Gas Kept Us Cool Last Week

/

Our power infrastructure survived last week’s heatwave, which saw the PJM Interconnect system peak at an almost twenty year high of 160,560 Megawatts on June 23. Natural gas provided 44% of generation, with solar at 6%. The ISO-NE system that covers New England saw peak demand a day later. This was met 47% by natural gas and 4% from renewables (wind, solar and batteries).

There is a revival of interest in new pipeline projects to serve the northeast. In recent years politically motivated regulatory hurdles led to several cancellations. In 2016 Kinder Morgan (KMI) shelved Northeast Energy Direct (NED) which was to transport natural gas from Pennsylvania through New York and into New England. They were unable to obtain enough firm commitments from power companies who feared future limits from state governments on their ability to use gas.

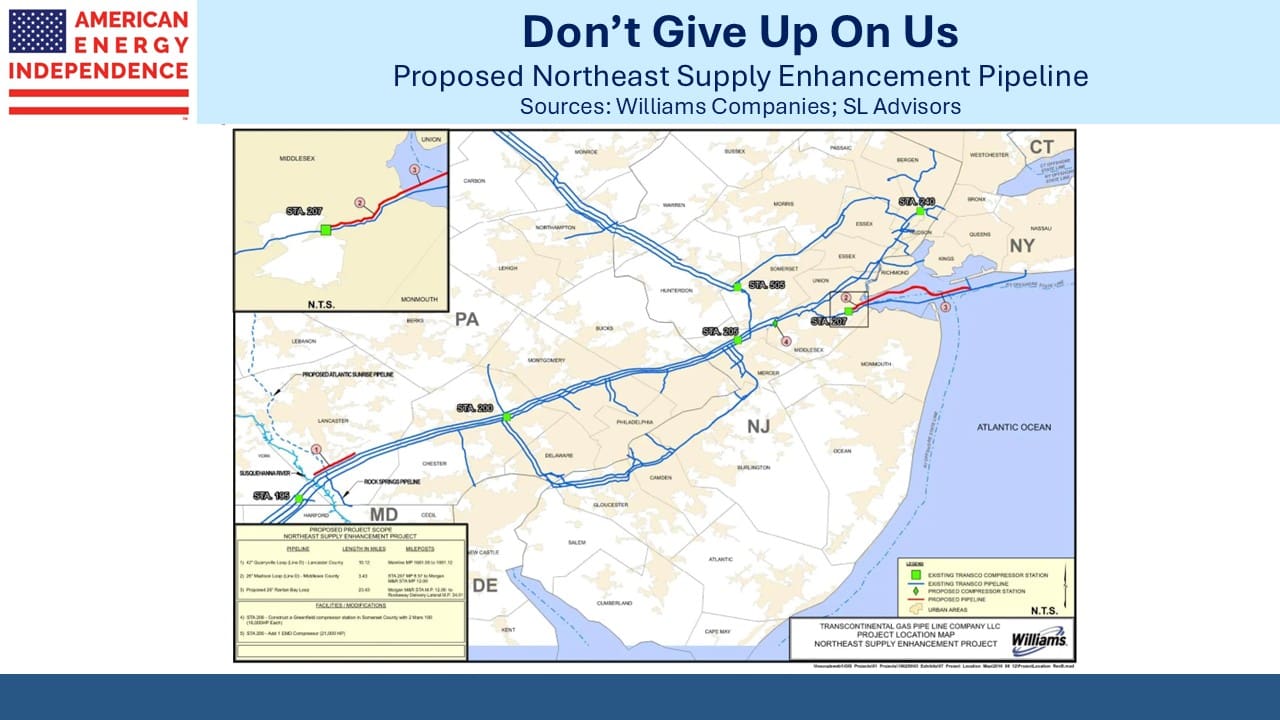

In 2020 Williams Companies (WMB) canceled Constitution Pipeline which was to link Pennsylvania and New York because of difficulties obtaining water permits. Last year they canceled the Northeast Supply Enhancement Pipeline (NESE) that was to run from Pennsylvania through New Jersey to New York City, also because of problems with water permits.

Constitution has now been restarted, with an in-service date of 3Q27.

NESE has also been restarted, with an in-service date of 4Q27. Residents of New York and New Jersey are fortunate that WMB still has an appetite to try and complete these projects given the hostility to reliable energy from their state governments.

So far KMI hasn’t indicated they’ll restart NED. But the shift is palpable, driven by the failure of renewables to meet expectations and the Administration’s reversal of energy policies followed under Joe Biden.

JPMorgan’s Energy, Power, Renewables, and Mining Conference provided positive news for domestic natural gas demand with Exxon Mobil (XOM) confirming that Golden Pass LNG will start operations by the end of the year. The project is situated on the Texas side of the Sabine-Neches Waterway, opposite Cheniere’s Sabine Pass LNG terminal which is on the Louisiana side. XOM owns 30% of the project and Qatar Energy 70%.

Energy Secretary Chris Wright wrote an op-ed last week justifying the shift against renewables in the One Big Beautiful Bill (OBBB) currently making its way through Congress. He compared the intermittency of solar and wind with the value of an Uber ride that couldn’t commit to a pickup time or drop-off point.

Other than his support for coal, we think Wright’s energy policies are good.

The OBBB has caused some big swings in renewables stocks as traders react to changes to the draft language. The damage to renewables businesses in the US is likely to last well beyond the current Administration even if the Democrats reclaim the White House in 2028, because investment timelines are longer than the presidential election cycle.

The Texas state legislature passed a new law allowing data centers to be cut off from the grid during times of high demand. This reflects the growing electricity needs of data centers and their limited political influence. Once constructed, they create few jobs since all that’s required is a handful of IT specialists to monitor the thousands of computers supporting the AI revolution.

This will boost Behind The Meter (BTM) solutions which deliver natural gas to a dedicated power plant, bypassing the grid. WMB is developing a reputation for offering market leading solutions as they’re able to combine access to large quantities of gas through their existing pipeline system with marketing knowledge and control of relevant plots of land.

Data centers often like to connect with the grid even if their main supply is BTM because it provides back-up when their gas power plant is down, most likely for maintenance. Data centers are increasingly seeking very consistent power supply with virtually no downtime. The current standard for maximum acceptable loss of power is reported to be as little as three seconds per year.

Lastly, the President had a good foreign policy week, but the implementation of tariffs continues to create uncertainty. The US sells ethane to China, and neither side has an easy replacement. Shortly after Liberation Day analysts worried that China might impose reciprocal tariffs on US ethane but demurred since they have a petrochemical industry designed to receive it.

Then the US announced a license requirement for ethane exports and even though Enterprise Products Partners and Energy Transfer both made “emergency applications” they were not forthcoming. The latest twist in the ethane trade is that ethane tankers can be loaded and travel to China but not unload.

It’s unclear if any ethane tankers will be dispatched under such circumstances. US trade policy remains capricious.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

US trade policy is “capricious”? What about the countries the US trades with? IP theft, dumping, extreme mercantilism, targeted subsidies of industries until sector domination. Plenty of “capricious” trade policy by all countries involved. Unfortunately, international trade policy is easily demagugued and vulnerable to fear mongering. Over the last 25 years, the US has allowed other countries to gain significant trade advantages. Notice that both China and the EU have yearly balance of trade surpluses; the US has trade deficits. No coincidence. All countries protect their own industries and employment base.

Energy Transfer LP (ET) is also actively pursuing BTM business with many data centers.