Natural Gas Prices Rise for Democrats

In recent weeks, 2021 natural gas have been quietly moving higher. November ’21 futures have rallied over 40 cents, to just under $3 per Thousand Cubic Feet (MCF).

Covid and the election are both behind this. Research reports from Goldman Sachs and Morgan Stanley both explore energy markets through the pandemic and likely policy changes if Democrats win next month.

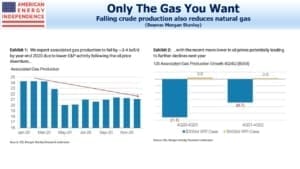

Associated gas that is produced along with crude oil in the Permian in west Texas has long weighed on prices. This gas wasn’t needed – because it had so little value, some of it was flared. The Texas Rail Road Commission (RRC) never rejected a flaring application, causing critics to ask why they regulated it at all (watch Stop Flaring).

The collapse in oil demand in the Spring led to production cutbacks in the Permian, which also reduced the volume of associated gas. Morgan Stanley notes that falling prices had already been reducing the gas rig count in key producing areas prior to Covid, and this trend accelerated during the spring. Domestic gas production is increasingly driven by the economics of the gas market.

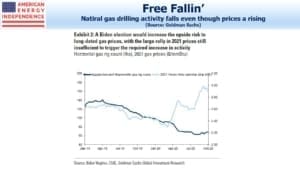

The election has had a more recent impact. With Joe Biden retaining his lead in opinion polls, markets are beginning to price in a Democrat victory, including the possibility of taking control of the Senate. VP candidate Kamala Harris pledged that a Biden administration would not ban fracking – a predictable pivot away from the anti-fracking posture Biden adopted during the primary.

Some of the more sweeping moves against the domestic energy business associated with the Democrat platform would require acts of Congress. This includes banning fracking on private land. Another example would be tightening the standards around produced water, since the 2005 Energy Policy Act excluded fracking from the Safe Drinking Water Act. It’ll be hard persuading senators from either party in oil-producing states to support legislation that’s harmful to their voters.

However, Goldman notes that a Biden presidency could restrict drilling on Federal land, clamp down on methane emissions and use other regulatory tools to increase the cost of production. Democrat policies are designed to produce higher energy prices, since this improves the competitiveness of renewables (Listen to Joe Biden and Energy and read Why Exxon Mobil Investors Might Like Biden).

A new administration might also engage more with Iran. Goldman notes that the return of 1 million barrels per day or Iranian output to oil markets would restrain Permian crude production and keep a lid on associated gas. It’s not intuitive, but diplomatic engagement with Iran is bullish for natural gas prices.

Will this be good for pipeline stocks? Trump pursuit of energy-friendly policies has led the industry into an exuberant glut of production. It’s not his fault, but it’s led to poor investment returns. Rising natural gas prices could be a sign of more parsimonious capital allocation. If pipeline stocks follow energy prices up the same way they’ve followed them down, few investors will complain.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

And maybe it has nothing to due with election but more the old saying the best cure for low prices is low prices. Natural gas prices have been in tank a long time, so maybe producers finally stopped growing production.