New York Times Forecasts the 2014-16 Energy Sector Collapse

One official says the shale industry may be “set up for failure.” “It is quite likely that many of these companies will go bankrupt,” a senior adviser to the Energy Information Administration administrator predicts.

This is from the New York Times. However, it wasn’t part of The Next Financial Crisis Lurks Underground, Bethany McLean’s recent article promoting her upcoming book. In 2011, the NY Times ran a series of articles by Ian Urbina that was critical of many aspects of the Shale Revolution, including the shaky finances underlying its companies. In the ensuing seven years, U.S. crude oil production has doubled and we’ve moved from planning imports of Liquified Natural Gas (LNG) to exporting it. Behind the Veneer, Doubt on Future of Natural Gas, Urbina’s June 2011 article predicting failure, was spectacularly wrong.

Hydraulic fracturing (‘fracking”) is how shale extraction of oil and gas has revolutionized America’s energy security. It has its opponents, whose worries include water contamination and earthquakes. We are environmentalists too – it is everyone’s environment. We like the reduced CO2 emissions made possible by natural gas substituting for coal-burning power plants (see Guess Who’s Most Effective at Combating Global Warming). Robust regulation is in everyone’s interests, so that the Shale Revolution’s benefits can continue to outweigh its costs. The NY Times has a long history of criticizing fracking.

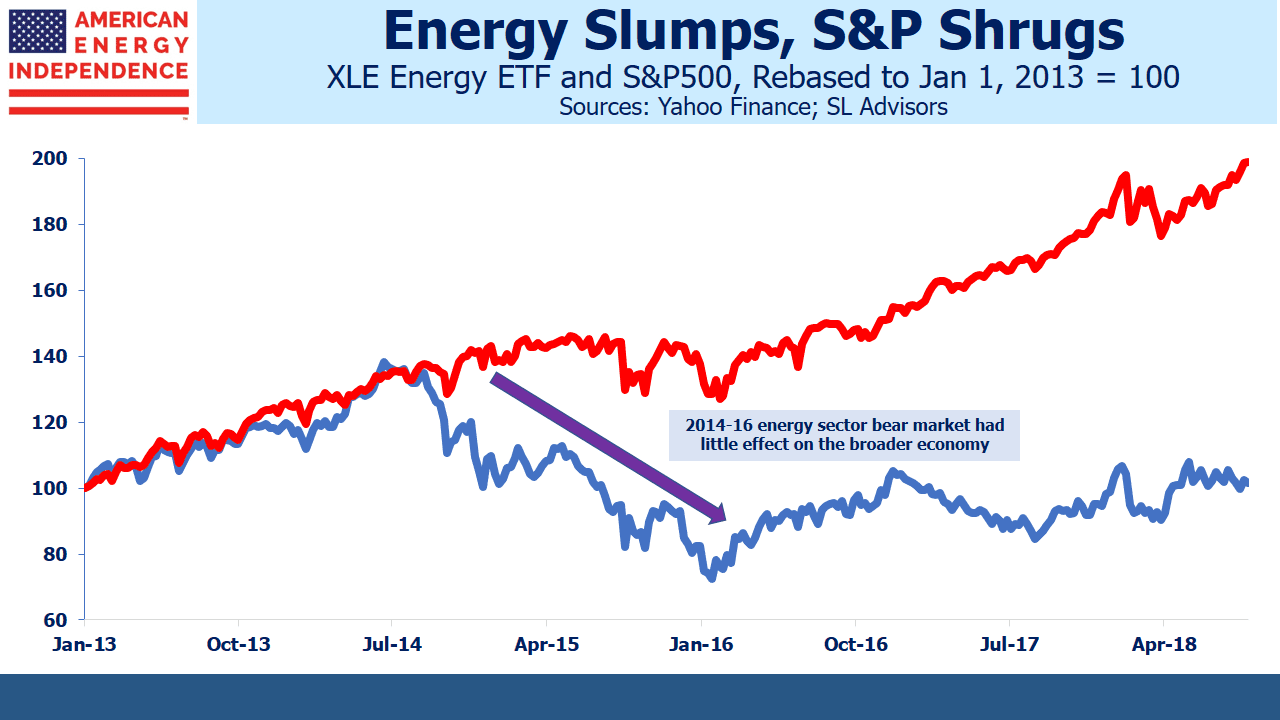

Ms. McLean’s essay was appropriately in the Op-Ed section, which acknowledges that it’s not intended as a news article. Her previous book, The Smartest Guys in the Room, recounted the collapse of Enron and was published six years after Skilling and Co’s demise. Similarly, Ms. McLean is forecasting a crisis in the energy sector after it’s already occurred. From June 2014 to January 2016, the Energy SPDR ETF (XLE) dropped 44%. An over-leveraged industry was hit by falling crude oil, which plummeted from $110 per barrel to $26. Investors complained that cash was being excessively reinvested in new wells, leaving too little available to be returned to investors via dividends or share buybacks.

Moreover, the energy sector endured its collapse pretty much alone. The rest of the U.S. economy shrugged. There was no recession, and the broader stock market averages meandered mostly sideways. During this period, Alerian’s MLP Index fell by 58.2%, more than during the 2008 financial crisis. It’s hard to imagine a more adverse scenario for America’s energy sector, and it suffered in isolation with no collateral damage. Bethany McLean may have missed all this; she might just as well breathlessly announce that the Philadelphia Eagles are about to win their first Super Bowl (note to non-U.S. readers – the Eagles did this in February).

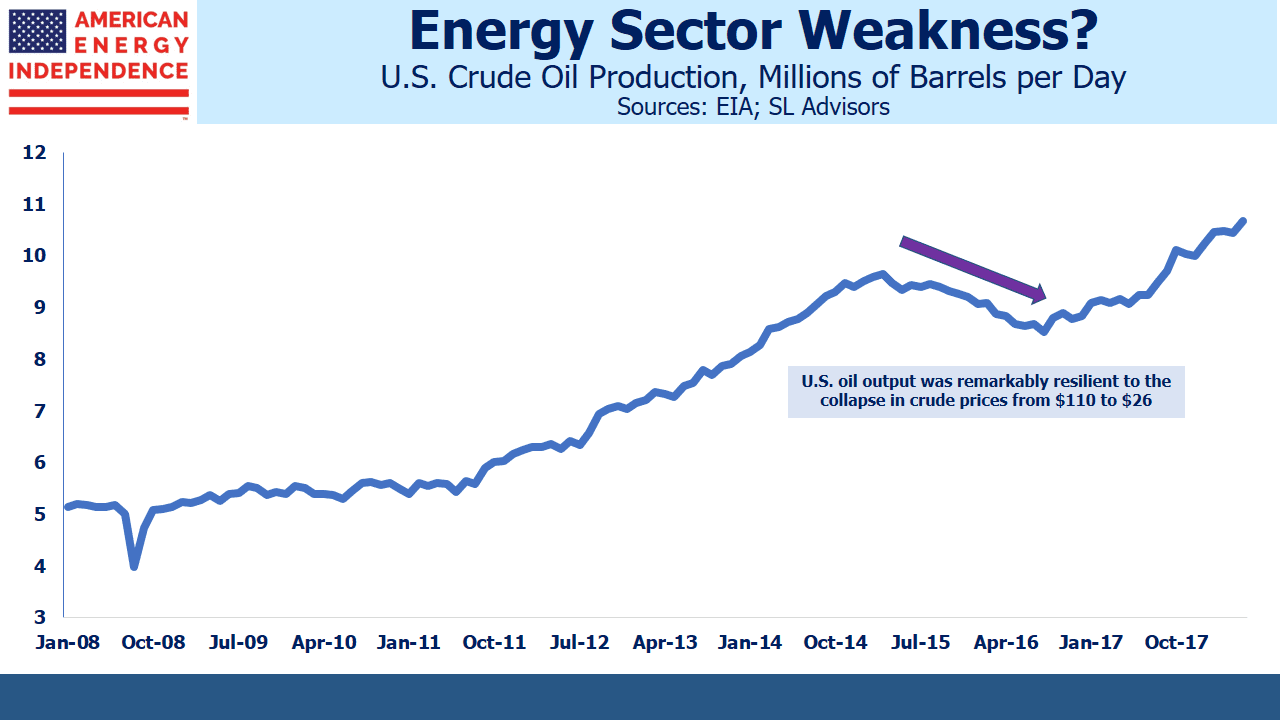

Since then, leverage has been falling, profitability rising and investors have been receiving more cash (see U.S. Oil Producers Continue To Chart Path to Long-Term Growth). Ms. McLean pays this little heed. She notes that, “By mid-2016 American oil production had declined by nearly a million barrels a day” although this relatively modest drop testifies to the resilience of the business, not its frailty. To assert that, “…the Federal Reserve is responsible for the fracking boom…” because of low interest rates sounds as if the Fed’s bond buying program included the debt issued by energy companies. Fed policies have increased risk appetites for equity of all kinds, increasing the competition for capital from non-energy sectors.

The energy sector is slowly recovering from its 2016 low, and the first question of potential investors is about a repeat of $26 oil. Free cash flow yields on the American Energy Independence Index are 9.5%, almost twice the S&P500 (see Reliable Yields Are the Best). This doesn’t look like a bubble.

The fast decline rate of shale wells that Ms. McLean criticizes are in fact a substantial risk mitigant. It’s how shale drillers earn back their invested capital more quickly, and is why the world’s biggest oil companies are substantially investing in North America (see The Short Cycle Advantage of Shale).

Because The Next Financial Crisis wasn’t published in 2015, it’s of little actionable use. However, the upcoming book from which it’s drawn (Saudi America; The Truth About Fracking and How It’s Changing the World) may well be interesting. It’ll probably be more useful as history than as a forecast.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!