Is Shale Driving Oil Higher?

Could the Shale Revolution be driving oil prices higher? It seems counter-intuitive – the U.S. is on course to be the world’s biggest oil producer by next year. And it was the additional shale supply that led to the 2014-15 oil collapse.

Yet, a growing chorus of industry voices is warning of an impending supply squeeze. This includes the Saudi Energy Minister, Khalid A. Al-Falih, who recently expressed concern about shortages of spare crude oil capacity. Last week David Demshur, CEO of oilfield services company Core Laboratories (CLB) forecast oil at $100 a barrel. He cited declining output in many key conventional plays globally, even while U.S. output is growing strongly. The International Energy Agency added their warning that, “…the world’s spare capacity cushion…might be stretched to the limit.”

Part of the problem relates to supply disruptions. Venezuela’s output continues to plummet because of chronic underinvestment. Renewed sanctions on Iran are impeding their exports sooner than expected. Saudi Arabia has promised to increase output to offset the loss of Iranian crude, but many question their ability to sustain output much above 11 Million Barrels a Day (MMB/D).

Meanwhile, global oil demand is expected to grow at around 1.5-1.7 MMB/D over the next year. Depletion of existing fields, estimated at 3-4 MMB/D annually, is worsening according to some observers. So the world needs at least 4-6 MMB/D of new supply to balance current consumption of around 98 MMB/D. Concern is growing of a shortfall.

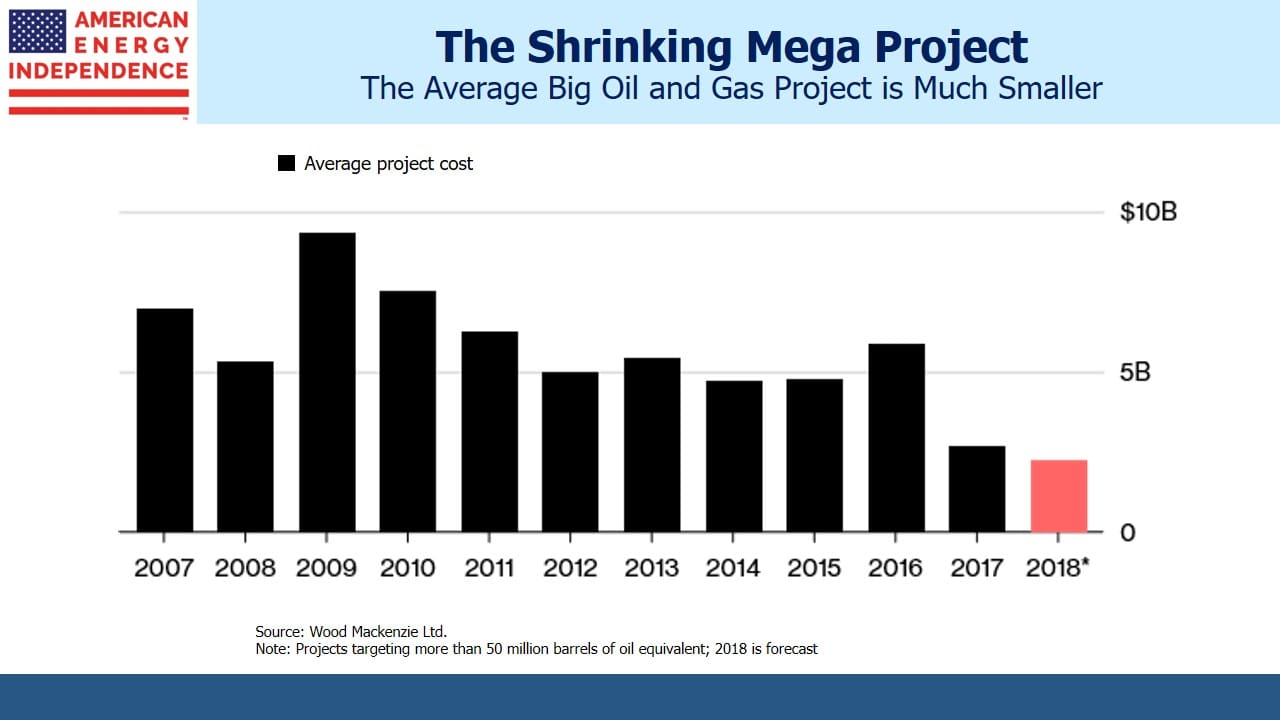

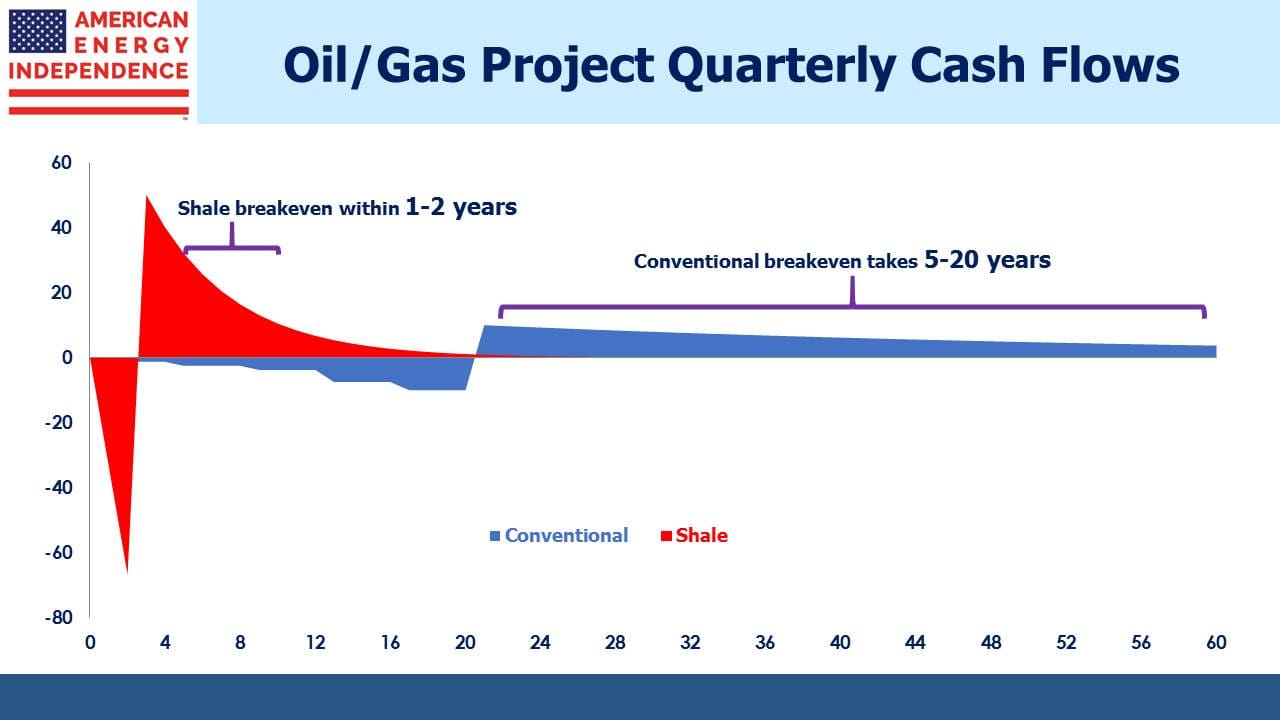

Although blaming the Shale Revolution for a looming supply shortage sounds implausible, Shale’s lower risk profile is drawing capital investment away from conventional projects. You can see this in Exxon Mobil’s (XOM) five year plan to commit $50BN to North American oil and gas production. You can also see it in the dramatic decline in the size of large projects. As we’ve noted before (see The Short Cycle Advantage of Shale) conventional oil and gas projects take far longer to return their capital invested than shale projects.

The energy business has always been cyclical for this reason, because of the supply side’s slow response function. Shale’s ability to recalibrate output much more responsively to price can smooth out the cycle, if there’s enough short-cycle supply available. But there isn’t. North America is the major source of such projects and virtually the only source of shale activity. Rising U.S. output is nonetheless insufficient to provide adequate supply.

Conventional projects have always had to consider macro factors, such as global GDP growth, commodity prices and production cost inflation before committing capital. Add to those the likely path of government policies aimed at curbing fossil-fuel related global warming, and the unknown pace of technological improvement with electric vehicles. Today it’s probably as hard as it’s ever been to confidently allocate capital to a conventional oil or gas project with a 10+ year payback horizon.

Moreover, short-cycle projects like Shale lurk in the background, capable of wrecking the market with oversupply, yet able to protect themselves by quickly curtailing production.

This uncertainty is limiting the commitment of capital to conventional projects. If the warnings are prescient, oil prices will rise to a level that induces more investment back in to conventional projects. The market will self-correct. But it’s looking increasingly likely that higher prices will be required in the meantime.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!