The Legal Boost For Pipelines

/

Most LNG export terminals are built when three quarters or more of their liquefaction capacity has been pre-sold to customers. This ensures that the project will generate cash needed to repay its financiers, since there’s not much else you can do with it other than export natural gas. Buyers have to pay the agreed liquefaction fee for years, even if they don’t need the gas. It’s similar to the “take-or-pay” agreements that predominate in the pipeline business. This is how industry leader Cheniere operates.

Charif Souki founded Cheniere before he was pushed out and went on to found Tellurian. Souki was bullish on global natural gas prices, and sought financing for an LNG terminal that, once complete, would sell opportunistically on the spot market rather than rely as heavily on long term commitments.

Done successfully, this business model generates much bigger profits but is more risky because if the spread between US and foreign gas markets narrows to the cost of liquefaction plus transport, buyers will disappear.

Tellurian struggled to raise financing. The few long term contracts they had negotiated lapsed as construction was delayed. Souki’s weekly Youtube updates included a memorable mea culpa as he conceded the strategic errors in not relying more fully on long term agreements with buyers. The company was rescued from bankruptcy when Australian Woodside Energy acquired it last year (see Tellurian Drifts Into Stronger Hands).

Venture Global (VG) has cleverly combined the stability of Cheniere’s model with the opportunism of Tellurian. They secured long term contracts with companies including Shell and BP, which helped finance construction of their Calcasieu Pass terminal in Louisiana.

When Russia invaded Ukraine in 2022, global LNG prices soared and VG took advantage of their ability to sell into the spot market, reaping huge profits on the spread between US and European prices. The contract flexibility VG interpreted surprised Shell and BP, who believed they should have been profiting from the sudden price spike by selling the LNG from Calcasieu Pass themselves.

The dispute wound up going to arbitration. The operator of a liquefaction terminal ultimately has to decide when it’s complete. VG says they were resolving some construction issues and that the contract only required them to deliver LNG to contracted buyers when the facility was fully operational. This didn’t prevent them from using the available capacity to net roughly $7BN in profit 2022-23.

Last week a tribunal ruled in VG’s favor in a case brought by Shell. Presumably the other similar disputes will be decided the same way. LNG contracts are already being negotiated to avoid the profitable ambiguity exploited by VG.

In a press release, VG said their “unique ability to incrementally export commissioning cargoes during the construction of our facilities has brought LNG to the market years faster than ever before and strengthened global energy security.”

Shell and other buyers see it differently.

There were other courtroom developments that favored midstream companies. The US Court of Appeals for the District of Columbia issued a ruling that was favorable to Oneok. Environmental extremists have for years sought and often obtained legal judgements requiring broad reviews of projects even where the government agency responsible felt they were unnecessary.

This is how the Sierra Club and others have weaponized the judiciary to insert cost and uncertainty, with the dystopian objective of leaving us solely dependent on renewables.

The US Supreme Court ruled earlier this year in Seven County Infrastructure Coalition v. Eagle County that lower courts must substantially defer to agencies’ environmental analysis. This means for example the CO2 emissions of burning natural gas when it’s consumed aren’t relevant to the pipeline that will help deliver it.

The Court of Appeals applied this precedent in considering objections to a 157-mile pipeline Oneok is building (the Saguaro Connector Pipeline), limiting the environmental review to a 1,000 foot section near the US-Mexico border. This wasn’t front page news, but was a positive development for US consumers in areas that could access natural gas if not for the climate crowd.

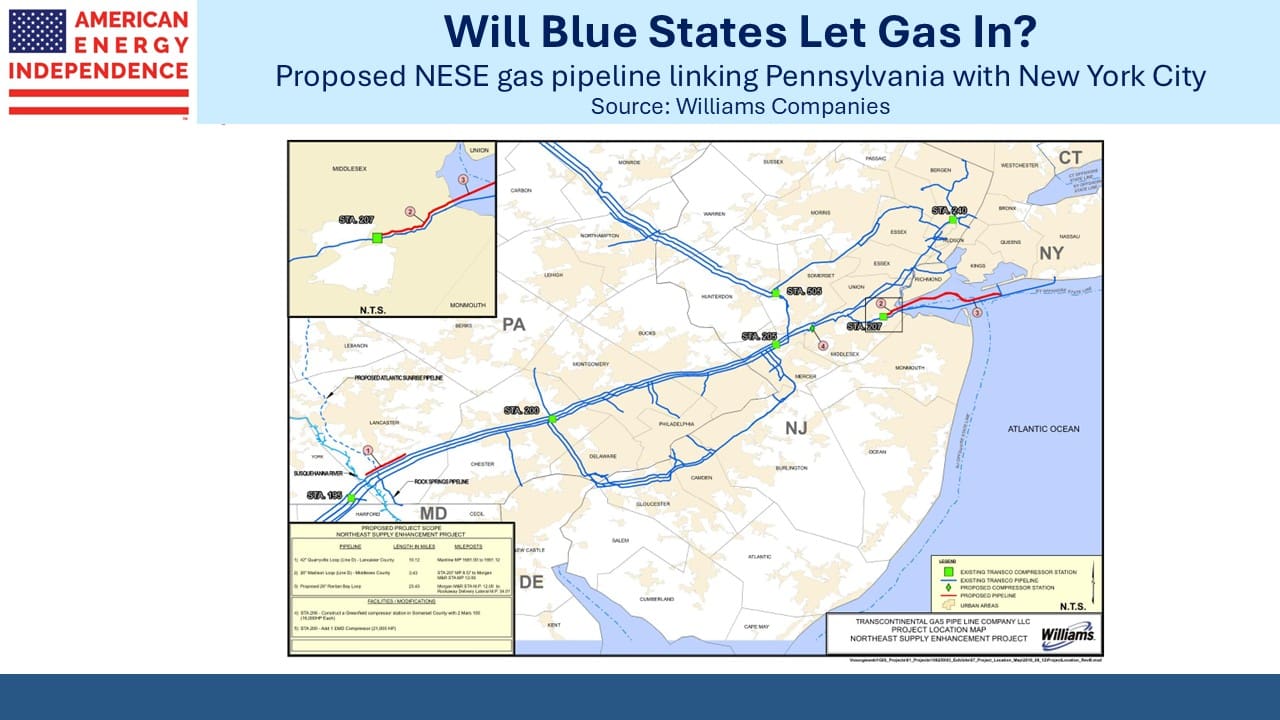

Another test involves Williams Companies (WMB) plans to add Northeast Supply Enhancement (NESE) to Transco, bringing gas from Pennsylvania through New Jersey to New York City. WMB gave up last year following persistent difficulties in obtaining water-crossing permits from both NY and NJ.

Anticipating a more co-operative process, they have reapplied for FERC approval, which was received and relied on the prior environmental assessment. The Sierra Club and others have sued, saying a new assessment is required, a move that’s just tossing sand in the gears.

If NESE proceeds it will confirm that important changes in the regulatory environment and the scope of judicial reviews are improving the visibility around completing infrastructure projects. The scope is beyond pipelines – it should apply to many other types of construction, perhaps including nuclear power and even solar and wind. The push-back against nihilistic environmentalists is under way.

Mountain Valley Pipeline (MVP) is the most egregious case of activist-driven cost over-runs. Completing MVP required an act of Congress (see Why Pipeline Construction Is Hard). Recent progress looks like the Mountain Valley effect.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Will any of these decisions aid Sable Offshore to restart its pipeline in California ?