Is Shale Driving Oil Higher?

Could the Shale Revolution be driving oil prices higher? It seems counter-intuitive – the U.S. is on course to be the world’s biggest oil producer by next year. And it was the additional shale supply that led to the 2014-15 oil collapse.

Yet, a growing chorus of industry voices is warning of an impending supply squeeze. This includes the Saudi Energy Minister, Khalid A. Al-Falih, who recently expressed concern about shortages of spare crude oil capacity. Last week David Demshur, CEO of oilfield services company Core Laboratories (CLB) forecast oil at $100 a barrel. He cited declining output in many key conventional plays globally, even while U.S. output is growing strongly. The International Energy Agency added their warning that, “…the world’s spare capacity cushion…might be stretched to the limit.”

Part of the problem relates to supply disruptions. Venezuela’s output continues to plummet because of chronic underinvestment. Renewed sanctions on Iran are impeding their exports sooner than expected. Saudi Arabia has promised to increase output to offset the loss of Iranian crude, but many question their ability to sustain output much above 11 Million Barrels a Day (MMB/D).

Meanwhile, global oil demand is expected to grow at around 1.5-1.7 MMB/D over the next year. Depletion of existing fields, estimated at 3-4 MMB/D annually, is worsening according to some observers. So the world needs at least 4-6 MMB/D of new supply to balance current consumption of around 98 MMB/D. Concern is growing of a shortfall.

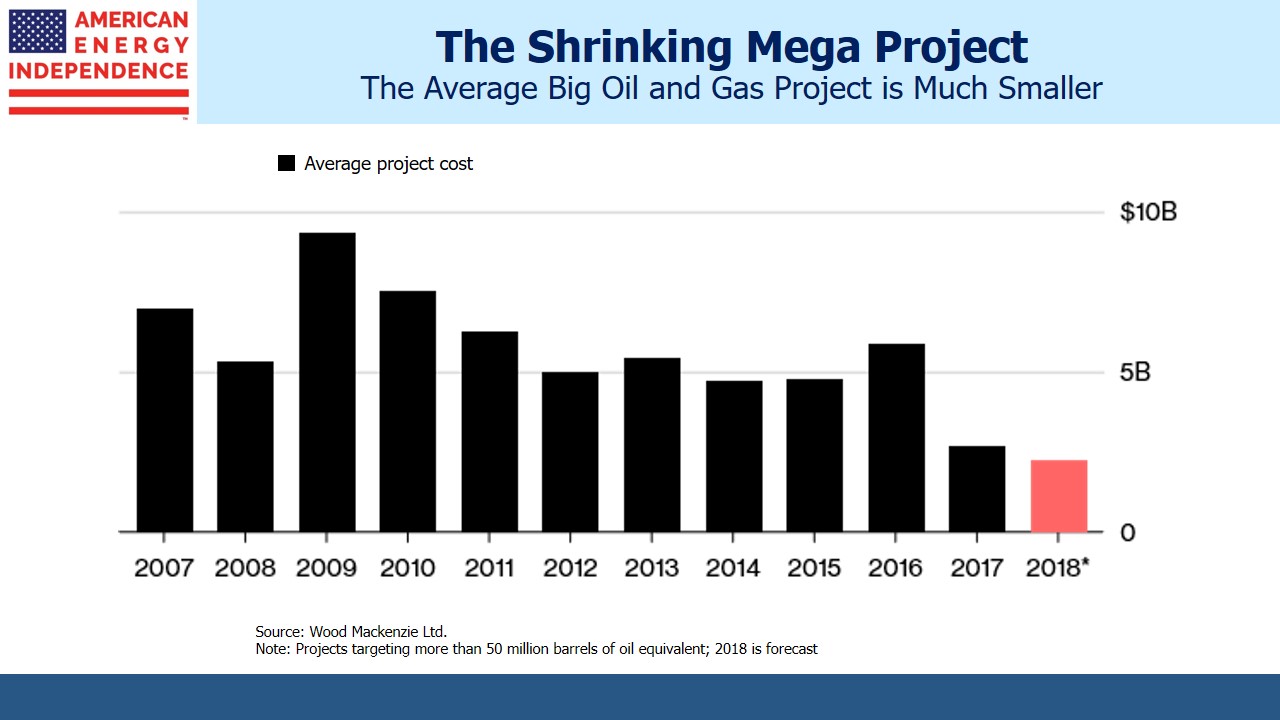

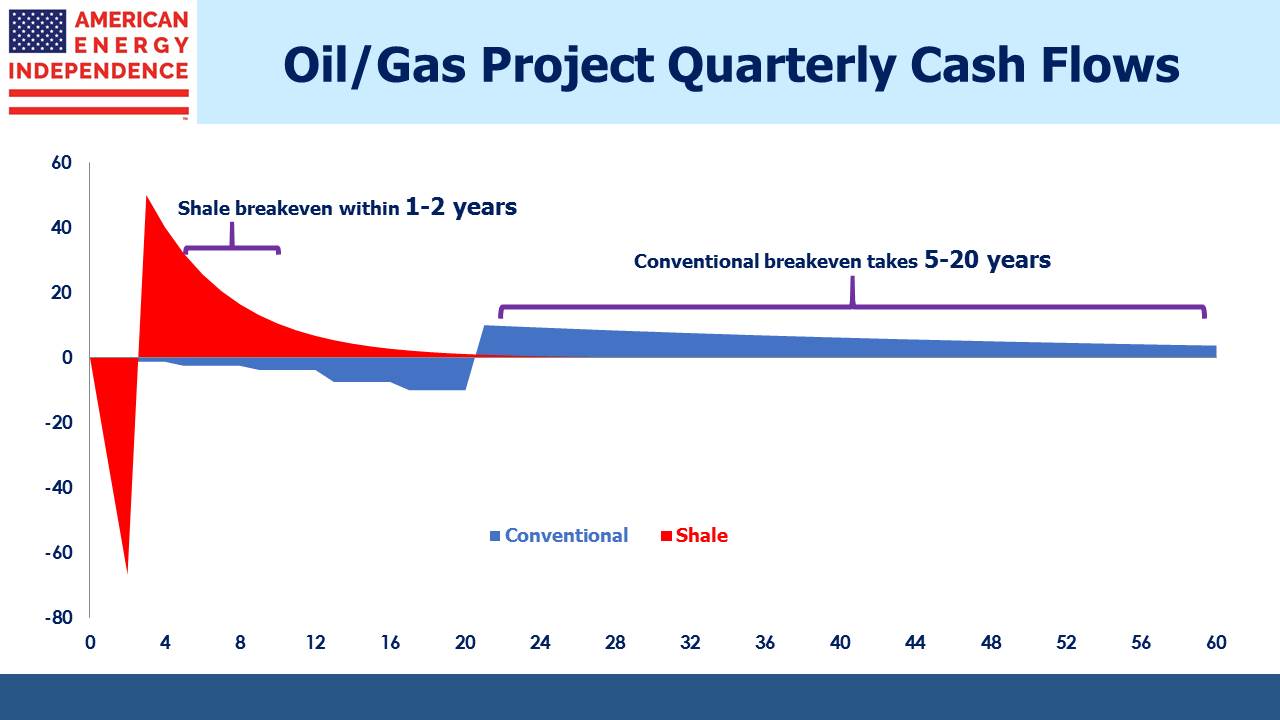

Although blaming the Shale Revolution for a looming supply shortage sounds implausible, Shale’s lower risk profile is drawing capital investment away from conventional projects. You can see this in Exxon Mobil’s (XOM) five year plan to commit $50BN to North American oil and gas production. You can also see it in the dramatic decline in the size of large projects. As we’ve noted before (see The Short Cycle Advantage of Shale) conventional oil and gas projects take far longer to return their capital invested than shale projects.

The energy business has always been cyclical for this reason, because of the supply side’s slow response function. Shale’s ability to recalibrate output much more responsively to price can smooth out the cycle, if there’s enough short-cycle supply available. But there isn’t. North America is the major source of such projects and virtually the only source of shale activity. Rising U.S. output is nonetheless insufficient to provide adequate supply.

Conventional projects have always had to consider macro factors, such as global GDP growth, commodity prices and production cost inflation before committing capital. Add to those the likely path of government policies aimed at curbing fossil-fuel related global warming, and the unknown pace of technological improvement with electric vehicles. Today it’s probably as hard as it’s ever been to confidently allocate capital to a conventional oil or gas project with a 10+ year payback horizon.

Moreover, short-cycle projects like Shale lurk in the background, capable of wrecking the market with oversupply, yet able to protect themselves by quickly curtailing production.

This uncertainty is limiting the commitment of capital to conventional projects. If the warnings are prescient, oil prices will rise to a level that induces more investment back in to conventional projects. The market will self-correct. But it’s looking increasingly likely that higher prices will be required in the meantime.