Markets Lose Faith In 2% Inflation

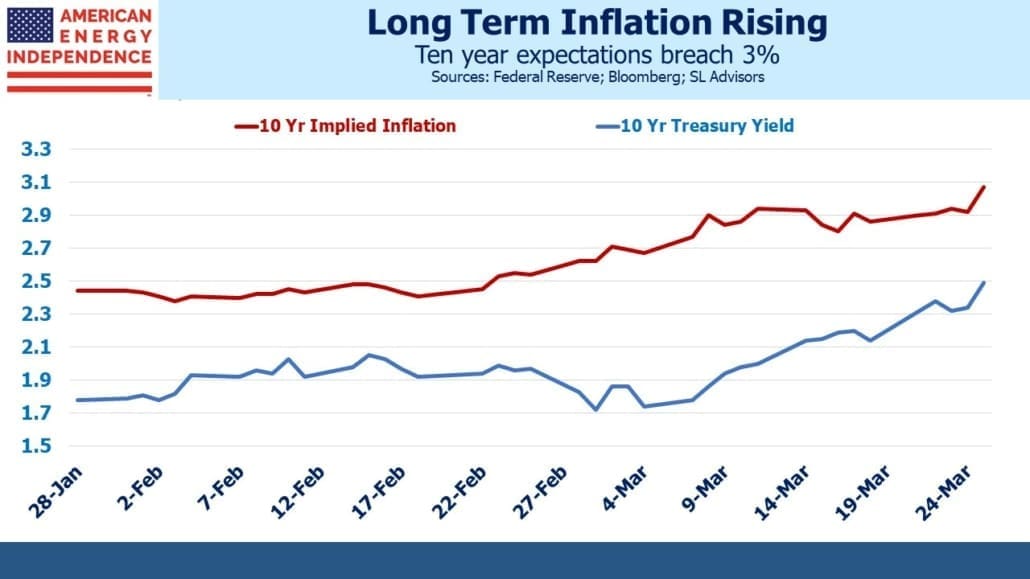

In mid-January in Why You Shouldn’t Expect A Return To 2% Inflation we explained some of the persistent upward pressures on inflation. Since then ten year inflation expectations derived from the treasury bond market have increased by 0.5%. Russia’s invasion of Ukraine is a big factor, but nonetheless a half point increase over the next decade is a substantial move. Preserving purchasing power is the point of saving, and inflation entrenched at a higher level investors presents new challenges to investors.

Five year inflation expectations have moved up to 3.5%

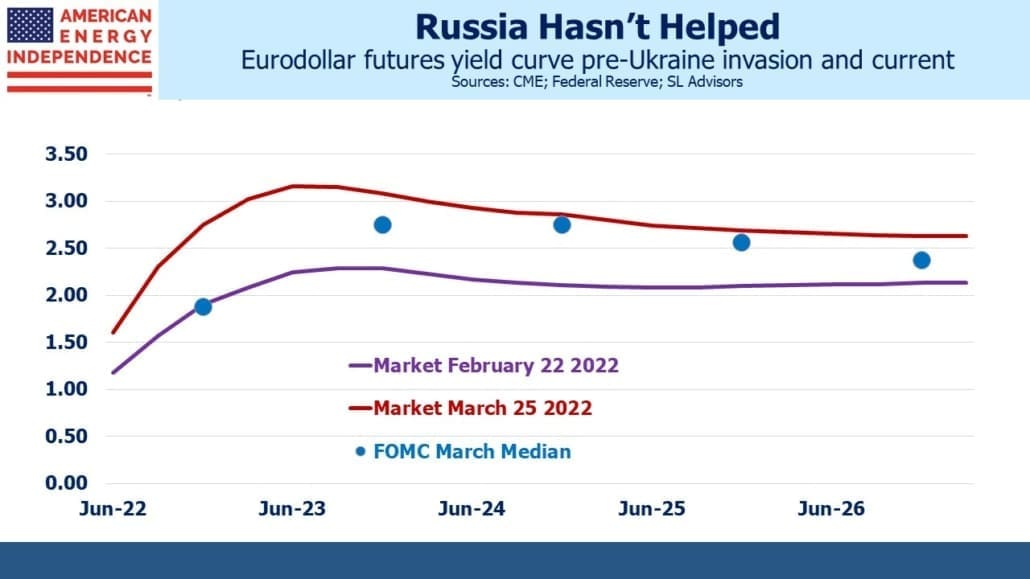

Interest rates have moved sharply higher, with the market pricing in at least one 0.50% hike over the next few months and a neutral rate around 2.5%, up from 2% a month ago. Inflation permanently above the Fed’s 2% objective is being priced in.

The list of reasons to expect inflation closer to 4% than 2% over the next several years includes:

- Excess fiscal stimulus from Covid. The $1.9TN American Rescue Plan that the Democrats passed shortly after Biden’s inauguration last year is now widely accepted to be the root cause of sharply rising prices. The Federal government boosted consumption even while the Covid vaccine was allowing the economy to re-open.

- Profligate fiscal policy in #1 was exacerbated by the Federal Reserve’s August 2020 reinterpretation of its mandate to tolerate inflation risk in pursuit of maximum employment. This led them to maintain highly accommodative monetary policy and expansion of their balance sheet for an additional year compared with what more orthodox policy would have required. Note also that this inflation risk tolerance persists. So while everyone can agree today’s 7.9% inflation is too high, once it falls expect the rising unemployment rate to cause much angst at the FOMC.

- Oil and gas prices were already rising before Russia’s invasion gave them a further boost. Joe Biden ran on a platform of eventually putting traditional energy companies out of business. ESG proponents like Blackrock’s Larry Fink have helped demonize producers of reliable energy. Climate extremists have used the court system to block pipeline projects largely completed. An example is the Mountain Valley Pipeline project owned by EQM Midstream Partners, LP, NextEra Capital Holdings, Inc., Con Edison Transmission, Inc., WGL Midstream; and RGC Midstream, LLC. Biden canceled the Keystone XL pipeline shortly after becoming president, resulting in TC Energy filing a $15BN lawsuit against the US. The Administration is getting the results its energy policies deserve, and the industry’s capex discipline is a result of prior poor returns as well as the long term hostility of Democrats to reliable energy. See I Can’t Go For That (No Can Do) – Why U.S. E&Ps Have Been Slow To Ramp Up Crude Oil Production for further detail.

- Russia’s invasion of Ukraine and the consequent sanctions have disrupted many commodity markets. Corn, wheat, fertilizer and steel are all sharply higher. No matter how the war plays out, Russia’s standing as a reliable supplier has been set back decades. Soviet troops violently suppressed protests in Budapest (1956) and Prague (1968), events that colored the west’s perspective of the Soviet Union until its fall in the early 1990s. Today’s war on Ukraine is much bigger and bloodier. Germany has led western Europe in belatedly correcting a posture of supplicant that relied on Russia for oil and gas and America for security. Many countries will regard Russia’s exports of commodities as permanently at risk to unpredictable military moves by the Kremlin, with prices higher as a result.

- Globalization has been an important source of disinflation for over three decades, allowing OECD economies to benefit from cheap Asian labor. Covid had already exposed supply chains to lockdowns overseas. Sanctions imposed on Russia will cause a further reassessment of suppliers and investments in other countries at risk of invading their neighbors. China and Taiwan is an obvious case. To put it in terms a CFO might consider, even 95% confidence that China won’t invade Taiwan in the next year translates into a 40% probability they will over a decade, resulting in a possible write off of any Chinese assets. This type of risk reassessment runs counter to globalization. Blackrock’s Larry Fink and Oaktree’s Howard Marks have both warned of a fundamental reordering of supply chains. “Cheapest” may lose to “most secure”, which will be closer to home or even domestic. This is inflationary.

- The energy transition is fundamentally inflationary, since it means paying more for the same amount of energy. This receives scant attention in the media which breathlessly reports on falling prices for solar panels and windmills. Obviously renewables cost more – otherwise they would dominate. Germany and California, both farther ahead in renewables use than most, have high electricity prices. Accepting more expensive energy is a legitimate public policy to lower emissions. In spite of the shrill climate extremists, coal-to-natgas switching, carbon capture and increased nuclear power are gaining support as more pragmatic solutions than weather-dependent ones. But reducing emissions is raising prices.

- Federal debt is on track to exceed the levels of World War II as a percentage of GDP. Treasury secretary Yellen has said that current levels of debt are sustainable but not the trajectory. Negative real yields on US treasuries are a persistent gift from return-insensitive buyers such as central banks, sovereign wealth funds and pension funds. They are facilitating our fiscal profligacy. But the US economy’s ability to tolerate rising rates has been decreasing with each cycle. Monetary policy is constrained because it effects the cost of financing our debt.

When wages rise faster than productivity, that provides an easy justification for the Fed to tighten policy. But the other factors listed above are less clearly in need of a hawkish response. Sanctions on Russia, de-globalization and policy choices to pay more for lower-emission power are all inflationary but do they really justify the Fed to counter them by slowing economic growth? This is the debate that will be occupying the FOMC during the current rate cycle.

If the Fed does overshoot, expect more $TNs of inflationary fiscal stimulus and Fed debt monetization via balance sheet expansion, because that’s how we combat recessions nowadays. We dislike recessions more than inflation, so the latter is more likely. Getting inflation back to 4% will calm their critics, such as Larry Summers who’s been as right as the FOMC has been wrong. But the Fed’s reinterpreted dual mandate along with fundamental shifts in world energy markets and trade flows make it likely we’ll adapt to permanently higher inflation than in the past 30 years.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I agree with all the above, but wages and benefits account for more than half of GDP, and employees are not stupid. They know that a raise of less than eight percent is a cut in pay. While labor markets remain very tight, quits are setting records and the wage price spiral genie is out of the bottle. I fear much more aggressive action by the Fed than that suggested will be required to tame price inflation, and a recession looms sooner rather than later, perhaps a quarter or two after the 2022 midterms.