Russia: The Climate Change Winner?

/

Higher prices for traditional energy are supportive of increased use of renewables. The point of a carbon tax is to create price signals for users and producers of coal, oil and gas that reflect society’s assessed cost of the burden imposed by rising CO2 emissions. Uncertainty over long-term public policy has led to years of underinvestment in new production. The economic rebound from Covid revealed how little excess supply was available, so prices rose. Russia’s invasion of Ukraine was a further shock the world didn’t need.

But the response from policymakers has been ambiguous. President Biden would rather ask Saudi Arabia to increase oil production than remove regulatory and policy uncertainty for domestic companies. The EU wants to import natural gas from Qatar but balks at twenty year commitments, even though Asian buyers regularly agree such terms. The result is that committing capital to oil and gas production remains an uncertain proposition.

Climate extremists should cheer today’s high oil and gas prices though. It improves the competitiveness of renewables. How ironic that the pursuit of intermittent energy has led to underinvestment in traditional energy and today’s elevated prices. A US carbon tax would have re-directed some of the revenue earned by OPEC+ to the Federal government, but political support is nonexistent because people are only worried about climate change until it costs money.

Energy security, Europe’s absence of which has been so cruelly exposed by Russia, is another reason to develop domestic renewables. Keeping the windmills nearby at least means their output can’t be cut off by a political adversary.

The energy transition means increased electrification. Serious analysis is being published that highlights the challenges. In the Internation Energy Agency’s (IEA) most recent World Energy Outlook they model a Stated Policies Scenario (STEPS) which is based on current policy settings around the world, and a Sustainable Development Scenario (SDS) which aligns with the UN IPCC’s goals whereby the world reaches net zero emissions by 2070 with many countries much earlier.

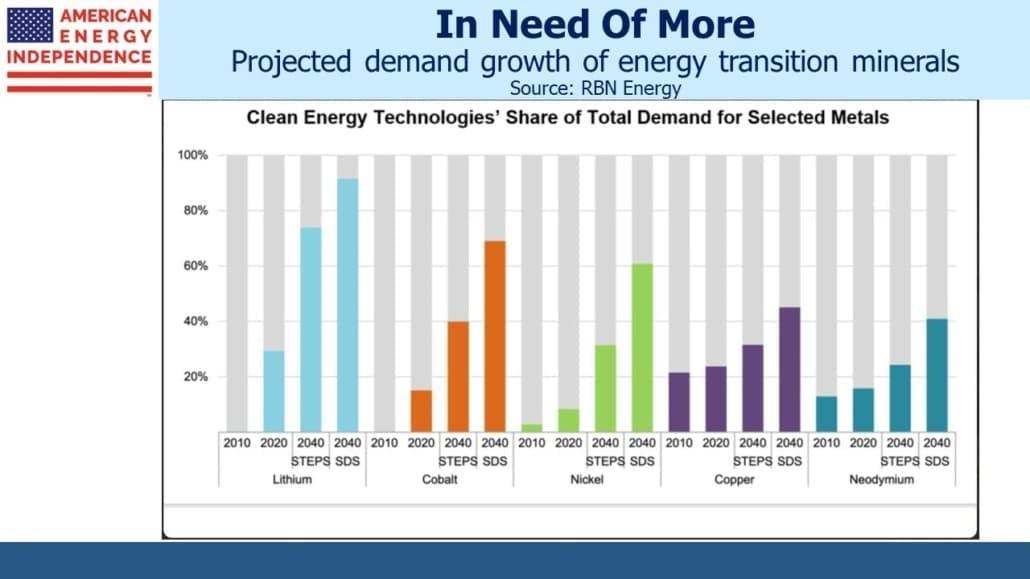

RBN Energy, which produces in-depth research on the energy sector, has translated these two IEA scenarios (STEPS and SDS) into demand for minerals key to the energy transition, such as lithium, cobalt, nickel, copper and neodymium. Even on the less ambitious STEPS pathway, these minerals will represent a significantly greater share of global demand.

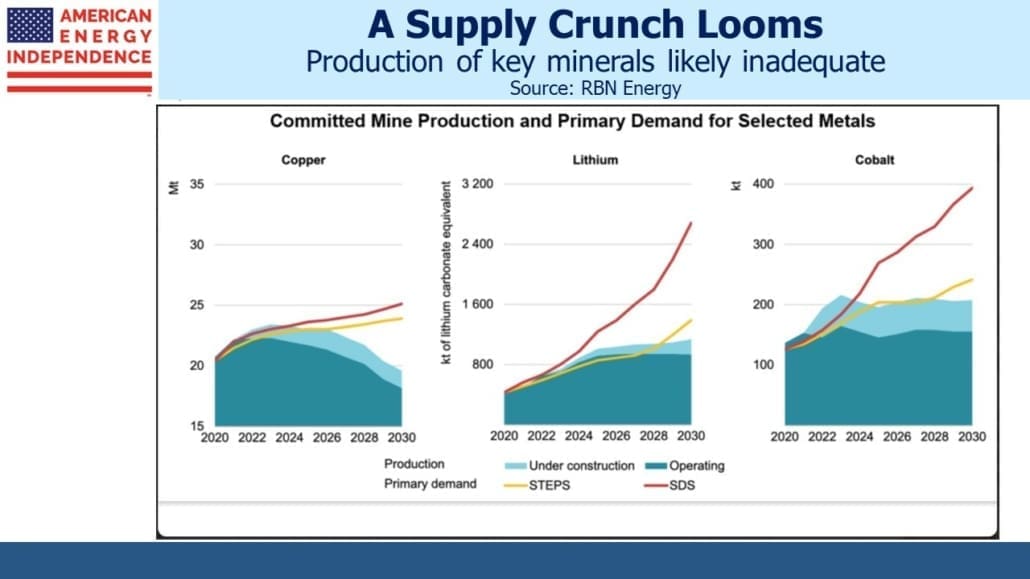

The time it takes to get a new mine from planning to production is longer than for oil and gas fields – a global average of sixteen years according to research from the IEA. On current trends, there will be an increasing supply shortfall for these key minerals. There’s no shortage of irony in such research. Energy (mostly oil and gas) can account for up to 40% of the total costs in mining. Although higher prices for traditional energy have a positive first order effect on renewables, they also raise the cost of obtaining the needed inputs for batteries, solar panels and windmills. The US is poorly positioned for this, dependent on imports for 100% of some 17 critical metals and minerals. Mining meets NIMBY resistance. As RBN Energy eloquently states: The simple fact is that the U.S., along with Europe, has regulated its way into far greater mineral import dependencies.

Vaclav Smil, a world-class author of books on energy, noted the mining needed for a single Electric Vehicle (EV) car battery weighing 450 kilograms (992 pounds). In How the World Really Works, Smil calculates that the lithium, cobalt, nickel, copper, graphite, steel, aluminum and plastic required for one EV would require the mining of 40 tons of ores and 225 tons of raw materials. Achieving an EV market share of 25% of the global auto fleet by 2050 would see demand for these and other inputs increasing by 15X or more.

California leads the US in embracing EVs, often cheered on by media that believes such policies will reduce the statewide fires, drought and floods they often blame on global warming. They overlook that policies in Beijing and Mumbai, where emissions are scheduled to grow for at least the rest of the decade, will determine California’s CO2 levels (and indeed everyone’s) far more than the legislature in Sacramento.

JPMorgan’s Mike Cembalest in his excellent 2021 Annual Energy Paper called out “the elephant in the room: the number one issue for China and the world is decarbonization of China’s massive industrial sector, which consumes 4x more primary energy than its transport sector and more primary energy than US and European industrial sectors combined.” In other words, widespread adoption of EVs creates great headlines but won’t make much difference.

Which brings us to the final irony. There is little to show so far for western sanctions on Russia. Their oil and gas revenues are soaring. Asian buyers freely ignore sanctions, and a humiliated Europe is slowly reducing imports so as to limit economic disruption. Russia looks likely to cut gas supplies anyway. This is Angela Merkel’s legacy.

Western policies that have discouraged investment in future oil and gas production align neatly with Russia’s vast supplies. Eight years ago NATO accused Russian intelligence agencies of covertly funding the European anti-fracking movement. It always seemed like a high return effort. But even if such charges are unproven, Russia is a top copper producer (4% of global supply, roughly equal to the US), 6% of the world’s aluminum (4X the US), and 10% of nickel (#3 in the world). Russia, one of the countries least concerned about climate change, might be one of its biggest winners.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Excellent analysis and assessment.