NextDecade Sees A Bright Future

Most US energy investors are familiar with Cheniere, America’s leading exporter of Liquified Natural Gas (LNG). Founded in 1996, the company was originally dedicated to increasing domestic supply, first as an oil & gas exploration business and then as an LNG importing company, which looked unlikely to keep up with growing demand. The Shale Revolution turned America into an exporter of cheap natural gas. Cheniere pivoted from importing to exporting, and currently ships just under half the LNG that leaves US facilities.

Natural gas is much trickier to move than oil or coal. Unless it’s traveling through a pipeline it has to be cooled and compressed. LNG export facilities cool methane and reduce it to 1/600th of its volume, while regasification plants at the receiving end warm it up for use by customers.

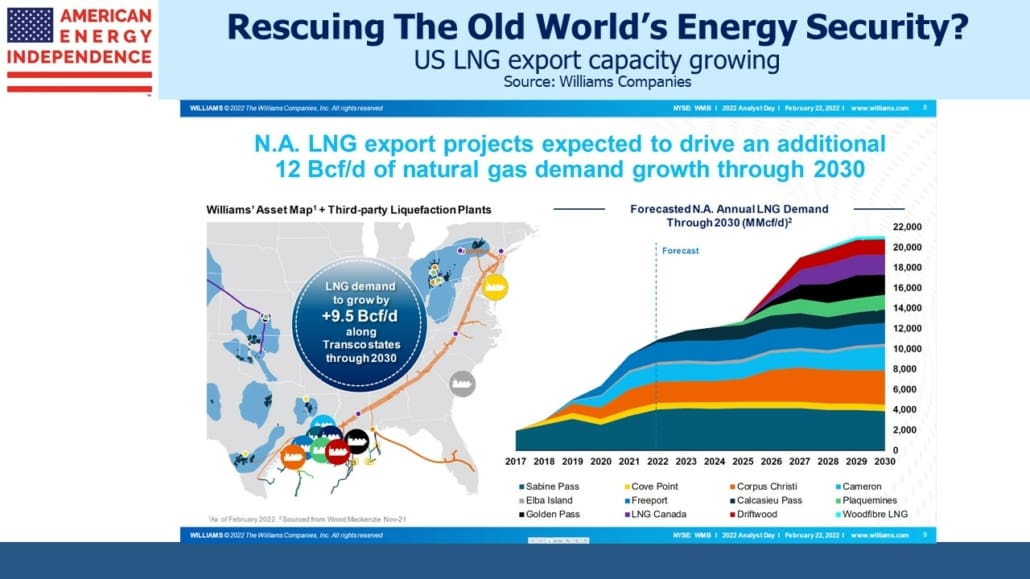

Not surprisingly, LNG facilities take years to construct. This makes it possible to project US export capacity out several years, based on existing projects either under construction or approaching Final Investment Decision (FID).

NextDecade was founded in 2010 by Kathleen Eisbrenner who took the company public in 2017 before retiring a year later. Their journey to building an LNG export facility has been long. In 2020 French utility Engie ended negotiations to become an anchor buyer due to concerns about flaring and methane leaks associated with US natural gas production.

This prompted NEXT to reposition themselves as a supplier of responsibly sourced gas that is chilled and compressed via a zero-emissions process. They even created a new division, Next Carbon Solutions, to lead this effort and explore selling their carbon capture expertise to other companies.

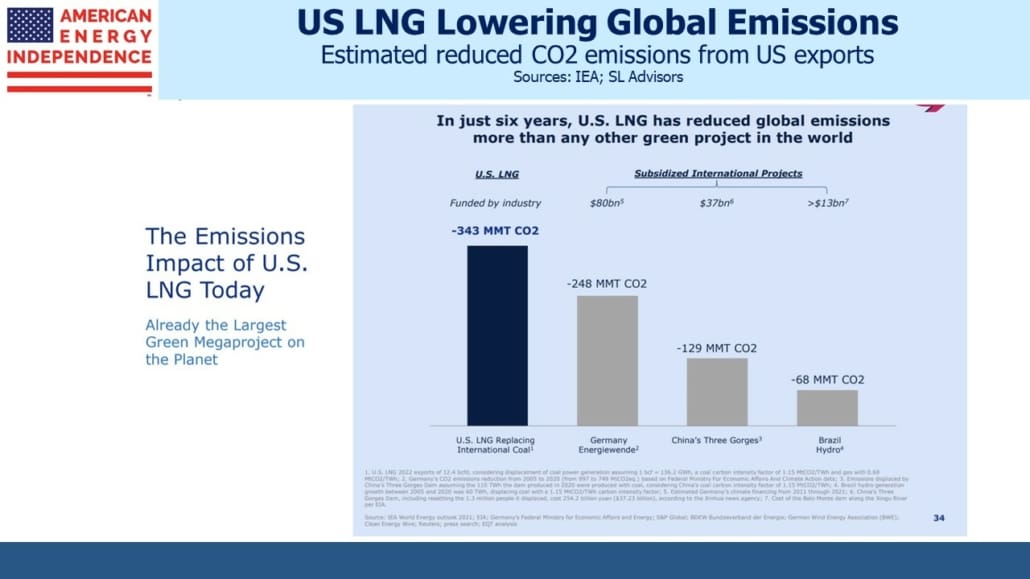

Data from the International Energy Agency (IEA) suggests that US exports of LNG have done more to reduce global CO2 emissions than any other project, including Germany’s drive into renewables (“Energiewende”). Last year the US Energy Information Administration (EIA) noted switching from coal to natural gas was the biggest driver of reduced CO2 emissions, a fact ignored by climate extremists.

Global coal consumption continues to increase, largely in emerging economies. Switching to natural gas for power generation remains the world’s most realistic hope for emissions reductions.

The outlook for US natural gas, already positive, received a further boost when Russia invaded Ukraine (see Russia Boosts US Energy Sector). Within days Germany had acknowledged its strategic error in relying so heavily on Russia for natural gas. Two new LNG import facilities are now planned on Germany’s north coast, and construction is expected to be fast-tracked. They are negotiating a long-term purchase agreement with Qatar.

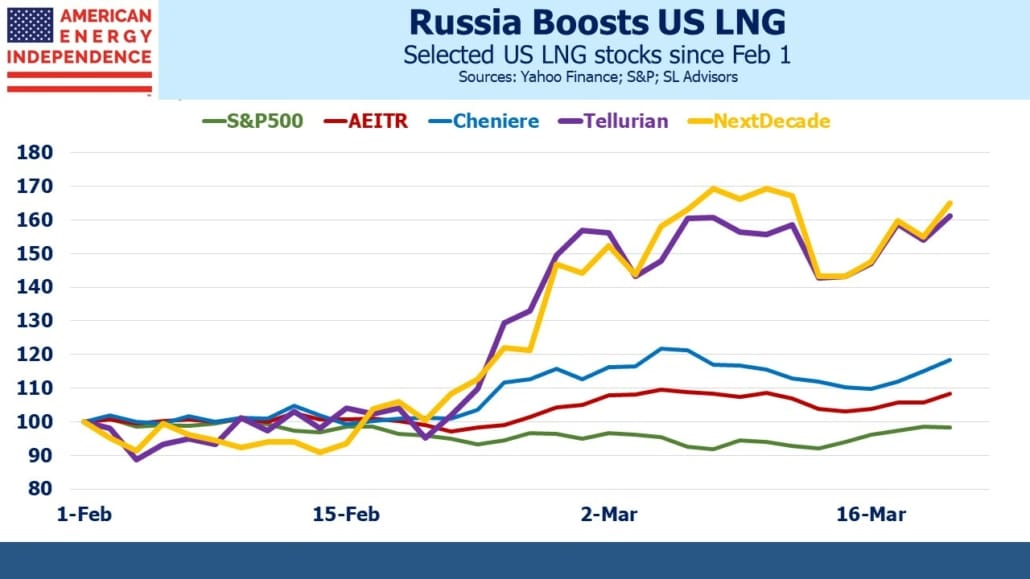

Markets were quick to anticipate what Europe’s abrupt shift in energy policy means for US natural gas. Since February 1, Cheniere is 20% ahead of the S&P500 and 10% ahead of the American Energy Independence Index (AEITR). NextDecade and Tellurian, another company planning to export LNG, have both rallied over 60%. The odds of these two obtaining the necessary financing have improved sharply.

We had an opportunity to talk with Michael Mott, Senior VP, Next Carbon Solutions. Michael described a process that will capture up to 90% of the CO2 involved in LNG – both the pre-combustion when CO2 and other impurities are separated from the methane, and the CO2 emissions generated from energy use in chilling the methane for loading and transportation as LNG. He believes this will be the world’s first LNG facility that uses Carbon Capture and Sequestration (CCS), resulting in the “greenest LNG in the world.” NCS is planning to market its technology for capturing CO2 from the combustion of natural gas to others.

NextDecade’s Rio Grande site where they plan to build trains 1 and 2 of their LNG facility has all the necessary permits in place and is “shovel-ready”. They expect to secure financing to allow FID in 2H22. The war in Ukraine has added urgency to potential LNG buyers to secure supplies. Mott described the current market as the “strongest I’ve ever seen” and noted that analysts were still only belatedly catching up with how tight supply conditions will be in the years ahead.

NextDecade is taking a traditional approach to pricing, in that contracts are typically linked to the Henry Hub or a Brent crude-related benchmark and where NextDecade earns a set margin. This is similar to Cheniere’s approach, and by reducing NextDecade’s direct commodity price risk it makes securing financing easier.

FERC recently included resulting emissions as an additional factor they consider in approving pipeline projects. This is controversial to many in the industry – Kinder Morgan and Enbridge have both publicly criticized FERC’s changed posture. Mott believes this is an increasing trend, and that NextDecade is positioning itself to offer solutions.

The failed Build Back Better legislation included increased 45Q tax credits for CCS, and many expect this element to ultimately be passed. Mott said the industry believes a carbon price of at least $100 is necessary to incentivize investment and thinks that will eventually become a reality with direct payments being preferred over tax credits. CCS could eventually become a big source of growth for the pipeline sector.

NextDecade is a company worth watching. For the full version of our conversation with Michael Mott, check out our next podcast.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.