US Natural Gas Takes Center Stage

/

Europe’s realization that it needs a strategy to ensure energy security has provided a further boost to US natural gas stocks. Last week was especially good – NextDecade (NEXT) added another customer for their proposed Rio Grande Liquefied Natural Gas (LNG) export facility.

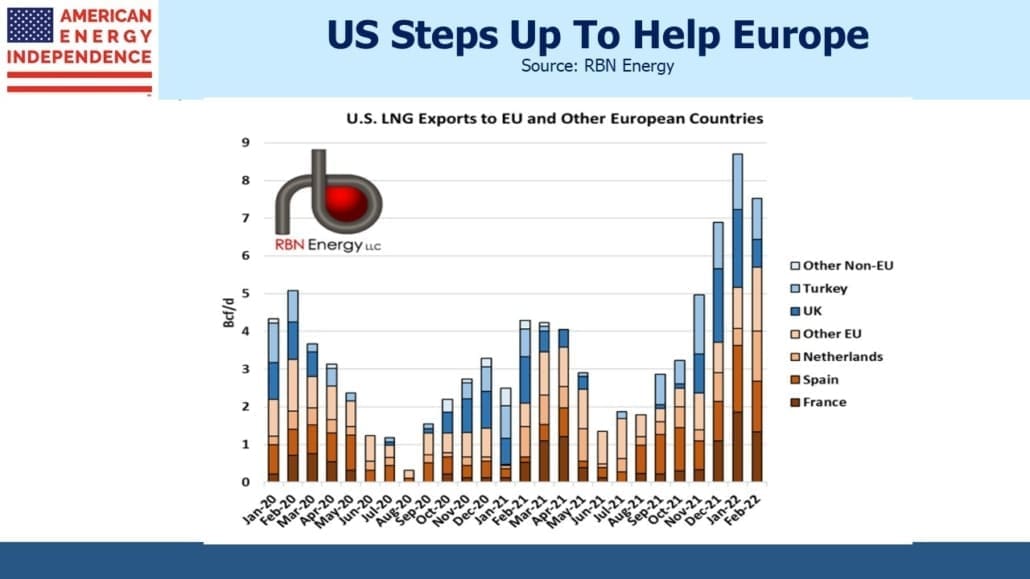

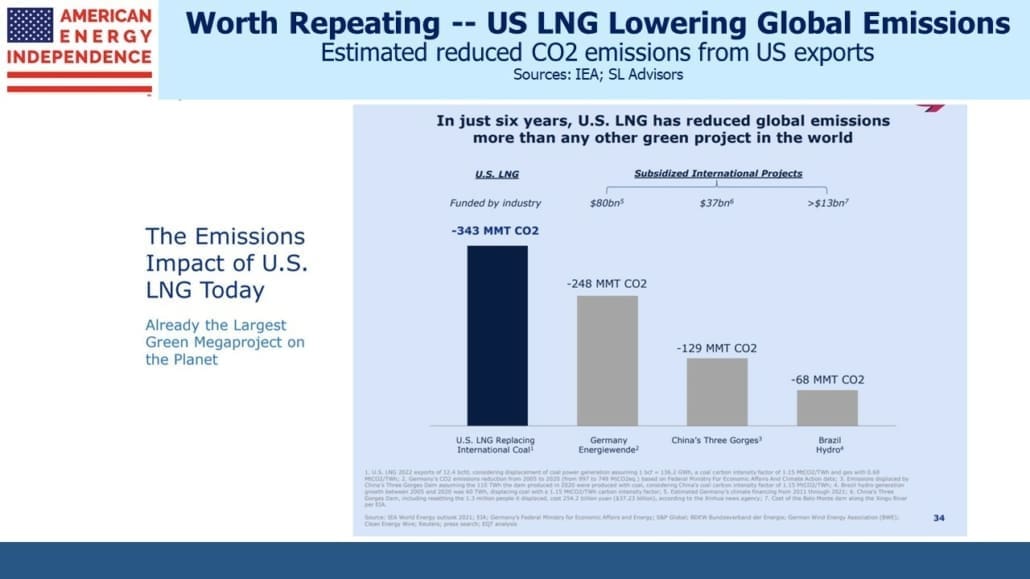

By coincidence we had just interviewed Matthew Mott, SVP of their Next Carbon Solutions division. President Biden also committed to increase US LNG shipments to Europe by 15 Billion Cubic Meters (BCM), equivalent to 1.45 Billion Cubic Feet per Day (BCF/D). US natural gas was already cheap, abundant and the biggest source of global CO2 emissions declines to date (see NextDecade Sees A Bright Future). Following Russia’s war on Ukraine, it is now part of Europe’s energy security too.

Biden’s commitment grabbed headlines but his advisers will know that on current trend 2022 US LNG exports to Europe will already exceed last year’s by more than 15 BCM. LNG facilities take years to build, which provides visibility into how fast our export capacity will grow. Germany has no regasification facilities at which to receive LNG, and the most optimistic forecasts are for one to be in service by the end of next year. The market for Floating Storage and Regasification Units (FSRUs) is suddenly hot because only a handful are available and they offer Germany a faster route to importing LNG. But not all will operate in the frigid waters off Germany’s north coast. Energy security went from irrelevant to critical in Europe. Getting there won’t be elegant.

Nonetheless, the German government hopes to be no longer reliant on Russian gas imports by the summer of 2024. So far it’s been in both Germany and Russia’s interests to maintain the flow of oil and gas. Germany has no near-term alternative, and Russia is enjoying the higher prices that their invasion has precipitated.

Russia is on notice that it will need to find alternative markets for the gas Germany will no longer want. That will require Russia to build new pipeline infrastructure, likely to their east coast for export as LNG. Western sanctions may impede the timely construction. Since the break in trade between the two countries is so well anticipated, Russia’s history suggests the timing will ultimately be at their choosing and not necessarily when Germany is ready to cut imports entirely.

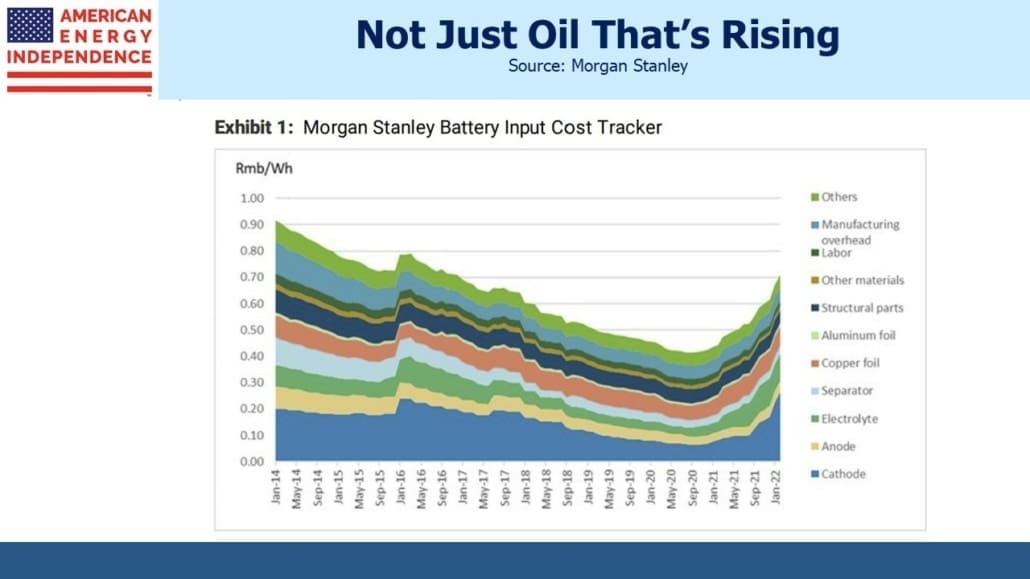

It’s not a leap to suggest that energy security for any country requires minimizing pipeline imports, since they create dependence on a single supplier that seaborne imports avoid. LNG trade is going to keep growing. And while increased investment in renewables is a natural move to improve security, their input prices are rising too.

US LNG trade is all run by commercial entities. Although Biden’s commitment drew attention, the Federal government isn’t about to get into the natural gas business. More meaningful would be an improved regulatory process that isn’t beholden to the liberal progressive wing of the Democrat party. Hewing to their anti-fossil fuel rhetoric has jeopardized Democrat control of the House in November – gasoline prices were already rising before Russia’s invasion. There are signs the Administration is tilting (pivoting would be too strong) towards a more balanced view of the energy transition.

For example, FERC recently shelved an earlier proposal to include the emissions ultimately generated by the oil/gas passing through any proposed pipeline they were considering for approval. This could even have applied to projects already under construction. Conveniently, last week this led to certificates being approved for two natural gas pipelines (the Evangeline Pass Expansion and Columbia Gulf Transmission’s East Lateral Xpress) that link up to Venture Global’s Plaquemines LNG export facility, among others (see Baby, I Got It – Could The U.S. Alone Meet Biden’s Call For 15 Bcm More LNG To The EU?).

The stalled Mountain Valley Pipeline (MVP) project run by Equitrans is another example where the Administration could signal a more enlightened policy. While courts can rescind previously issued permits from Federal agencies that were the basis for $BNs of invested capital, energy companies will correctly assess a hostile environment for new projects. Fixing this might require legislation, but like the Keystone XL pipeline that Biden canceled immediately upon taking office, capricious policy has its costs.

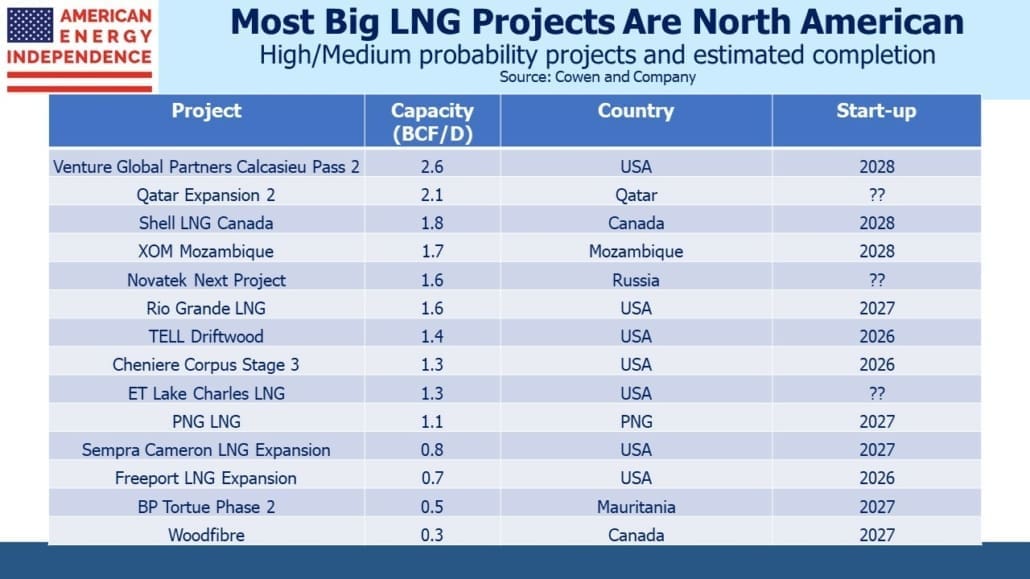

The path to increased LNG exports is visible but long. Because it typically takes up to five years from Final Investment Decision (FID) to start-up, it’s possible to project out export capacity well into the future. Of 18.9 BCF/D in projects deemed “High/Medium probability” by Cowen and Company, 11.9 BCF/D are in North America. Russia’s Novatek project may struggle to complete because of western sanctions.

Of the 20 BCF/D in US projects awaiting FID, only 6 BCF/D are on the High/Medium Probability list, whereas we think most if not all of these will eventually be done.

Europe’s energy security and US LNG profitability are now more closely linked. What remains to be seen is whether Administration policy will pragmatically move from a tilt to a pivot away from its extremist liberal wing. So far US LNG has done more to reduce global emissions than anything else.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!