Trading Futures With The Fed

Last week’s big story was the sharp drop in bond yields. Ten-year treasuries dropped below 1.3% on Thursday, down 0.30% on the month. Big moves in bonds usually have a visible catalyst, but there was no obvious driver of last week’s move. Inflation expectations dropped somewhat, which is typically reflective of a change in the economic outlook. But around half the drop in bond yields has been caused by falling real yields, which are typically less sensitive to economic data. Today’s investors in ten-year treasuries are willingly accepting a loss, after CPI inflation, of almost 1%. Non-commercial buyers, including central banks and pension funds with rigid investment mandates that require fixed income allocations are setting bond prices today.

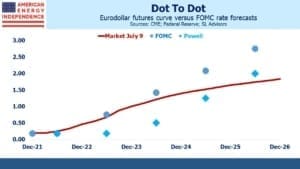

Eurodollar futures continue to provide a fascinating counterpoint to the FOMC’s Summary of Economic Projections (SEP). The infamous “blue dots” from the SEP are overlaid on the eurodollar yield curve below. They show the median forecast for the Fed’s overnight policy rate – the blue dots provide annual readings for 2021-23, and a long-term forecast. So we’ve assumed the equilibrium real rate of 0.5%, what the FOMC calls “r*”, is reached by 2026. With their 2% inflation target, that results in a 2.5% neutral Fed Funds rate.

We’ve also added in Fed chair Jay Powell’s blue dots. The SEP doesn’t disclose dot ownership, so we’ve simply assumed he’s the most dovish dot in each year which is consistent with his public comments.

If Jay Powell was allowed to trade eurodollar futures, he would surely bet on a steeper yield curve from 2023-2025. Even though he constantly warns us not to pay too much attention to the dot plot, he provides a forecast himself like the other FOMC members.

We’re told they will move slowly in raising rates, and the most dovish dots are 0.75% below eurodollar yields for 2023 even after the recent bond rally. But five years out even the most dovish FOMC member is 0.25% above eurodollars. The discrepancy was more pronounced on Thursday morning when the bond market’s recent rally faltered.

Although FOMC doves think the market is ahead of itself in anticipating the beginning of monetary tightening, it’s also too relaxed about the pace of tightening once the FOMC gets started.

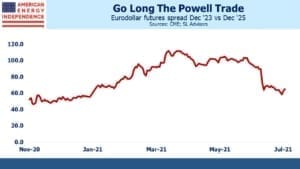

This shows up in calendar spreads. On Thursday the spread between December ‘23 and December ‘25 eurodollars narrowed to 0.55%, implying the Fed will be on a pace of barely more than one 25bps hike annually during that time. This is historically very slow, and at odds with what FOMC members expect. In March, the market was priced for almost five tightenings over this two year period. By the end of the week, this spread had widened back out to 0.65%.

For those who are familiar with the colors of each year of futures, the Jay Powell trade is to go “long the green Dec gold Dec spread.”

Betting against the FOMC made sense early this year, when the yield curve was too flat. Six months ago the market was priced for only a one in five odds of a tightening by the end of next year. Today, seven out of 18 FOMC “blue dots” are forecasting such, and the market has adjusted accordingly.

But the opportunity is shifting towards later rather than sooner, which is in line with Fed chair Powell’s view. Former NY Fed president Bill Dudley noted that the employment situation is likely to remain unclear until Federal unemployment benefits fully expire in September and children finally return to in-person school. So it’s going to be at least another couple of months before the Fed can conclude “substantial further progress” towards full employment has been made.

Being an inflation hawk has gradually gone out of fashion, not least because persistently low inflation has rendered such a stance out of touch. But even today’s dovish FOMC expects to raise rates within two years – their internal debate will be one of speed.

Joe Biden will have an opportunity to influence the FOMC’s composition. Fed chair Powell is up for reappointment next year and looks likely to stay. Vice chairs Richard Clarida and Randal Quarles are also both up for reappointment, and one of the seven Fed board seats is vacant, with a term that expires in 2024.

This offers the president an opportunity to modify the FOMC somewhat to reflect his views. Don’t expect anything so crass as public advice on monetary policy from the White House, but subtle pressure out of the spotlight is likely. This makes a slow pace of monetary tightening more likely, because the FOMC’s dovish tendencies will be reinforced.

Chair Jay Powell is likely to have a say in any appointments. He’s already suggested that monetary policy has a role to play in reducing income inequality. There are many considerations the FOMC could include in setting rates, and they’re all likely to lead to more dovish outcomes than a simple focus on inflation.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!