Covid By The Numbers

The recent news on Covid-19 has been mostly bad. Infections are increasing sharply in sunbelt states, where Florida now holds the record for two worst days’ new infections – 15,300 and 13,965, both reached last week. Reopening plans are being halted. Even the Republican convention scheduled for late August, which was moved from Charlotte, NC to Jacksonville, FL (i.e. from a Democrat governor to a Republican one), has been scaling back its planned attendance.

We’ve aimed to be apolitical in covering what is the biggest story concerning investors nowadays (see Taking The Politics Out Of Covid-19). Writing about this is a fraught subject – you don’t want to get Covid-19, and there have been over 140,000 deaths each one of which is a tragic loss. It continues to be a traumatic time for the country. My mother is high risk, in assisted living, and our interactions with her are constrained in both frequency and form.

Nonetheless, we focus on the data, which we interpret as more optimistic than the media coverage for the overall population. Some readers have criticized us for this. Equity markets clearly have a more sanguine view (see Is Being Bullish Socially Acceptable?), and investors may be wrong or they may collectively also be interpreting the data as more positive. We think it’s worth trying to understand the implied relative optimism, as it contrasts so strongly with how many of us feel.

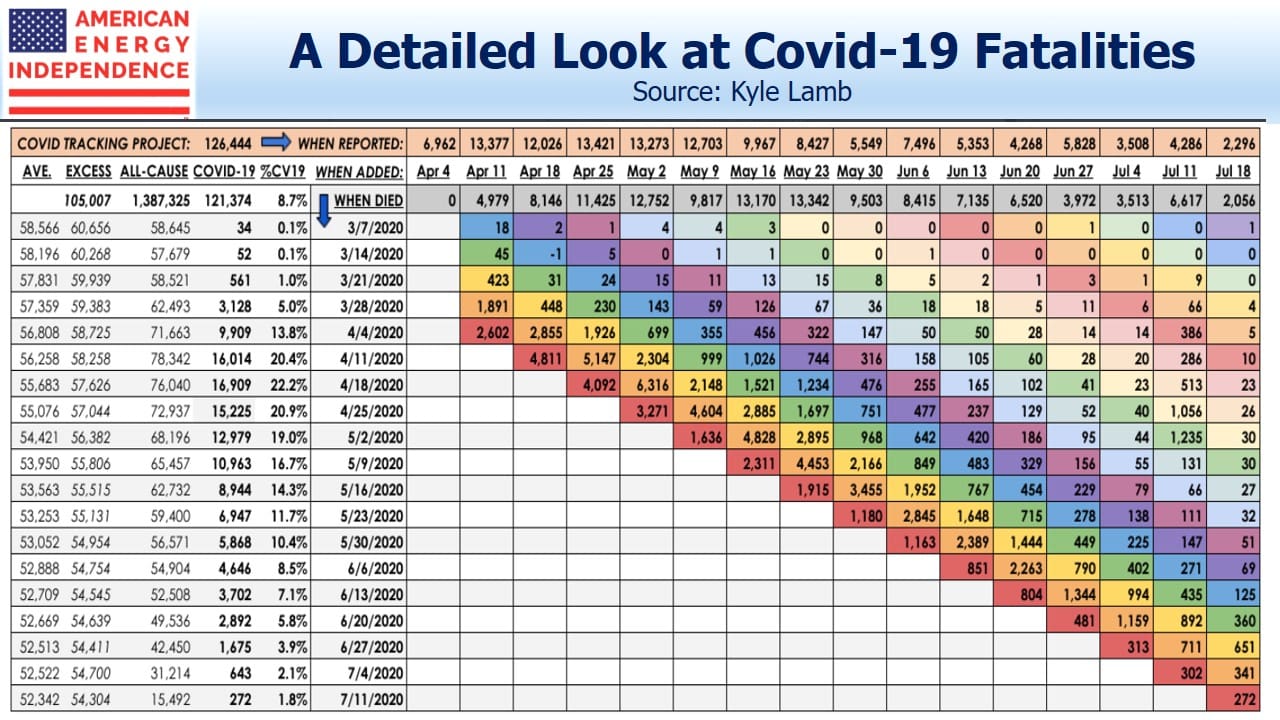

With that preamble, let me introduce a fascinating table that Kyle Lamb has recently posted on Twitter analyzing Covid-19 fatalities. Some effort is required to fully appreciate the depth of information it contains – we’ll explain:

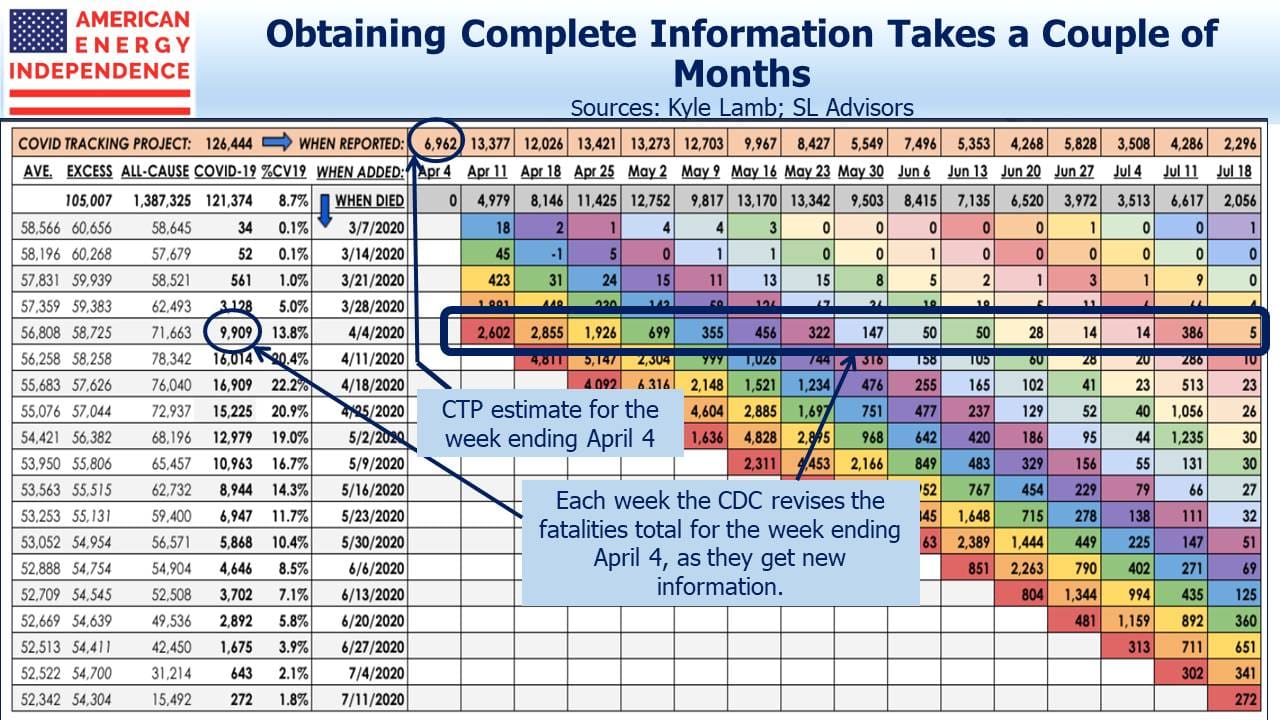

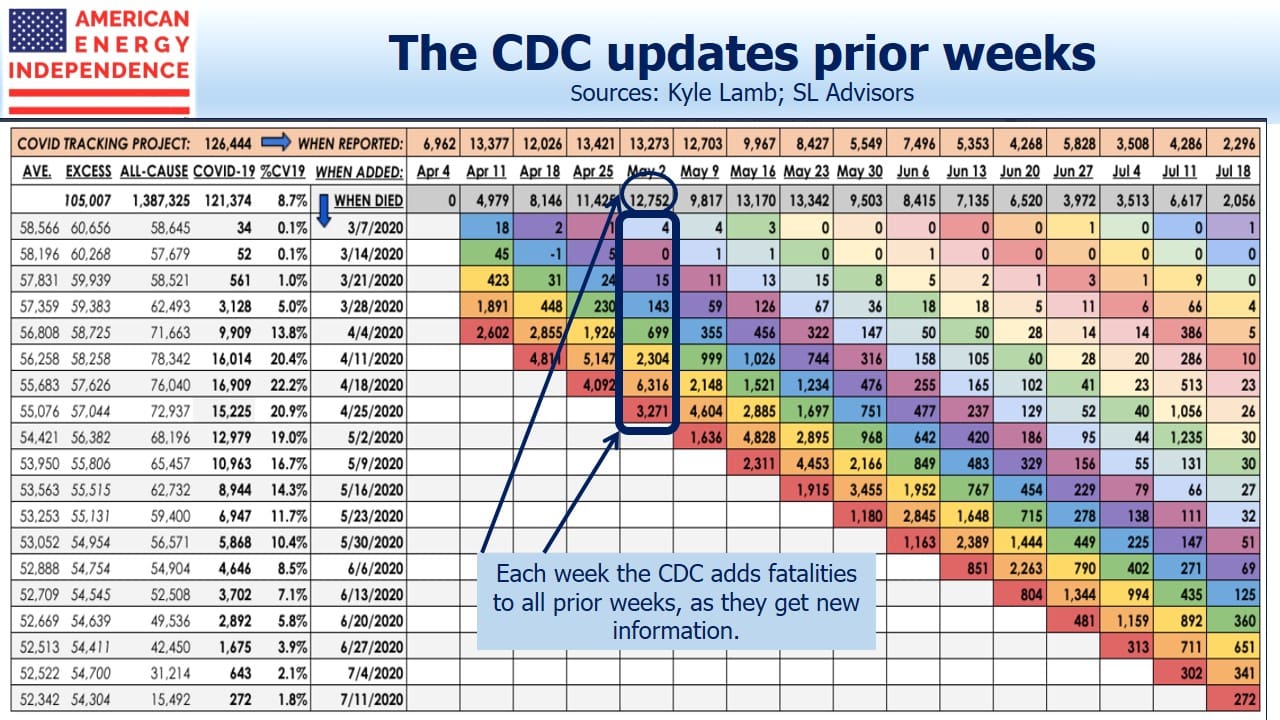

The Center for Disease Control (CDC) publishes a Provisional Death Count which tracks “deaths involving Covid-19”. CDC data relies on death certificates being processed, so lags by several weeks the data published by the Covid Tracking Project (CTP), which is what most media outlets use. Although both produce weekly data, the CDC updates prior weeks for a couple of months, as they receive new information.

For example, reading off the table for the week ending April 4, CTP shows 6,962. The CDC data shows 9,909, a figure they’ve been revising up every week. The first time they reported a figure for April 4 was on April 11, and it was 2,602. If you sum all the colored cells horizontally, you get the fatality total for the week in the “When Died” column.

If you sum the colored cells vertically, you get what the CDC revisions to prior weeks totaled.

Both have revised their websites to higher figures since the table was produced.

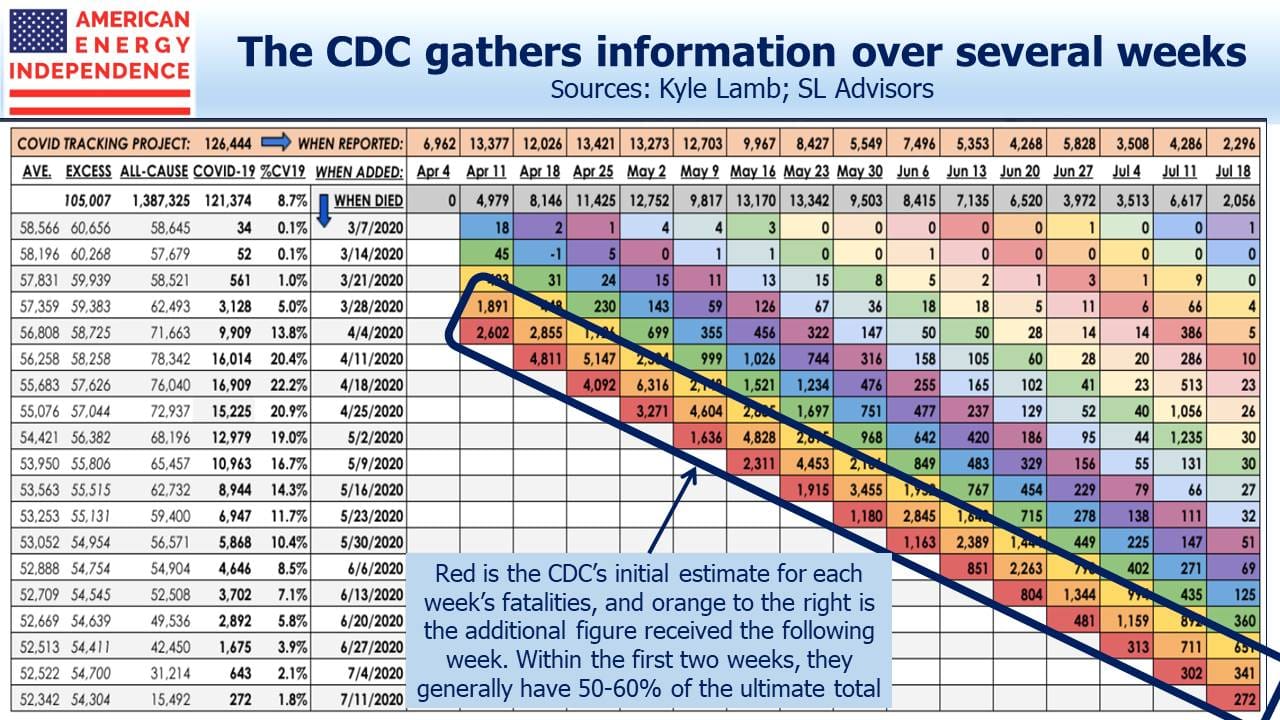

What the table does is break down the CDC fatalities for any given week into multiple weekly buckets to show when they were reported. So the red cells show the CDC’s initial estimate of fatalities for that week. Moving to the right, the orange cells show the number of additional fatalities added to that week’s total a week later.

So what’s the point? Although the CDC’s initial weekly estimate is always revised up, after eight weeks they have most of the data. Within the first two weeks, they typically have 50-60% of the ultimate total for that week.

On April 18, the CDC reported 4,811 deaths for the prior week, a figure that eventually rose to 16,014. The most recent week on the table, ending July 18, shows 272 for the prior week (more recently revised up to 1,099 on the CDC website, which could mean faster reporting or increased fatalities). As the CDC’s initial weekly estimates are falling, it’s reasonable to assume that the ultimate figures will also fall. Clearly sunbelt states are seeing increases, but today’s infected patients are faring much better. They’re younger and are benefitting from improved treatments. Nursing homes have learned to better protect their highly vulnerable residents. CTP fatalities remain well under half the levels of April, when New York was the epicenter.

Stocks continue to trend higher. You should still wear a mask, practice social distancing and wash your hands frequently, as we do. But we’re getting through this.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Very well done

You really seem to be using some obtuse logic to indicate things are getting better. According to most reports over 1,000 people died yesterday (June 21 2020) from Covid. Are you stating this number is incorrect? Will it be revised down next week, next month?