Renewables Confront NIMBYs

/

Last week a Federal judge blocked completion of the Cardinal-Hickory Creek high-voltage transmission line. The 102-mile project linking Dubuque County, Iowa, to Dane County, Wisconsin has one mile remaining. Three environmental groups opposed its construction through a Mississippi River wildlife refuge. It’s needed to upgrade an existing transmission line built in the 1950s, add capacity, and bring new solar and wind power to Madison, WI.

Environmentalists are far from one homogeneous group. Locally, they can oppose infrastructure enabling the energy transition they support nationally. An FT video on the Cardinal-Hickory Creek website shows an environmentalist holding a feather (“I found five today”) lost by a bird unsuccessfully navigating the pylons.

Power lines are an unfortunate ugly corollary to electricity use. Because solar and wind need large spaces, their output must travel long distances to customers. Climate extremists wishing to project a coherent view must reconcile the two. Nuclear and natural gas take up less room so can be placed nearer their customers.

The big problem with energy infrastructure isn’t the opposition from environmentalists. It’s the legal process that allows last-minute delays to projects that are almost complete.

Cardinal-Hickory Creek was first conceived in 2011. Public engagement began in 2014, authorizations were in hand by 2020 and construction began in 2021. 115 renewables projects with 17 gigawatts of capacity depend upon its completion. Nobody will build anything that can be derailed at the finish line when capital has been long committed and spent. But this is America’s process today.

We’re suddenly moving into a period of high demand growth for electricity following decades of flat demand. Electrification, including increased use of EVs was expected to add 1% pa to demand. Data centers are suddenly the new power hogs.

Wells Fargo estimates that AI will add 16% to US power demand by 2030. In less than a year, 1% annual demand growth has become 3%+.

For some this will increase the urgency to add even more solar and wind, although it’s hard to imagine that we could be doing any more. Therefore, it will boost natural gas demand.

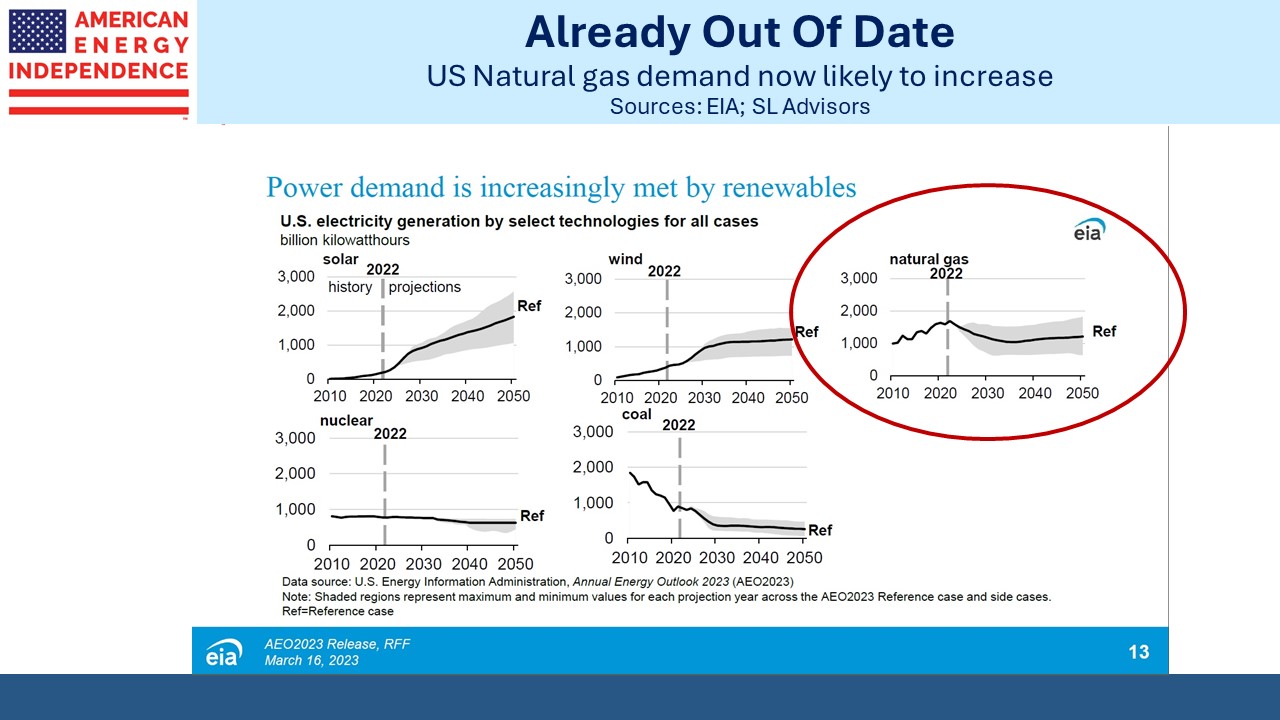

Last year the Energy Information Administration (EIA) projected natural gas use in electricity generation was about to peak. The EIA produces unbiased research, unlike the International Energy Agency (IEA) whose publications are mostly fantasy appealing to climate extremists.

This loss of demand will be made up for elsewhere in industry and via LNG exports once the pause on new permits is lifted. But now the trajectory has changed. Wells Fargo estimates that AI will boost natural gas by 7 Billion Cubic Feet per Day (BCF/D) in order to meet just 40% of the incremental power load. Their upside case is 16 BCF/D. Last year the US produced 105.5 BCF/D from the lower 48 states.

This analysis only considers US data centers. But they’re being built all over the world. The AI revolution is global. Projected increases in electricity generation will add to global LNG demand. US natural gas prices are cheap. Chad Zamarin, a senior vice president at Williams Companies (WMB) says, “Domestic U.S. markets are oversupplied.”

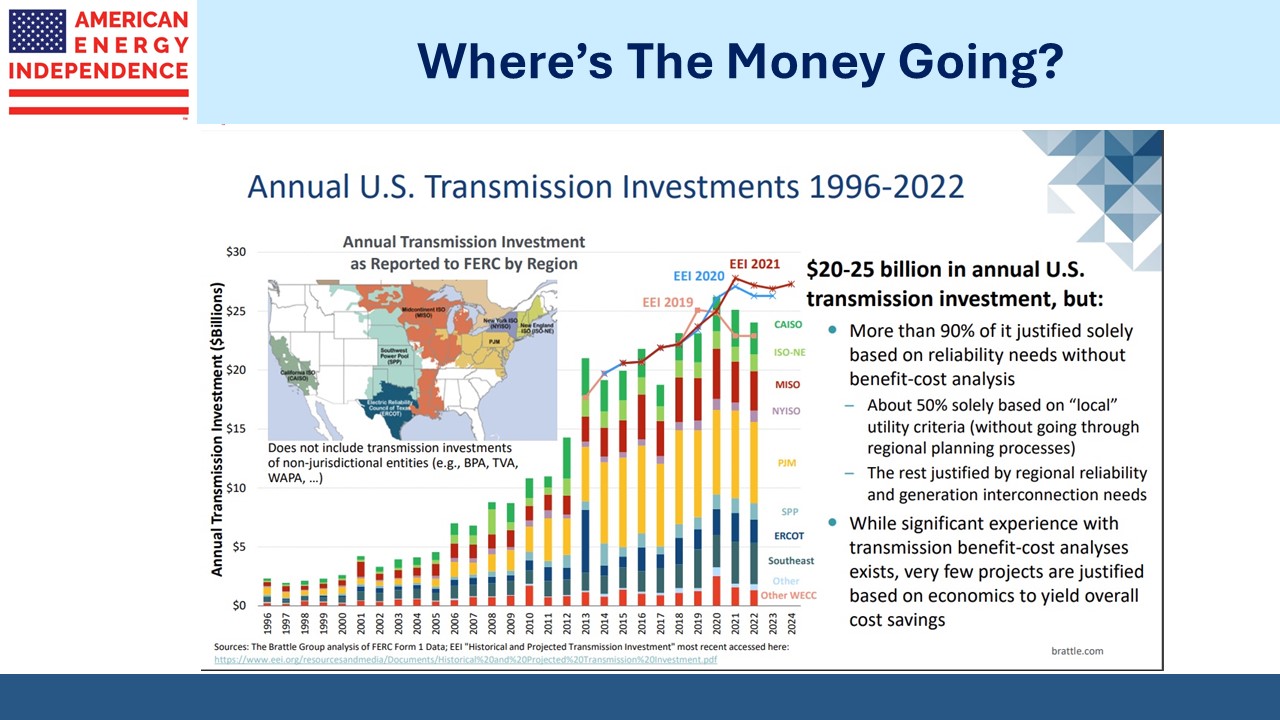

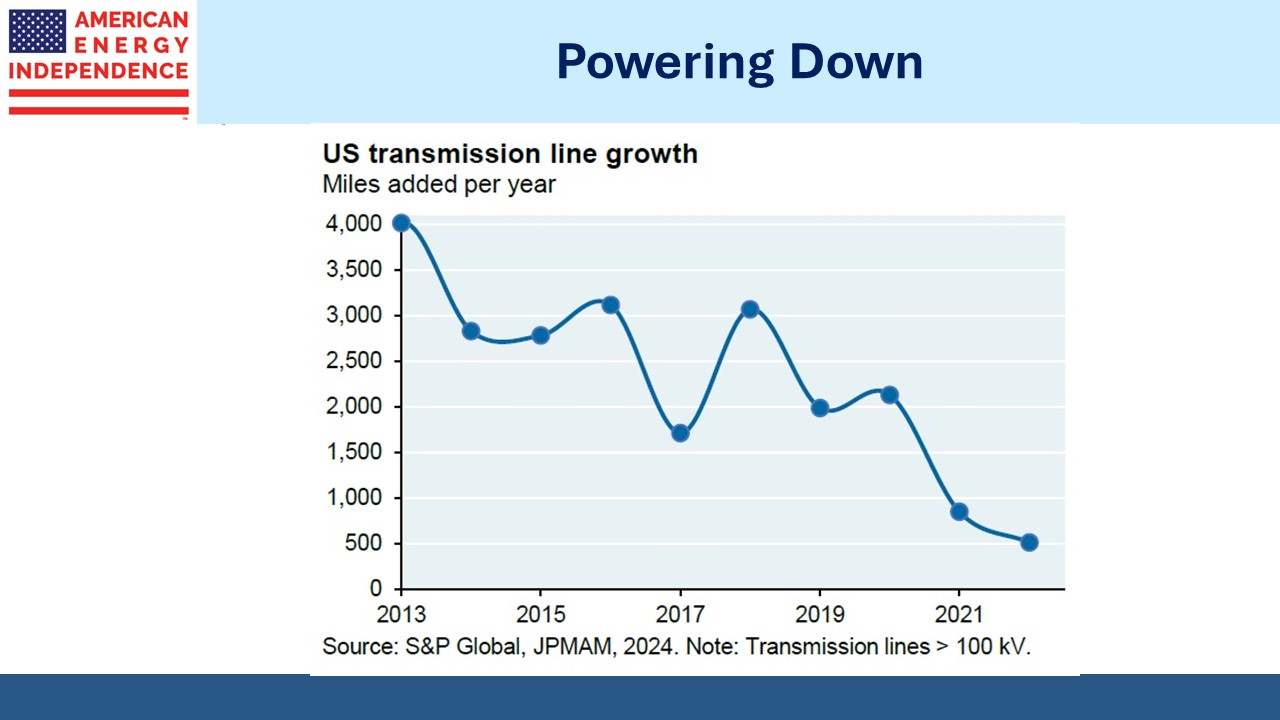

Companies that produce electrical equipment should do well. Transformers are on a two year backlog. But assuming this will be good for renewables is to bet on a transformation of how infrastructure gets built.

America’s regional grids are increasing spending. But we’re adding the fewest miles of transmission in a decade. This is the morass into which investors in clean energy and utilities are jumping. Regardless of how strongly you believe in renewables and how sleepless rising sea levels make you, financing solar, wind and new power lines looks like a good way to lose money.

Morocco’s Noor Ouarzazate solar complex, operated by Saudi Arabia’s ACWA Power International, has had to shut down for most of the year because of problems at its storage unit. The facility has suffered repeated problems. A government agency called for its closure in 2020 because of high cost.

Morocco has a goal of getting renewables to half its power capacity by 2030. Their primary energy consumption is 7% renewables, with the balance from fossil fuels. Give them credit for trying. Many Moroccans would likely prefer adding cheap energy over green energy to raise living standards. Per capita energy consumption is a tenth of the US.

It seems increasingly clear that the AI revolution is going to boost natural gas consumption. Adding new pipelines is no easier than adding power lines. But pipeline operators can add small amounts of capacity at the margin. They don’t face any new competitors. Toby Rice, CEO of EQT, said, “Our pipeline infrastructure is maxed out.”

Rather than being compelled to deliver the energy transition, natural gas pipelines are positioned to compensate for the transition’s inability to deliver what politicians have promised.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

“Wells Fargo estimates that AI will add 16% to US power demand by 2030. In less than a year, 1% annual demand growth has become 3%+.”

It practically goes without saying, but this could be huge for midstream natural gas companies.