What’s Next For NextDecade?

/

NextDecade (NEXT) has drawn plenty of investor questions over the past ten days. It began with their most recent 10Q, filed with the SEC on May 13th. The phrase, “... there is substantial doubt about the Company’s ability to continue as a going concern.” wasn’t pleasant reading for many. How can a company that reached Final Investment Decision (FID) on trains 1-3 for its Rio Grande LNG export facility last year have any doubts about its survival?

Investors initially looked past the company’s reiteration that it has secured funding for Stage 1 (Trains 1-3). The “going concern” language referred to Stage 2 (Trains 4-5) which is not financed and hasn’t yet reached FID.

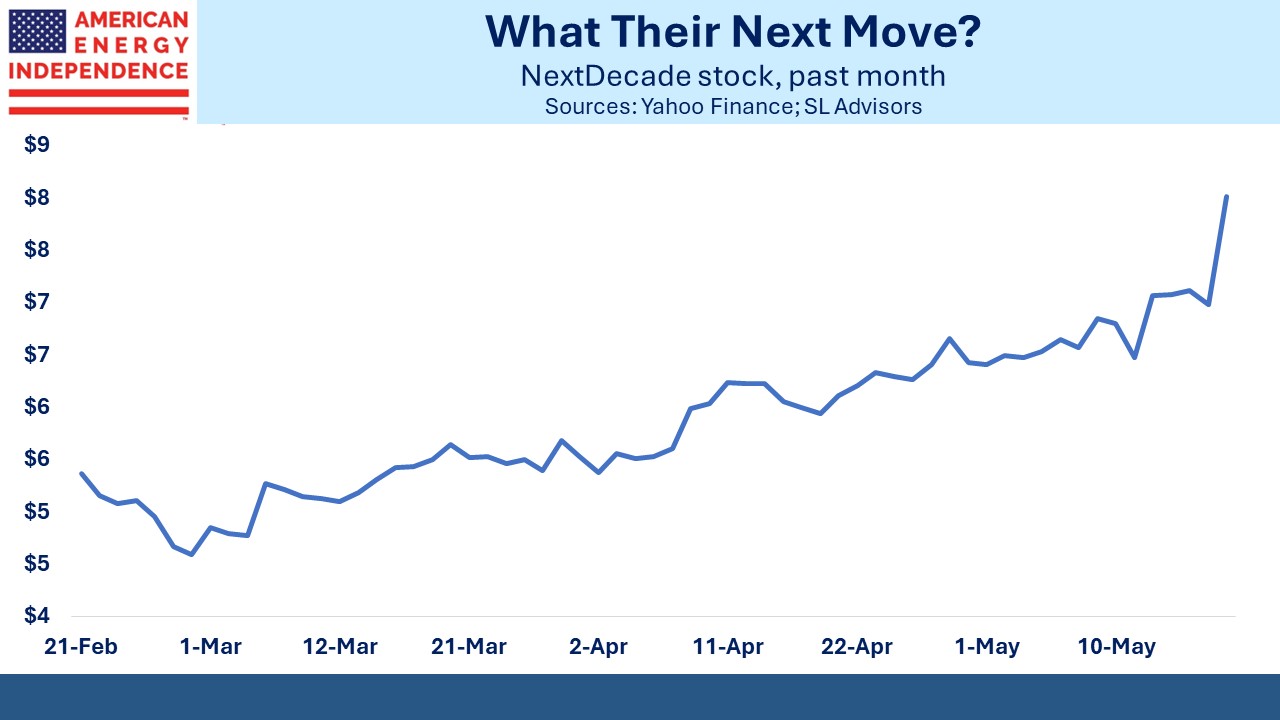

The stock swung wildly over the two trading days (May 10-13), covering a range from $7.41 to $6.37. On Tuesday 14th it recovered strongly, perhaps as investors reassessed.

Our opinion remains that the market is giving little if any credit for the economics of Stage 2. The costs of completing Trains 4-5 should be lower than 1-3 because the site will have already undergone its initial preparation. So we think it’s undervalued. However, the company disappointed investors when they reached Stage 1 FID last July because they wound up with only 21% of the economics.

My partner Henry and I often debate how to assess this. I think they negotiated poorly. Global Infrastructure Partners (GIP) and TotalEnergy outsmarted them. No doubt capital and offtake agreements are vital to the project. But if you’re acquiring the land, capital, infrastructure partner and customers it seems that should be worth more than a fifth of the resulting business. NEXT had led investors to expect a 30%+ share, so on this they disappointed.

The counter, as Henry points out, is that they’re in a much stronger position to negotiate over stage 2 where we expect them to achieve a higher share than Stage 1. Even though Stage 2 is two trains versus three in Stage 1, it’s plausible that Stage 2 could be more valuable.

The LNG permit pause, ill-advised though it is, has helped NEXT. This is because, crucially, they have permits for Stage 2 already. Energy Transfer, whose planned Lake Charles LNG project is currently hostage to the pause, has seen negotiations slow because of the uncertainty. Japan’s Minister of Economy, Trade and Industry Ken Saito has sought clarification since Japanese companies are among the potential customers.

NEXT is not impacted by this. As if to demonstrate, on Monday they announced a 20-year 1.9 million tons per annum offtake agreement for Train 4 (ie Stage 2) with ADNOC of the United Arab Emirates. ADNOC additionally acquired an 11.7% stake in Stage 1 through GIP.

NEXT’s 10Q reminded that they plan to resolve the going concern issue by, “obtaining sufficient funding through additional equity, equity-based or debt instruments.”

This deal didn’t raise any equity for NEXT, so the possibility of a secondary is still there. But it did provide welcome confirmation of Stage 1 economics for the current investors.

NEXT hopes to reach FID on Train 4 later this year.

Deals can get done before FID has been reached on a facility, as NEXT has shown repeatedly in recent years. Permit uncertainty is a more difficult hurdle to overcome.

The contrast with Tellurian (TELL) is stark. Former CEO Charif Souki pursued deals that let TELL retain natural gas price exposure, a risky approach that made it impossible to obtain financing. Agreements expired as TELL failed to make progress. Souki left a job that had already awarded him success bonuses even though he hadn’t been. He was better at negotiating payment for performance in advance than in making TELL successful (see What’s Next For Tellurian?).

In other news, JPMorgan reiterated their bullish outlook on Cheniere (CEI) with its 11% Distributable Cash Flow (DCF) yield and highly visible cashflows. One of my favorite charts is from Wells Fargo where they rank companies in the sector based on what percentage of EBITDA they need to reinvest as maintenance capex.

CEI is top on this metric. LNG terminals don’t require much spending to preserve their functionality.

Earnings for the sector generated few surprises other than CEI’s predictable beat of expectations. Midstream energy infrastructure businesses are generating steadily increasing cashflow. Yields betray that a substantial percentage of investors remain skeptical. Fund flows are modestly positive but there is no irrational exuberance evident. Energy is the best performing S&P sector for the past three years, but to us it still looks like we’re in the early innings.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!