Bond Investors Agree With the Fed…For Now

The Federal Reserve has brought transparency to their decisions. The famous “blue dots” which show visually each FOMC voting member’s forecast for rates provides insight into their thinking, even if it doesn’t attach names to each dot. We’ve come a long way from Alan Greenspan’s Senate testimony, “Since becoming a central banker, I have learned to mumble with great incoherence. If I seem unduly clear to you, you must have misunderstood what I said.”

Transparency has removed the mystique. It’s now clear that the Fed doesn’t know much more than the rest of us about the economy. They’re also only average forecasters. Ever since the blue dots laid out the likely path of short term rates, which the Fed largely controls, they’ve consistently overestimated where they would set rates. It’s been a source of some amusement – if they can’t even forecast their own actions with accuracy, how can they forecast the economy?

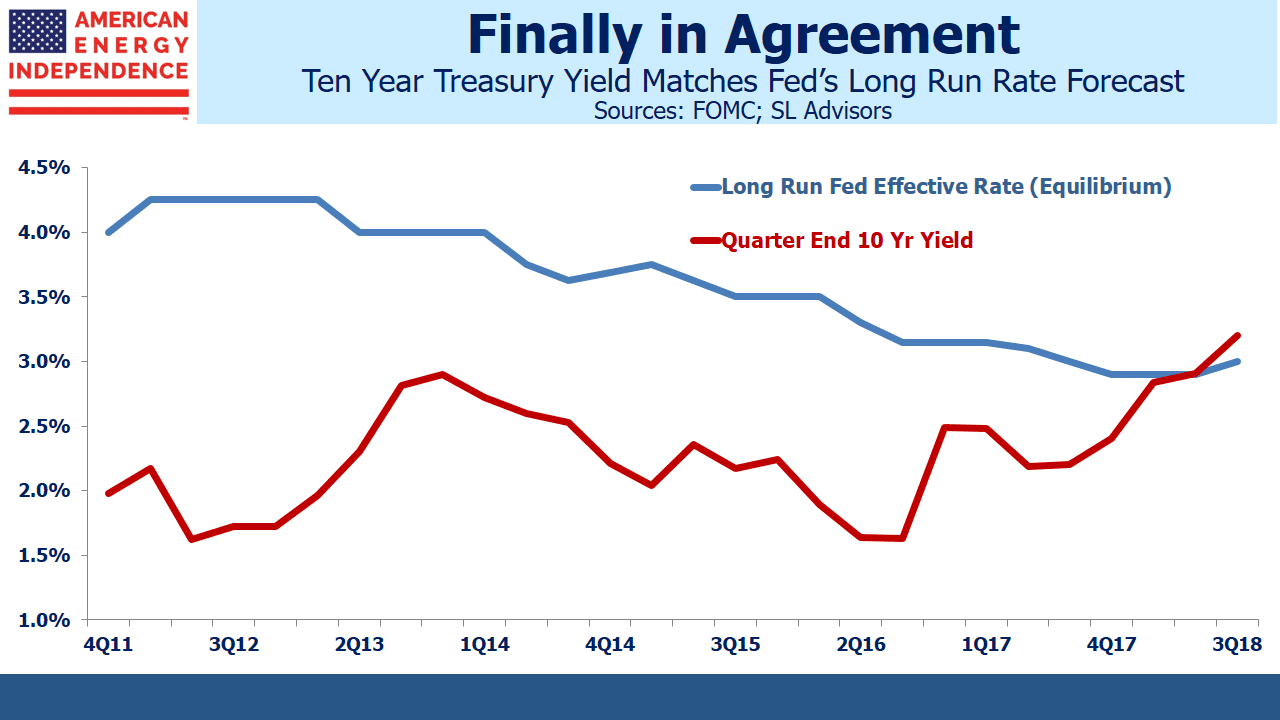

Bond investors long ago concluded that rates would stay lower for longer than the FOMC thought. Ten year treasury yields approximately reflect the bond market’s expectation for short term rates over the next decade. If the FOMC’s thinking aligns with investors, the Fed’s long run forecast of the Federal Funds rate should be similar to the ten year yield. This is the neutral rate, the equilibrium that they regard as being neither accommodative nor restrictive. Historically, it was believed to be around 2% above inflation, for a “real” rate of 2%. Since the inflation target is itself around 2%, 4% was held to be the equilibrium Fed funds rate.

As the Fed provided greater transparency, it revealed a yawning gap between their thinking and that of bond buyers. The bond market turned out to be right, and low treasury yields correctly reflected that short term rates would rise very slowly.

Interestingly though, the Fed’s equilibrium rate also began to slide lower. Since their inflation target of 2% hasn’t changed, it means their equilibrium real rate has dropped to only 1%.

One of the enduring puzzles of the past 25 years is why inflation has been so well behaved. Countless forecasters have been wrong-footed in expecting inflation to rise – with the U.S. unemployment rate at 3.7%, the lowest in living memory, few could be surprised if inflation does move sharply higher. But the FOMC implicitly expects that a less restrictive (i.e. lower real rate) will be needed than in the past to slow things down.

With the Great Recession now ten years old and the need for ultra-low rates gone, views are starting to converge. The Fed’s moderating long run forecast has now crossed the ten year treasury yield. For the first time since the regime of greater transparency, the market and the Fed are in agreement.

However, if treasury yields continue to rise, this will show that the bond market’s forecast of equilibrium rates is higher than the Fed’s. It’ll cause commentators to worry that the Fed is reacting too slowly to the threat of inflation.

It looks likely the Fed Funds rate will approach the 3% equilibrium by next year. The Fed expects moves beyond those levels to become restrictive, which is a normal part of the rate cycle. The interplay between bond yields and Fed Funds forecasts will become more important. So far, investors have been more accurate than voting FOMC members. If treasury yields head towards 3.5% it’ll suggest that the FOMC has allowed their equilibrium rate to drift too low. In that case, expect more White House tweets on rates.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I think that the answer to the puzzle of why inflation has been so tame can be summed up in a single word: technology.

I would add another word – globalization. The opening of Asian labor markets allowed us to import our goods at lower prices. The great disinflation and accompanying bull markets in both stocks and bonds that began in 1982 coincided with the Walmart-ization of the economy, for better or worse. Which is why the Trump Administration’s policies are so profoundly risky and may bring the whole thing to a great screeching halt. I continue to be baffled why more so-called “conservatives” are not yelling loudly about this. Between tariffs and a tax cut at the top of an economic cycle and with an already tight labor market, if you were trying to trigger inflation, you would have a hard time coming up with a better strategy. Oh, and don’t forget limiting immigration which keeps labor costs under control. The upshot is a much higher risk of inflation – higher interest rates and lower bond and stock prices. Maybe much, much lower.