NextDecade Sees A Bright Future

Most US energy investors are familiar with Cheniere, America’s leading exporter of Liquified Natural Gas (LNG). Founded in 1996, the company was originally dedicated to increasing domestic supply, first as an oil & gas exploration business and then as an LNG importing company, which looked unlikely to keep up with growing demand. The Shale Revolution turned America into an exporter of cheap natural gas. Cheniere pivoted from importing to exporting, and currently ships just under half the LNG that leaves US facilities.

Natural gas is much trickier to move than oil or coal. Unless it’s traveling through a pipeline it has to be cooled and compressed. LNG export facilities cool methane and reduce it to 1/600th of its volume, while regasification plants at the receiving end warm it up for use by customers.

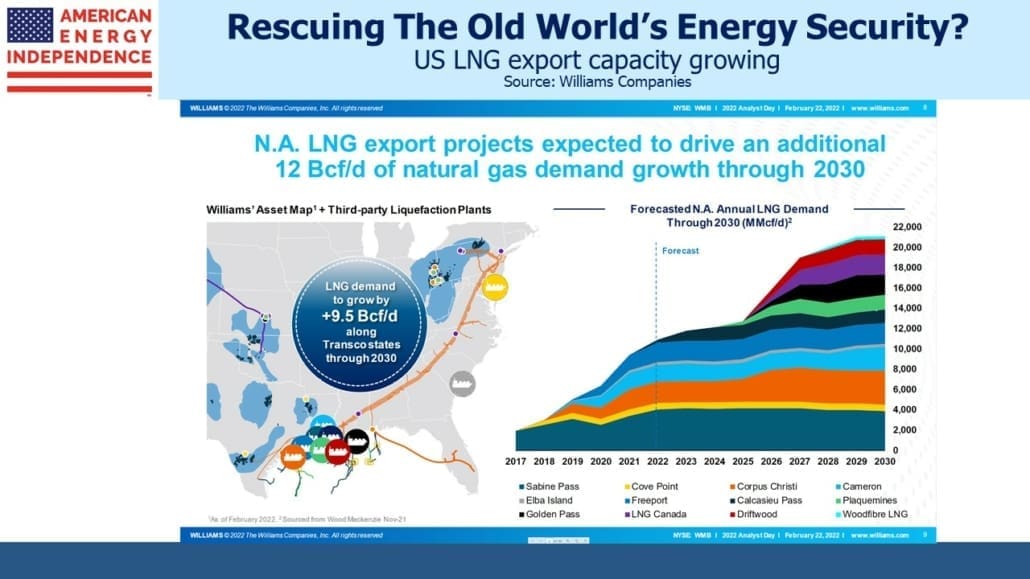

Not surprisingly, LNG facilities take years to construct. This makes it possible to project US export capacity out several years, based on existing projects either under construction or approaching Final Investment Decision (FID).

NextDecade was founded in 2010 by Kathleen Eisbrenner who took the company public in 2017 before retiring a year later. Their journey to building an LNG export facility has been long. In 2020 French utility Engie ended negotiations to become an anchor buyer due to concerns about flaring and methane leaks associated with US natural gas production.

This prompted NEXT to reposition themselves as a supplier of responsibly sourced gas that is chilled and compressed via a zero-emissions process. They even created a new division, Next Carbon Solutions, to lead this effort and explore selling their carbon capture expertise to other companies.

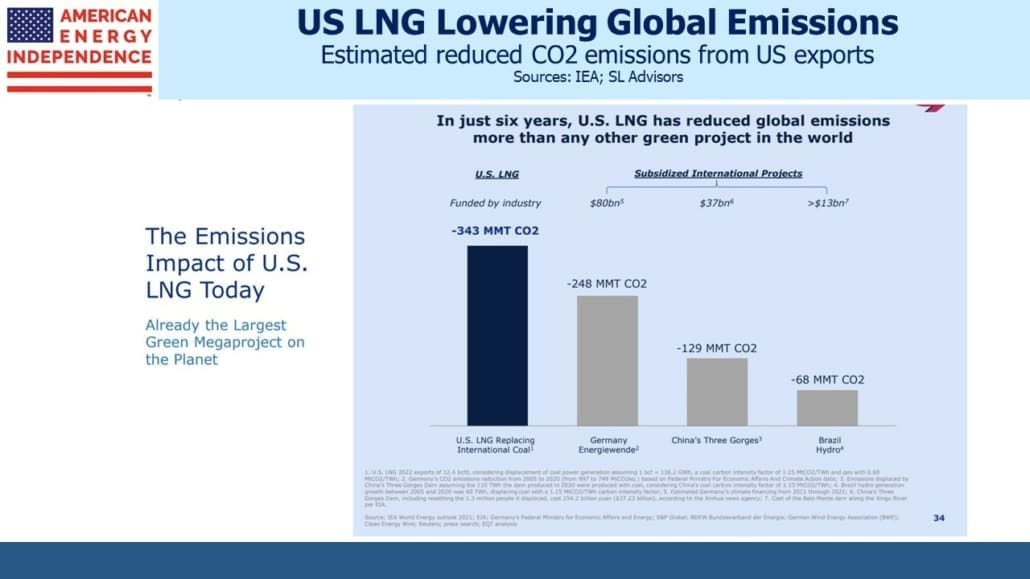

Data from the International Energy Agency (IEA) suggests that US exports of LNG have done more to reduce global CO2 emissions than any other project, including Germany’s drive into renewables (“Energiewende”). Last year the US Energy Information Administration (EIA) noted switching from coal to natural gas was the biggest driver of reduced CO2 emissions, a fact ignored by climate extremists.

Global coal consumption continues to increase, largely in emerging economies. Switching to natural gas for power generation remains the world’s most realistic hope for emissions reductions.

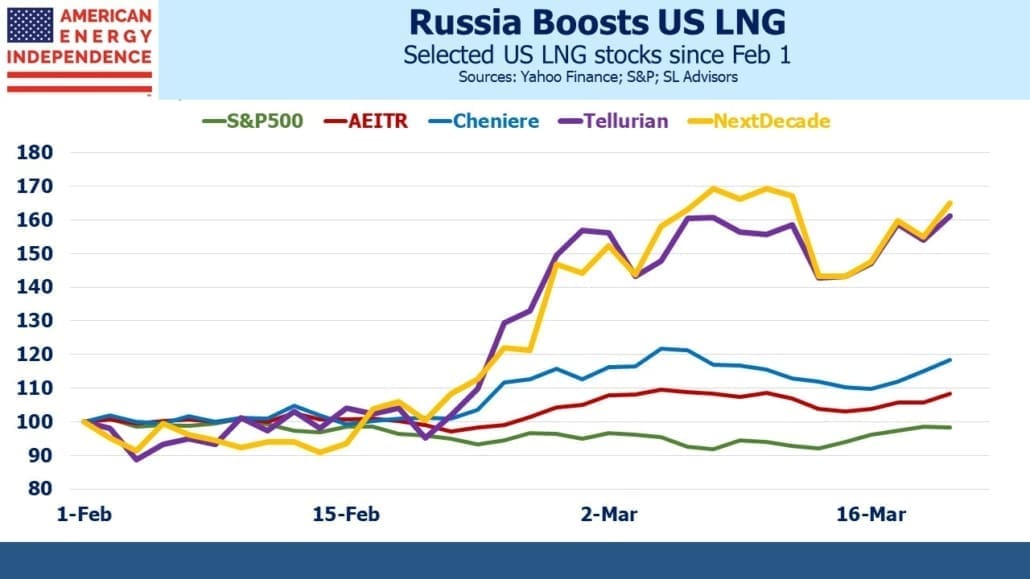

The outlook for US natural gas, already positive, received a further boost when Russia invaded Ukraine (see Russia Boosts US Energy Sector). Within days Germany had acknowledged its strategic error in relying so heavily on Russia for natural gas. Two new LNG import facilities are now planned on Germany’s north coast, and construction is expected to be fast-tracked. They are negotiating a long-term purchase agreement with Qatar.

Markets were quick to anticipate what Europe’s abrupt shift in energy policy means for US natural gas. Since February 1, Cheniere is 20% ahead of the S&P500 and 10% ahead of the American Energy Independence Index (AEITR). NextDecade and Tellurian, another company planning to export LNG, have both rallied over 60%. The odds of these two obtaining the necessary financing have improved sharply.

We had an opportunity to talk with Michael Mott, Senior VP, Next Carbon Solutions. Michael described a process that will capture up to 90% of the CO2 involved in LNG – both the pre-combustion when CO2 and other impurities are separated from the methane, and the CO2 emissions generated from energy use in chilling the methane for loading and transportation as LNG. He believes this will be the world’s first LNG facility that uses Carbon Capture and Sequestration (CCS), resulting in the “greenest LNG in the world.” NCS is planning to market its technology for capturing CO2 from the combustion of natural gas to others.

NextDecade’s Rio Grande site where they plan to build trains 1 and 2 of their LNG facility has all the necessary permits in place and is “shovel-ready”. They expect to secure financing to allow FID in 2H22. The war in Ukraine has added urgency to potential LNG buyers to secure supplies. Mott described the current market as the “strongest I’ve ever seen” and noted that analysts were still only belatedly catching up with how tight supply conditions will be in the years ahead.

NextDecade is taking a traditional approach to pricing, in that contracts are typically linked to the Henry Hub or a Brent crude-related benchmark and where NextDecade earns a set margin. This is similar to Cheniere’s approach, and by reducing NextDecade’s direct commodity price risk it makes securing financing easier.

FERC recently included resulting emissions as an additional factor they consider in approving pipeline projects. This is controversial to many in the industry – Kinder Morgan and Enbridge have both publicly criticized FERC’s changed posture. Mott believes this is an increasing trend, and that NextDecade is positioning itself to offer solutions.

The failed Build Back Better legislation included increased 45Q tax credits for CCS, and many expect this element to ultimately be passed. Mott said the industry believes a carbon price of at least $100 is necessary to incentivize investment and thinks that will eventually become a reality with direct payments being preferred over tax credits. CCS could eventually become a big source of growth for the pipeline sector.

NextDecade is a company worth watching. For the full version of our conversation with Michael Mott, check out our next podcast.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

On 11-17-2021 Rio Grande LNG’s submitted a Limited Amendment application to FERC asking permission to include CCS Systems during the construction of its LNG Terminal (https://elibrary.ferc.gov/eLibrary/idmws/file_list.asp?accession_num=20211117-5060)

Much still depends on whether or not FERC a) approves the application as written, b) decides to do an Environmental Assessment on the Application, or 3) resets its schedule for making its decision on which path to take. It was to make this decision 90 days after 11-29-2021 (https://elibrary.ferc.gov/eLibrary/filelist?accession_num=20211129-3020). 11-29-2021 + 90 = 02-27-2022 but as of 03-22-2022, FERC hasn’t yet posted any decision regarding the application.

At this point, it’s not clear that Rio Grande LNG can reliably guarantee any delivery of Net Zero LNG.

In addition, much still depends on Rio Grande LNG getting a firm LNG offtake contract for the 9 more mtpa of LNG in addition to its 04-01-2019 contract with Shell it needs to make an initial FID on two LNG liquefaction production trains that are to be built sequentially — each capable of producing 5.87 mtpa of LNG.

So it’s not clear when Rio Grande LNG will be able to produce its initial 5.87 mtpa of LNG.

And on Enbridge getting its Rio Bravo Pipeline Limited Amendment to its 11-22-2019 FERC permit approved. On 10-26-2020 FERC set a 03-22-2021 Federal Authorization Decision Deadline but, so far, has taken no further action on Rio Bravo Pipeline’s Limited Amendment application. The last document under Rio Bravo Pipeline’s FERC Docket Number CP20-481-000 is dated 10-06-2021 (https://elibrary.ferc.gov/eLibrary/filelist?accession_num=20211006-5120).

So it’s not clear that Enbridge can start construction on the Rio Bravo Pipeline’s Line 1 (of 2 lines) if and when Rio Grande LNG makes its initial FID and gives Bechtel the Order To Proceed with the construction of its initial 2 of 5 planned LNG liquefaction Production Trains.

Last but not least, on 11-22-2021, Sierra Club notified FERC that it would request a 5th Circuit Court review of the US Army Corps of Engineers Section 404 Permits for the RGLNG and Rio Bravo Pipeline projects (https://elibrary.ferc.gov/eLibrary/filelist?accession_num=20211122-5129). Last I heard, Sierra Club planned to submit its petition to the Court on 02-14-2022.

Full disclosure: I’ve been an active member of Save RGV from LNG (now simply Save RGV) since May 2014 (https://www.savergv.org/, http://www.facebook.com/saveRGVfromLNG).

John Young, San Benito TX

Registered with FERC as an Intervenor opposed to:

1) The originally paired Rio Grande LNG and Rio Bravo Pipeline projects on 05-25-2016 (http://elibrary.ferc.gov/idmws/file_list.asp?accession_num=20160609-5280);

2) Enbridge’s Rio Bravo Pipeline Company’s Rio Bravo Pipeline project on 06-26-2020 (https://elibrary.ferc.gov/eLibrary/idmws/file_list.asp?accession_num=20200626-5079); and

3) Rio Grande LNG’s application for a Limited Amendment on 11-22-2021 (https://elibrary.ferc.gov/eLibrary/idmws/file_list.asp?accession_num=20211122-5057).