MLP Closed End Funds – Masters Of Value Destruction

When MLP investors cast around for characters to blame for the past few years of underwhelming equity returns, management teams are the obvious target. Like their upstream clients, midstream businesses embraced the endless volume growth of the Shale Revolution with sharply increased growth capex. By 2018 they’d heard the message from investors that stability trumps growth and begun to pull back. This year, as a result of continued capex frugality, free cash flow will double. Given the pandemic, which even led briefly to negative crude prices in April, this result is extraordinary and only now beginning to register with investors.

Although recent equity returns for pipelines have been sparkling, few will soon forget the trauma of March when wholly indiscriminate selling drove prices to unfathomable depths. Management teams are responsible for operating performance and while this drives equity returns over the long run, in between quarterly earnings reports stock prices gyrate on investor opinion, guesses and hunches. March was miserable for everyone involved in midstream, but chief among the villains of that sector-wide margin call are the managers of MLP Closed End Funds (CEFs).

These vehicles have been around for years, holding MLPs in an inefficient, tax-paying c-corp structure. They were Wall Street’s first attempt at separating the K-1 from the sought-after retail buyer. The corporate tax liability, an expensive haircut to returns, was obscured by the tax-deductible interest expense on leverage.

MLPs were once considered a fixed income substitute. Borrowing money to buy bonds in a closed end fund structure can be defensible if the underlying assets are very stable. MLPs long ago lost the advantageous reputation of “income-seeking substitute” as their rush for Shale Revolution growth stressed balance sheets and led to higher volatility. Nonetheless, MLP CEFs retained their leveraged model, even though most were forced into distressed sales during the 2014-16 slump when depressed MLP values tripped risk limits.

Moreover, they stuck with it even while the pool of MLPs shrunk. This now unrepresentative set of securities is a third of the American Energy Independence Index, our broad-based index of North American midstream energy infrastructure. By comparison, MLPs are smaller, less creditworthy, more liquids/less natural gas focused, and offer weaker corporate governance. In short, nobody is contemplating an IPO of an MLP closed end fund today. If they hadn’t been created years ago, they wouldn’t be around.

The problem with investing with leverage is that it leaves you exposed to even a brief sharp fall in your holdings. If you buy $100 of securities with $30 in debt, a 40% market drop takes your leverage from 30% to 50%. If that’s beyond your lender’s risk tolerance, sales must immediately follow. Once done, recouping the locked in losses is almost impossible. The leveraged investor assumes risk to the path of short term returns that the cash buyer does not.

To see how dumb an idea closed end MLP Funds had become, consider that leverage at MLPs had been coming down in recent years as rating agencies tightened the standards required of an investment grade rating. Debt:EBITDA of 4X became the new target, and MLPs either reached it or planned to.

A portfolio of MLPs is not a diversified equity portfolio. Individual security returns will differ to be sure, but the group will largely move together — especially so when prices are falling hard. So, when the closed end fund MLP portfolio manager adds leverage to this homogeneous basket of securities he (and it most assuredly is he, for such imprudence requires excess testosterone) is asserting that pipeline companies are managed too conservatively. Never mind that the industry and its rating agencies have settled on 4X Debt:EBITDA as appropriate, the MLP PM believes 5-6X is fine.

The intellectual arrogance in this stance is breathtaking. Because the holdings of an MLP CEF will track each other more than any other sector, this amounts to increasing each individual company’s leverage to 5-6X. The only possible justification for this is if the PM has both the plan and the skill to reduce leverage just before the crash. As we saw in March, they had neither.

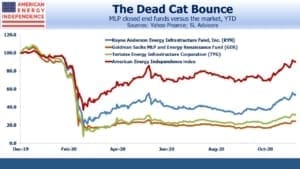

March is a memory, although still raw for many. At the low on March 18, the sector was briefly –63% YTD. MLP CEFs lost almost their entire value through forced sales. Tortoise’s fund closed –92% for the year on that date. Even now MLP CEFs, including those run by Goldman Sachs and Kayne Anderson as well as Tortoise, have still lost half to three quarters of their value since January 1. They have barely participated in the sector’s strong recovery, now -10% for the year.

MLP CEFs could never make up for their forced sales in March when leverage limits kicked in.

If you were invested in pipelines but avoided MLP CEFs you probably feel unaffected. You’d be wrong. When these funds sold, they defined the low and caused prices to fall more than they would have absent the forced deleveraging. Your portfolio consequently fell more than it had to as well. The excessive volatility doubtless induced other investors to exit, tired of the distress. It’s permanently part of the price history of the sector, guiding future buyers in their assessment of risk. In short, today’s holders require more conviction in their investment thesis to compensate for the risk history suggests they’re taking.

The villains in this episode are the PMs of funds run by Goldman Sachs, Kayne Anderson and Tortoise, to name a few. They all persisted with the arrogantly leveraged structure right into the maw of the March collapse. Goldman Sachs knows about risk, and the firm emerged from that period of heightened volatility relatively unscathed. Their fund blowing up simply means the PM didn’t get the memo from Risk Management to cut back.

But Kayne Anderson and Tortoise are dedicated MLP investors. Their risk management function should have had little else to confuse it. They clearly had no risk management, no judgement, or neither.

The silver lining is Darwinian, in that such incompetence destroyed sufficient capital that MLP CEFs are no longer big enough to matter to anyone other than their hapless investors.

If you own one of these wretched vehicles, consider the stewardship practiced by your PM and whether it’s worthy of your money.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

As usual, you guys are spot on in your analysis of the sector. Thank you for opening our eyes to this issue. When you look at 13F data of a stock like Enlink over many quarters it paints a very clear picture of what happened to their unit price. Institutional investors like Tortoise who dumped a whopping 28 million shares in Q1 of 2020 have been forced sellers as the price of the partnership fell. As you mention in the article, many of their funds were leveraged. Add that to a long list of CEFs and other funds like Kayne Anderson’s funds who sold out due to forced selling and high leverage. Clearly a case of buy high, sell low. The estimated number of shares held by smaller funds holding less than $100 million in assets, retail investors and short shares at the end of Q3 2018 was 26 million. The number peaked at 104 million shares in Q2 2020, about 40% of the float. So retail investors who are investing directly in the partnership are soaking up the excess inventory of units/shares sold by overleveraged institutional funds, although Q3 2020 saw about 6.5 million shares clawed back by the larger funds. The recovery in stocks like Enlink will be slow and gradual, unlike general stocks which enjoyed a nice V-shaped recovery into new highs. Again, thanks for the content.

Actually I’m very thankful for MLP CEFs. It was their blowing up on March 18th which signaled for me to go heavily into the sector.