Heat Pumps Need Natural Gas

/

I was surprised to read the other day that sales of heat pumps across Europe dropped 47% in 1H24 versus a year earlier. The EU has adopted more aggressive policies to combat climate change than any other region. Residential adoption of heat pumps is part of their green agenda.

We recently replaced an oil furnace with a gas one – doing our part to reduce emissions since the new furnace is more efficient and gas generates less CO2 per unit of energy output than heating oil.

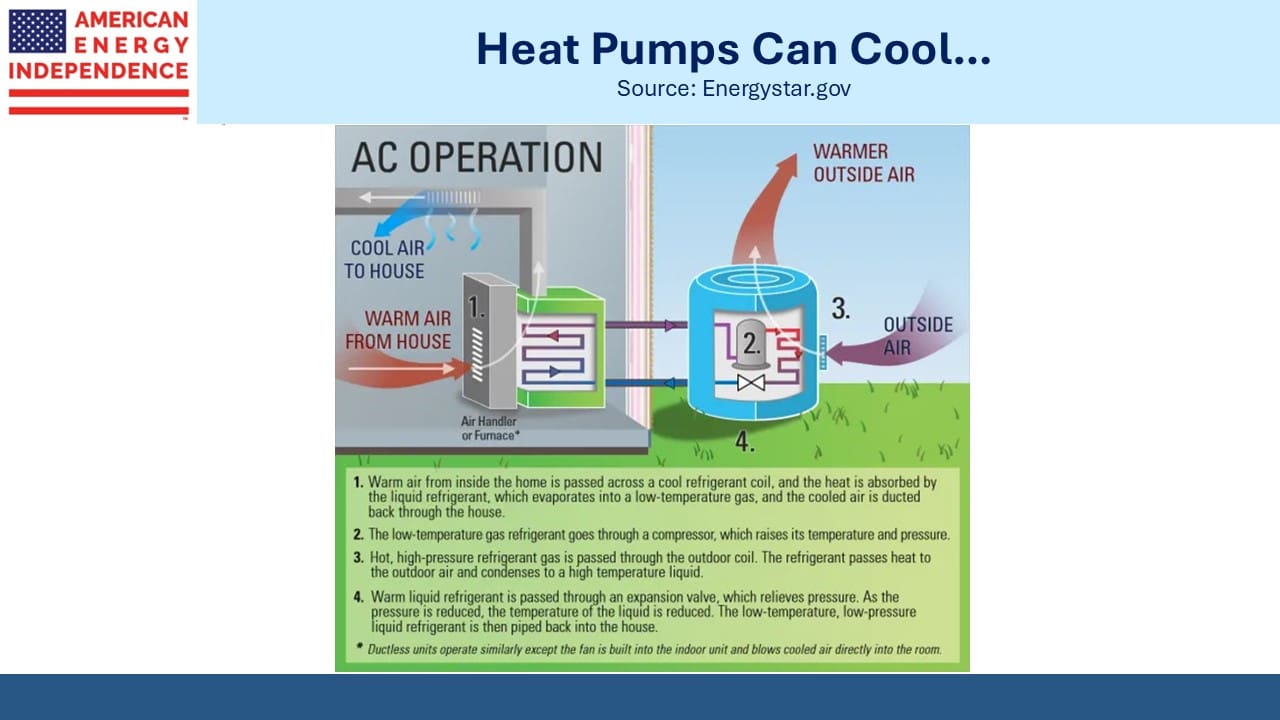

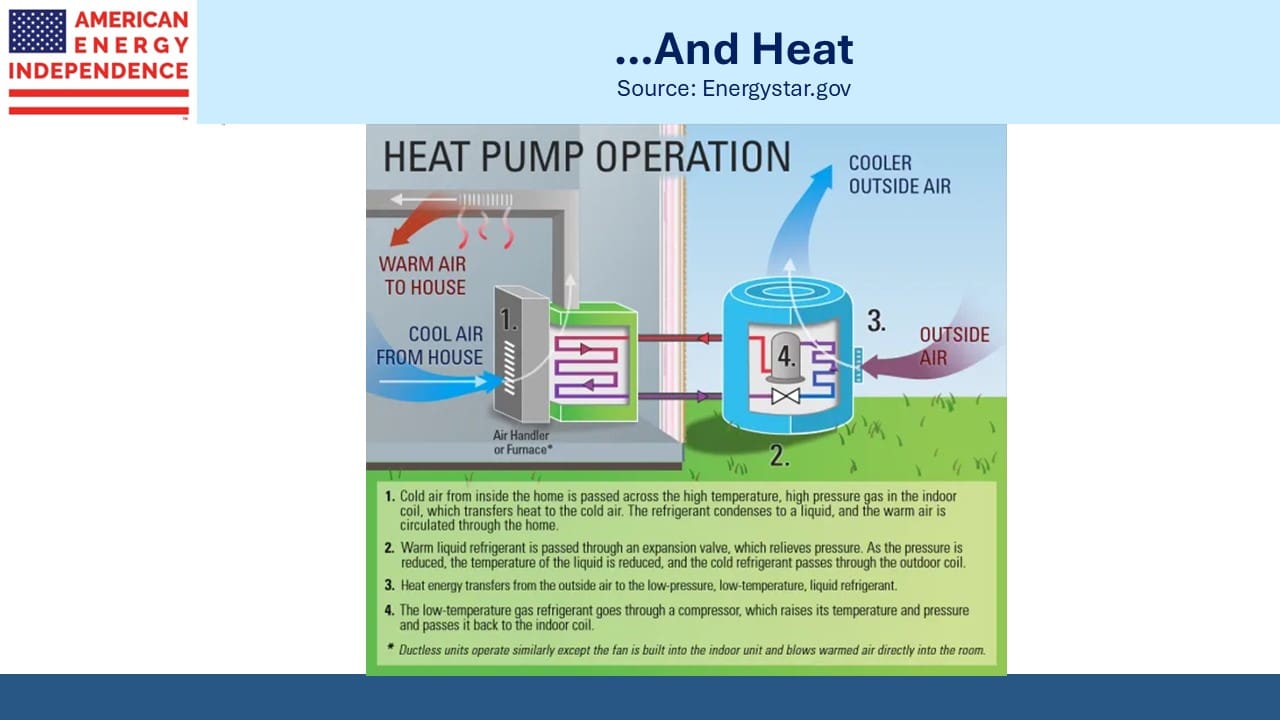

Heat pumps utilize an ingenious technology which relies on increasing the pressure/temperature of a refrigerant inside a coil, warming the air passed over it. This cools the refrigerant, which is recycled back through a compressor which raises the temperature back up. The same equipment working in reverse provides air conditioning.

The electrification of energy consumption underpins the energy transition. Heat pumps use less energy and generate CO2 dependent on the source of electricity. So in the utopian vision of climate extremists, we’ll all heat our homes with solar panels and windmills.

We never seriously considered installing a heat pump. Because they work like a/c in reverse, they rely on ductwork to warm the house. Our 1928 home has radiators, and we weren’t interested in tearing out walls to replace them.

Around 16% of US homes have heat pumps. They come with a lot of qualifications. Carrier, a leading US manufacturer of heat pumps, warns that, “… when outside temperatures drop below freezing, the efficiency of a heat pump is affected as the unit requires more energy to maintain warm temperatures inside the home.”

This is because the compressor is placed outside. Carrier suggests either installing an “auxiliary electric heater” for when the outside air is very cold but prefers adding a furnace (presumably natural gas) which would take over when needed.

This seems ruinously expensive. Figures on furnace augmented heat pumps aren’t available but it seems a common solution.

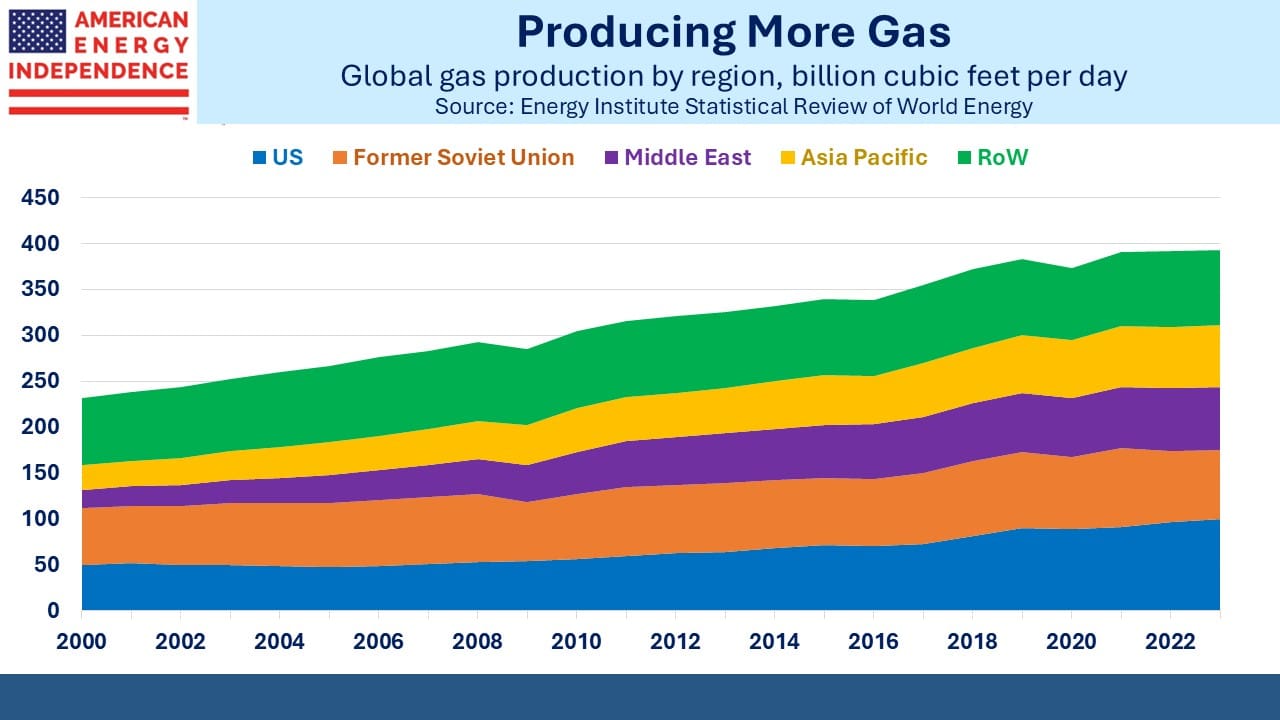

Natural gas power plants also provide reliable power when it’s not sunny and windy. The energy transition relies heavily on gas to compensate for shortcomings in equipment that’s supposed to enable us to do without it. This is supporting relentless growth in consumption globally.

There’s the added inconvenience that an accumulation of snow and ice on your compressor can impede its operation. So the homeowner might find she has to venture out in a blizzard to shovel snow off the unit.

Much of the information on heat pumps is from proponents, so is overwhelmingly positive. They seem to be best suited to mild climates where snow is rare – from North Carolina on south for example. They’re outselling gas furnaces in the US, although sales fell 17% last year. However, gas furnace sales were down 27%.

Heat pumps are more popular in Scandinavia than anywhere else, which suggests that operating in a very cold snowy climate isn’t insurmountable. Natural gas and electricity are both more expensive than in the US. In addition, there are financial incentives to reduce fossil fuel consumption, which also explains why Norwegians drive so many EVs.

Oslo sits on the 60th latitude and the average low in January is 23 degrees F. Minneapolis is on the 45th latitude, over 1,000 miles farther south and has an average January low of 7F. Norway’s weather is pretty mild compared to the midwest. I don’t think I’d buy a heat pump there, although Minnesota is providing subsidies to increase adoption.

Everything to do with the energy transition is more expensive and less convenient. EVs come with range anxiety. All my Tesla-owning friends love their car but have another conventional one. Solar and wind are costly, intermittent and require lots of room and extensive high voltage transmission lines. Heat pumps are expensive to install and may need a furnace in cold climates.

European heat pump sales fell because some subsidies were ended and natural gas prices fell following the jump that followed Russia’s 2022 invasion of Ukraine. Some households embrace low carbon solutions regardless of price, but many more are sensitive to cost. Luke Sussams, an analyst at Jefferies, wrote, “If the economics do not work, the consumer will not accept it.”

An enduring theme is that all these initiatives increase demand for natural gas. 43% of US electricity comes from natural gas, so EVs drive that higher. Heat pumps also need a natural gas furnace. Solar and wind couldn’t work without gas power for when it’s not sunny or windy.

Natural gas is critical to the energy transition and unlike renewables doesn’t rely on subsidies. Its infrastructure will be in use for the foreseeable future. We think traditional energy offers the best investment prospects in the sector.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!