Pipeline Stocks Resume Their Rally

/

Managing investments in pipeline companies, even with a bias towards natural gas as we have, nonetheless means explaining the relationship with crude oil. It measures energy investor sentiment like a Texas-sized barometer. A discussion about the near-term direction of oil is often an important timing consideration for many investors.

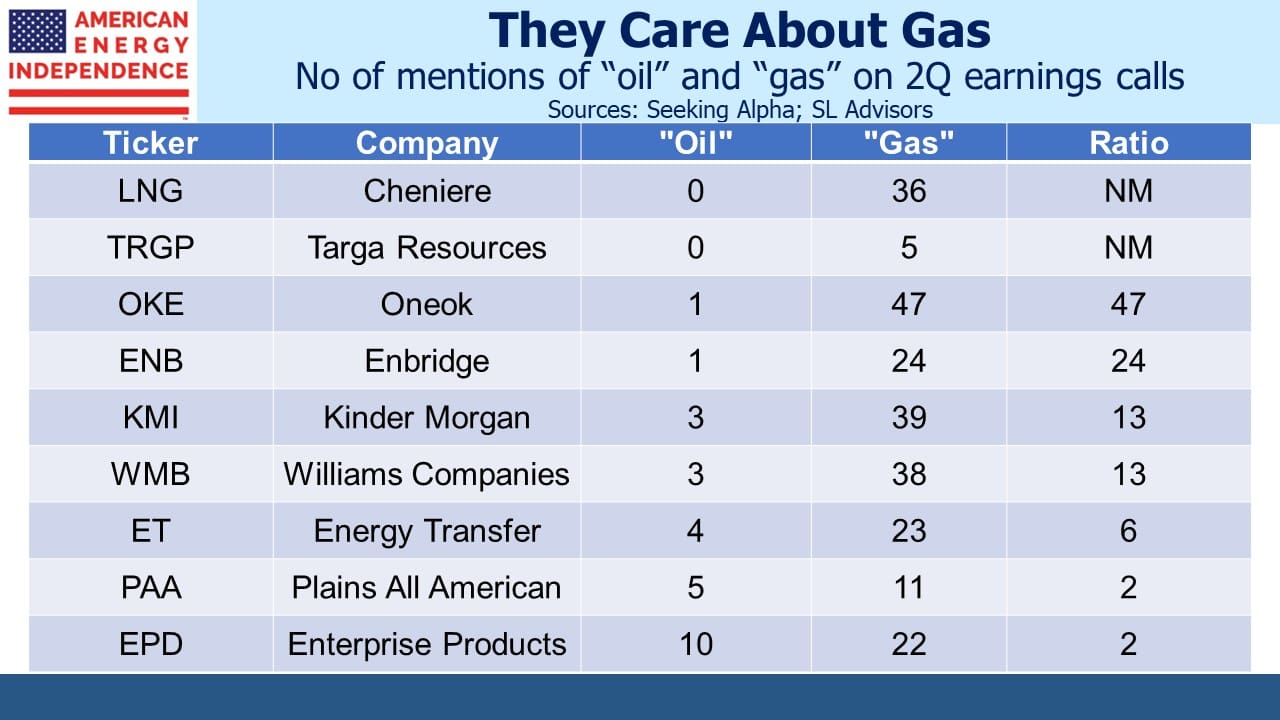

A simple count of the frequency of the words “gas” and “oil” in 2Q22 earnings call transcripts reveals what management teams spend their time pondering. It should be no surprise that Cheniere, exporter of half of America’s Liquefied Natural Gas (LNG) never mentioned crude oil at all. Or that Williams Companies, owner of the Transco natural gas pipeline that runs up the US east coast, mentioned natural gas 38 times and crude oil three. But even Plains All American, a dedicated crude pipeline company, favored natural gas twice as much in their comments. And a detailed review of the transcript confirms that they were not referring to gasoline.

Oil grabs the headlines while natural gas flows do the heavy lifting of driving financial performance for many of these companies although not all of them.

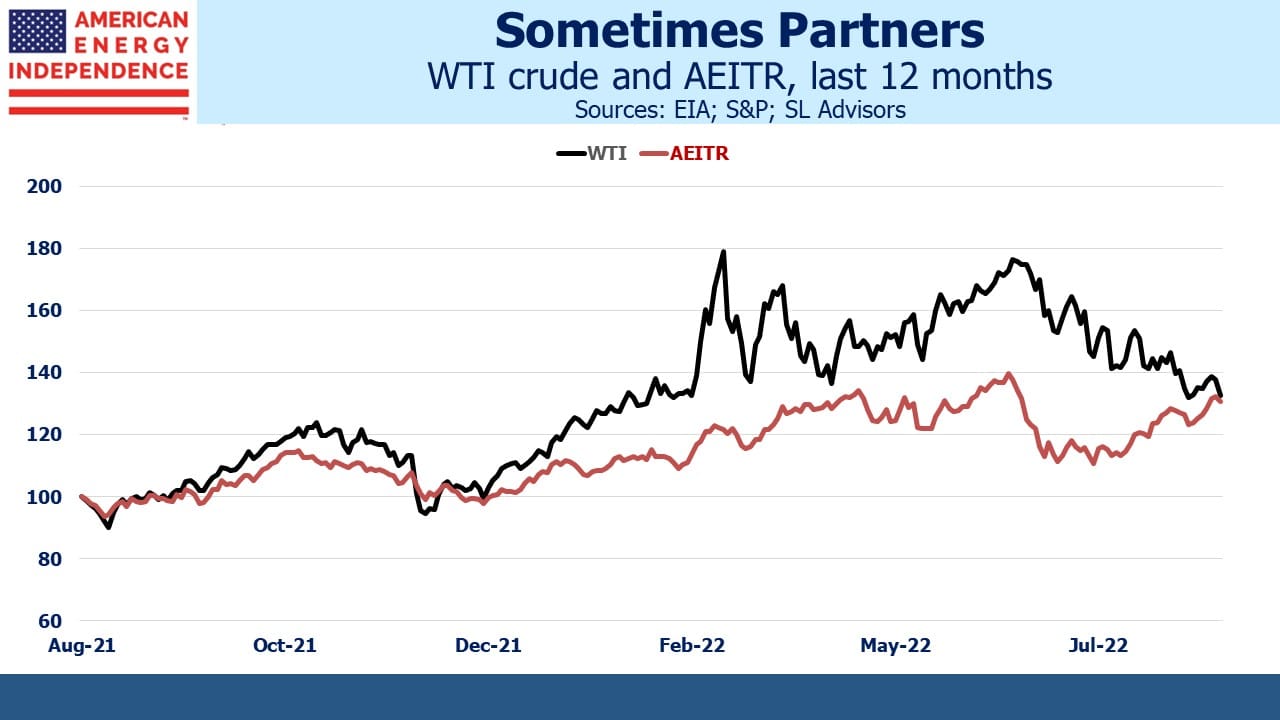

By coincidence, the one-year performance of the American Energy Independence Index (AEITR) and WTI crude are close at 31% and 33% respectively. Over the past year their daily returns have a correlation of 0.54. By contrast Henry Hub natural gas (the US benchmark) is +90% compared with a year ago.

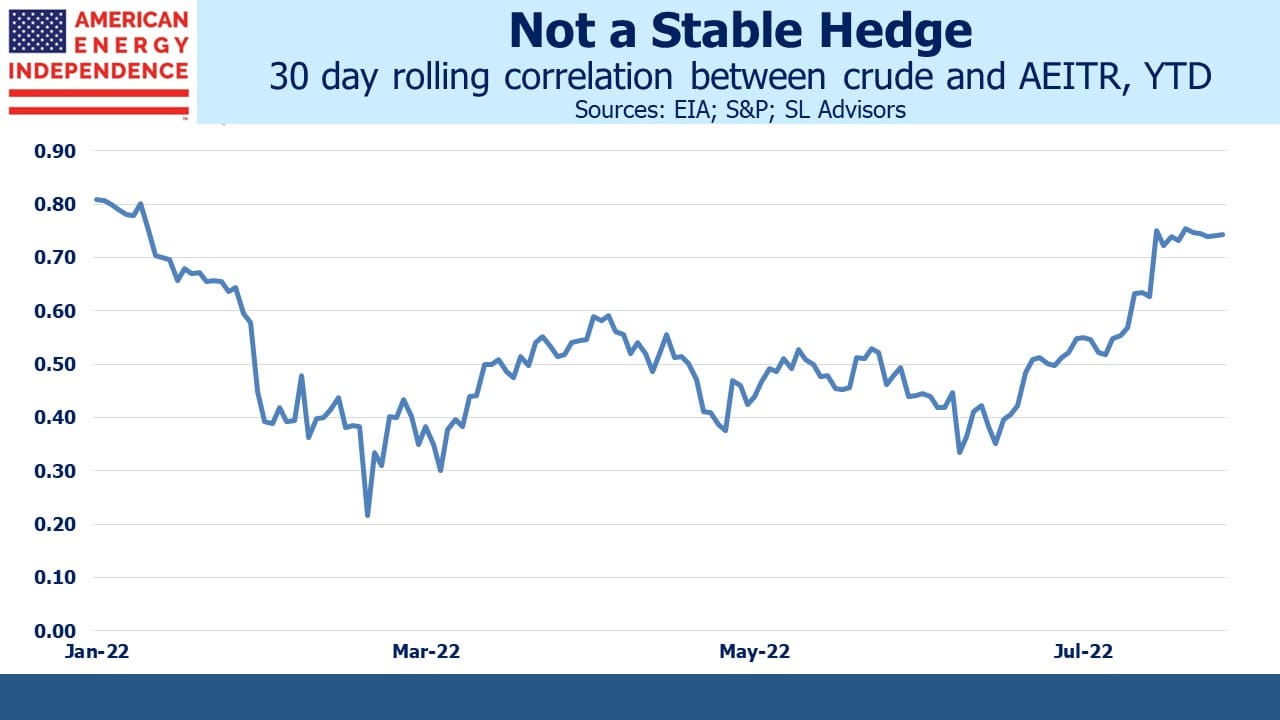

However, the link between pipelines and crude is tenuous. In early June both fell, but since then the AEITR recovered around two thirds of its losses while the price of oil has continued to weaken. Their rolling 30 day correlation has fluctuated between 0.81 and 0.22 this year. The two move together more often than not, but the relationship is far too weak to allow for a portfolio of pipeline stocks to be hedged by shorting oil futures.

This is why successful investors in the sector consider pipeline fundamentals rather than the future price of crude oil in determining their exposure. The forward dividend yield on the AEITR is around 5.6%. With dividends growing at 5-6% and stock buybacks worth another 1-2% of market cap, a 12-13% total return (5.6+5.5+1.5) is a not unreasonable expectation. We are increasingly seeing income-oriented investors make allocation to the sector. A half per cent drop in yields would add another 9% in capital appreciation.

The US Energy Information Administration’s current Short Term Energy Outlook is forecasting US crude production of 12.7 Million Barrels per Day (MMB/D) next year, up from 11.9 this year; 100 Billion Cubic Feet per Day (BCF/D) of natural gas production versus 96.6 this year; 12.7 BCF/D of LNG exports next year versus 11.2 this year; and global consumption of petroleum and liquid fuels of 101.5 MMB/D in 2023, up from 99.4 this year.

Midstream energy infrastructure is a volume business, the outlook for which is positive.

The inappropriately named Inflation Reduction Act (IRA) was warmly received by several companies on recent earnings calls. They especially liked the $85 per ton tax credit for CO2 captured where it’s generated and permanently sequestered underground. Pipeline companies are well-suited to benefit from this, and since only tax-paying businesses can claim the credit it’s unlikely to attract many start-ups.

There’s also a credit of up to $180 per ton for pulling CO2 out of the ambient air. Given the relentless focus on global warming you might think we’re choking on an unhealthy excess, but the reality is that at 412 parts per million, there’s not much CO2 around. This means extracting it is expensive because you have to process enormous quantities of air. Encouragingly, the tax credit looks to be near the low end of the range of likely costs (see The Hard Math Of The Energy Transition). This could stimulate new business opportunities in the sector.

Other features in the IRA were less appealing – the corporate alternative minimum tax could represent as much as a 3% loss in NAV for pipeline corporations according to research from Wells Fargo, although they cautioned that this could be an overly conservative estimate. Expect tax lawyers to work on minimizing the impact.

The 1% tax on buybacks is unlikely to be material but is nonetheless bad tax policy because it now adds a third tax bite out of corporate profits before they reach the investor.

Overall passage of the IRA doesn’t seem to have hurt the midstream sector and the carbon capture opportunities might even make it a net positive. Prospects remain very good.

Two other stories caught my eye. The Financial Times published ‘Extreme heat belt’ to place 100mn Americans at risk in 3 decades, research shows. Large swathes of the central US along with already hot places like Arizona and Florida are predicted to have more days of 125F within three decades. An economist lamented that, “Households and businesses alike continue to flock to markets throughout states like Texas, Florida, Arizona, Georgia and the Carolinas, despite the nation’s ever-increasing climate risks and challenges.”

Americans have been moving south for decades – sometimes for the politics but often for the climate. We like warm weather. 125F will be too hot for many, but winter in the northeast sucks and that’s why migration is south.

Bloomberg reported that the UK is importing LNG from Australia. The cargo was even transferred to a second vessel in Malaysia. That such a desperate and expensive purchase is worthwhile serves as another example of the failed policies engulfing Europe (see America Dodges The Energy Crisis). We are fortunate that New England’s energy policies haven’t spread or we might be doing the same as Britain.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Inquiring minds want to know: The 1% tax on stock buybacks has received a lot of press; but where MLPs are concerned, is there a similar tax on unit buybacks?