The Biggest Pipeline Companies Are Doing Well

Last week Enbridge (ENB) and Enterprise Products (EPD), North America’s two biggest pipeline companies, were among those reporting earnings. Both beat expectations – ENB reported 2Q EBITDA of $3,312MM versus $3,155MM, helped by strong results in natural gas transmission. EPD came in at $1,961MM versus $1,877MM, boosted by strength in crude oil. Dividend yields of 7.7% (ENB) and 10.1% (EPD) look secure.

The earnings calls that accompany quarterly results often provide some interesting additions. The ENB call included several exchanges with analysts on renewables. For example, CEO Al Monaco noted, “…we know the supply profile is going to change globally for energy. It’s not going to be a quick transition by any stretch, but slowly renewables will be a bigger portion.” He continued, “U.S. offshore wind is certainly an attractive opportunity but… the supply chains are not as developed yet”

Bill Yardley, President of Gas Transmission & Midstream, added,“…on the ISO website… wind is 30 megawatts, natural gas is 10,200. You could quadruple the amount of wind as they’re projecting and it’s just–on the peak hours, it’s just not there.”

Although ENB expects renewables to gain market share, conventional fuels still get most of their spending on new projects. Al Monaco explained, “In terms of the asset mix today, I think when we repositioned the asset mix to almost 50/50, I’m going to call it, between natural gas and the liquids businesses, with a little bit in there for renewables, I think we’re happy with the mix there.”

Hydrogen as a potential renewable fuel has been drawing a lot of interest recently. For example, on Nextera’s (NEE) call, hydrogen appears 25 times in the transcript. But it’s still way off in the future. Rebecca Kujawa, CFO, noted that NEE is, “really excited about hydrogen, particularly in the 2030 and beyond time frame”

On the same topic, ENB’s Bill Yardley added, “Natural gas pipeline networks may be repurposed for hydrogen at some point in the future, if the economics work. To that end, It’s extremely expensive – you know, is it green hydrogen, is it blue hydrogen, how does it interact with the pipelines and the actual steel in the pipeline, and that takes a lot of engineering to look at. But you’re right – the network, and this is decades from now, would be well positioned if hydrogen transitioned from that shiny object that is potentially a solution to a reality.”

EPD’s CEO Jim Teague often adds some colorful phrases and humor to these calls. He referred to the prior quarter’s conference call as a “COVID call” and opened last week by saying, “…today, we are going to tell you our COVID story.”

Since EPD had beaten expectations during a tumultuous period in energy markets, Teague immediately addressed the issue: “We usually get the question of how much of our results are non-recurring, and it is the same question we got when Katrina blew through South Louisiana and literally knocked out every plant we had…Demand came back before indigenous supply and we made more money with our West to East pipelines than if those plants had been running. So it was non-recurring.

“We got that question during Hurricane Ike in 2008… got the question in Hurricane Harvey in 2017.” Teague continued,” Events like what we are going through now, and the opportunities they present may be labeled as non-recurring, but our performance and our results are recurring regardless of the environment.” In other words, the diversity and naturally offsetting risks among business lines create the opportunity for recurring upside surprise.

Crude oil dominates sentiment around pipelines, although natural gas is more important. Little attention is paid to the non-energy side of the business, such as plastics. Teague reminded listeners that,“…the United States, especially in ethylene, has quickly moved into being the world’s incremental supplier.” He added, “In June, we loaded a record size ethylene cargo of 44 million pounds.”

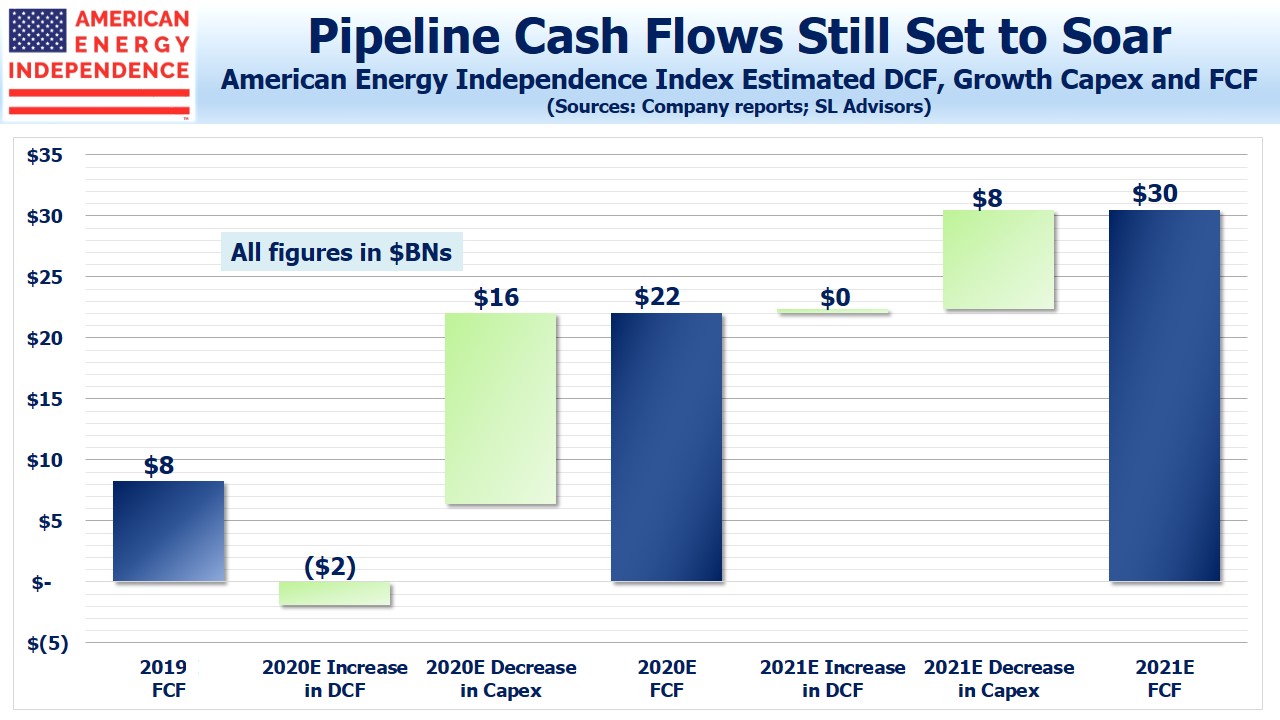

Growth capex is also falling as both companies are maintaining strict return criteria. Teague said, “For 2021 and 2022, we currently anticipate growth capital investments to be approximately $2.3 billion and $1 billion respectively. This is an aggregate $700 million reduction from guidance we provided for 2021 and 2022, at the end of the first quarter.” Last year EPD spent $4BN. Their Free Cash Flow in 2022 is on track to have doubled in only three years.

Both companies can issue ten year debt “with a two handle”, reflecting the confidence of bond investors in their balance sheets and showing a juxtaposition with their dividend yields.

Earnings continue to support our expectation of strong cash generation (see Pipeline Cash Flows Will Still Double This Year). Listening to conference calls like these provides further comfort around the outlook.

We are invested in ENB, EPD, and all the components of the American Energy Independence Index via the ETF that seeks to track its performance.