Lose Money Fast with Levered ETFs

A few years ago Vanguard invited me to their campus to give a presentation on my just-published book, The Hedge Fund Mirage. Vanguard’s business model is the antithesis of the hedge fund industry, and they were curious to hear from that rare breed, a hedge fund critic. The company’s frugal culture runs deep. As I joked during my presentation, the only German car in the parking lot was mine. Lunch was in the “galley” (cafeteria), where my host reached into his pocket to buy my sandwich and fruit cup. This is a company whose products are usually appropriate ways to access a desired asset class.

So it was in character for Vanguard to recently ban leveraged and inverse ETFs from their brokerage platform. Such products have long been criticized because their only plausible use is for extremely brief holding periods of a few days or less. Because of their daily rebalancing, over time compounding drives their value to zero. To visualize this, imagine if you owned a security which rebalanced its risk daily so as to maintain constant market exposure. A 10% down move followed by a 10% up move would leave you down 1%. Time and volatility work against the holder, except for those able to successfully predict the daily fluctuations and time their trades accordingly. Only those seeking profits in a hurry, or trying to temporarily hedge more risk than they’d like, find them attractive. Neither resembles a long-term investor.

Vanguard’s philosophy prevents creating leveraged or inverse ETFs of their own, but now they’ve taken a logical further step to increase the distance between their clients and long term value-destroyers. They correctly noted that such products are, “generally incompatible with a buy-and-hold strategy.”

This is a popular area, with soaring volumes in recent years. It’s another example of the excessive focus on short term market direction. Consumers of financial news want to know where the market’s going today, and media outlets duly respond. But prospectuses routinely warn that leveraged ETFs will probably decline to zero over time, which means the average holder will lose money. On this basis, one might think the SEC would find banning them easily defensible. So far, while individual commissioners have voiced concern, they haven’t moved further. Finance is not short of regulation, and a philosophy that allows consumers to decide appropriateness for themselves allows innovation, and is more right than wrong. However, it works best when the products financial companies offer to their least sophisticated, retail clients are designed with good intentions. Hedge funds and other sophisticated investors can be expected to properly understand how to use leveraged and inverse ETFs – like prescription medication, their availability should be carefully controlled.

We’ve been critics of these products for years (see Are Leveraged ETFs a Legitimate Investment? from 2014 as well as The Folly of Leveraged ETFs and recently FANG Goes Bang).

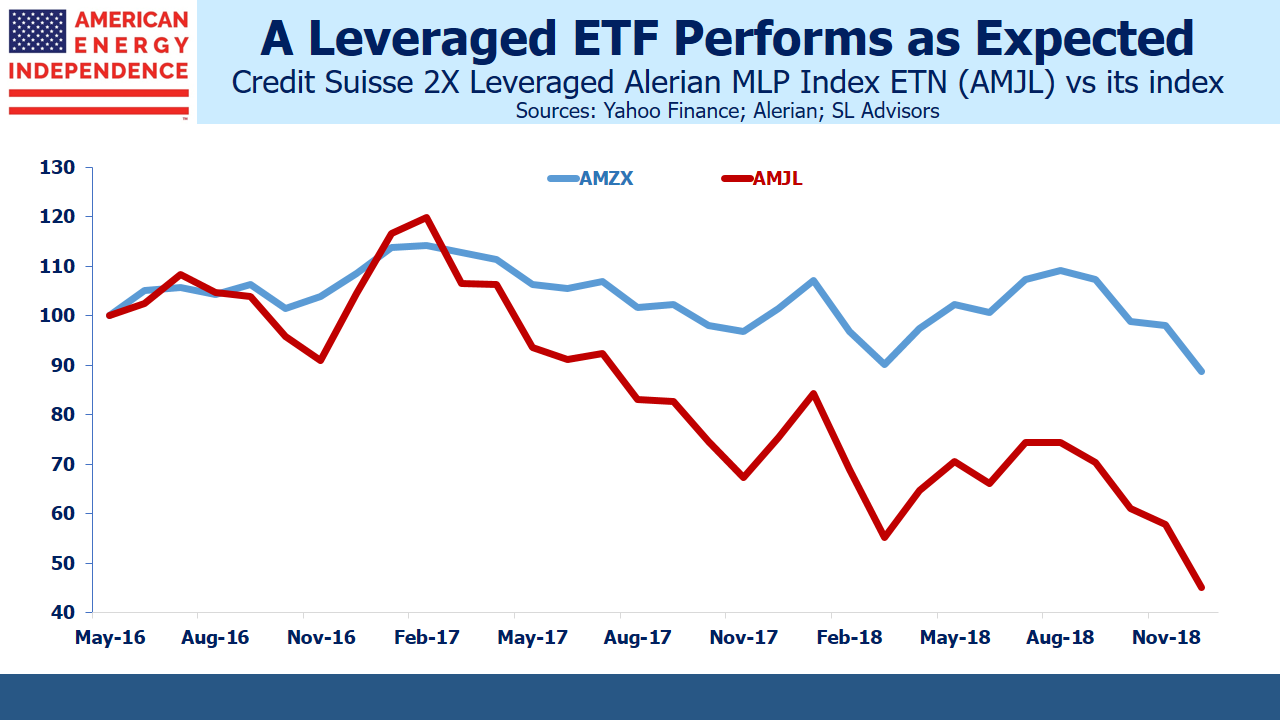

In May 2016 Credit Suisse issued a 2X Leveraged ETN linked to the Alerian index. Since then it’s down 55%, while the index is down 12% (including distributions). Losses are only limited to two times the index over very short periods. This type of long term result is common. It’s unrelated to the index and invariably worse, which Credit Suisse, and Alerian (who allowed their index to be licensed) would have known at the outset. Either name attached to an investment should give the buyer pause. It’s why these products shouldn’t be offered to retail investors.

Energy infrastructure remains one of the most attractively valued sectors around. The American Energy Independence Index yields 6.75%, and we expect dividends to grow 6-7% this year. This is attractive enough for the long-term investor, and isn’t available as a leveraged product.

On Wednesday, January 16th at 1pm Eastern we’ll be hosting a conference call with clients. If you’re interested in joining, please contact your Catalyst wholesaler, or send an e-mail to SL@SL-Advisors.com.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).