Energy’s Slow Transition

/

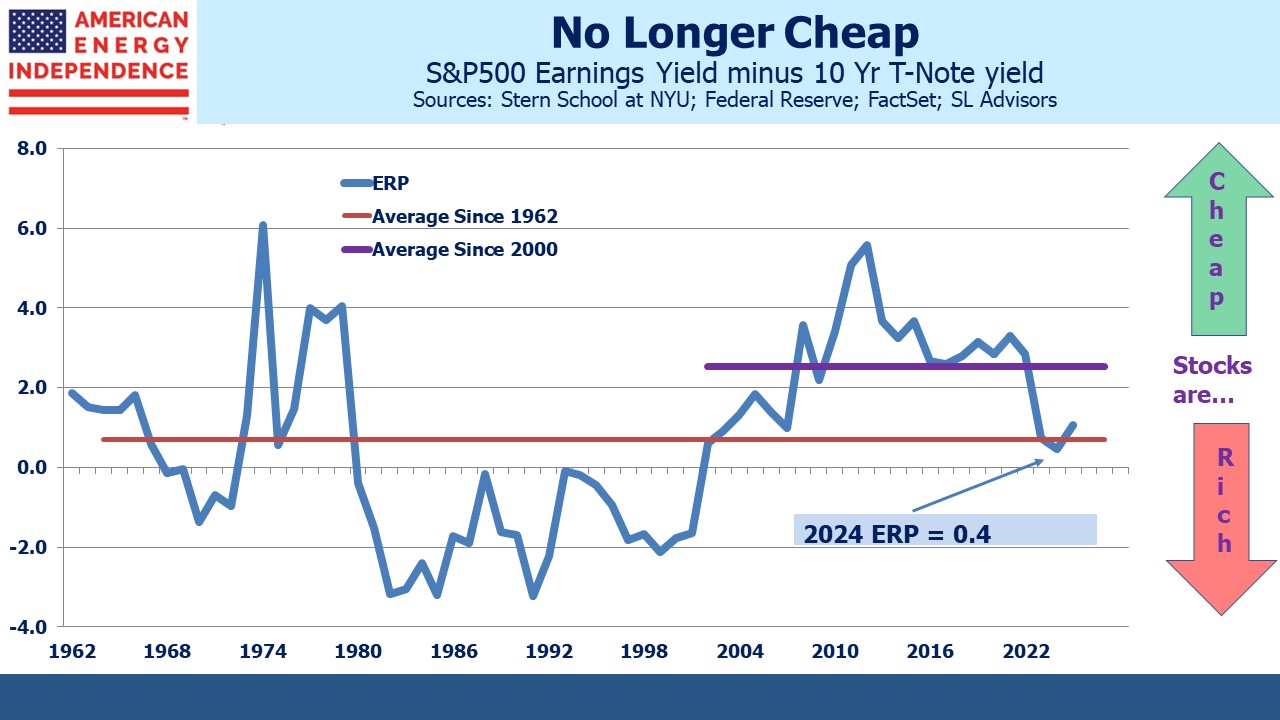

Treasury bills yielding 5.3% are not the worst place to put some cash. Long term expected returns on US large cap equities are generally 5-7%. Schwab expects 6.2%. JPMorgan is at 7%. The Equity Risk Premium is the lowest it’s been in over two decades. S&P500 earnings projections for this year and next are roughly unchanged over the past three months, but stocks are +10% driven by the AI boom.

The Fed doesn’t target asset prices, but the release of the FOMC’s projection materials last week confirmed that they expect to cut rates later this year. Stocks duly rose.

The Fed is walking a precise path. FOMC forecasts for the Fed Funds rate are aligned with the market. December SOFR futures are at 4.5% versus the median blue dot at 4.6%. Policymakers can be forgiven a degree of immodesty. They have quelled inflation without causing a recession.

On the back of this success, they now plan to cut rates with inflation still above their target and the unemployment rate below their projected equilibrium. This drew criticism from Larry Summers who thinks they’re too eager to cut rates. The counter argument is that current Fed policy is restrictive, and having avoided a recession to this point they don’t want to stay too tight for too long.

The economy is doing well, and the margin for error is on the side of slower rate cuts or none this year. If the unemployment rate dropped back to 3.7% the 4.6% year-end projected Fed Funds rate would look optimistic.

With stocks historically expensive against bonds, which themselves don’t look that cheap, there shouldn’t be any great rush among investors to commit new cash to equities.

The exception is midstream energy infrastructure, which has quietly been delivering strong returns for over three years and is drawing the attention of more buyers.

Williams Companies CEO Alan Armstrong told the CERAWeek energy conference that the need for permitting reform has made building infrastructure more difficult. This has reduced competition within the midstream sector, leaving incumbents in a strong position. Climate extremists (hug one) have done this. Armstrong said Boston burns garbage, oil and coal to generate electricity rather than allow pipelines to bring in natural gas from Pennsylvania.

We agree with Armstrong that any serious effort to reduce emissions should exploit cheap natural gas to displace coal. As the world concludes that the UN IPCC “zero by 50” goal is out of reach under current policies, pragmatism will favor solutions like this.

In 2017 we wrote about Stanford University’s Tony Seba (see A Futurist’s Vision of Energy). Seba tells you what the future will look like. His presentations are engaging and his forecasts far from mainstream. This makes them exciting, by forcing the viewer to contemplate a world very different from today.

Seba’s not the only person to have made spectacularly wrong energy forecasts. Vaclav Smil is a brilliant writer on energy whose many books include How the World Really Works. Smil eschews long term forecasts, recalling a 1983 meeting of the Internation Energy Agency (IEA) where he drew some comfort because his, “was less ridiculous than that of the World Bank’s chief economist.”

In 2017, Tony Seba opened his presentation with a photo of horse-drawn carriages in New York’s 1900 Easter parade followed by a 1913 photo of Fifth Avenue with all cars and no horses. It’s great theatre and draws the audience to embrace the notion that dramatic change is all too common.

At the time of that presentation, Seba forecast that by 2030 EVs would be 100% of US auto sales and that global oil demand would be 70 Million barrels per Day (MMB/D). We’re halfway to that deadline. Today US EVs are 10% of sales if you include hybrids. Global oil demand is at a record 103 MMB/D and the IEA regularly revises its forecasts up.

Seba’s website still uses the 1913 photo labelled “Where is the horse?”

Unbowed by the improbability of the 2017 forecasts, Seba currently expects 95% of US passenger miles to be “served by on-demand autonomous electric vehicles owned by fleets, not individuals.” Never mind that the average US car is over 12 years old and that today fleet-owned autonomous cars are limited to a few experiments in places like Tempe, AZ.

Change is coming, and sometimes it’s faster than expected. Tony Seba is not short of invitations to speak at events. However, profits do not come to those following his vision.

Seven years ago, Exxon’s US EV forecast was a 10% market share by 2040, likely to be a big miss. They also forecast 115 MMB/D of global crude oil demand at that time, which is quite possible given recent trends.

Aramco CEO Amin Nasser told CERAWeek that the “current transition strategy is visibly failing” and that emissions will increasingly be determined by the “global south” (meaning the developing world including Asia). He’s right.

This energy transition will last decades as did previous ones from wood to coal to oil and gas. Futurists are fun but the incumbents are where the money is.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!