Another MLP Jumps Ship

Last week Antero Midstream (AM) became the latest MLP to simplify their structure. This is further evidence of the declining opportunity set for MLP-dedicated funds, and cause for investors to seek exposure to energy infrastructure that goes beyond MLPs to include corporations (see The Uncertain Future of MLP-Dedicated Funds).

Like many MLPs before them, Antero is becoming a corporation. Broader institutional ownership and enhanced trading liquidity were cited as the reasons.

The benefits of being an MLP persist – our friend and regular commenter Elliot Miller would note that the tax benefits remain significant: MLPs don’t pay Federal corporate income tax, leaving more money available for distributions. And those distributions are largely tax deferred, with the possibility of being tax-free to one’s heirs given thoughtful estate planning.

Nonetheless, Antero concluded that the MLP structure no longer suited them. They joined a long list of companies who’ve reached the same conclusion, including Kinder Morgan (KMI), Targa Resources (TRGP), Semgroup (SEMG), Oneok (OKE), Archrock (AROC), Williams (WMB), Dominion (D) and Enbridge (ENB). Tallgrass (TGE) has retained the partnership structure for governance but chosen to be taxed as a corporation, and Plains All American offers a option for both 1099 (PAGP) and K-1 tolerant (PAA) investors.

They’ve all found that MLP investors are too few and fickle to be a reliable source of equity capital. Tax impediments add cost and complexity to tax-exempt and non-U.S. institutions, a substantial portion of the investor base for U.S. public equities. The K-1s are how investors achieve the tax benefits noted above, but their complexity dissuades most retail investors. Once you eliminate these different classes of investor, almost the only buyers left are taxable, high net worth individuals. In other words, older, wealthy Americans.

These investors like their income, and the several dozen distribution cuts imposed in recent years have done irreparable harm. The high payout ratios of MLPs left little cash for funding growth projects (see It’s the Distributions, Stupid!). This wasn’t a problem until the Shale Revolution created the need for investments in new infrastructure, to support the huge increases in U.S. oil and gas output. Cash was duly diverted from payouts to growth projects, leading to a 30% drop in distributions (see Will MLP Distribution Cuts Pay Off?).

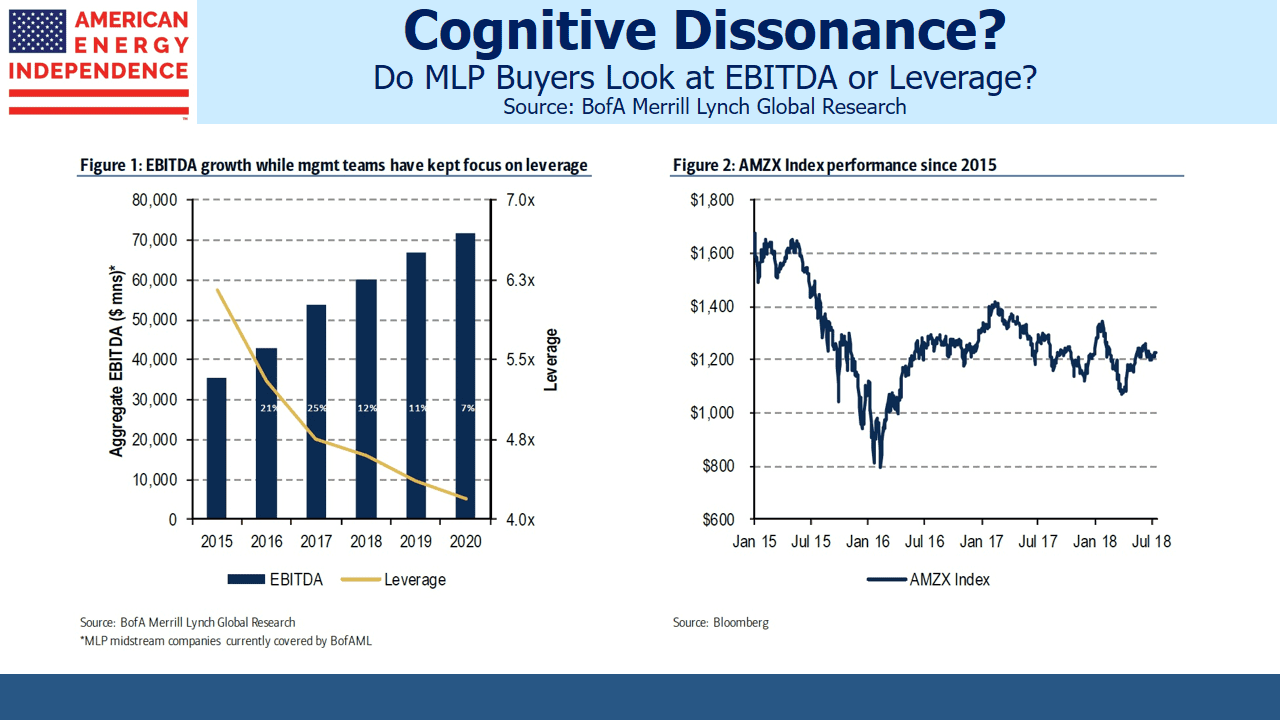

EBITDA improved and leverage came down, but MLP investors only care about distributions, which were cut by 30%. Consequently, the sector fell hard and is still 30% below its 2014 peak.

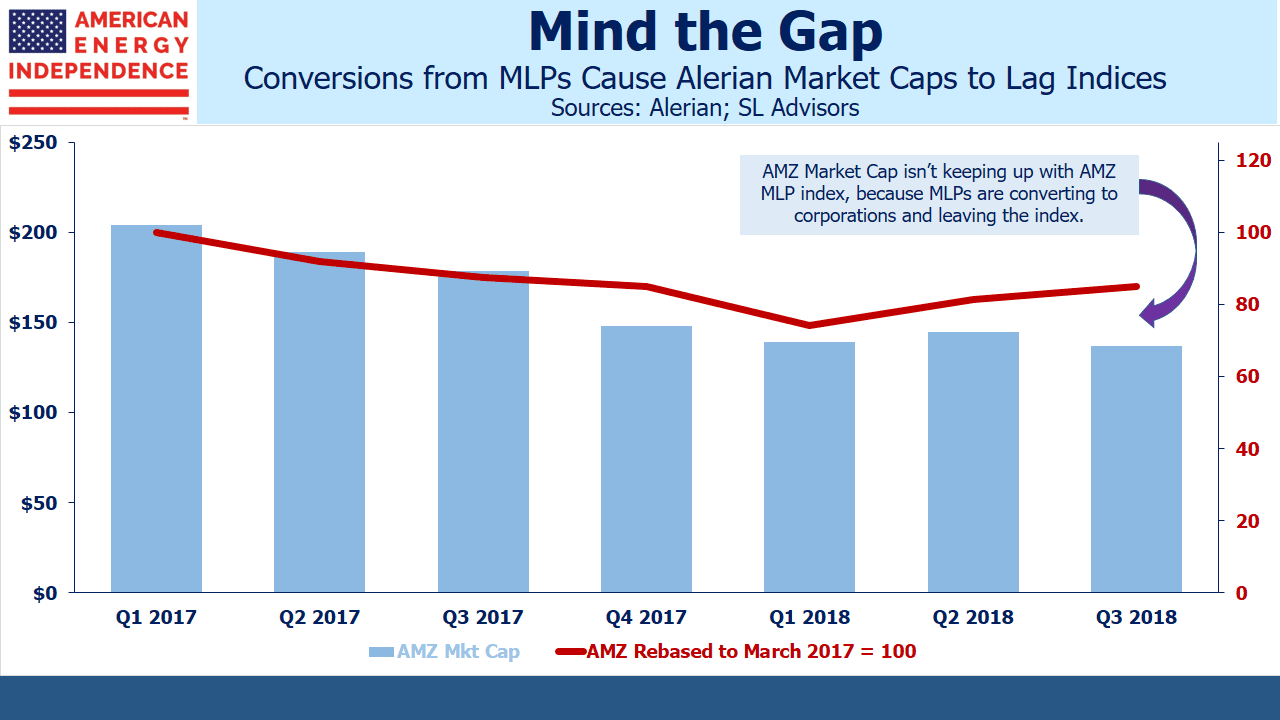

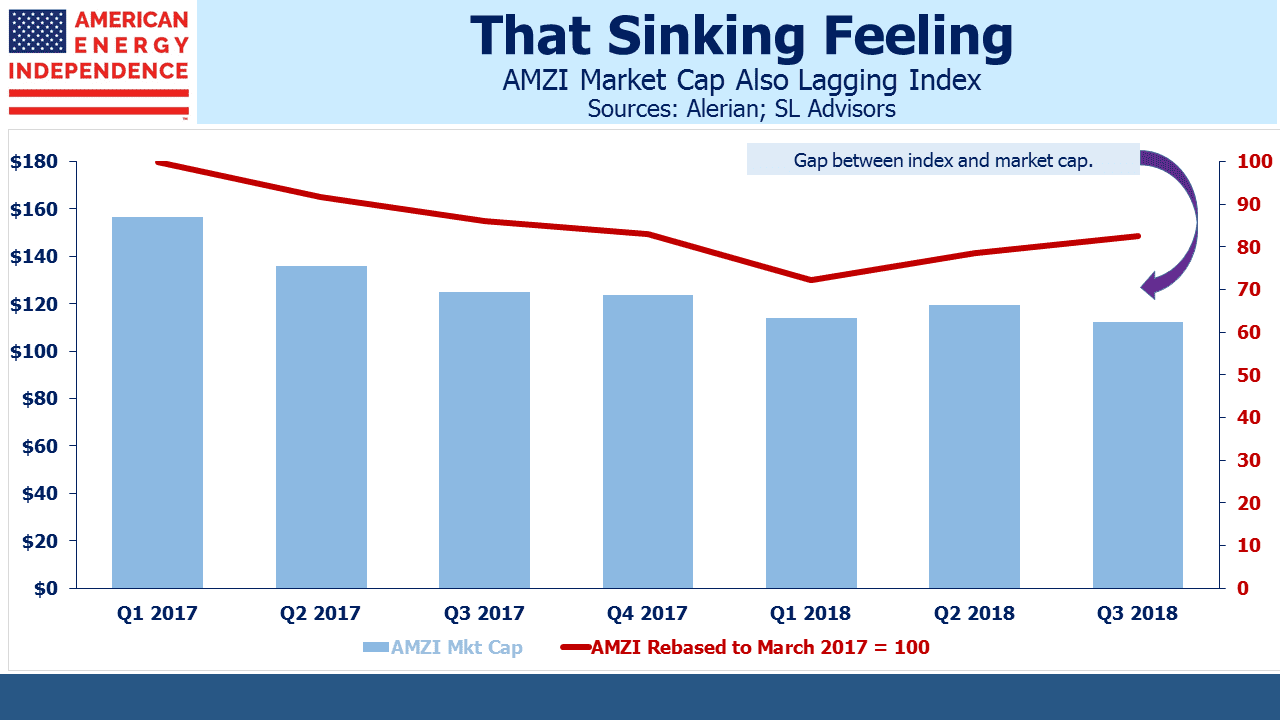

MLP-dedicated funds are left with fewer, smaller fish to catch. Their promoters still defend them, in spite of their flawed structure rendering them taxable with correspondingly eye-watering expenses (see MLP Funds Made for Uncle Sam). As pipeline companies continue to abandon the MLP structure, it’s showing up in the sinking market cap of the MLP indices. The market cap of both the Alerian MLP Index (AMZ) and the Alerian MLP Infrastructure Index (AMZI) are decreasing even while the sector is up this year.

It’s stark evidence of the declining role MLPs play in U.S.energy infrastructure. Affected ETFs include those from Alerian (AMLP) and InfraCap (AMZA). Mutual funds from Oppenheimer Steelpath, Centercoast, Mainstay Cushing and Goldman Sachs are similarly stuck with a declining opportunity set.

These MLP-dedicated funds can’t easily change their structure to avoid taxes by becoming RIC-compliant – they’d have to sell 75% of their MLPs, which is prohibitively disruptive. Some smaller funds whose MLP sales weren’t market moving have done so, which shows that others would if they could. Instead, MLP fund proponents are left to argue that their fund structure is optimal, even though no new MLP-dedicated funds are being launched any more.

Some big MLPs are happy enough. Enterprise Products (EPD), Magellan Midstream (MMP) and Energy Transfer (ETE) are all sticking with the structure. It works best if you don’t need external financing. We are invested in all three companies through our funds and separately managed account strategies.

MLPs can still be good. An MLP-only approach is not. MLP-dedicated funds are the worst place to be, given the shrinking MLP market cap and tax burden. But broad energy infrastructure, growing as we pursue American Energy Independence, is cheap.

We are long AMGP, AROC, ENB, EPD, ETE, KMI, OKE, MMP, PAGP, SEMG, TGE, TRGP, WMB. We are short AMLP.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

CS had a 100+ page report on MLP’s this week. Below is the feedback of a few days later.

Midstream Snapshot

S. Dounis

Initial Investor Feedback on Launch

Initial Investor Feedback =>

Lingering Apathy: We launched coverage of 39 midstream stocks this week with a constructive

outlook. Investors did not pushback on the constructive outlook, generally agreeing that the space is undervalued and

fundamentals remains strong. That said, most

could not point to catalysts that would increase interest in the space.

Concern focused on the general apathy preventing multiple expansion. ETE appears to be the consensus long (CSe O/P),

most view the stock as very undervalued but are frustrated by its l

ack of positive stock response. We received the most

pushback on our MPLX O/P rating. TGE (CSe O/P) also received pushback due to re

–

contracting risk (that we view as

largely priced in against improving fundamentals). There appears to be disagreement on VL

P’s strategic review; investors

split on whether the outcome is positive or negative. No firm opinions on BPL’s strategic review conclusion; most leaning

towards distribution cut.

Simplification Continues with Antero: Antero announced the completion

of its strategic review; AMGP will buy AM at a

~6.5% premium. The surviving entity (“New AM”) is maintaining distribution growth. AM appears to have avoided sacrificing

its merits as coverage is expected to remain healthy at 1.2

–

1.3x and leverage increase

s temporarily but should return to

~2.0x by 2022. We expect the New AM to improve its status in the CS Investor Scorecard due to the improved corporate

governance and removal of IDRs.

Performance: This week, the AMZ outperformed the XLE and S&P 500 by ~3.

0%. Most sectors were down this week as a

result of the severe market correction on Wednesday and Thursday. Defensive names outperformed.

Thanks, Simon. I would also note that the vast majority of the private equity money going into midstream infrastructure is through LLCs, a sibling of MLPs often used for non-public entities, and not C corporations. Like partnerships, LLCs pay no entity level tax and depreciation defers most or all of the distributions. So to the list of older, wealthier tax-deferral seeking MLP investors, you can add private equity also favoring non-corporate forms of investing in midstream infrastructure.

Elliot, thanks for your comment. I think the availability of private equity money via LLC confirms that the problem lies with public equity investors. PE money is much more long term. Retail public MLP buyers have been totally turned off by distribution cuts.

NYTimes article printed today (14Oct18) complements your piece. https://www.nytimes.com/2018/10/12/business/energy-partnerships-rebound-as-us-oil-and-gas-output-rise.html

Forbes reported in 7/28/18 that “the number of companies moving from a MLP to a C Corp is small”. I see you report that 9 companies have changed to a C Corp. I found that there are a total of 114 MLP companies. So , it seems the companies changing is in-fact quite insignificant. Alerian reports that the aggregate MLP tax benefit has moved from 8% to 7%.

The market seems to have over reacted to this tax change.

Hi Hunter. Thanks for your comment. The problem is that the companies switching from MLP to corporate form are the big ones. They have the most to gain from broader equity ownership. That’s why the market cap of the Alerian indices has fallen even though price. s have risen. So the result is that MLPs are less representative of energy infrastructure overall.

Why are you short AMLP? Is it for hedging purposes?

Yes David. We are long energy infrastructure corporations and a few MLPs. Short AMLP as part of one pairs trade.