Hackers Highlight Pipelines’ Value

The hacking into Colonial Pipeline’s network demonstrated the high-tech vulnerability of some infrastructure as well as society’s reliance on it. Colonial is the largest privately owned pipeline in the U.S., carrying up to 45% of the east coast’s gasoline supply from refineries in Texas to New Jersey. On Monday gasoline futures initially rose 4% on fears of an extended outage before Colonial announced a goal of, “…substantially restoring operational service by the end of the week.”

Pipelines and other midstream energy infrastructure don’t command much public attention until there’s a problem. Enbridge’s Line 5 pipeline supplies 540,000 barrels per day of propane and crude oil to customers in Ontario, Quebec and Michigan.

Governor Whitmer wants to close the pipeline because it runs under the Straits of Mackinac. She fears a leak, while Enbridge argues that it meets or exceeds all relevant safety standards. They’re also planning a replacement to the segment that passes under the Straits, the Great Lakes Tunnel Project. Enbridge CEO Al Monaco is pushing for approval to build the concrete tunnel which will house the pipelines so as, “to reduce the risk (of a spill) to as near zero as humanly possible.”

Governor Whitmer’s closure order may cause Line 5 to be shut down this week. Al Monaco has warned this would result in a “very bad outcome” for consumers.

It must be tempting for companies like Enbridge to give political leaders what they want, including the consequences. One alternative to Line 5 would require 2,100 trucks per day. In New York’s Westchester county, Con Edison stopped accepting new natural gas customers because the state is impeding pipeline access. My partner lives in Westchester, and he has installed a back-up generator at his home to counter the state’s policies that favor less reliable energy.

If Enbridge’s Line 5 stops delivering crude oil to refineries in Michigan and beyond, gasoline prices will rise. Energy companies like Enbridge are more responsible than state governors such as Whitman and New York’s Andrew Cuomo.

February’s cold snap which led to power outages created windfall gains for pipeline companies. Energy Transfer gained $2.5BN, and after using the proceeds to help pay down $3.5BN in debt during 1Q21 is now expected to bring leverage (Debt:EBITDA) to to 4.5X by early 2023 rather than late 2024 previously. Kinder Morgan (KMI) picked up an extra $1BN, and Enterprise Products Partners (EPD) reported some benefit from sales of natural gas at high prices.

Proponents and critics of renewables have both used the Texas power cuts to support their case (see Why Texas Lost Power). All sources of energy came up short of what was needed. But the $Billions in extra profits generated by companies with natural gas infrastructure in the right place reflects their value. There were no reports of windmills or solar panels suddenly being in high demand. Natural gas changed hands at over 100X its normal price – the unique features of the Texas power market allowing uncontrolled price discovery. At least it was available. Additional solar and wind wouldn’t have been there even at 1,000X normal pricing.

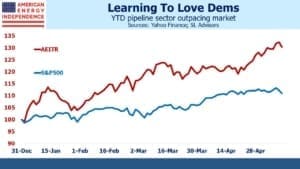

Energy infrastructure has been outperforming the market since the Covid low in March of last year. President Biden’s policies have inadvertently helped, by constraining spending within the energy sector which is leading to higher energy prices. The market’s response to the Colonial cyber attack on Monday was to push stocks pipeline stocks higher. It highlighted the critical nature of the sector to the economy. The WSJ has suggested that Biden’s proposed infrastructure plan should dedicate money to protecting vital energy infrastructure – perhaps this sensible suggestion will find increased support.

Although the media makes it sound as if renewables are ubiquitous, last year wind was 8.4% of U.S. power generation and solar just 2.3%. Hydropower (7.3%) and nuclear (19.7%) don’t suffer from the intermittency of solar panels and windmills, so are more valuable.

The pipeline sector is benefiting from many recent developments. Companies are demonstrating greater financial discipline. Energy prices are rising, thanks to Democrat policies. Inflation expectations are up, helped by the profligate Covid relief bill and the Fed’s continued buying of bonds (see The Fed Is Playing With Fire in the WSJ), boosting demand for a sector that offers decent inflation protection. Finally, misguided policies in some states and cyberattacks by criminal gangs are highlighting the importance of energy infrastructure. First quarter pipeline earnings were full of positive surprises. It’s one of the very few cheap sectors remaining, which is why the American Energy Independence Index (AEITR) is 20% ahead of the S&P500 this year.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!