Is Biden Vulnerable At The Gas Pump?

Voters have a history of blaming the president for high gasoline prices, even if the White House has limited power to change them. When OPEC tripled oil prices following the Iranian revolution in 1979 it was one blow too many for Jimmy Carter, who was swept aside by Reagan in 1980. The Arab world’s opposition to US foreign policy in the Middle East was one of the causes of high crude.

Although Joe Biden wasn’t at the OPEC meeting that just collapsed over the UAE’s insistence on an increased production quota, the continued bull market in oil which got a further boost can be partly traced back to his policies. Goaded by the progressive wing of the Democrat party, the Administration has a hostile attitude towards new oil and gas production.

Growing political pressure on energy companies to cut back oil and gas production is having an impact. Large publicly traded companies are especially vulnerable to such pressure. Exxon Mobil and Chevron both recently had to modify their spending plans in response to shareholder pressure, while Royal Dutch Shell was ordered to do so by a court (see Profiting From The Efforts Of Climate Extremists).

One consequence is that OPEC’s influence over oil prices is growing, as non-OPEC producers have less spare capacity. Demand is currently running at 97 Million Barrels per Day (MMB/D) and looks set to reach 100 MMB/D by year’s end. There’s no reason to expect demand to stop increasing at that point, as rising living standards in emerging Asia are likely to push it above pre-Covid levels.

The US energy industry’s newfound financial discipline is also helping. Domestic production is not rising nearly as much as in past cycles. This is all great news for energy investors. Having endured excessive capex with low prices, the pendulum is now swinging back the other way. Morgan Stanley expects the group of independent US shale producers under research coverage to boost Free Cash Flow (FCF) by a third over the next year, where they’ll have a FCF yield of 15%. We expect North American pipeline companies to generate $49BN in FCF this year, up 27%, and $56BN in 2022.

Environmental extremists are very happy with rising oil prices. There will be no energy transition unless renewables are competitive, and this helps. They tend to be more city-dwellers than rural, so gasoline prices don’t have much impact.

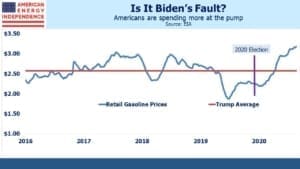

Energy investors are also happy, as the unlikely alignment of interests with the liberals has led to a mutually desired outcome. But what about the rest of America? Gasoline prices are now higher than at any time during the Trump presidency. This is yet another incongruity with continued fiscal and monetary support for the economy which clearly no longer needs it. Biden can quietly turn to the disillusioned progressives who think he’s abandoned them and claim credit for the high oil prices they want.

So far the energy transition has had limited impact on consumers. Apart from power outages in states where renewables have risen to an unwieldy share of electricity generation (see California and Texas), disruption has been minimal. Rising gasoline prices will eventually test society’s willingness to pay more for energy. We should pay more. The energy transition is expensive. If lowering CO2 emissions was easy we would have already done it. If it’s a worthwhile endeavor, it’s worth paying for.

The problem is that the energy transition hasn’t been marketed as such. Candidate Biden promised us green employment opportunities that would be well-paying union jobs. It’s all been disingenuously promoted as an exciting opportunity. Instead it’s an eternal slog to avoid carpeting the landscape with intermittent solar panels and windmills until pragmatism dictates the adoption of new technologies: carbon capture and sequestration to allow increased use of natural gas (see Carbon Capture Gains Momentum); blending of hydrogen into the natural gas supply (see Europe’s Nascent Hydrogen Industry); and perhaps one day we’ll revisit nuclear, if society truly wants to solve the problem.

Although Biden gasoline prices are higher than at any time under Trump, they reached $4 a gallon in 2014 under Obama. It wasn’t much of a political issue back then, because the president hadn’t done much to cause it. That was also the peak in the energy cycle, since the Shale Revolution’s supply shock followed and prices duly fell.

This suggests that the pain threshold for rising gasoline prices is above where they are today, which is good news for energy investors. It means environmental extremists can continue shifting oil supply to foreign governments and privately held firms, continuing the publicly traded industry’s virtuous cycle of reduced capex and growing FCF. Biden’s vulnerable on gas prices because his policies are intended to push them higher, but we’re not there yet. Pipeline stocks still have plenty of upside.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Two of the world’s leading oil exporters, Saudi Arabia and Russia will be two countries that will not have our best interests at heart. We can appease them or confront them … confronting them requires a Plan B when it comes to Carbon based fuels. To me the ideal Plan B would involve other countries in the Americas such as Brazil or Venezuela but neither offers an easy path for any administration.