Hedge Funds: Still Fleecing Investors with Expensive Mediocrity

A decade ago, the collapse of Lehman Brothers marked the psychological low of the 2008 Financial Crisis. Equity prices bottomed a few months later, in March 2009. Hedge funds had nimbly managed their way through the 2000-02 dotcom collapse, which led to substantial inflows over the next six years. By 2008 AUM had quadrupled, as less discerning investors piled in. In my 2012 book The Hedge Fund Mirage; The illusion of Big Money and Why It’s Too Good to be True, I showed that although early hedge fund investors had done very well, they weren’t that numerous.

The strong returns from the 1990s through 2002 had come with a much smaller industry. Consequently, hedge funds were far too big when the 2008 collapse came, and losses wiped out all the prior years’ profits. It meant that in the history of hedge funds, aggregate investor gains were offset by other investors’ losses. Hedge fund managers had profited; the clients had not. If all the money that’s ever been invested in hedge funds had been put in treasury bills instead, the results would have been twice as good. The Hedge Fund Mirage Turns Five showed that the book’s prediction of continued disappointment was right.

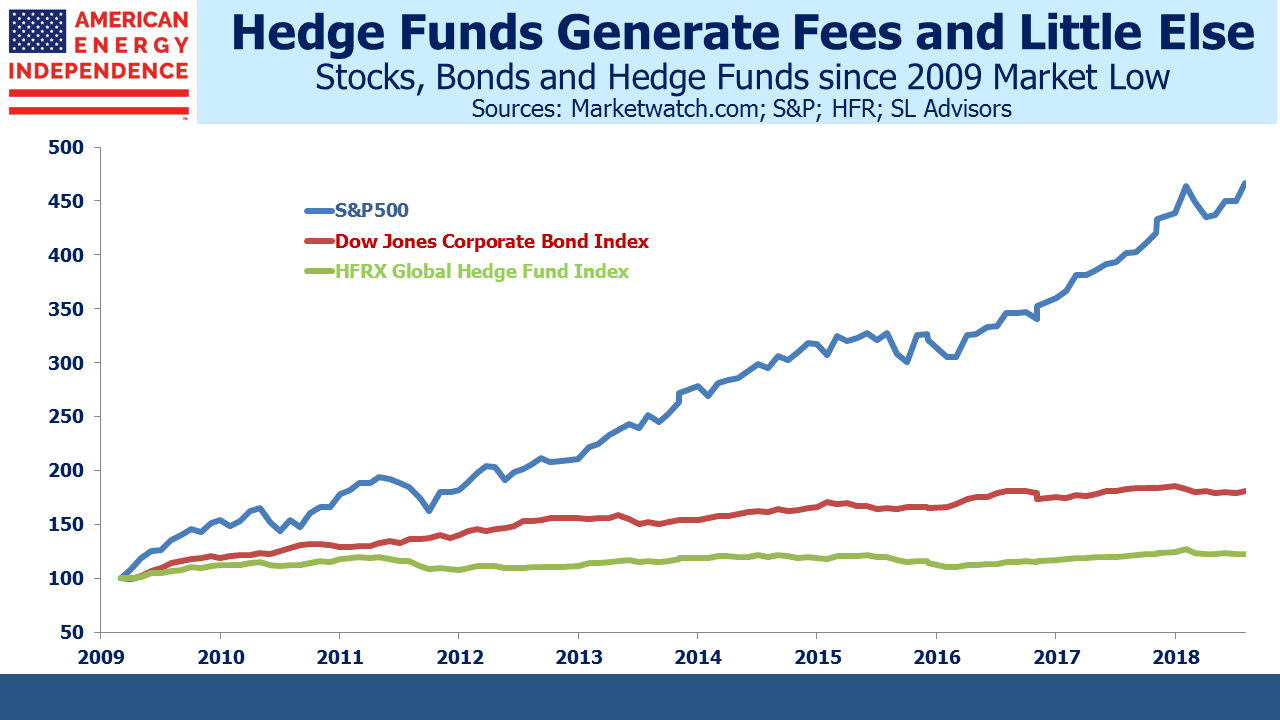

Having rudely reminded investors in 2008 that they take risk, one might think that hedge funds would have gained from the subsequent rebound in risky assets. Endure the downside, participate in the upside. Since the low in 2009 the S&P500 has returned 17.9% p.a. With dividends reinvested, it’s increased almost fivefold. Although it’s unfair to expect hedge funds to beat long-only stocks at that level, they’ve missed by such a margin that one wonders who still seriously recommends an allocation to the sector. The Dow Jones Corporate Bond index has delivered 6.4% p.a., three times the 2.1% annual return of hedge funds, even with a decade of ruinously low rates. Although worse investments are hard to find, hedge funds handily beat a fund launched in 2009 to follow Dennis Gartman’s newsletter recommendations.

Nonetheless, hedge fund managers have continued to do handsomely. Some of the smartest asset managers run hedge funds and they are highly talented at separating clients from their wealth via fees (see The Alpha Rich List Got 15% of Everything). Try thinking of anyone who became wealthy by being a hedge fund client.

Hedge fund AUM fell by half through the 2008 crisis, through investment losses as well as withdrawals from investors. Eventually some institutions saw through the false promises and left for good (see CalPERS Has Enough of Hedge Funds). But such is the attraction of investing with highly paid people that money flowed back in. Hedge fund promoters adapted their pitch. AR magazine, which published my original article on paltry returns, drew its name from covering the Absolute Return industry. When results showed that positive returns weren’t always assured, the goalposts were shifted and Relative Returns became the new mantra. But results turned out to be relatively worse than anything else. The shameless consultants moved to Uncorrelated Returns, which has turned out to be enduring since they’ve lagged just about everything outside of Venezuela. The July 2013 front cover of Bloomberg Businessweek needed few words.

It’s therefore no surprise that David Einhorn’s fund Greenlight is making its owners far richer than its clients. Investors in his $1.7BN flagship fund have endured almost four years of miserable performance, with a drop of 36% since November 2014. Like virtually all hedge fund managers and the industry overall, Greenlight was better when it was smaller.

Don’t blame David Einhorn. It’s a common story and he’s only the most recent former star to crash to earth. Einhorn must sincerely believe in his ability. Blame the enablers, the consultants and other advisors who drive clients to hedge funds. They still fail to recognize that high returns come from limited opportunities, and that competition from increased AUM drives them down. Last year Ted Seides (then, but no longer, co-CIO at Protégé, a fund of hedge funds) famously lost his 2007 $1million bet with Warren Buffett that hedge funds would outperform the S&P over the subsequent decade – and that was made before the financial crisis decimated stocks (see Buffett’s Hedge Fund Bet).

Protégé owner Jeff Tarrant later argued that a decade of lunches and dinners with Buffett following the bet made it money well spent – and based on what an auctioned Buffet lunch goes for, he has a point. But drawing attention to hedge fund performance is rarely a good marketing strategy, so the Ted Seides bet was ill-advised. The poor guy must have actually believed he’d win, betraying a gaping absence of investment acumen and common sense.

There are some thoughtful hedge fund investors around that add value for their clients. A few of them are friends of mine. They’re the ones who recognize the conflict of size with performance, adapting their portfolios to avoid the crowd. But the majority of hedge fund promoters orbit the truly talented to whom they only aspire, promising their gullible investors gold over the rainbow that they must know really isn’t there.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Mediocrity is a very generous characterization…imagine a Daniel Loeb or David Einhorn analysis turned on themselves and their colleagues