Today’s Pipelines Leave MLPs Behind

Last week Kelcy Warren, CEO of Energy Transfer (ET), defended the MLP structure. He’s definitely correct that MLPs possess a powerful tax advantage over corporations, in that their profits are only taxed at the investor level. Tax-deferred income free of the double-taxation to which corporate profits are subject is very appealing, and for years it drew countless buyers. Unfortunately, Warren is part of the reason that the MLP structure is losing favor. Midstream energy infrastructure and MLPs used to be synonymous, but widespread distribution cuts and investor abuse have left the old, rich Americans who used to be the investor base betrayed. The names Kelcy Warren and Rich Kinder still elicit strong reactions from longtime MLP investors.

The Alerian MLP ETF, a good proxy for how MLPs have performed, has cut its distribution by 34% since the market peak in 2014. Companies chose to finance growth projects in excess of free cash flow, and ultimately resorted to either outright distribution cuts or “backdoor” distribution cuts by merging with a their lower yielding corporate general partner. Many MLPs abandoned the structure, and income seeking investors in turn have abandoned the remaining ones.

The result today is that MLPs represent 36.5% of the sector by market capitalization, as defined by the Alerian Midstream Energy Index — AMNA (see MLPs No Longer Represent Pipelines). Kinder Morgan, ONEOK, Enbridge, Targa Resoures and Williams Companies are among those that have fully adopted the corporate structure.

MLP-dedicated mutual funds and ETFs were originally designed to offer sector exposure to retail investors who didn’t want to deal with K-1s. They saddled their investors with a ruinous tax burden, because funds with over 25% of their portfolios in partnerships (which is what MLPs are) have to pay corporate tax. It seems odd to take a tax-efficient vehicle and add taxes to it, but showing how few investors read the fine print, these products took hold. And they’re now focused on just 36.5% of the sector (see Are MLPs Going Away?).

To illustrate how much things have changed, just two names, Energy Transfer and Enterprise Products, represent 43% of the market cap of all MLPs. Dedicated MLP funds are forced to drastically underweight these two, which leaves them with outsized exposure to the smaller MLPs. They’ve moved a long way from diversified portfolios of large, fully integrated “toll road” pipeline systems that originally attracted investors.

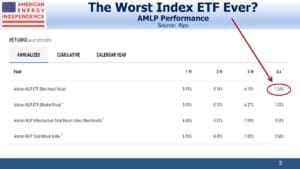

The biggest of them, the Alerian MLP ETF, has since inception delivered less than one third of its index. This is probably the worst performing index ETF in history. Corporate taxes have taken a bite, and when the sector delivers a couple of big years the tax hit will be even more noticeable (see MLP Funds Made for Uncle Sam). The 1.04% since inception annual return is not far from the 0.85% advisory fee, putting AMLP in the company of the hedge fund industry in making profits while the clients don’t.

If you ever meet one of the hapless souls who’s chosen AMLP, you’ll find they’re probably unaware of the tax drag.

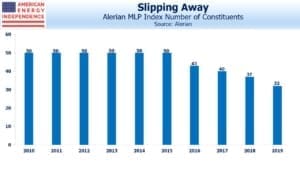

The shrinking number of MLPs has rendered MLP-dedicated funds less representative of the sector. Of the ten biggest North American pipeline companies, six are corporations and so excluded from AMLP and its cousins. Every time another pipeline company leaves the publicly-traded MLP universe, these funds are left with fewer names and a preponderance of small ones. The market has shifted since many of these were launched a decade or more ago (see AMLP’s Shrinking Investor Base).

If any of these funds decides to reduce their MLP exposure below the 25% threshold, so as to be more representative and avoid corporate taxes, it’ll depress MLP prices because many will have to sell three quarters of their holdings. A quarter of the $135BN in public float for all MLPs is held by $34BN in MLP dedicated-funds. It’s a crowded space.

Moreover, AMLP reflects the worst of MLPs – AMNA is 21% Gathering and Processing (G&P), the more risky end of the midstream business because it’s more dependent on production from specific areas. Due to limited choices, AMLP has 26% exposure to G&P. Even worse, natural gas pipelines are a big underweight in AMLP, even though the long term prospects for natural gas are more visibly positive than for crude oil and liquids. Natural gas pipelines represent 46% of AMNA, but only 27% of AMLP. So AMLP investors have an overweight towards crude oil and liquids.

Investors are starting to act on the many flaws of MLP-dedicated funds. Over the past year, $4.1BN has left the sector. The American Energy Independence Index is investible (you cannot invest directly in an index) and has weights that are more reflective of the industry. Its holdings are mostly corporations, which reflects today’s pipeline business. Several names are ESG holdings for Blackrock and other big fund managers, but MLPs don’t pass ESG screens because of poor governance (watch ESG Investors Like Pipelines). The broader investor base and ESG qualities helped pipeline corporations outperform MLPs last year.

Disclosure: our affiliated investment products are structured to reflect the insights listed above.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

ironically, I agree both with Kelcy Warren’s attitude towards the tax benefits of MLPs and the negative perception of Warren himself as a disregarder of unitholder rights. I also believe that future conversions of those MLPs that qualify will be to REITs, not to C corporations. REITs retain the tax exempt pass through status of MLPs and the qualification for the 20% deduction under Code section 199A and yet provide the perceived benefits of a corporate structure.Of course, not all MLPs will qualify. For example compression partnerships will not, but pipeline owners will.