The U.S. Lowers Oil Volatility

MLP investors are well aware that energy infrastructure securities move with crude oil, until that relationship inconveniently broke down during the Summer. Although we move and process far more natural gas (on an energy equivalent basis) than oil, investor sentiment causes the link. Because the economic link is weaker than sometimes implied by moves in the sector, the two can part company with little warning.

Some relationship makes sense, because pipelines and related infrastructure are typically built in anticipation of future demand. Commencing pipeline operations at 100% capacity is of course the best case, but more common is a steady ramp-up of utilization. The rate at which capacity gets used up can depend on production levels in the supplying region, and production is sensitive to price.

Before the Shale Revolution, U.S. crude oil production was heading steadily lower. Today, any forecast of U.S. output must be based in part on commodity prices. The correlation between the two is sometimes higher than it should be, but it’s no longer a commodity-insensitive business.

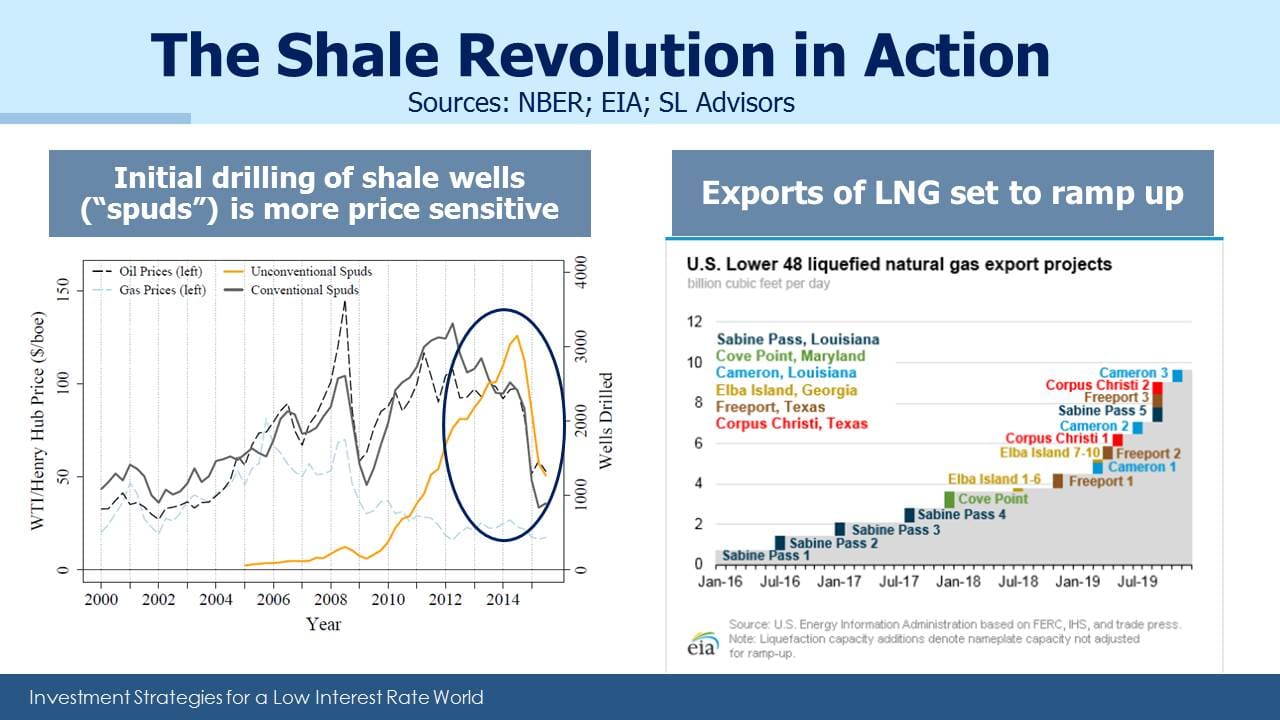

A recent report from the National Bureau of Economic Research (The Unconventional Oil Supply Boom: Aggregate Price Response From MicroData) seeks to measure the sensitivity of U.S. oil production to price. Among their conclusions is that unconventional drilling is up to six times more responsive to prices than conventional. This is because shale projects are “short-cycle”; the payback time is far shorter. Shale drillers can hedge enough of their expected output to ensure an adequate return, not just because upfront expenses are comparatively low but also because initial production rates are high, relative to conventional wells (see Why Shale Upends Conventional Thinking). Exxon Mobil’s CEO Darren Woods commented earlier this year that a third of their capex budget was dedicated to short-cycle opportunities. It’s because they’re less risky. Conventional projects have far longer payback periods, exposing them to the vicissitudes of prices.

The growing importance of short-cycle projects has a couple of other implications for crude oil. One is that it should reduce market volatility. The greater responsiveness to price of shale production means that supply/demand imbalances are more smoothly corrected. NBER doesn’t go as far as to classify the U.S. as the swing producer (which they define as one able to react within 30-90 days), because such adjustments still take several months. But we clearly have a more sensitive supply response function than in the past. Oil prices are becoming less volatile, as we suggested might happen (see U.S. Oil Output Continues to Grow).

NBER’s conclusions include an additional insight, which is that production from unconventional wells is less variable. Not only do you get your capital investment returned more quickly, but you have greater certainty around output. In combination, these two aspects of shale should lead to lower required returns on capital. All of this is to the enormous benefit of the U.S., since shale drilling is almost exclusively an American phenomenon.

Crude prices have been rising as OPEC’s production curbs gradually take effect. Their decisions will continue to significantly impact prices. But another consequence of shale could be gradually rising prices. NBER estimates that a rise to $80 a barrel would stimulate an additional 2 million barrels a day (MMB/D) of U.S. production within two years. Investing in conventional oil and gas projects has been falling, and it’s generally accepted that we need to produce an additional 4-5 MMB/D annually to offset depletion of existing fields as well as meet new demand. U.S. shale may be part of the solution but the figures above show that other sources will need to provide the lion’s share. Earlier this year Goldman Sachs forecast that at $75 a barrel U.S. production would exceed 20 MMB/D. Cleatly there’s enormous variations in forecasts, and NBER may be overly conservative.

Therefore, gently rising crude oil prices are the most likely outcome. This can only be good for U.S. energy infrastructure. Meanwhile, Liquified Natural Gas exports are set to increase sharply. The constructive analysis on crude oil prices doesn’t apply as readily to natural gas, because global LNG trade volumes are benefiting from several new sources of supply. But as one of the lowest cost producers, the U.S. is in good shape here as well.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

This is a great article and touches on a point I’ve been struggling to get my head round.

I accept the point that fast reacting supply ought to reduce SHORT-TERM volatility. However, the US cannot replace all offshore oil. And offshore is in deep trouble at less than $70 or so. And given the timecycles for offshore oil, I’m pretty sure that the current environment is generating a huge supply side shock at some point – as nobody is drilling in the sea any more, at some point the existing projects will tail off and there will be a supply crunch. This will have to lead to a sufficiently large price spike to stimulate more offshore projects, before they come on stream and we repeat the current cycle. Now if you agree and have a view on the timescales of this price shock…. 🙂