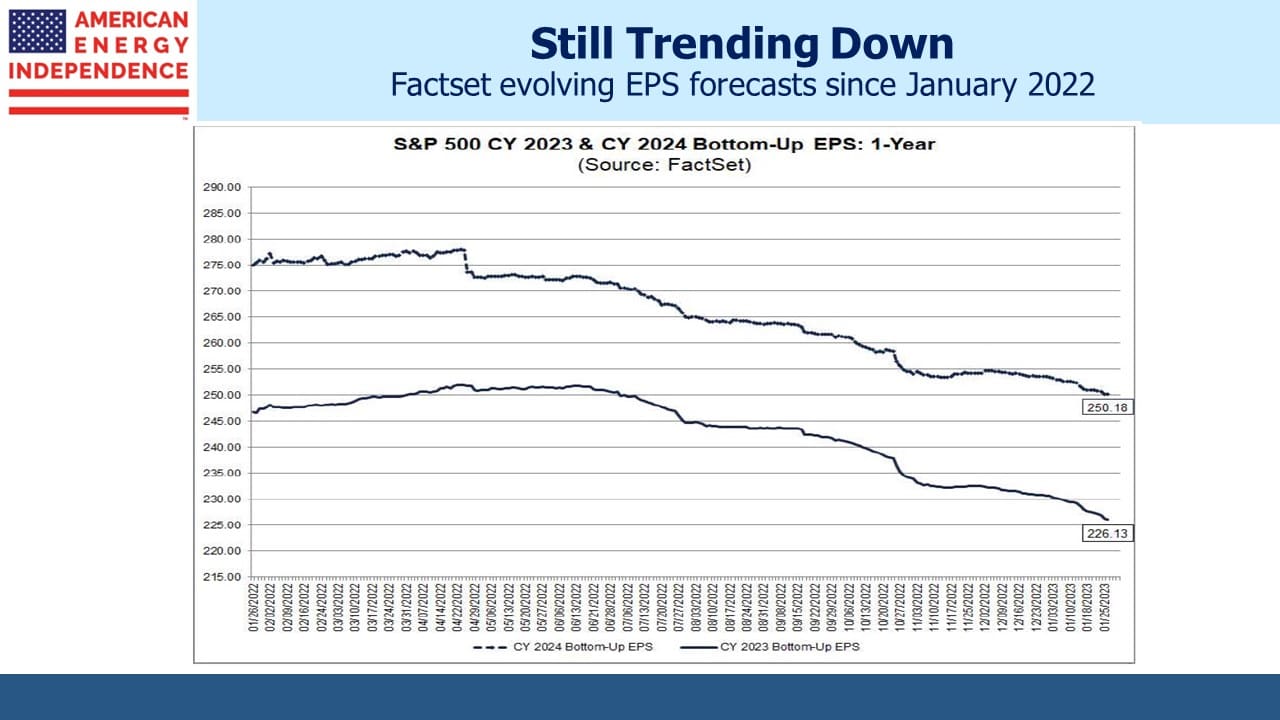

The Fed’s mid-week policy meeting will punctuate a busy earnings week. Sell-side analysts continue to ratchet down earnings forecasts. Factset reports bottom-up 2023 earnings expectations of $226, down over 10% compared with last spring when Fed tightening started to have an impact.

Energy continues to be a bright spot, providing positive surprises in 4Q earnings released so far. Companies continue to return capital to shareholders. Chevron tripled its planned buybacks to $75BN over the next five years, drawing more economically illiterate criticism from the White House for not plowing this money into increased production. Incoherent energy policies and fair-weather friendship aren’t inducing Chevron CEO Mike Wirth and other energy executives to alter their capital allocation.

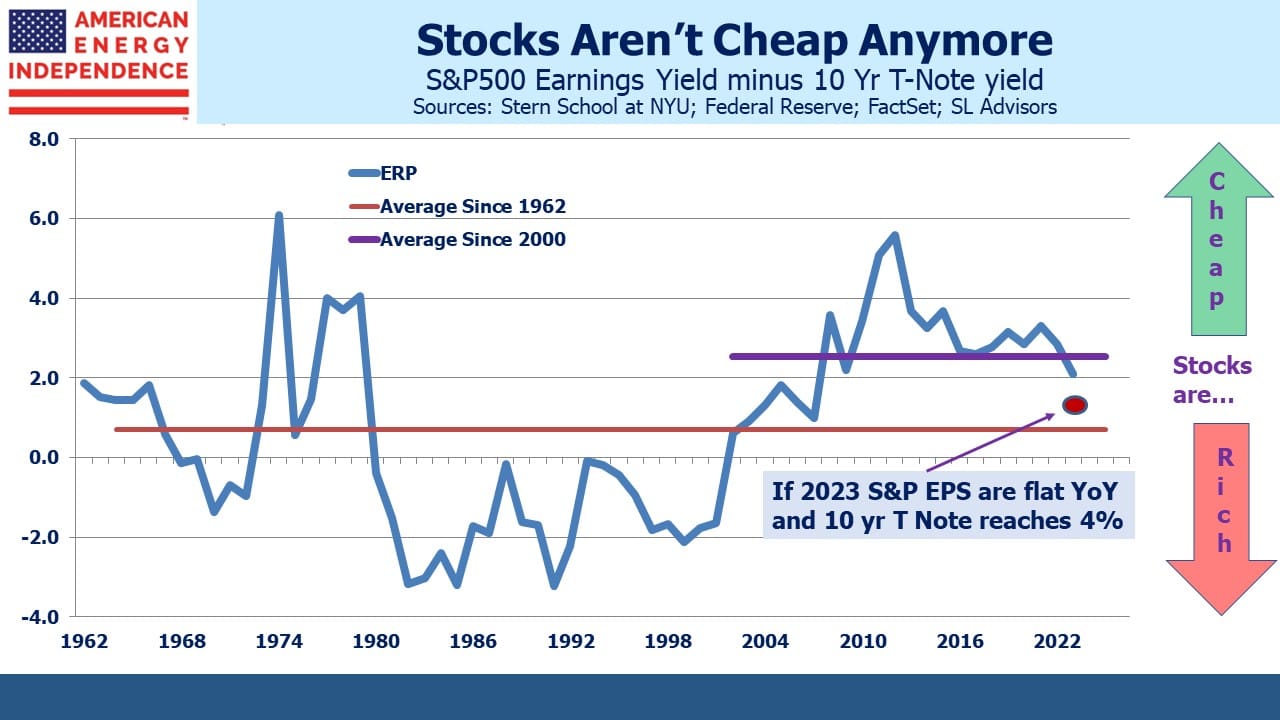

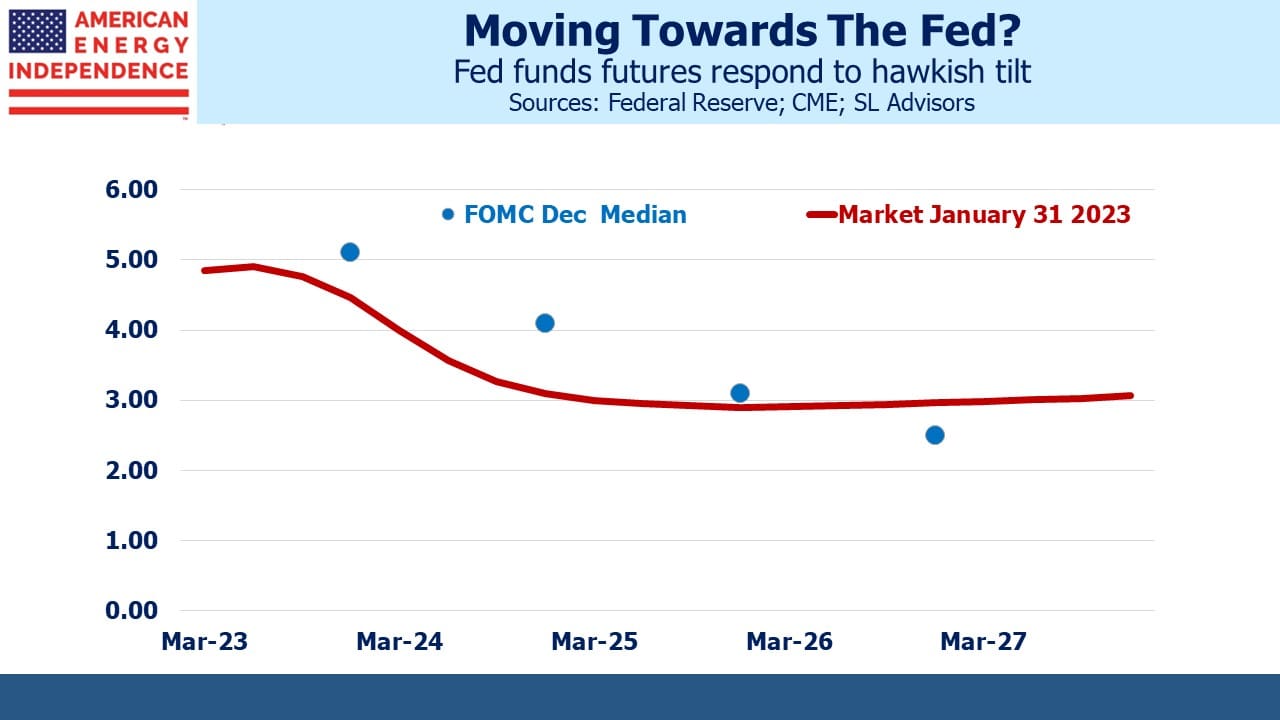

The broad equity market isn’t cheap, based on the Equity Risk Premium (ERP). Stocks are vulnerable to higher interest rates. Fed funds futures project a peak in Fed policy this summer with rates coming down later this year. By contrast, the FOMC Summary of Economic Projections (SEP) released on December 14 pushes that scenario back around a year.

Fed funds futures six to twelve months out differ as much as 1% from the FOMC. Data since the last SEP has been on balance slightly weaker. So a surprising move in futures to more closely align the two would leave the stock market vulnerable, especially given the trend towards weaker earnings forecasts.

Morgan Stanley strategist Michael Wilson is cautious because of the Fed outlook, although Robert Kad, who heads up their MLP and Energy Infrastructure research, is gloriously bullish on his sector.

Midstream energy infrastructure should be resilient to higher rates. Yields of 5-6% are already attractive, but more important is the embedded inflation hedge that is in many pipeline tariffs. Inflation expectations remain low considering recent history. Risk here is also skewed to the upside. Wells Fargo has estimated that half the industry’s EBITDA is linked to inflation protected contracts.

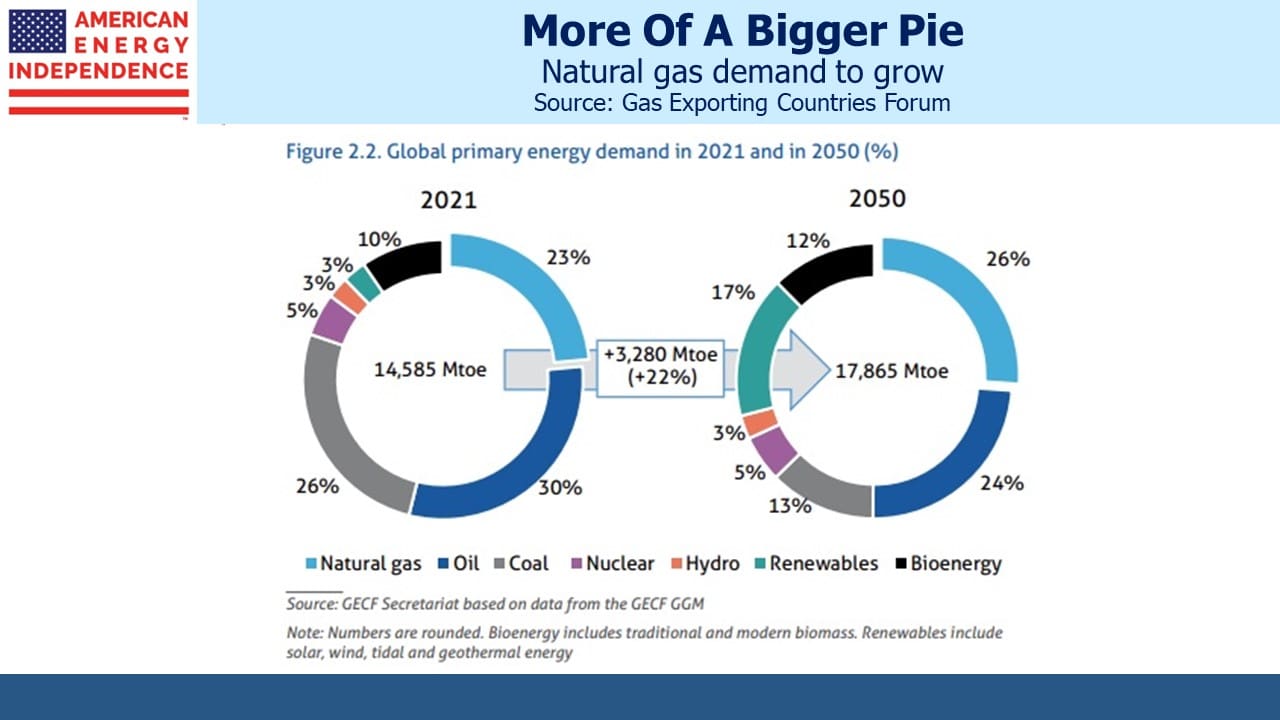

European demand for LNG imports jumped last year, but over the long-term emerging economies are likely to grow consumption. The Gas Exporting Countries Forum expects natural gas to increase market share from 23% to 26% by 2050 while global energy demand increases at 0.7% pa. Thanks to Stephen Stapczynski of Bloomberg for pointing this out.

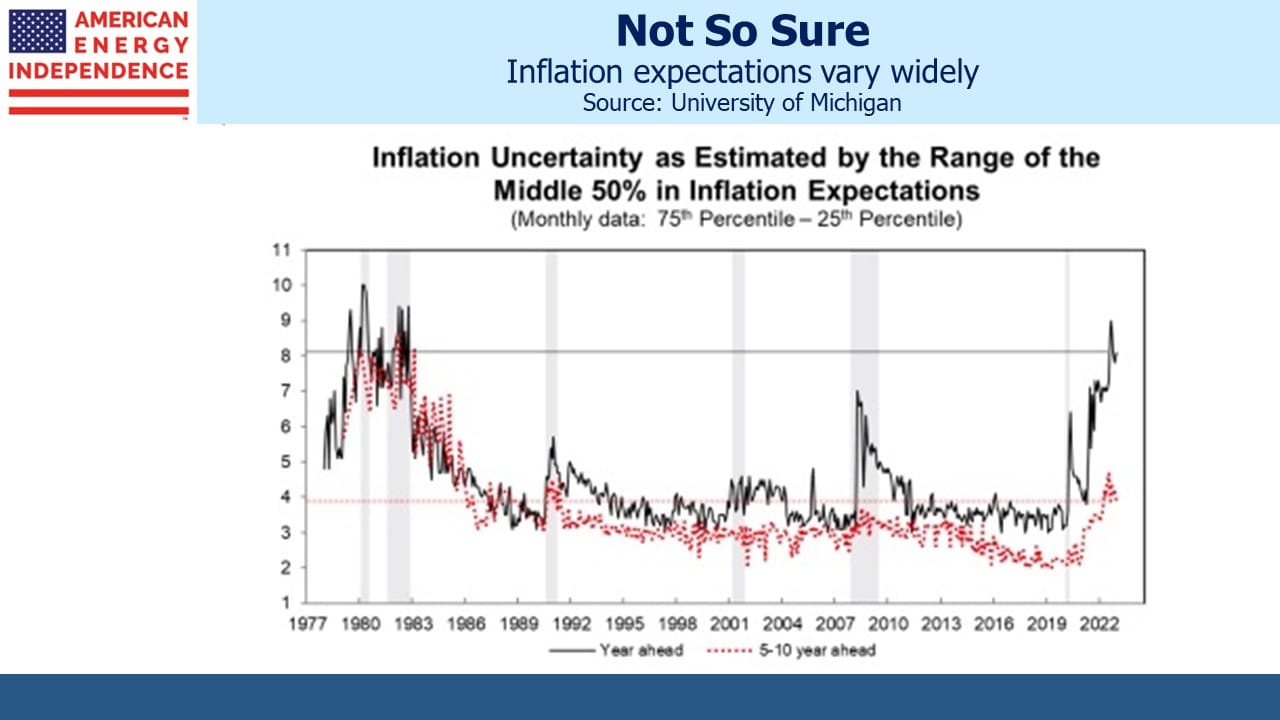

The University of Michigan consumer survey revealed the uncertainty consumers have about the inflation outlook. Although households expect it to return to 2% based upon the average of responses, the range of expectations is the highest it’s been since the 1980s. The difference between the 25th and 75th percentiles for 5-10 year inflation is 4%. Over the next year it’s 8%. There’s not high confidence that it’s returning to 2%.

Benign inflation forecasts, which are similar in the bond market, represent asymmetric risk. Inflation isn’t going to trend below 2%. Retirement planning should be based on 3% and scenarios should be run with higher rates to test how well an investment portfolio will meet one’s spending needs. There are several reasons why conventionally reported inflation figures aren’t a good basis on which to plan growth in living expenses (see Why You Can’t Trust Reported Inflation Numbers). The most obvious is the hedonic quality adjustments that are routinely applied to the CPI to reflect improvements in quality. CPI tries to measure a basket of goods and services of constant utility. Quality improvement at the same price is treated as a price cut.

Hedonic quality adjustments are made to a wide range of products such as clothing, electronic goods and housing. The problem this creates for a consumer is that if a jacket, iPhone or rental property provides better quality at the same price, you don’t have any money left over even though your utility has risen. If you plan on replacing your iPhone regularly in retirement, it’s going to cost you more even though the Bureau of Labor Statistics calculates iPhones are cheaper (because they’re better).

Returning to the ERP – based on the past two decades, the S&P500 is somewhat expensive compared with bonds. Low inflation expectations and optimistic futures create asymmetric upside risk to interest rates, and downside risk to earnings, forecasts for which are trending lower. Both leave stocks vulnerable.

For now, Factset bottom-up earnings for 2023 is for 3% growth over 2022. Flat earnings and ten-year yields back to 4% where they were in November would require a 15% drop in the S&P500 before the ERP was back to its two-decade average. We’re not selling stocks for long-term investors, but the risk asymmetry suggests little need to rush purchases.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!