Guess Who’s Most Effective at Combating Global Warming

When it comes to limiting CO2 emissions, the results are not always what you’d expect.

Debates about climate change often draw zealots on both sides. The common accusatory opener, “Do you believe in global warming?” betrays the binary, almost religious argument between those who think we’re wrecking the planet and those who don’t. Pragmatism is rare on either side.

The science of climate change is complex, and we won’t attempt to assess man’s contribution to global warming. For a thought-provoking view of the issue, read Alex Epstein’s “The Moral Case for Fossil Fuels”. In one section, Epstein comments on U.S. Secretary of State John Kerry’s 2014 plea for Indonesia to cut carbon emissions to fight global warming. From 2006-16 Indonesia’s CO2 emissions grew by 3.1% annually, the Asian average. It’s no coincidence that in 2016 Indonesian life expectancy reached 69, up by 17 years over the previous half century.

As in much of the developing world, Indonesians are living longer. This is because increased energy use supports cleaner water and food, improved hygiene and better medical care, staples of developed country life. Because fossil-free energy is not yet price-competitive, its adoption implies using less energy. This in turn means shorter life expectancy for Indonesians and citizens of other developing countries. If the science around man-made climate change was unequivocal, it would imply acceptance of briefer lives today so that subsequent generations may live longer. But the science isn’t clear, and a warmer planet may be manageable. Moreover, climate prediction models have consistently overestimated actual warming. Epstein’s book offers a rare, stimulating perspective and seizes the moral high ground assumed by the anti-fossil fuel crowd. He defines improving human life as the standard against which to test climate change policies. By this measure, greater energy use has been a success.

The BP Statistical Review of World Energy 2018 reports on emissions of carbon dioxide, a greenhouse gas. It has some surprising facts.

Global CO2 emissions continue to rise, reaching 33.4 Billion tons last year. Yet, many will be startled to learn that America easily leads the world in reducing CO2 output. Our reduction of 794 million tons over the past decade is a 1.4% annual rate of decrease. The Shale Revolution has certainly helped, although U.S. CO2 emissions peaked in 2005, long before Shale started to have its positive impact. Improved energy efficiency is one reason. More recently, cheap natural gas, combined with regulatory constraints on coal-burning utilities, have favorably altered the mix of hydrocarbons burned to produce electricity. Regrettably, the Trump Administration’s weakening of Obama-era coal constraints will moderate this positive trend.

Another surprise is that the UK managed the second biggest ten-year drop in CO2 emissions, at 170 million tons. This represents a 3.5% annual reduction rate, easily the best for any big country. Lower coal use is similarly the cause here, caused by exhaustion of commercially accessible coal reserves.

The 2015 Paris climate accord represents the world’s desire to combat climate change through reduced greenhouse gas emissions. The U.S. withdrew from it last year. The Climate Action Network, an EU-sponsored NGO, finds that only five EU members are even halfway on track to meeting their obligations under the Paris accord. Some of the most vocal Paris supporters have been the biggest laggards.

For example, Germany has famously managed to be a leader in renewables while failing to lead in emission reductions. Heavy dependence on solar and wind requires baseload electricity generation for when it’s not sunny or windy. In Germany, that’s primarily coal (see It’s Not Easy Being Green). As an unfortunate consequence, Germany plans to increase its reliance on Russian natural gas via the Nord Stream 2 project.

Spain, Italy and Greece have all managed very credible 2-3% annual reductions in CO2 emissions. However, this is due to chronically weak economies: over the past decade, Spain has managed only one quarter of GDP growth above 1% and Italy none, while Greece has been in economic purgatory. By constraining growth in southern Europe, the Euro has been environmentalists’ most effective tool.

China produces 28% of the world’s CO2 emissions, spewing out 9.2 Billion tons which is 50% more than second placed America. This is almost four times India’s emissions level, even though they have similar sized populations. However, India is catching up, with a CO2 growth rate twice China’s.

Over the past decade, China’s increased CO2 output of 2.02 Billion tons was 60% of the global increase. Clearly, lowering CO2 won’t happen without China’s help. That will require reconciling conflicting objectives: developing countries are striving to achieve developed country living standards and longevity, which requires more energy use. Developed country advocates of reduced emissions are, in effect, seeking to slow this progress.

Thoughtful advocacy of renewables recognizes the symbiosis with natural gas in providing reliable electricity generation. The purity of thought required of renewables advocates has them rejecting even those fossil fuels that can help achieve lower overall emissions. Few would enjoy a world in which the Sierra Club had achieved all its goals.

Fossil fuels aren’t equally bad. Electricity generated by burning natural gas results in around half the CO2 output as does coal, and far less damaging particulates. Some may be surprised to learn that investing in fossil fuel infrastructure can be consistent with desiring a cleaner planet. But that’s where your blogging team sits, occupying the lonely, pragmatic middle ground and advocating natural gas as an environmental solution.

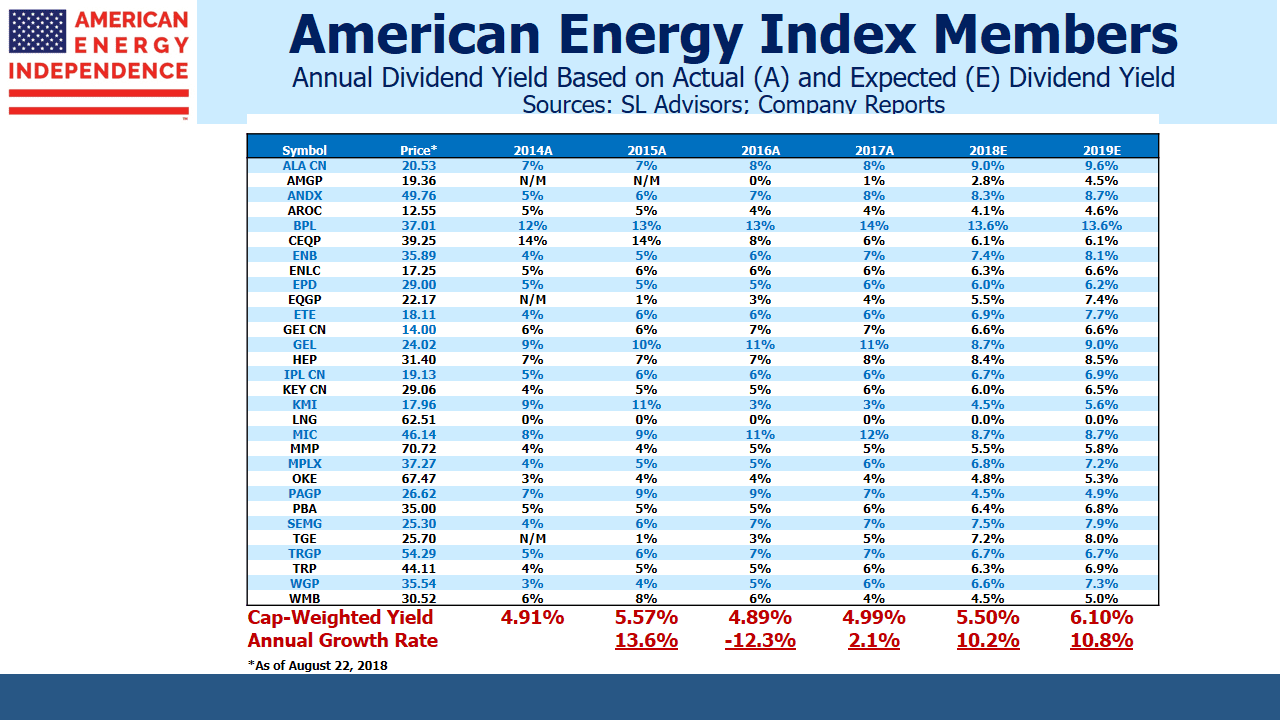

Natural gas is going to be a vital part of our energy mix for decades to come. Although movements in crude oil prices drive sentiment around U.S. energy infrastructure stocks, we have over 300,000 miles of gas transmission pipeline compared with 79,000 moving crude oil. The American Energy Independence Index provides broad exposure to the U.S. energy infrastructure network. It has a long, bright future ahead of it. We expect 10% annual dividend growth this year and next on its constituents.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!