Falling Emissions Are Good For Energy

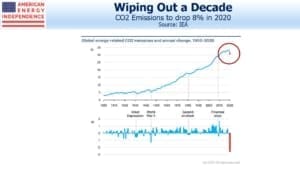

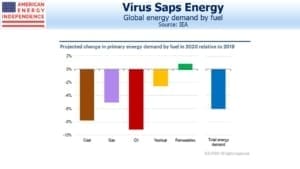

The International Energy Agency (IEA) expects CO2 emissions to fall 8% this year. This is six times the reduction that followed the 2008 financial crisis, reflecting the far greater drop in economic activity. Transportation has plummeted — peak congestion on roads in March was estimated down 50-60% in major cities around the world including Los Angeles, Sao Paolo and Mumbai. The IEA estimates that aviation fuel demand was down 27% in March. This likely understates the actual fall. TSA figures show passenger traffic through security checkpoints down over 95% in March and April.

Even the most die-hard climate extremist can hardly cheer this news, given the circumstances. But the size of the drop will take emissions back almost a decade. If the world had only twelve years left before climate change catastrophe, as Alexandra Ocasio-Cortez (AOC) asserted last year, we can now make it to 2040.

Energy demand from the transportation sector may never fully recover. Working from home has been less disruptive than imagined. On earnings calls with pipeline companies, whenever the topic came up CEOs noted that working remotely was fine. Facebook is just one company whose workforce will largely be remote for the rest of the year. Less commuting, less business travel and vacations closer to home could become permanent. Declining use of public transport for fear of infection may partially offset this, but overall the pandemic’s impact on energy demand will most likely be a long-lasting reduction.

Coal demand has also been hit hard. China burns half the world’s coal, and it produces around 70% of their electricity. Nothing meaningful can happen on climate change without China (listen to our podcast: China Keeps Warming the Planet). The lockdown lowered Chinese power demand, shrinking coal consumption. In the U.S., coal-fired power demand in 1Q was down by a third compared with a year ago (a mild winter, cheap natural gas and greater use of renewables helped).

Climate extremists will continue to press their case, but they’re unlikely to gain new adherents in the next few years. Falling emissions and the urgency of repairing the huge economic damage we’re enduring will drive public policy. As we count the human cost of the lockdown in terms of neglected health, business failures and emotional trauma, returning to the economy we had will be a priority.

We need to be better prepared for the next pandemic. The World Health Organization (WHO) called climate change the biggest global health threat of the 21st century. They warn of 250,000 additional deaths annually from climate sensitive diseases starting in 2030 (like AOC, they believe we have around a decade left). Coronavirus deaths will be multiples of this figure when the numbers are finally added up.

The WHO’s website on climate change adds that, “The direct damage costs to health is estimated to be between USD 2-4 billion per year by 2030.” This number is derisively insignificant compared to the trillions we’re spending in America in financial support alone. Similar fiscal support along with economic losses are occurring globally.

The WHO pursued politically correct groupthink (listen to our podcast: Climate Change Was Never Our Biggest Threat). They were trying to be woke. It’s time they woke up.

This reordering of priorities is bullish for the energy sector. Jim Cramer often points out that young money managers won’t invest in fossil fuels because of climate change. Many will retain that bias, but that’s now yesterday’s trade. At the margin, rebuilding our economy and the current sharp drop in emissions will trump global warming. High school dropout Greta can resume her education — remotely. The world’s focus has shifted.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!