GameStop Overhauls The Hedge Fund Business

The impact of GameStop (GME) will resonate far beyond a few short-selling hedge funds. It’s a rare breed of manager that runs exclusively or mostly short positions. Behind the forensic financial analysis that’s required lies a deep skepticism of company executives. They see a dark side to human behavior lurking out of sight to most of us. Short sellers often believe they’ve uncovered a fraud – they’re not just looking for a quick 10-20% gain, they think the stock is a zero. One short seller was so disgusted at the failure of men’s clothier Joseph A Banks to collapse that he abandoned the industry for a few years to rear chickens (see A Hedge Fund Manager Finds More to Like in Farming).

Unshakeable conviction and thick skin absorb the blows of massed opposing forces, from sell-side research, management and other investors to, now, social media sites.

Shorting stocks isn’t limited to specialist funds such a Kynikos, run by Jim Chanos. The original hedge fund created by A. W. Jones was a long/short fund. It sought to neutralize its exposure to market moves by balancing long and short positions. The objectives of hedge funds have evolved over the years. They were originally described as Absolute Return funds — reliably positive, inspiring AR Magazine, which has since folded into Institutional Investor. The 2008 financial crisis showed hedge funds could lose money like anyone else, so marketing shifted to Relative Returns, except those were relatively poor (see Hedge Funds: Still Fleecing Investors with Expensive Mediocrity). In recent years they’ve settled on delivering uncorrelated returns, which Melvin Capital provided so spectacularly last month (reportedly down 53%).

Whatever the description, hedge funds are supposed to offer something different. For a broad array of strategies, that includes carrying some short positions.

Shorting stocks is hard. Almost everyone else involved with the company is against you. Investors in the stock, research analysts and the company itself all regard the short’s failure as vindication of their work. In Germany, the securities regulator was so incensed at negative press coverage of Wirecard that it sued two Financial Times journalists. The lawsuit was only dropped after Wirecard itself confirmed the €1.9BN hole in its balance sheet.

The risk in shorting is asymmetric – as the price falls, your position size shrinks as well. If it rises, your losses are theoretically unlimited, and can reach unfathomable depths as we just saw.

Hedge fund managers regularly describe the difficulty in adding value from short positions. Betting against a company certainly requires more care and attention than other positions. I’ve always thought managers would often be better off simply focusing on long ideas and hedging out the market risk with S&P futures. By focusing their often-considerable analytical abilities on long positions, maybe they’d do better.

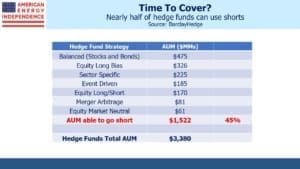

Of $3.4TN in hedge fund assets under management, 45% can be estimated as using short positions in some form. Scraping data from social media sites to identify the crowd’s next victim will quickly become another tool. But shorts just became more risky than previously imagined, and this will have consequences.

A year ago, GME was under $4. A short-seller might have considered a doubling, or perhaps even a quadrupling in price as a plausible worst outcome, and size the position accordingly. For GME, this would have been inadequate by an order of magnitude, since it rose over 100X. The standard definition of “how bad can it get?” just changed.

The social media crowd is reveling in its newfound power. They believe they have launched a form of high-tech populism taking on what they regard as the financial establishment, although hedge fund managers used to think that was their role. We continue to scour chatrooms hopefully for signs they’ll corner the pipeline sector. It must be ripe for their exploitation.

Hedge fund managers will adapt. They’ll have smaller positions, will use options to control risk and will follow DeepF***ingValue on r/WallStreetBets. But shorting stocks has changed forever. Finding a fraud won’t make as much money, because of tighter position limits. Out of the money option volatility will be high, as the value of tail-risk protection rises. Borrowing stock to short may become harder.

Hedge fund investors will add the Melvin question to their due diligence questionnaire. Prime brokers will tighten their financing requirements for most individual short positions. Nobody wants a surprise like this. Being associated with a subsequent GME-like debacle will abbreviate careers. So everyone will avoid it. There will be less shorting of stocks.

This will cast a chill over the hedge fund business. Many of the smartest people in finance run hedge funds, and they’ll continue to prosper personally. But hedge fund returns, which any casual observer can see have mostly failed to justify their fees for almost two decades, now face an additional headwind.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Trackbacks & Pingbacks

[…] GameStop saga overhauls the hedge fund business – SL Advisors […]

[…] GameStop saga overhauls the hedge fund business – SL Advisors […]

Leave a Reply

Want to join the discussion?Feel free to contribute!