A Few Thoughts on Long Term Energy Use

Every year Exxon Mobil publishes their outlook for global energy over the next 25 years. It’s an absorbing read for people who care about such things. Their projections may not all be right, but they have to think about such issues pretty carefully and make long term investment decision based in part on their views. In reading the latest edition: 2017 Outlook for Energy: A View to 2040, a few slides jumped out.

The U.S. Energy Information Agency (EIA) also just published their 2017 Annual Energy Outlook which includes projections out to 2040. Although these two reports are structured differently (Global versus U.S.; Exxon makes single case forecasts whereas EIA includes multiple scenarios) they are generally consistent. They agree on broad issues such as improving energy efficiency, more U.S. consumption of natural gas for electric power and industrial use, and gradually increasing crude oil production. The EIA forecasts the U.S. to be a net energy exporter within 5-10 years (depending on scenario), driven by sharply higher natural gas production displacing imports and leading to a net export position, and somewhat higher crude oil output reducing but not eliminating oil imports.

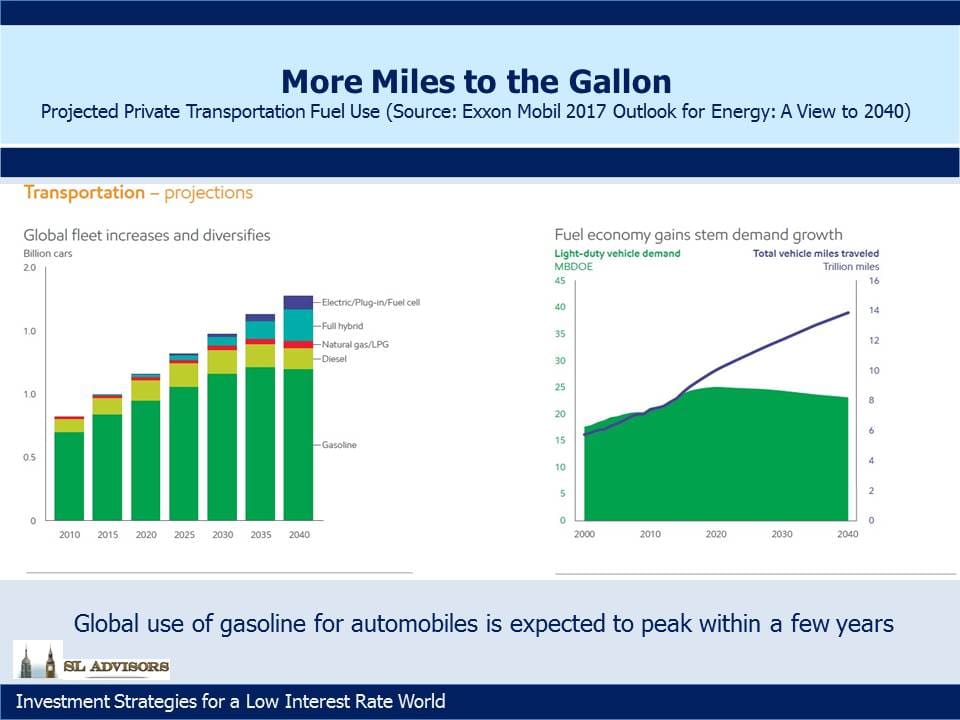

Although the world will drive more cars and many more miles thanks to demand in Asia, gasoline use for private automobiles is expected to peak within just a few years. Increasing use of electric and hybrid cars along with continued improvements in conventional engine fuel efficiency will more than offset more driving. China for example just announced plans to invest almost $400BN in renewable fuels by 2020. Although this is directed at reducing pollution from power generation, to the extent hybrid and electric cars gain market share in China they will use cleaner electricity. Based on today’s heavy reliance on coal for generating electricity, Chinese Tesla drivers have little to brag about. It’s also worth noting that the EIA in its Reference Case forecasts continued growth in U.S. exports of petroleum. This isn’t necessarily at odds with Exxon’s forecast of flat global gasoline use if U.S. refiners gain market share.

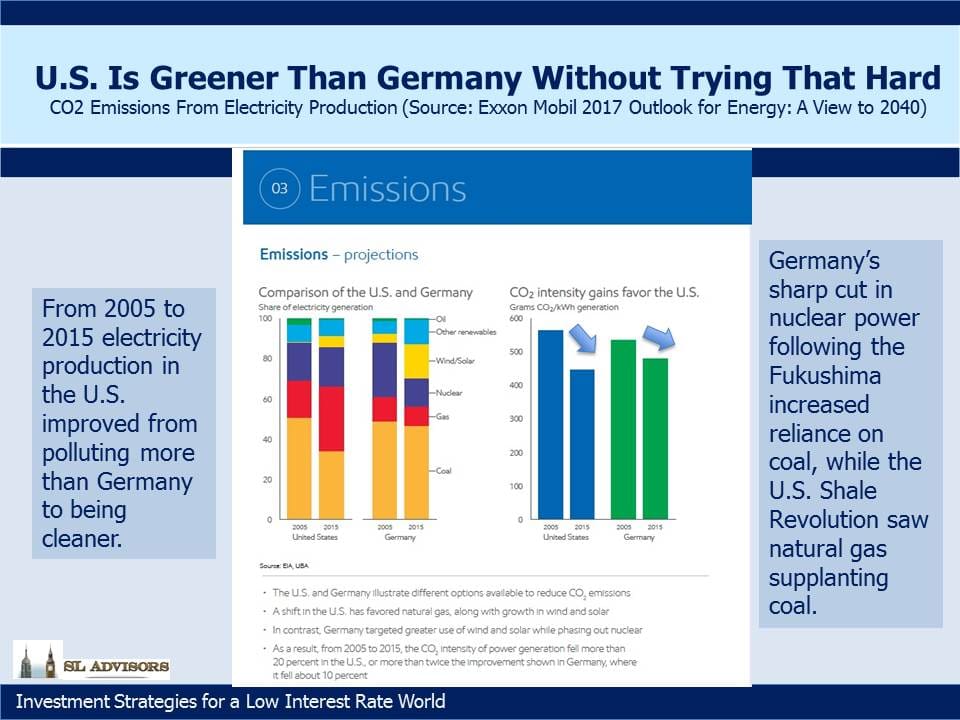

Germany has become a pioneer in the use of windpower, aided by many flat areas on which to build windmills as well as the very windy Baltic and North Seas. Germany sees itself as a leader in the use of renewable energy, a responsible global citizen limiting its contribution to global warming. And yet, few probably realize that the U.S. now generates electricity with less CO2 output than Germany. The improvement in the U.S. is due in large part to greater burning of natural gas instead of coal for electricity generation, a consequence of the Shale Revolution. Meanwhile, Germany’s green efforts have been harmed by its sharp reduction in nuclear power following the near meltdown of Japan’s Fukushima reactor in 2011. Renewables can only do so much, and as a result Germany’s use of coal has stayed higher than it might otherwise. Germans may not feel they need a lecture from Americans about saving the planet, but America can demonstrate better results.

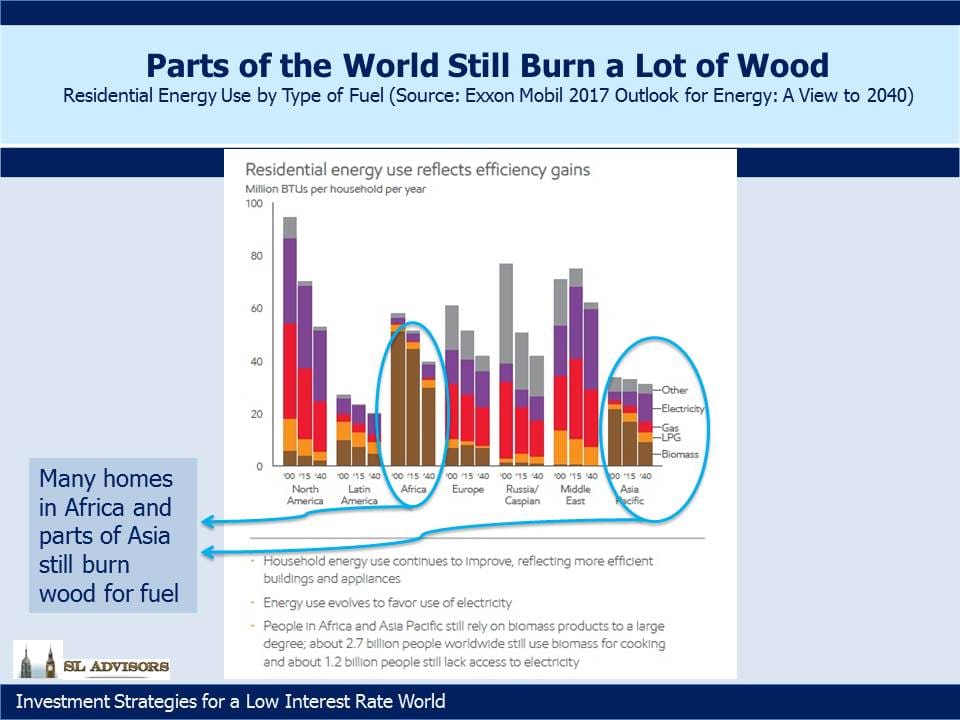

The third slide highlights the highly undeveloped use of energy in homes across Africa and parts of Asia. Biomass (wood, in different forms) may be renewable but it’s not especially clean burning for those in its immediate vicinity. A complete assessment of its environmental impact is complex and depends on how it’s harvested, the climate, what type of wood and the available alternatives. We just found it surprising to see how much of the world still relies on a relatively primitive source of energy.

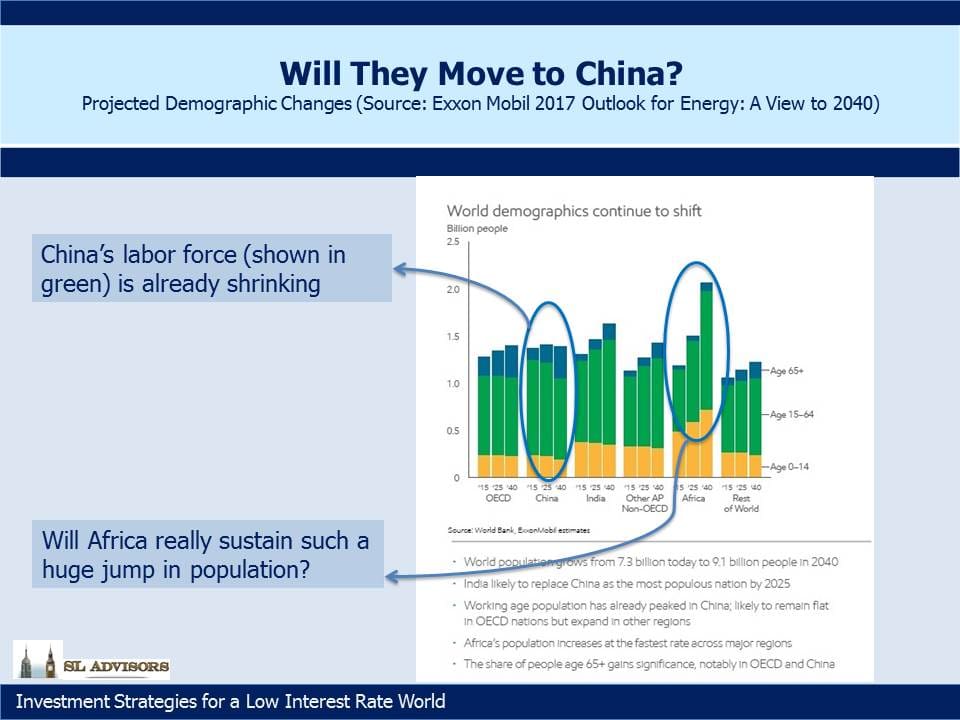

Finally, although demographics shift slowly, they’re still worth a look from time to time. China’s working age population is peaking around now. Since GDP growth comes from only three sources: (1) Labor force growth, (2) Productivity improvements and (3) Capital, Chinese GDP growth will need to come fully from the latter two now on. Developed economies are reckoned to be capable of 1-2% annual GDP growth before adding in the effect of labor force changes. Few are forecasting that China’s GDP growth will sink to this level, but it’s an interesting thought that ALL their growth will have to come from doing things better than before.

Meanwhile, Africa is forecast to add twice the population of North America in about a generation. Providing food, employment, housing and infrastructure for so many people is a challenge no region of the world has faced before.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!