The Bond Market Sends A Warning

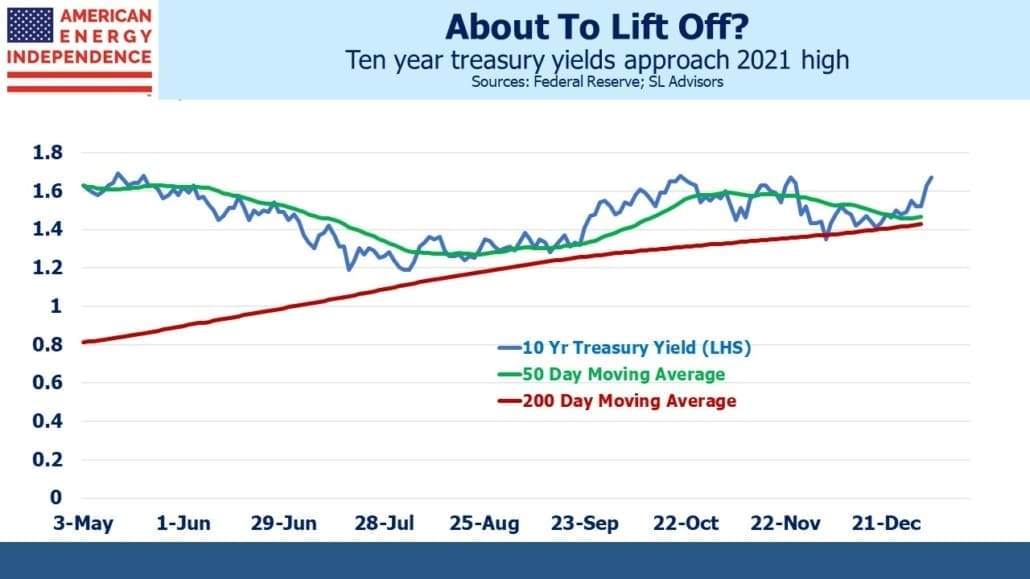

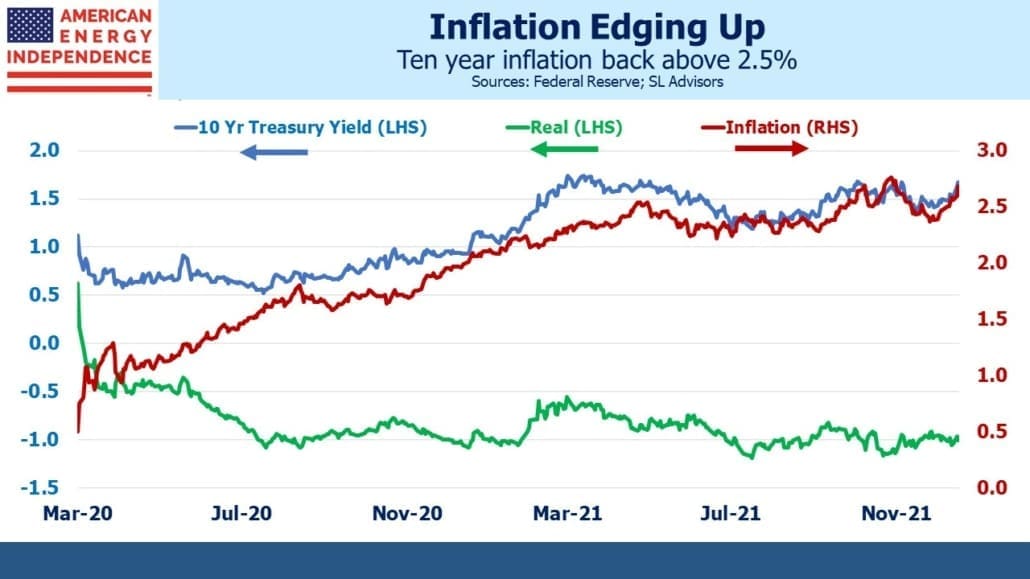

Although markets were quiet over the Christmas break, treasury yields drifted steadily upward. On the first trading day of the new year the ten year yield burst higher by 0.12%. Although the Fed seemed to bring inflation expectations under control at their most recent FOMC meeting in December, this is now starting to reverse.

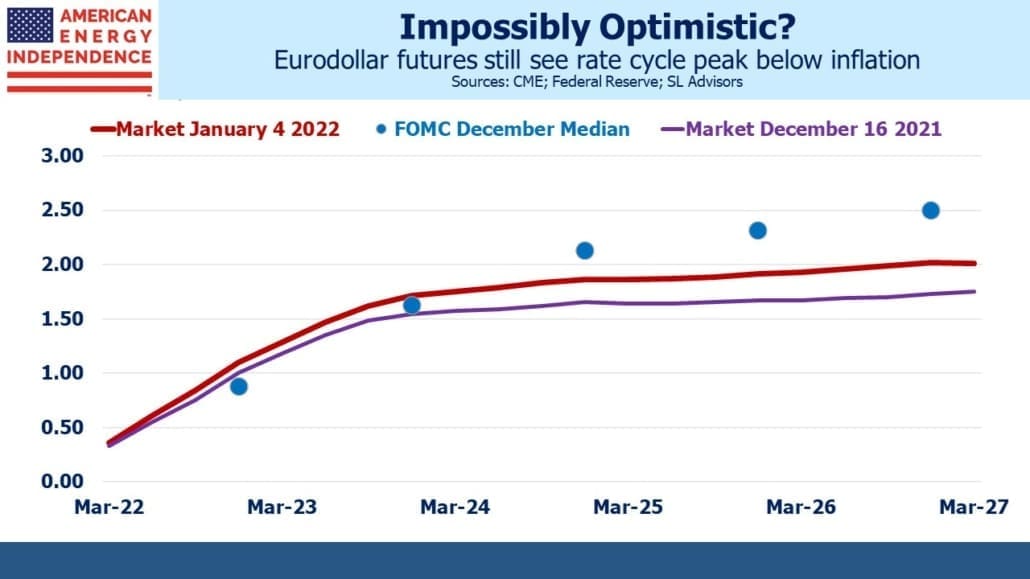

The yield curve has been steepening, reversing the sharp flattening that hurt several hedge funds late last year. It still seems impossibly flat – we’re about to enter a tightening cycle and expectations are that it will be mostly complete by the end of 2023 – less than a full 0.25% tightening is priced in over the following two years.

Eurodollar futures are still priced for Fed Funds to remain below 2% — implausibly optimistic, because it implies that the Fed will contain inflation without raising short term rates even to their long term inflation target. The FOMC’s guidance is 0.50% higher, and although they are awful at forecasting their own actions, this time perhaps the market will adjust to the Fed rather than the other way around as usually happens. Put another way, history suggests that inflation won’t get back to 2% unless the Fed raises rates above this level.

Part of the justification for equanimity over how high short term rates need to go has come from the bond market. In mid-December, ten year treasury yields were below 1.5%. Pushing short term rates above long term yields, creating an inverted curve, would provoke warnings that the Fed was about to cause a recession. An inverted yield has a mixed track record as a predictor of a slower economy, but it might be expected to give decision makers pause.

However, following the recent slump in the bond market, ten year treasury yields are within reach of last year’s 1.73% high. Maybe it’s a delayed reaction, but confidence about the Fed’s ability to bring inflation back down has been seeping away for a month. The continued fall in real yields has muffled the message somewhat, but ten year inflation expectations have risen 0.30% since the announcement of a speedier taper.

Employers are budgeting for wage increases of 3.9% this year, according to a survey by the Conference Board. Most analysts expect inflation to moderate, but bringing it back to 2% is looking less likely. The modest tightening projected by the market is unlikely to convince businesses to expect it, which would make ~4% annual wage hikes more likely to persist.

The Fed over-estimated the amount of slack in the labor market, a point chair Jay Powell began to concede during his press conference last month. They maintained a highly accommodative policy stance for too long in the hope that labor force participation would improve. They targeted a return to employment level of 152 million last seen in January 2020, before Covid hit. It’s still more than four million below that level, and since the Fed now emphasizes the “full employment” element of their twin mandate, they were willing to risk inflation to help those remaining unemployed people back to work.

The Fed has not given up, because their policy remains highly accommodative. A slower pace of buying bonds and near-zero rates do not represent hawkish policy. But they’ve belatedly recognized all the other signs of a tight labor market, such as 3.9% wage increases or the record 4.5 million Americans who quit their jobs in November.

“The important metric that has been disappointing really has been labor force participation,” noted Powell during his press conference. He cited, “factors related to the pandemic, including caregiving needs and ongoing concerns about the virus…” Others were, “aging of the population and retirements” Three years of a strong market has probably helped many people retire ahead of time.

The rise in treasury yields is bearish. It reflects rising inflation expectations and implies a higher peak in the Fed Funds rate during this tightening cycle. At a certain point it is negative for stocks, since low rates have driven investors into equities for years. However, ten year yields would need to be approaching 3% not 2% for that to be a factor. And the pool of return-insensitive capital willing to own sovereign debt at negative real yields seems limitless, which is facilitating a degree fiscal profligacy that would otherwise be much more costly.

But it does mean that eurodollar futures 2+ years out below 2% remain too low. The Fed’s sloth-like return to neutral policy relies on the hope that inflation will moderate of its own accord, not that the Fed’s actions will cause it to. Much can go wrong with that.

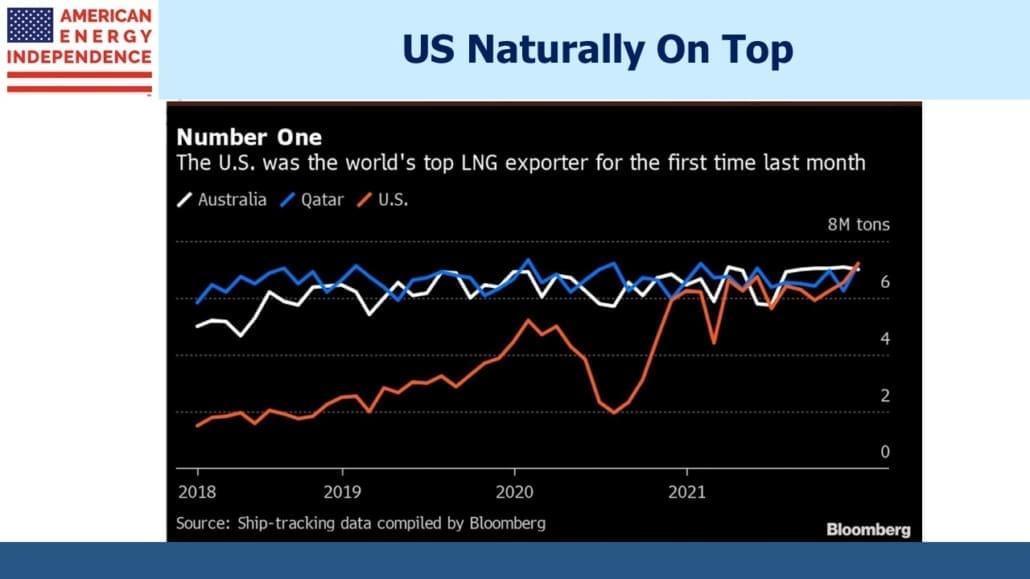

Unrelated to inflation but notable nonetheless was news that last month the US became the world’s biggest exporter of liquified natural gas.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

There is (I think more than) a distinct possibility that the Fed has turned political and won’t raise rates dramatically in an election year.