The Changing Pipeline Investor

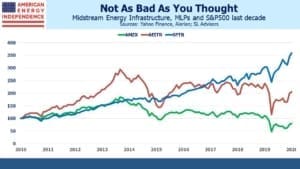

The S&P500 (SPTR) had a strong decade, returning 13.6% p.a. from 2011-20. By contrast, MLPs had a lousy ten years, delivering –1.2% p.a. The reasons have been well documented on this blog and scarcely need repeating. The Shale Revolution induced overinvestment which led to excessive leverage. Distribution cuts followed, driving away many traditional MLP investors.

But midstream energy infrastructure didn’t do nearly as poorly as MLPs. The broad-based American Energy Independence Index (AEITR) returned 7.5% p.a. MLPs have dragged down the overall sector for several years. The Alerian MLP Index (AMZX) does a poor job of representing the pipeline sector nowadays, with most of the industry having dropped the MLP structure in search of a wider set of investors.

Pipelines lagged the S&P500 to be sure, but much of the miss occurred last year. In the nine years prior to last year (I.e. 2011-19) annual returns are 13.1% and 10.1% respectively. Covid hit the energy sector hard, but strongly growing free cash flow and rising commodity prices offer reasons for optimism this year.

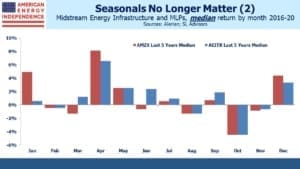

There’s also evidence that income-seeking buyers, long a core investor base for MLPs, are less relevant. For a couple of decades there existed a clear intra-year seasonal pattern around MLP returns. Because of the high yields, sellers would often wait until just after a quarterly distribution to sell. Buyers would similarly invest just prior to a distribution. This created a quarterly pattern in which the first month of the quarter, typically the record date for quarterly distributions, saw higher than average returns.

Holding a stock so as to receive the dividend is a pointless strategy, unless there are tax considerations. Stock prices, including MLPs, adjust for the payout once they go ex-dividend. It’s an example of some retail investors misunderstanding this. Clearly, over 1995-2015, sales timed just before a distribution would have generated better returns, as would purchases just after.

The K-1s also give a January boost – if you’re planning to buy an MLP in December, waiting a month avoids a K-1 for the year, just as selling in December avoids one for the following year.

But in the last five years, higher volatility and distribution cuts have reduced the importance of quarterly distributions as a factor in timing buys or sales. Because 2020 was so volatile, it distorts average returns by month over the past five years; however, the median shows a similar result. The overall sector, as represented by the AEITR, shows a more muted pattern than MLPs, probably because of its broader, institutional investor base.

The result is that only January and April now show reliable above-average returns. Returns are positive 70-80% of the time, depending on the index. July and October no longer stand out. Trading around quarterly distributions has lost importance – that the effect remains visible in January/April could be random, or at least not related to payouts. The S&P500 has a modest January effect too, likely reflecting year-end portfolio decisions by investors.

What the data shows is that pipelines haven’t been nearly as bad an investment as MLPs alone indicate. Corporations, especially the Canadians which are prudently managed, have made the difference. And individual investors focused on distributions are a diminishing part of the overall investor base.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I-and many I know-do continue to view natural gas oriented MLPs as a very good investment vehicle thanks to (a) algorithm based investment decisions and (b) market analysts that ignore the irrationally high tax deferred sustainable yields available from such partnership investments, and which thereby cause unreasonable high yields.to be available, with tax deferrals and a section 199A deduction as part of the bargain.