New Pipeline Investment Roars Back

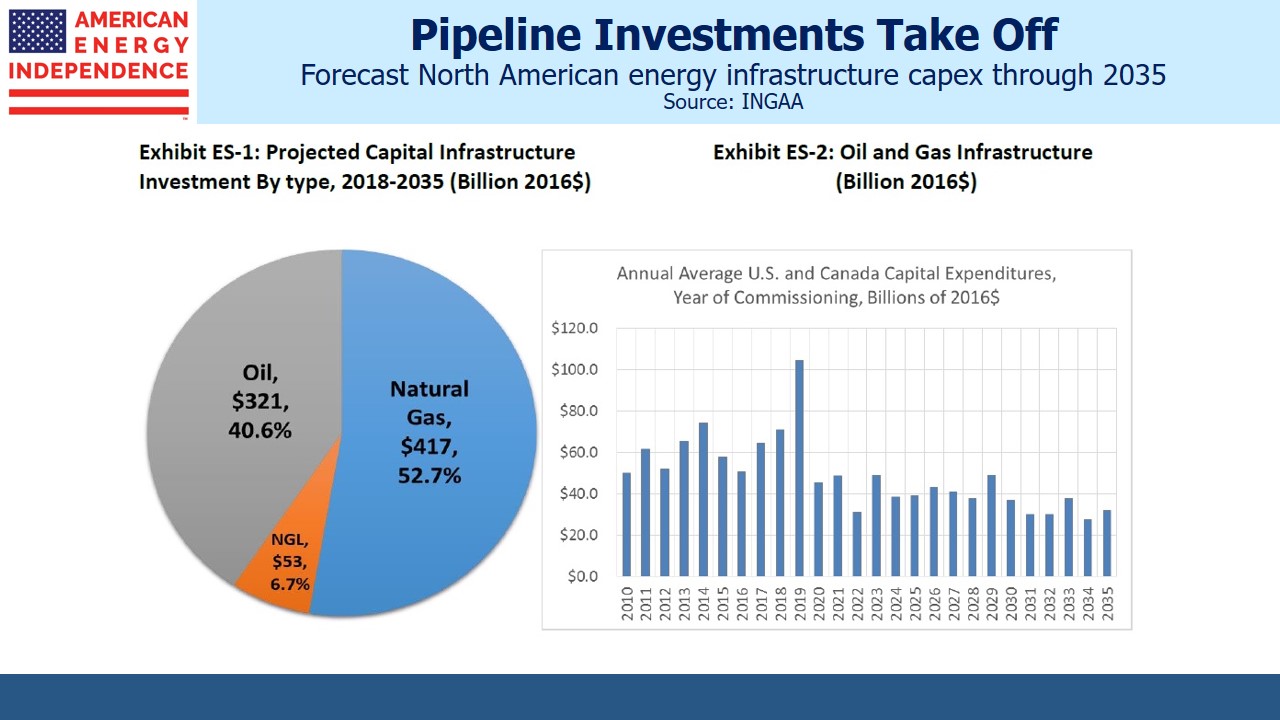

In recent years as MLP investors balked at providing the growth capital sought by midstream energy infrastructure, the biggest companies have been converting to corporations (see MLPs Searching for a New Look). The collapse in MLPs during 2014-15 slowed investment, subsequently causing many of the biggest companies to simplify as they concluded that the MLP investor base was too narrow. This shift away from MLP buyers (mostly older, wealthy Americans) to the global equity investor is evidently working, at least based on one trade group’s forecast of new investment. The Interstate Natural Gas Association of America (INGAA, not limited to natural gas in spite of their name) lobbies for industry-friendly policies and produces long term forecasts of midstream infrastructure investment in the energy sector. They see a bright future for North America.

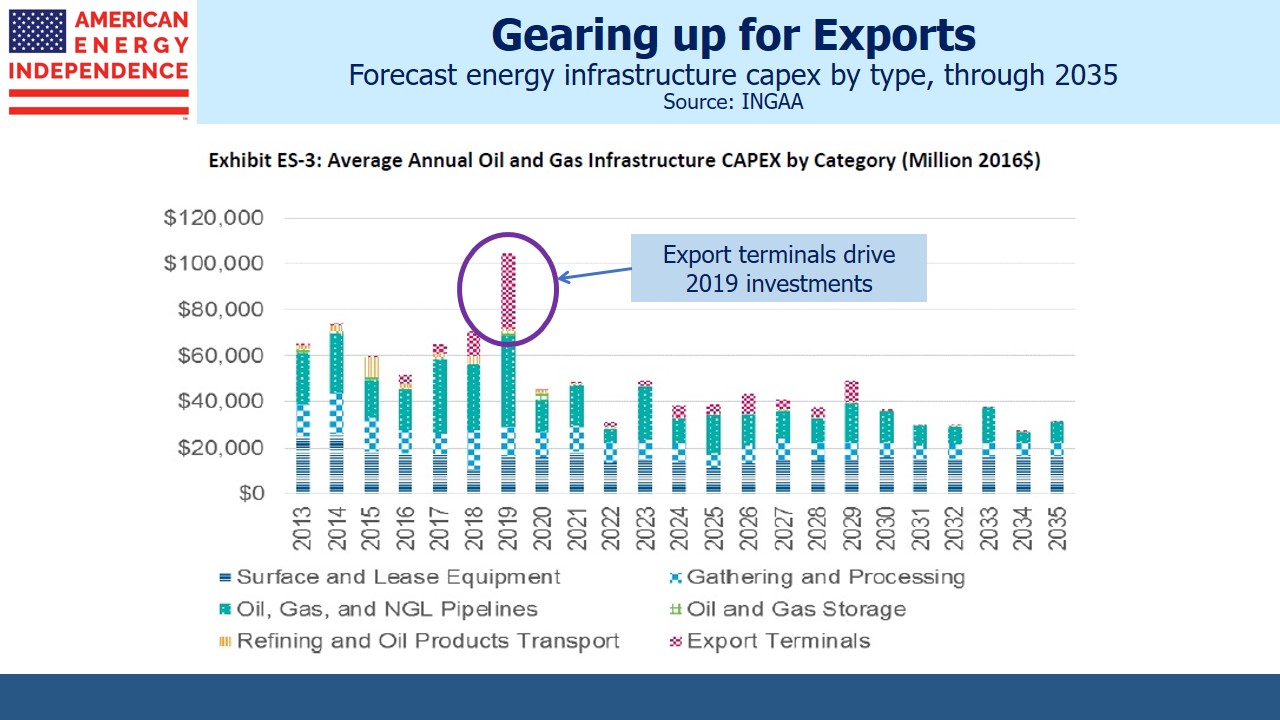

Given the renewed focus in recent years on prudent distribution coverage with lower leverage, it’s striking that 2019 is likely to be a record year for investment in new capacity. Following two years of decline as companies grappled with income-seeking investors unwilling to finance growth, in 2017 capex rebounded. The recovery has continued strongly, driven in large part by increasing export capacity for crude oil, Natural Gas Liquids (NGLs) and natural gas. The path to American Energy Independence is paved by such investments.

It’s interesting to compare INGAA’s current forecast with their prior one, which we covered two years ago (see There’s More to Pipelines Than Oil). INGAA has modified their format and their forecast period covers a slightly shorter time period. But after adjusting for differences, we find INGAA’s latest projection to be 39% higher than their 2016 Upside Case, at $44BN of annual investment.

It’s a remarkable statement about the resilience of the Shale Revolution and how America’s Energy Renaissance is evolving. INGAA’s prior report reflected the still raw memories of the 2014-15 energy recession, when questions lingered about the sustainability of the new, unconventional production.

Today, with production of crude, natural gas and NGLs all hitting records, there can be little doubt that the industry has shifted to an era of long term growth.

Natural gas continues to command over 50% of new investment. Although movements in crude oil pricing continue to drive short-term sector returns, natural gas remains the more important commodity. Exports, by pipeline to Mexico, and as Liquified Natural Gas (LNG) globally, are both set to rise sharply in the years ahead. Net U.S. LNG exports in 2035 are forecast to reach 12 Billion Cubic feet per Day (BCF/D), from around 1.3 BCF/D currently. Overall, North American natural gas output should rise 2% annually, from 91 BCF/D to 130 BCF/D. Natural gas use in the power sector is also expected to show healthy growth, both as coal-fired plants are retired and as a backup for renewables. We’ve long asserted that natural gas is critical to increased use of renewables, to provide baseload power for when it’s not sunny and windy.

NGLs receive far less attention than crude oil or natural gas, but ethane and propane are key feedstocks for ethylene and polypropylene (different types of plastics) respectively. U.S. NGL production is expected to double by 2035, to 6.6 MMB/D, with exports also doubling to 2 MMB/D.

Although the U.S. is already energy independent, in that we produce more total energy on a BTU-equivalent basis than we consume, the popular measure relates to crude oil independence. Industry forecasts of the date when the U.S. reaches that milestone generally fall between 2025 and 2030. Because crude oil comes in hundreds of grades, we’ll continue to import the heavy crude favored by U.S. refineries even while net exports triple, from 0.5 MMB/d to 1.5 MMB/D. Another favorable development will be a halving of non-Canadian imports, further lessening our dependency on unstable regions and unfriendly governments. More than 100% of the growth in U.S. crude production is expected to come from the Permian, Niobrara and Bakken formations.

Given this outlook, it’s clear why many large MLPs have converted to corporations. They need a financial structure that will support growth plans. Investment bankers will find much in INGAA’s report to get them excited, since capex implies ongoing debt and equity issuance. For investors though, the new projects will need to generate a return above their cost of capital. That’s what will determine whether INGAA’s report is truly exciting.

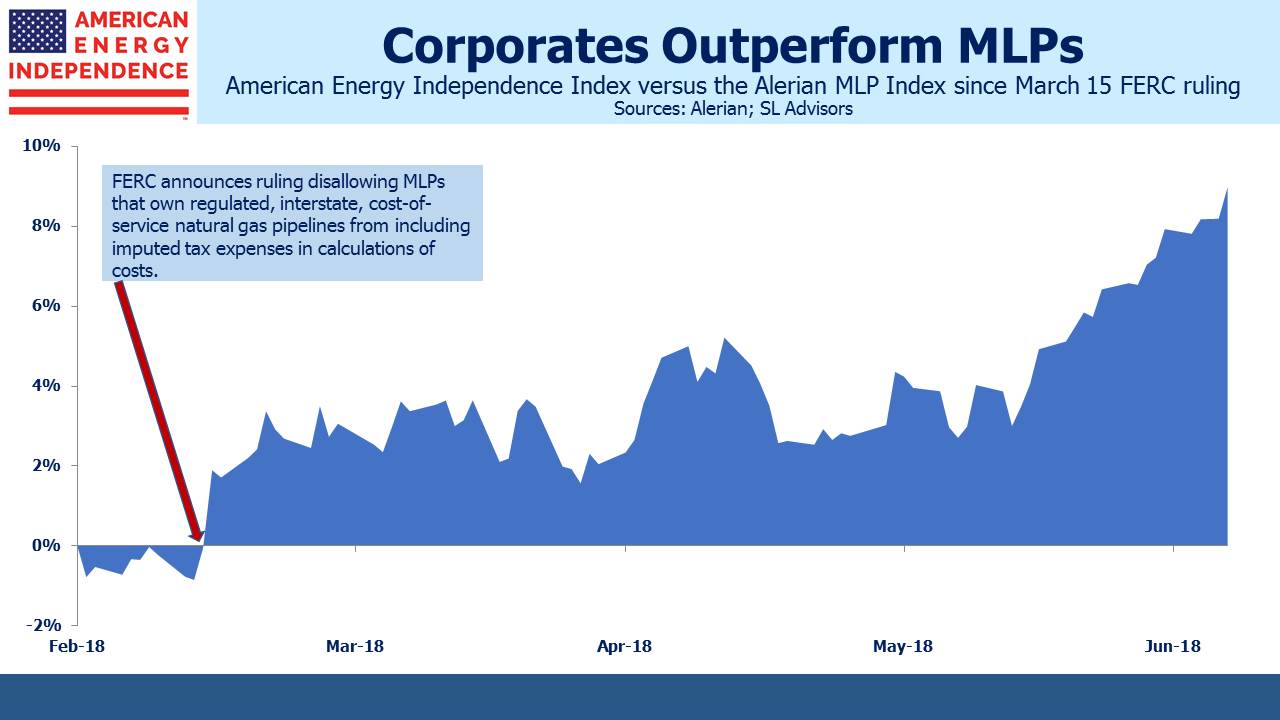

Last week the corporate-heavy American Energy Independence Index added another 1% to its outperformance of the MLP-only Alerian MLP Index, reaching a 9% difference since the March FERC decision cast doubt on the MLP structure for certain companies.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I do not believe that the enhanced investment is attributable to MLPs becoming C corporations, and I do not believe that your weekly articles constantly touting such conversions is justified. The increased investment is attributable to the growth in demand as your article describes, and there is no clearly established connection between the investment and the conversions other than in your self-serving statement to that effect. Rapidly increasing growth capex at MLPs such as EPD, CEQP, MPLX, SMLP, and many, many others, continues, thankfully in the absence of conversions to C corporations. There is still a vibrant, active market for MLPs and capital is abundant for them for economically justified projects. Indeed, many midstream private equity investments are through partnerships, not corporations. And if you look back at the perceived overall need for investment in the 2016 INGAA report (written before conversions became a fad), you will find a very positive note to that as well; the need has grown because of growth in the sector not because of corporate conversions.