Gas Is A Growth Business

/

The International Energy Agency (IEA), which polishes its progressive credentials every time Executive director Fatih Birol speaks from his ivory tower, is forecasting fossil fuel use to peak within a decade. Down at ground level, evidence continues to mount that fossil fuel consumption will continue to grow, led by natural gas.

Williams Companies CEO Alan Armstrong sees natural gas as critical to providing the increased electricity needed for AI data centers. Although many big tech companies would prefer to rely on solar and wind, Armstrong is confident that the size of the increased demand as well as the requirement for 24X7 supply makes natural gas the obvious beneficiary.

Some planned data center operators have found utilities balking at supplying the needed electricity, and have approached Williams seeking direct supply of natural gas so they can bypass the grid.

The Pacific Northwest’s power grid has warned that within five years data centers in its region could consume 5X the power of Seattle.

Climate extremists may be surprised to learn that 60 percent of US emissions reductions have come on the back of converting coal to natural gas–fired power generation. This is the opportunity the pause in LNG permits is potentially denying other countries.

Armstrong even suggests it’s an issue of national security, since poor energy choices could leave the US struggling to keep up with others in the global AI race.

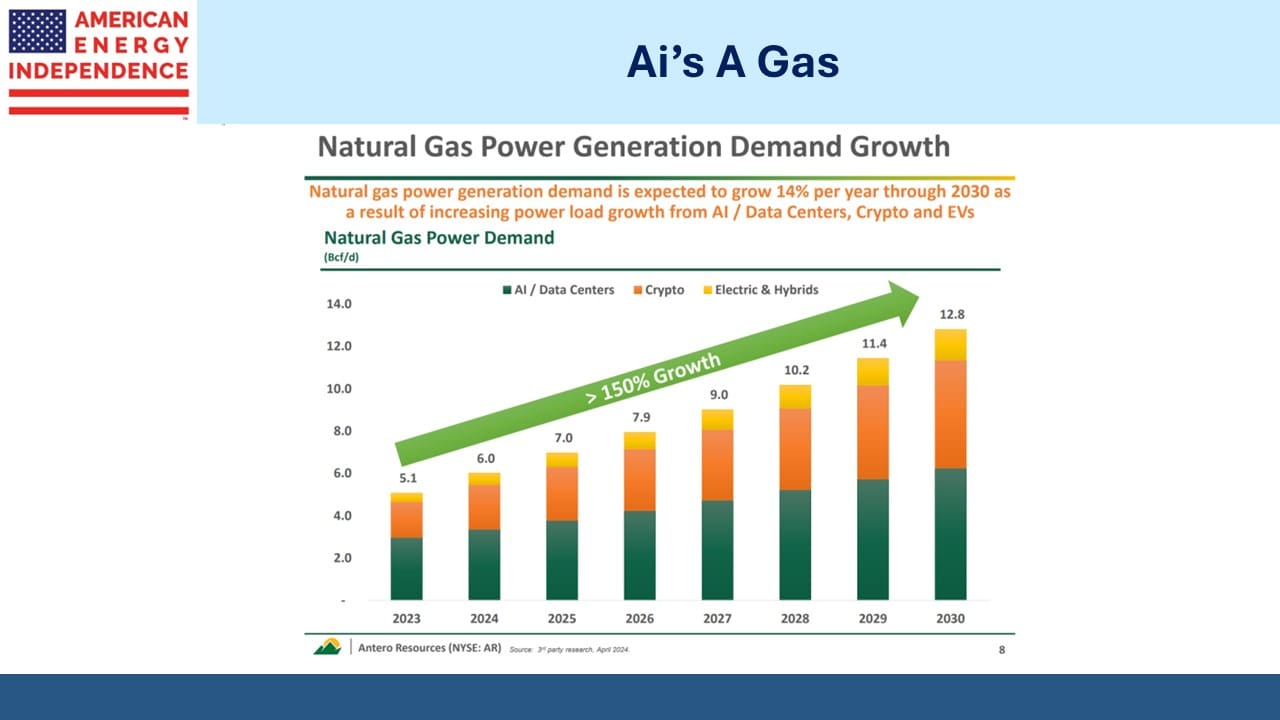

Other energy companies agree with Armstrong. Antero Resources expects 14% pa growth in natural gas demand for US electricity generation. Kinder Morgan added a $3BN natural gas pipeline expansion which is expected in part to support increased power generation for data centers.

Texas is doubling the amount of loans it will provide for new natural gas power plants. The Lone Star state already relies on gas-fired power for nearly half of its electric needs.

The former Conservative government in the UK warned in March that, “Without gas backing up renewables, we face the genuine prospect of blackouts.”

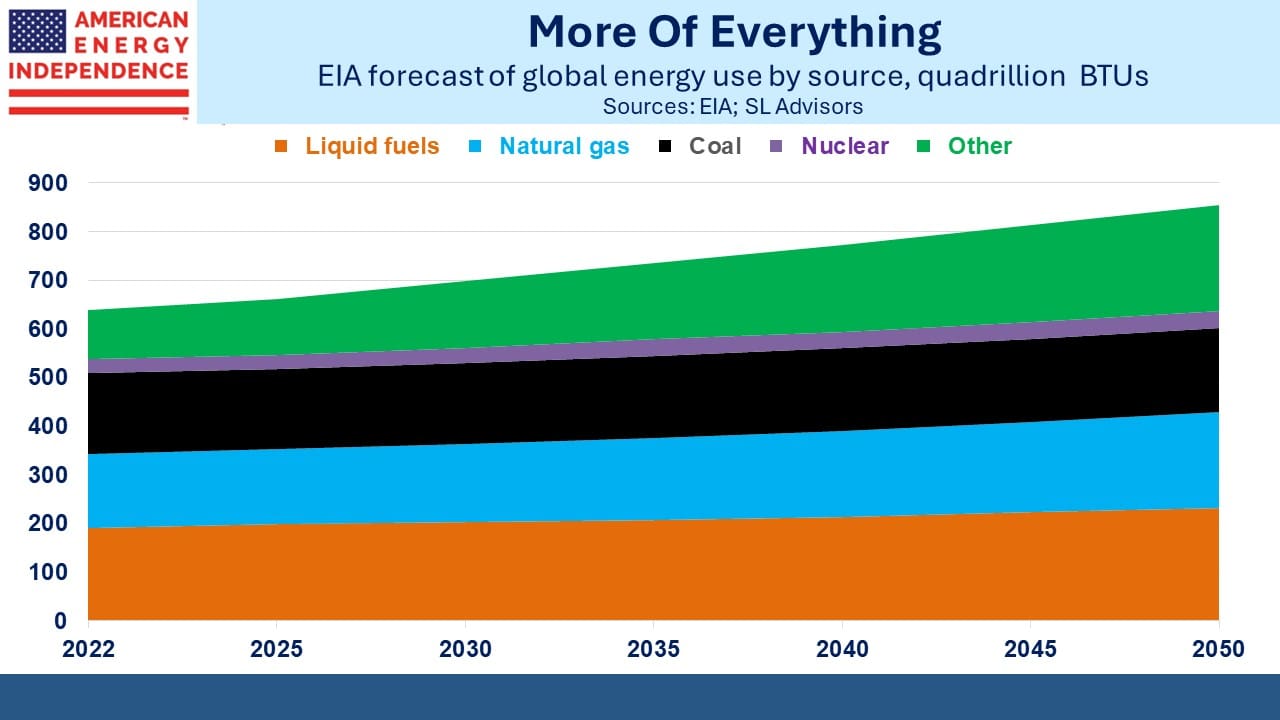

The world is going to increase its use of all sources of energy. The US Energy Information Administration (EIA) publishes non-partisan forecasts, unlike the IEA. Calls from Conservative politicians to defund the IEA recognize that it’s strayed far from its original mission, to provide useful energy forecasts.

Their acronyms may be confusingly similar, but their forecasts are not. The EIA sees global renewables supply growing enough to meet around half of the increase in total energy demand. Solar and wind will modestly gain market share, but because of rising living standards in emerging economies all sources will grow.

By contrast the IEA expects fossil fuel consumption to peak within the next decade. This seems especially unrealistic given upward revisions to data center power demand.

Pakistan has recently endured temperatures as high as 117 degrees F. Hundreds of people were treated for heatstroke, and dozens of deaths were attributed to it. One World Bank expert predicts temperatures will rise more in Pakistan than elsewhere in the world, possibly by as much as 9 degrees F by the 2090s. They’d like to buy more LNG which could reduce their coal consumption, but the Biden Administration’s permit pause is keeping global prices higher than they would otherwise be.

A friend in NJ told me the other day that he’d recently installed 30 solar panels on his roof and was saving around $300 per month in utility bills. He also relies on solar to recharge his Tesla. With the tax breaks he estimates the break-even is around eight years.

Another friend in California is similarly enamored of solar to recharge his EV and doesn’t miss going to the gas station. EVs are inconvenient for long journeys because of the time and effort required to recharge on the road, although my Californian friend thinks it’s silly to let such infrequent trips be a consideration.

I was surprised to learn that solar panels don’t work when conventional power from the grid is down. Avoiding the inconvenience of a power outage with your own personal solar farm would seem attractive, especially given our aging infrastructure.

Solar panels are programmed to turn off when the power’s down to prevent them from sending electricity back to the grid when workers may be repairing storm damage. If you have a battery, you can still use stored solar power when it’s cloudy and the grid is down.

For our part, we’re upgrading from an oil furnace to natural gas. This will reduce our emissions by a third. Think of it as the Conservative’s approach to fighting climate change.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!