The Sunshine State Runs On Natural Gas

/

If you google “Florida solar” or “Florida natural gas”, both searches return around 150 million results. NextEra Energy, which owns Florida Power and Light (FPL), the utility that covers much of the state, is targeting zero emissions by 2045. Their 2022 ESG report says FPL expects to quadruple its solar generation capacity by 2031. They currently operate 63 solar sites across the sunshine state.

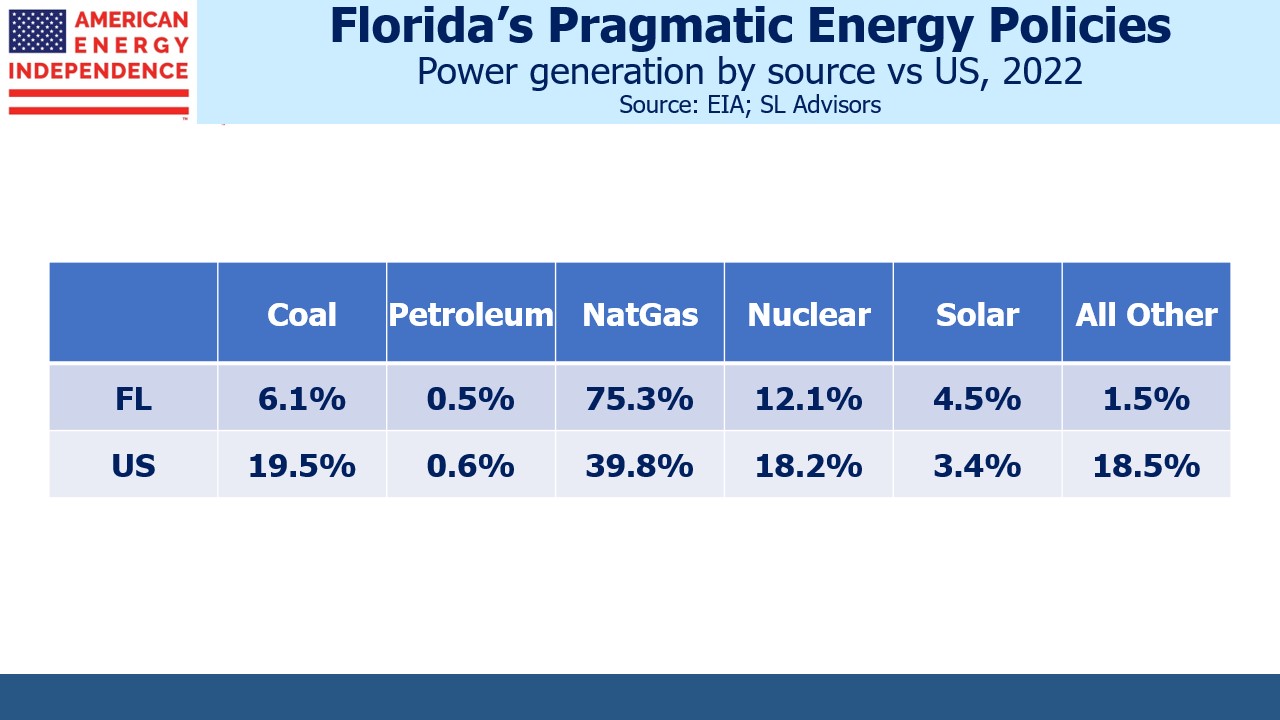

As its nickname suggests, Florida is well situated for solar power. Casually following the announcements of new solar installations and battery centers to back them up, one might think the state is largely powered by the sun. But as the Energy Information Administration (EIA) recently noted, 75% of Florida’s electricity comes from natural gas.

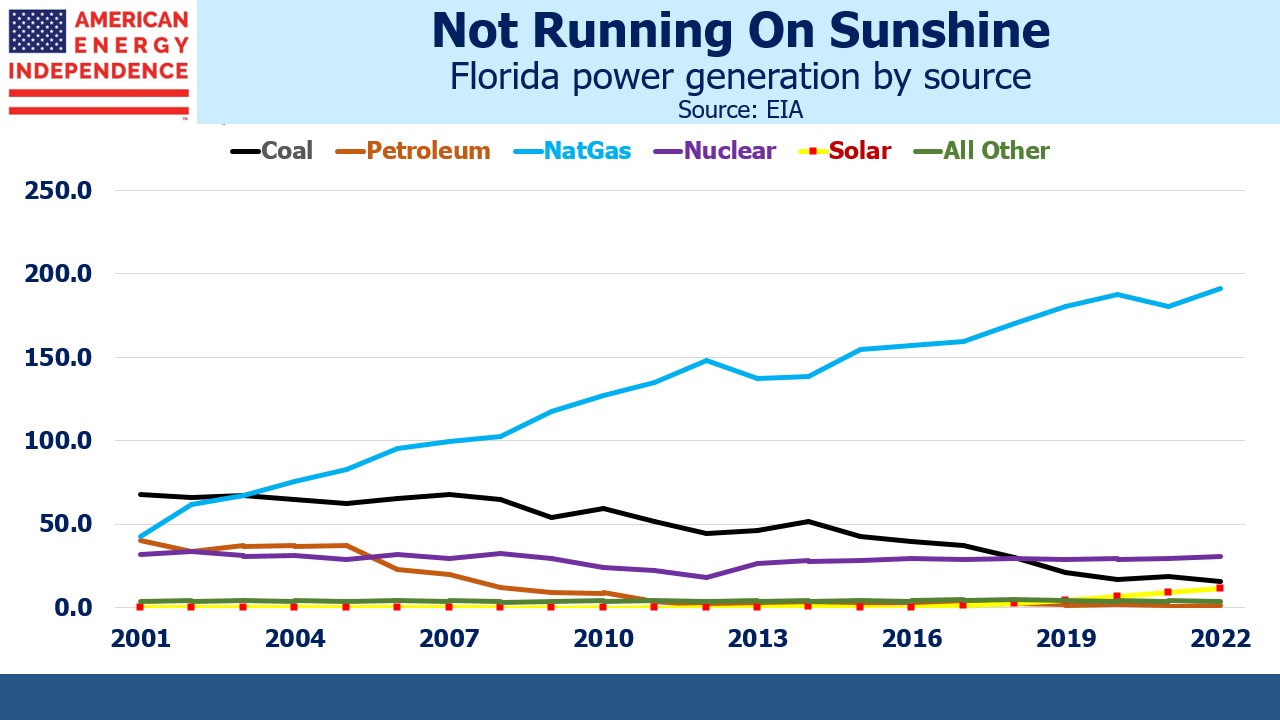

The biggest change in Florida’s sources of power generation over the past decade has been the increase in its use of natural gas, which generated 191 Terrawatt hours (TWh) last year, 53 TWh more than in 2012. This 2.6% annual growth rate pales against solar’s 50.3% annual rate over the same time. But growth rates starting with a very small base number often look deceptively high. Renewables fans use this mathematical sleight regularly to overstate their impact. Last year solar power generated 11.4 TWh for Floridians. Even the year-on-year increase of 2.4 TWh was less than a quarter of the jump in natural gas. And it’s safe to say that solar growth rate will not sustain anything close to 50%.

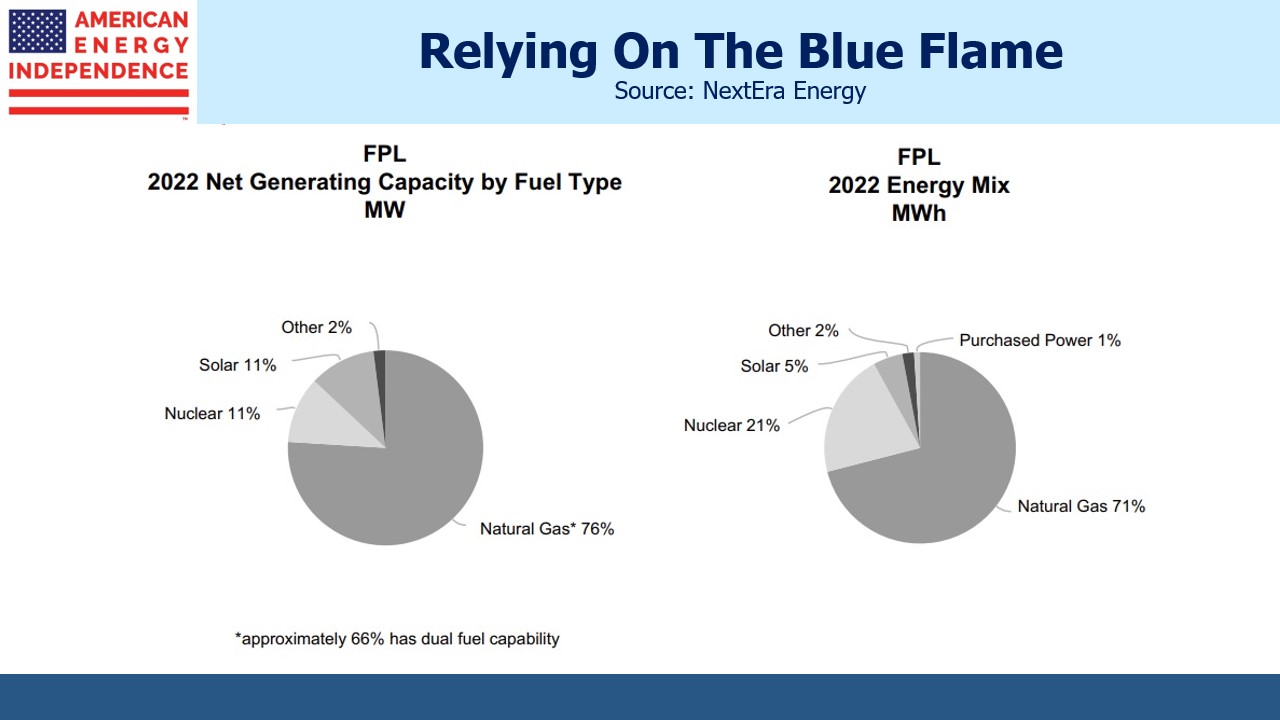

Florida relies on solar power for 4.5% of its electricity, a little higher than the US at 3.4%. Generation over the past decade has grown at a 1.6% annual rate, three times the US at 0.5%. As a Florida homeowner I think FPL is getting it right. They’re delivering reliable power at a reasonable price. Their mix of sources roughly matches Florida’s, since they’re the states’s biggest provider. Also note that solar is 11% of capacity but only 5% of supply. Solar and wind tend to run at 20-30% of capacity (offshore wind can be higher). Florida’s solar may run higher because it is usually sunny, but after each glorious sunset those solar panels stop working.

NextEra’s ESG document is fortunately not being implemented in a way that’s harming consumers, because adding nuclear’s 12% share means 87% of the state’s electricity comes from reliable sources.

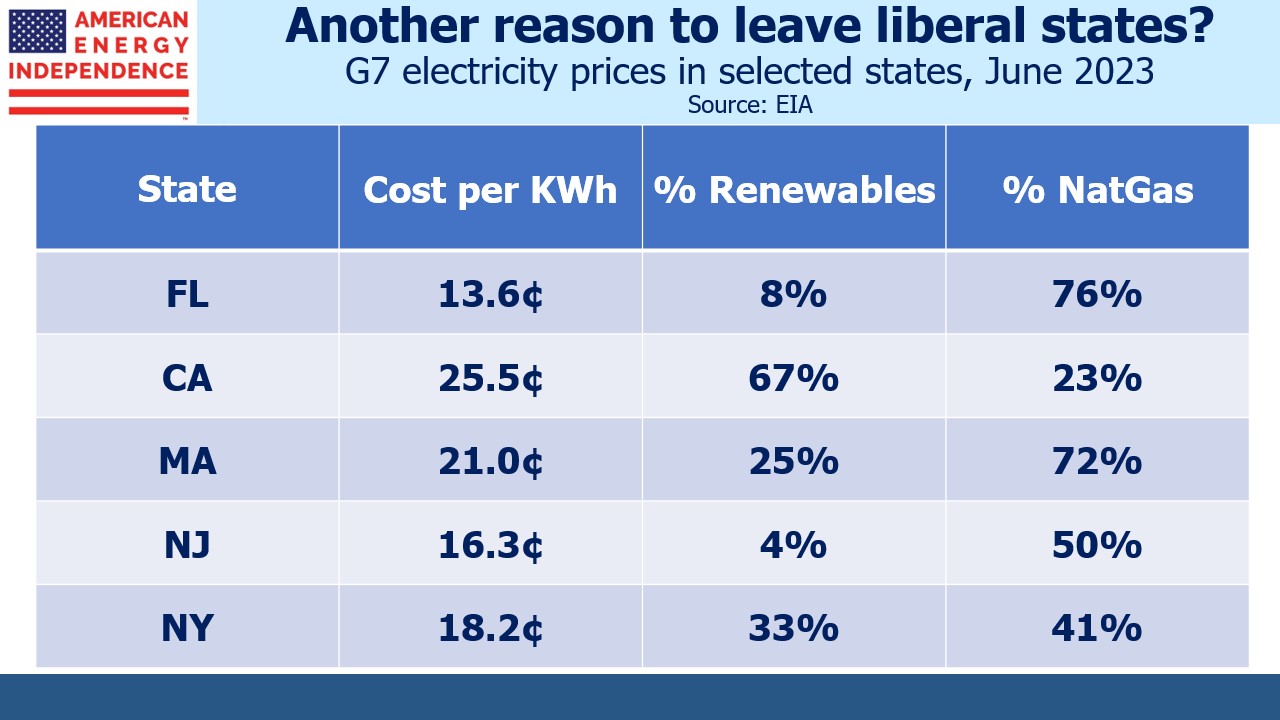

Liberal states have higher electricity prices, partly because they are adopting more stridently anti-fossil fuel policies. More renewables mean more costly power. New York won’t let new buildings connect to natural gas. Massachusetts has high prices even though their reliance on natural gas rivals Florida. This is because they’ve blocked the new pipelines and storage facilities that they clearly need, limiting their benefit from low domestic prices. Instead, they import liquefied natural gas (LNG) and therefore have to compete on the global market at much higher global prices.

Florida’s use of coal has dropped by two thirds over the past decade. China plows ahead with new coal burning power plants at the rate of around two per week. They’re building six times as many as the rest of the world. Climate extremists in liberal states drive energy policies that impose higher costs on their own citizens and any modest benefit in reduced emissions is swamped by China’s actions.

US residential solar is losing momentum, because of higher interest rates as well as a sharp drop in the rebates California residents can earn for sending surplus solar power back to the grid. Wells Fargo estimates installations this year will be up only 3% versus last year and is forecasting a 13% drop next year. The EIA expects cheap natural gas to cause a slight drop in electricity prices next year. Florida should benefit more than most. Massachusetts probably won’t.

Tesla offers installation of photovoltaic roof tiles that don’t look like ugly solar panels arrayed on top of your house. The WSJ recently interviewed two homeowners happy in spite of long delays. But volumes are far below the company’s forecast of five years ago and the story suggests Tesla severely underpriced the jobs. Solar really isn’t that cheap, especially in northern states.

Job growth in Florida is double the rate of New York and New Jersey, and 50% faster than Massachusetts and California. Remote work is allowing Americans to spread out, and they’re choosing Republican states because they’re generally better run and more pro-business.

Long-time Florida residents often express the fear that “northern liberals” will turn Florida blue. The opposite has happened, because political conservatives are generally the ones that move. My golf club in NJ has seen an increase in members moving to Florida. Few voted for Democrat governor Phil Murphy. This is why migration south has created a liberal shift in states like New York and New Jersey instead. Energy policies are starting to reflect this.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!