U.S. Natural Gas Exports Taking Off

A couple of months ago we wrote about how the U.S. had sent a shipment of Liquid Natural Gas (LNG) to the United Arab Emirates (see Coals to Newcastle). The notion of natural gas being extracted under a field in Pennsylvania, processed and then transported by pipeline to Louisiana, chilled and condensed to liquid form, loaded onto an LNG tanker and then sent to a part of the world that’s the world’s major hydrocarbon supplier is amazing. It probably reflects better than most things how the worlds of natural gas and crude oil have been upended by the Shale Revolution. So far this year, U.S. sourced LNG has also shipped to Brazil, Chile, Portugal, China, India, Jordan and Kuwait.

Ten years ago when the U.S. was importing around 10 BCFD (Billion Cubic Feet per Day) of natural gas, the idea that some of that would arrive by LNG tanker was uncontroversial. Cheniere Energy began planning facilities such as Sabine Pass to accommodate such flows. As natural gas became steadily more abundant in the U.S., Cheniere reversed themselves and planned for its export via LNG tanker. Although their chosen site had deep water access and connectivity to the domestic network, switching a facility from LNG imports to exports isn’t trivial. Former Cheniere President Charif Souki, who led the company through this metamorphosis, is one of the industry’s most colorful characters.

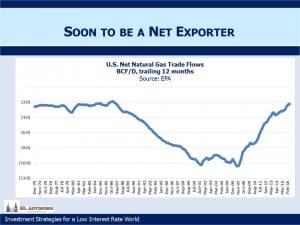

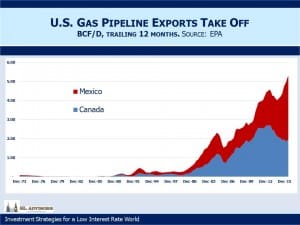

The U.S. is within sight of being a net exporter of natural gas. Additional LNG export facilities are at various stages of development. However, other countries are also increasing their export capability and it’s quite possible the world will have more LNG available than it needs for several years. So far, virtually all the shift in the U.S. balance of trade in natural gas has taken place through pipelines. Canada has long been a net exporter to us although flows go both ways and our net imports from Canada are down by almost half in ten years. We’ve exported to Mexico for thirty years but in recent months volumes have really taken off. Early last year exports to Mexico exceeded those to Canada and the gap keeps growing.

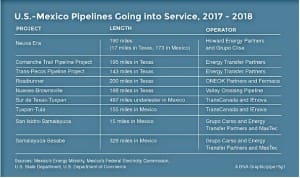

Several new pipeline projects are at various stages of development. Between supplying gas for LNG export facilities and increasing Mexican exports, there’s a lot of energy infrastructure being built. One of the clear beneficiaries is Williams Companies (WMB), whose Transco pipeline is the main recipient of their capital expenditures to accommodate growing demand.

But other midstream infrastructure companies involved in Mexican trade include TransCanada (TRP), Spectra (SE), Energy Transfer Equity (ETE) and Oneok (OKE).

In many cases their Master Limited Partnership (MLP) will build the assets and then share the Distributable CashFlow with their General Partners (GPs) via Incentive Distribution Rights as is common. This asset growth will benefit the GPs. Just as asset growth for a hedge fund benefits the hedge fund manager, or GP, so does asset growth for an MLP benefit its GP. An MLP GP is like a hedge fund manager.

We are invested in ETE, OKE, SE, TRP and WMB

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!