Prospects Continue to Brighten for U.S. Energy Infrastructure

A few seemingly unrelated pieces of news caught our attention last week. Together, they provide a useful perspective on why U.S. energy infrastructure offers such an attractive return potential.

Khalid al-Falih, Saudi Arabia’s Energy Minister, warned of a looming shortage of crude oil with the risk of a consequent price spike. This may seem like an odd concern given last year’s collapse in prices, but the Saudis are looking farther ahead than the drawdown of existing stockpiles. He recognizes that the $300-400BN slashed from drilling budgets this year, and the estimated $1TN cut through 2020, will lead to much less new supply coming online than might have been the case had oil stayed at $100 a barrel where it was in 2014. There’s a substantial time lag between committing to a new project and producing oil. Volatile prices hurt demand, and are therefore not in the interests of suppliers either. We wrote about precisely this issue in Why Oil Could Be Higher for Longer.

However, Rex Tillerson, Exxon Mobil (XOM) CEO, offered a contrasting view based on the resurgence in shale output in the U.S. being capable of responding to higher prices with increased output. Unlike conventional oil projects with their large upfront investment and long payback times, shale drilling involves numerous fairly cheap wells and high initial production. This means payback times are shorter and production can be quickly curtailed when prices are adverse (see Why the Shale Revolution Could Only Happen in America). On their recent earnings call, Haliburton CEO Dave Lesar said, “…North America has assumed the role of swing producer in global oil production.”

Either of these views on oil could be right. In each case, it will be good for U.S. producers and their infrastructure providers.

Related to this, there’s a growing disconnect between falling capital expenditure (capex) by companies drilling for hydrocarbons and their rising production. Antero Resources (AR) has cut capex by 20% since last year while production is up 14%. EQT Corporation cut capex 41% and raised production by 31%. Consol Energy (CNX), -74% and +16%. Exploration and production companies (E&P) are managing substantial improvements in efficiency, which speaks to Rex Tillerson’s comments above.

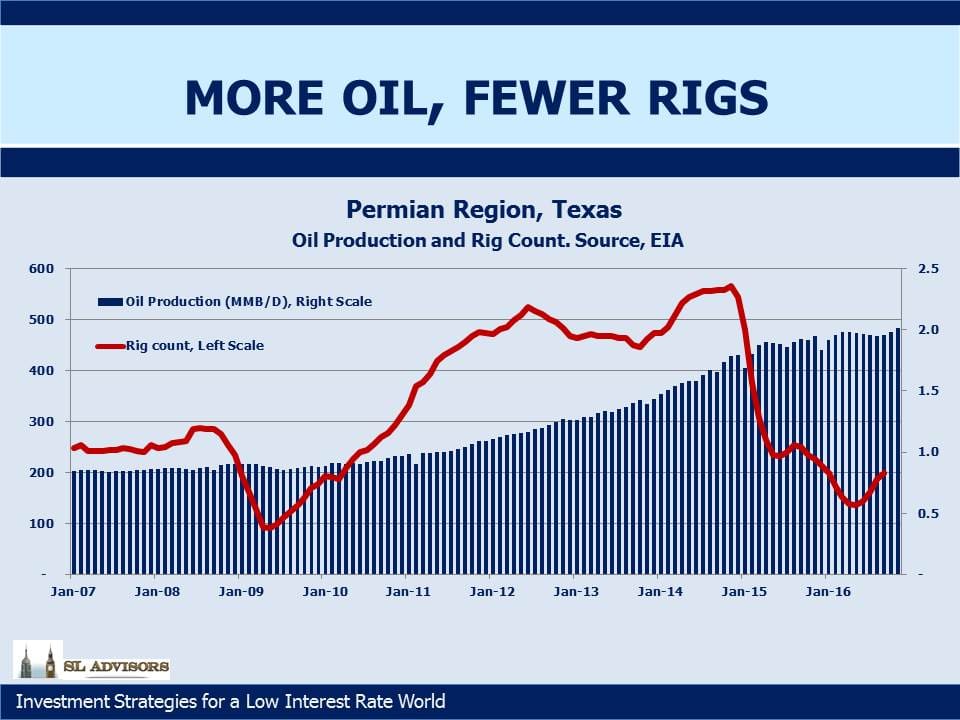

The chart above shows what’s happened in the Permian Basin in Texas, currently one of the most productive regions in the U.S. Using data from the U.S. Energy Information Administration (EIA), the rig count fell 75% from September 2014 to May 2016 while production increased 19% over the same period, representing a dramatic improvement in efficiency and lower break-evens for E&P companies. This is pointedly not what the Saudis expected when they increased output in 2014 so as to expose the weak business models of shale drillers.

Finally, a few weeks ago (see There’s More to Pipelines Than Oil) we noted a documentary made in the 1950s about the Transcontinental Gas Pipe Line, later called Transco and today owned by Williams Companies (WMB). It’s worth watching. In 1931 the Natural Gas Pipeline Company of America built a transmission pipeline from Texas and Louisiana to Chicago. It is still in use today, owned by Kinder Morgan (KMI). Properly maintained, infrastructure lasts a long time – far longer than the depreciation schedules used under GAAP accounting, which is why net income is generally less useful than cashflow less the cost of maintenance (Distributable Cashflow, or DCF) in measuring performance. GAAP Depreciation, a non-cash expense, depresses net income and understates the cash flow generating capability of an asset that doesn’t depreciate according to a GAAP schedule. Pipelines more typically increase in value over time, because they’re hard to replicate. On KMI’s earnings call on Wednesday, chairman Rich Kinder noted the challenges in building certain new projects such as in New England because of the regulatory environment, but added, “…to the extent it becomes difficult to build new infrastructure, that tends to make existing pipeline networks more valuable.”

U.S. energy infrastructure remains one of the most interesting places to invest.

We are invested in KMI and WMB.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!