Environmentalists Mistakenly Choose Perfect Over Good

/

All three TV networks recently carried stories of northern state Electric Vehicle (EV) owners stranded. Chicago’s very cold weather reminded EV owners that not only do their batteries hold less charge when temperatures drop, but they are slower to charge as well. Public charging stations saw vehicles lined up – some EVs ran out of power before they could even pull up to the charging station. Not all charging stations were working.

The cold weather caused some drivers to sit in their EVs with the heat on, further slowing recharging. One driver reported seeing ten flatbed trucks taking away dead EVs. Because you can’t just get a gallon of gasoline and bring it to your car. The flat EV must be taken to a source of electricity.

A 2019 study by AAA found that temperatures below 20 degrees can reduce EV range by up to 41%.

This was an extreme weather event. Every Tesla driver I know loves their car. But they all own another gas-powered car and would have used it at a time like that. The drivers on the network news didn’t look as if their EV was a second car. They looked as if it was their car, and as such it needed to do better than work most of the time in most conditions.

Given the negative press around slowing EV sales, the industry didn’t need this. Hertz is selling a third of its EV fleet because of low demand. They found repairs were more costly than expected. And who seriously wants to rent an EV in an unfamiliar region and worry about finding somewhere to charge it? Hertz’s embrace of EVs always looked like a dumb move. They expect to take a $245MM charge in 4Q23 for EV depreciation.

It increasingly looks as if hybrids would have been a more sensible intermediate step while EV technology improves beyond its current standard.

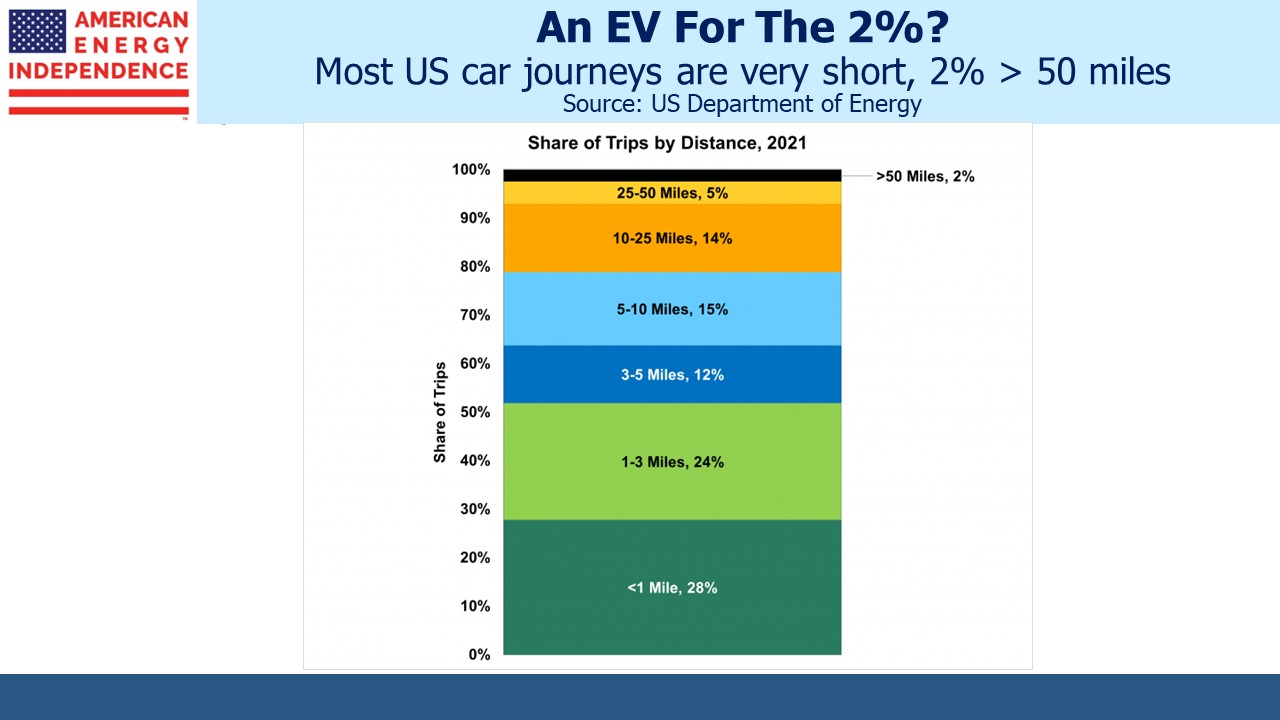

Over 60% of car trips are less than five miles. Over 90% are under 25 miles. Most of these can be supported by a hybrid’s battery, recharged when the owner is at home. The gasoline assures that a long journey or a cold one won’t end with a flatbed truck. The average hybrid gets over fifty miles per gallon.

Policymakers have chosen the perfect over the good. The White House has a goal that half of US auto sales be EVs by 2030. Hybrids are included in this, which is just as well because anyone who relies on a single EV to get around is taking more risk of getting stranded than the owner of a conventional car.

Progressive liberals, many of whom live in urban environments with adequate public transport, naturally believe we should transition straight to fully electric EVs. Americans (1) drive long distances, (2) like bigger cars, and (3) benefit from cheaper gasoline compared with other OECD (ie rich) countries. We are less likely than others to embrace EVs absent even more substantial tax breaks until the reliability improves.

Another example of progressive liberals increasing greenhouse gas emissions by pursuing perfection is the recent news that the White House is considering tougher rules before approving new Liquefied Natural Gas (LNG) export terminals. Environmental extremists calculate the emissions the additional LNG exports will generate when consumed by foreign buyers. They naively think that limiting LNG availability will support more solar and wind power in Asia.

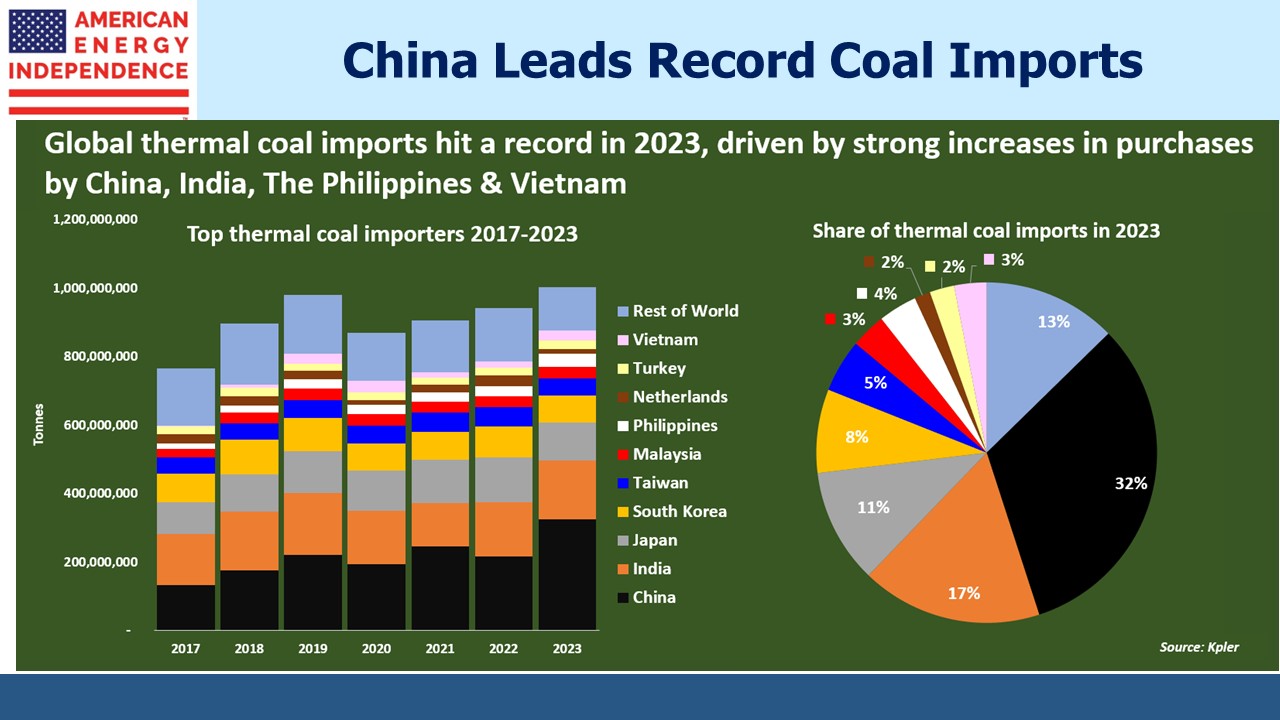

Meanwhile, power generation from coal hit a new global record last year. 82% of all coal-fired power generation was in Asia, up from 75% in 2019. Reductions in Japan and South Korea were almost completely offset by growth in Vietnam alone. Along with China, India and the Philippines they all saw strong import growth last year.

Coal is cheap and reliable. It also generates on average 2X the emissions of natural gas.

The most effective way for the US to help developing countries in Asia reduce their coal consumption is to send them more LNG. The correct analysis of LNG’s impact on emissions would consider what energy source it’s displacing. In the US, coal to gas switching is our biggest success on emissions. We should be helping other countries do the same.

The White House appears to be adopting the superficial analysis described above as a soundbite to the progressives rather than trying to solve the problem. If you want to invest in lower emissions, natural gas infrastructure is a more certain bet than renewable energy.

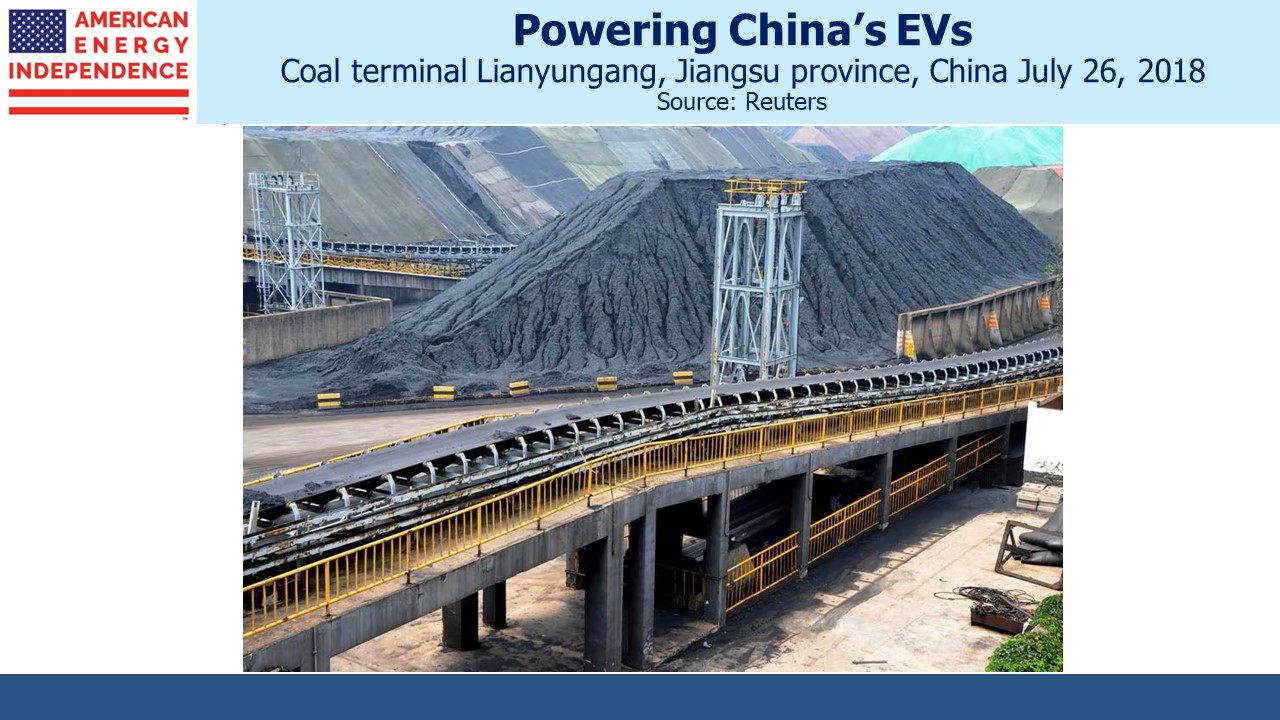

Progressive liberals are often the biggest hurdle to sensible energy policies that recognize the reality of developing countries’ prioritization of growth over climate. Outgoing climate czar John Kerry will be remembered as a booster of what he perceived as China’s commitments to reduce emissions even while they have grown by burning half the world’s coal production. That’s the dominant source of the power than runs through China’s EVs.

Pragmatic climate policies will have better success than the idealism too prevalent on the left.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

White House pandering to climate alarmists is irrational and has negative consequences for the US, but it is not surprising for the inane Biden administration.