Natural Gas Is The Solution

/

With forecasts for power demand growth seemingly increasing every month, it’s clear that part of the solution will be “behind the meter”, meaning new natural gas power plants directly connected to their data center customers without the need to connect to the grid.

This also sidesteps potential complaints that existing electricity customers are subsidizing the new ones because the cost of added infrastructure is broadly shared across a network. Although adding data centers is a vital step in developing AI capabilities, they don’t add many jobs.

Once constructed, oversight of a warehouse of servers is not labor-intensive. Like bitcoin miners, they don’t have much political clout, so operating independently of the grid is likely to become more widespread.

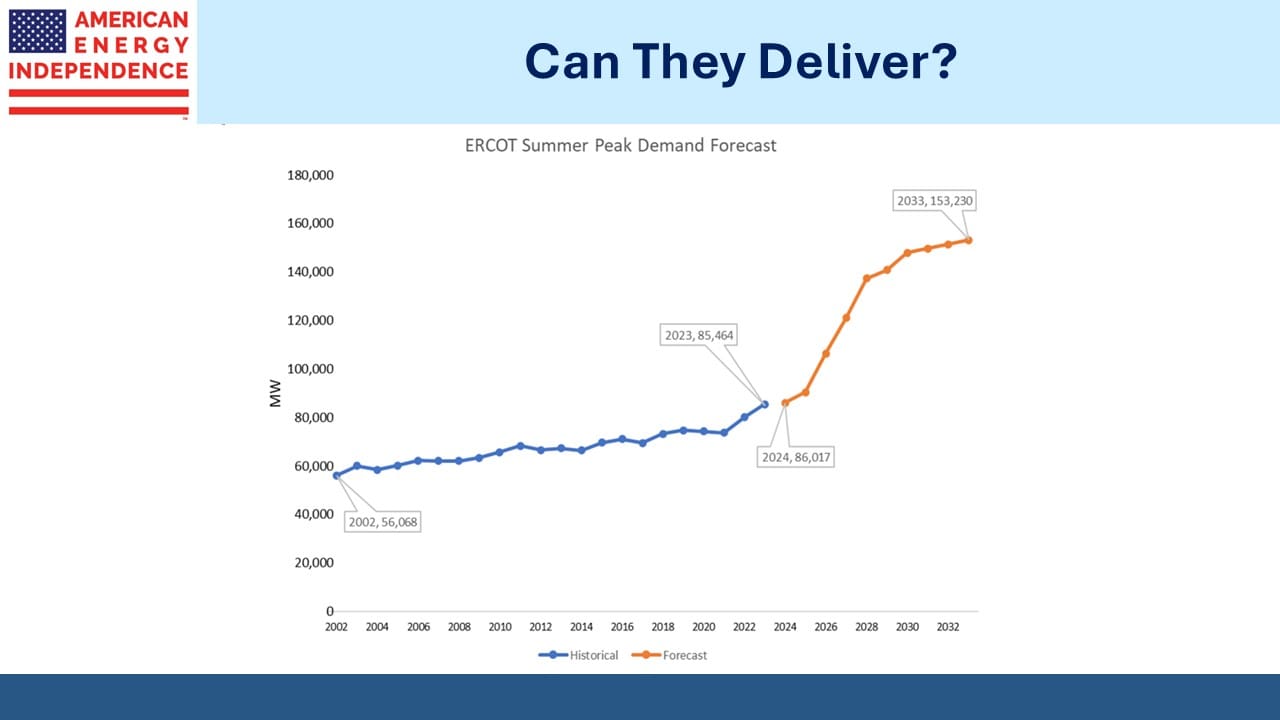

Texas has its own grid that operates without any meaningful connections to other states. Their forecast growth in peak summer illustrates the problem. Having increased at 2% pa for the past couple of decades, they now expect a tripling of that growth rate over the next nine years. Nobody knows if the power infrastructure to support this can be built on such a schedule. We’re adding 148 new gas power plants across the country, up from 133 in April, according to S&P.

Renewables are too unreliable to receive serious consideration because data centers need to run all the time, not just when it’s sunny or windy. Several nuclear projects are being pursued but none are likely to be operational before the 2030s. So natural gas is the only remaining solution. Williams Companies has discussed offering co-located gas generation as a complete solution for data centers.

Because the technology companies building these new facilities care about their carbon footprint, Carbon Capture and Sequestration (CCS) is often part of the package. Exxon Mobil thinks data centers could be 20% of the total CCS market by 2050.

Too few people in America appreciate how significantly the energy sector has boosted our economy. The casual observer contemplating equity markets sees technology stocks and anything linked to AI driving returns. While true, this view doesn’t give sufficient credit to the energy sector and how our access to cheap, reliable hydrocarbons has let the US leap ahead of other developed countries.

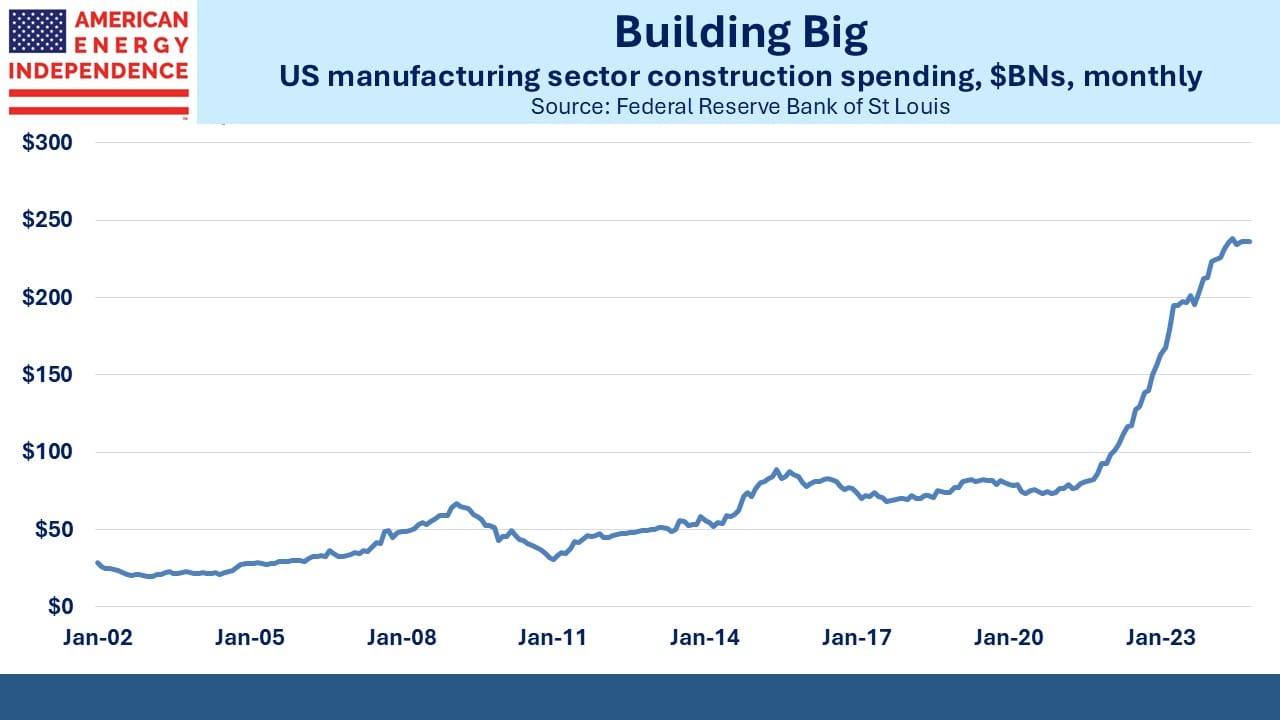

Construction of manufacturing plants has tripled from pre-pandemic levels. Part of this is the result of all the fiscal stimulus the Biden administration pumped into the economy, from spending to offset the drag caused by covid lockdowns to the Inflation Reduction Act. But there can be little doubt that access to cheap, reliable energy has played an important role. Manufacturing employment has stopped its multi-decade decline.

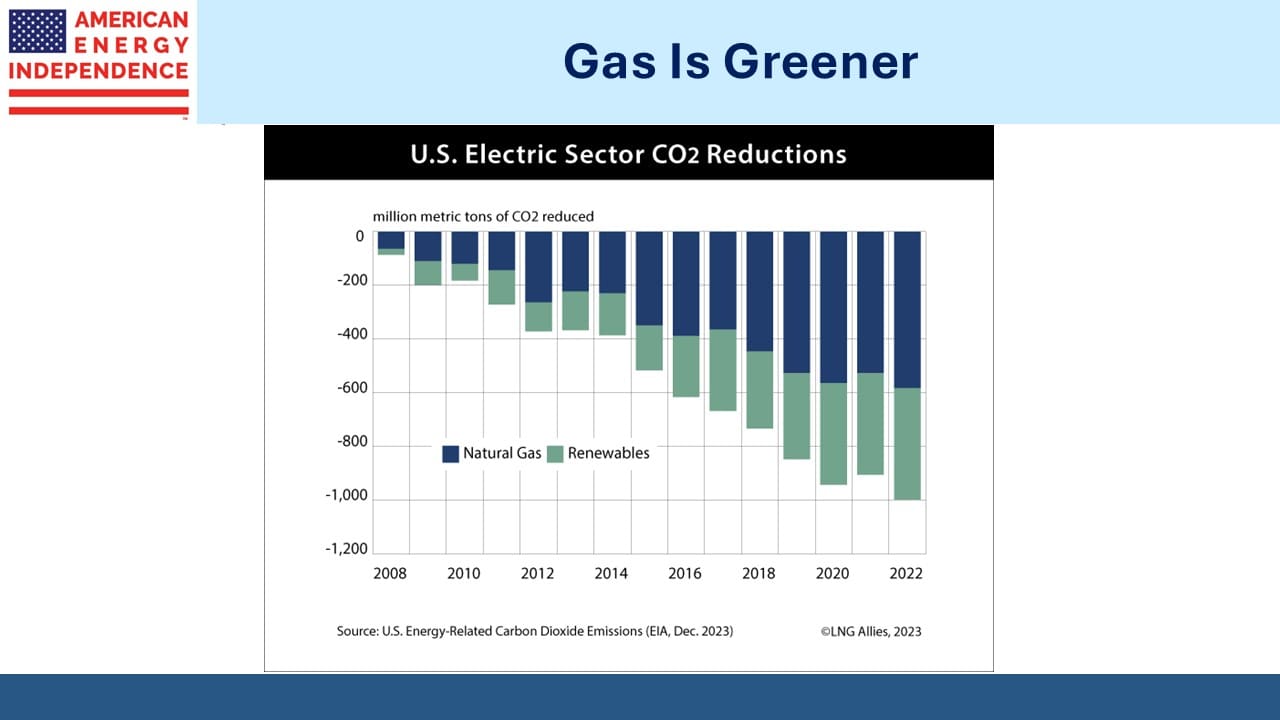

Natural gas is in demand for data centers and to power new manufacturing. But it’s also the biggest source of reduced CO2 emissions by displacing coal. Roughly two thirds of the million metric tonnes we’ve cut is down to natural gas. This has happened with little fanfare and scant support from environmental extremists. Yet it’s been more important than all the solar and wind we’ve built.

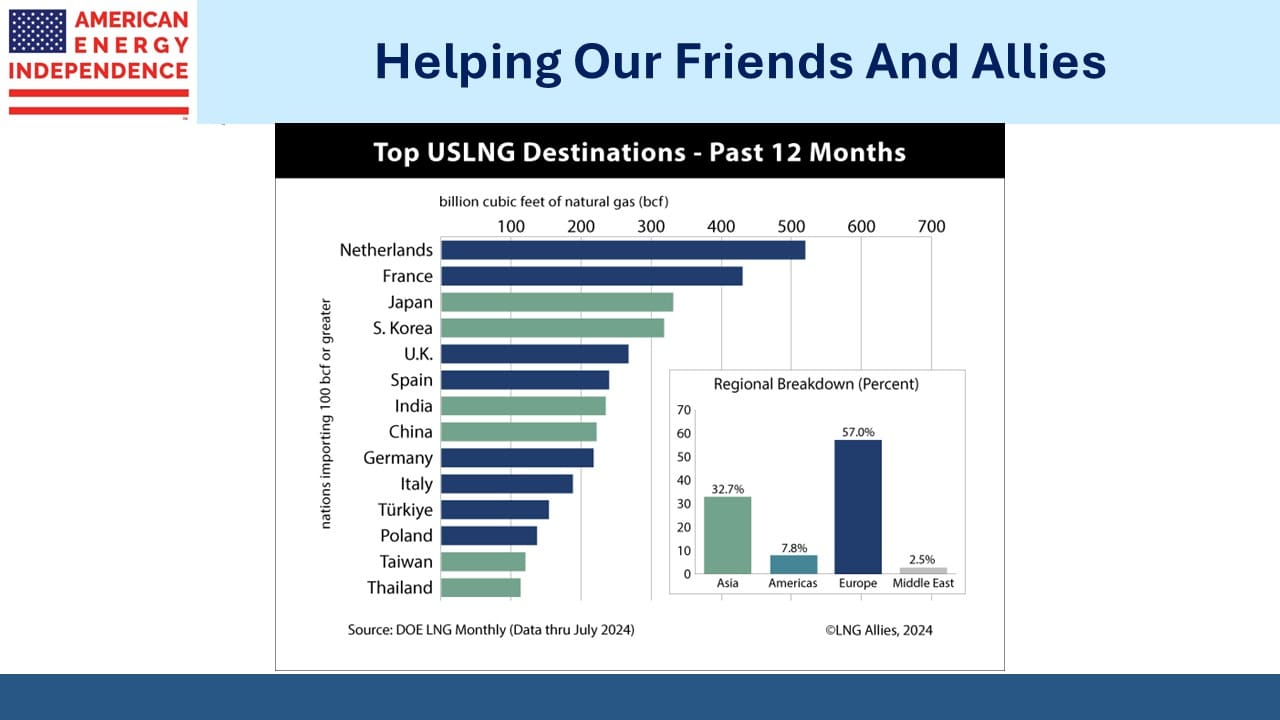

America has come to Europe’s aid with exports of LNG, with over half of our volumes sent there to replace lost Russian imports. The widely criticized LNG permit pause, an ineffective sop to progressives, injected uncertainty into our willingness to continue with long term supplies. Fortunately, that will be lifted next month.

The US Department of Energy (DoE) is expected to release the environmental study whose preparation the pause was intended to allow – apparently it wasn’t possible to keep approving permits while doing research.

In a letter obtained by the NYTimes, outgoing DoE head Jennifer Granholm said increased exports would drive domestic gas prices higher, by as much as 30%. Even if true, US natural gas is around $3.25 per Million BTUs versus over $12 in Europe and Asia. It would still be very cheap compared to global prices.

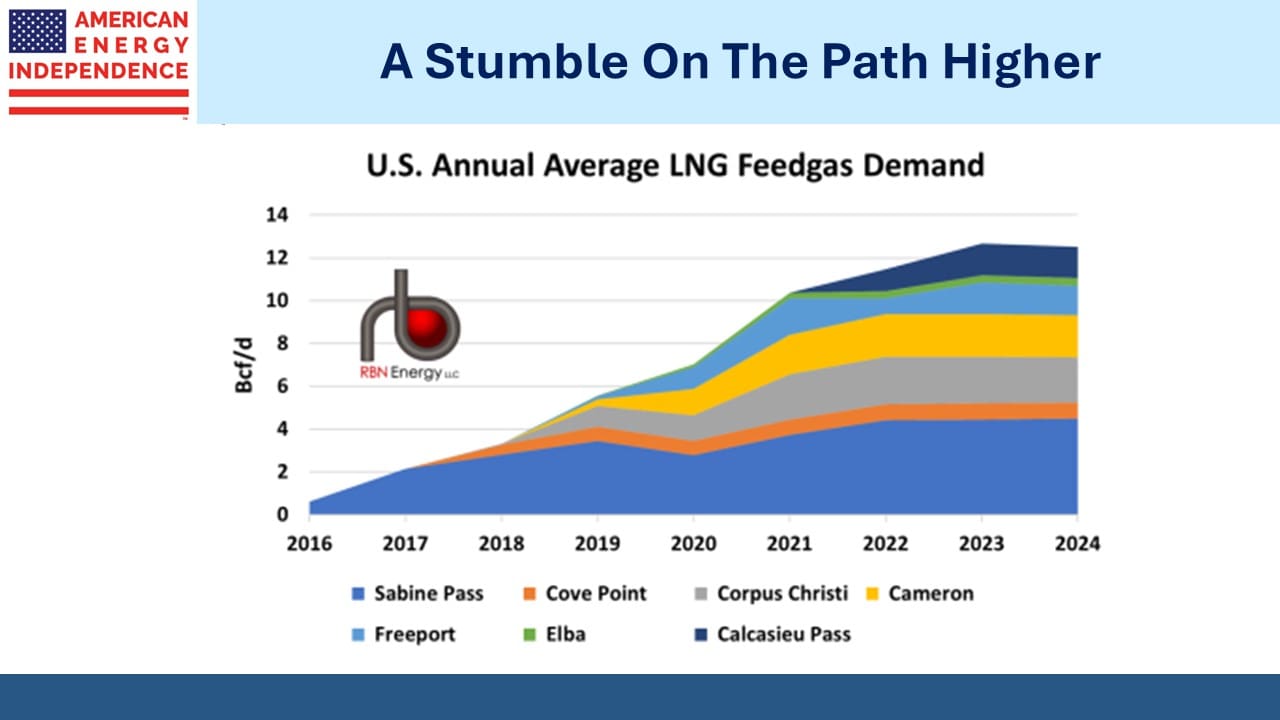

We often use a chart showing growing LNG export capacity as new terminals are completed. Surprisingly, this year volumes are down. It’s not the permit pause, which had no impact on existing projects, but is the result of slower than expected completion at a couple of expansion projects and downtime for maintenance elsewhere.

In some cases, FERC has been slow to issue approvals – whether this was politically motivated or simply the result of diligent regulators depends on your perspective. But the net result has been that feedgas demand from all our LNG terminals averaged 12.53 Billion Cubic Feet per Day (BCF/D) this year, down slightly from 2023 and the first drop since we began exporting LNG in 2016.

There’s every reason to expect higher volumes next year. For many energy challenges, natural gas is the solution.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!