Does the Future of Electrification Rely On Natural Gas?

/

Electric Vehicle (EV) penetration in the US is slower than many other countries. Sales of EVs and hybrids reached 5% market share last year, compared with 16% in China and 17% in Europe. US auto ownership is among the highest in the world, at 875 per 1,000 people.

But relatively cheap gasoline weakens the cost competitiveness of EVs, as well as enabling Americans to average twice the annual miles as Europeans and over three times Japan. In addition, Americans favor bigger vehicles. with light trucks and SUVs around three quarters of sales. California dominates US EV sales, with almost 40% of US-registered EVs.

Charging is an impediment to faster adoption – both access to charging stations and the time required. Oasis Microgrids is a start-up co-founded by a former colleague of mine at JPMorgan who believes they have a solution.

We have no investment in or affiliation with Oasis – it’s just interesting to see the range of initiatives that are being pursued in support of the energy transition. Here we are, as described by co-founder and CEO Michael Lawson in his own words:

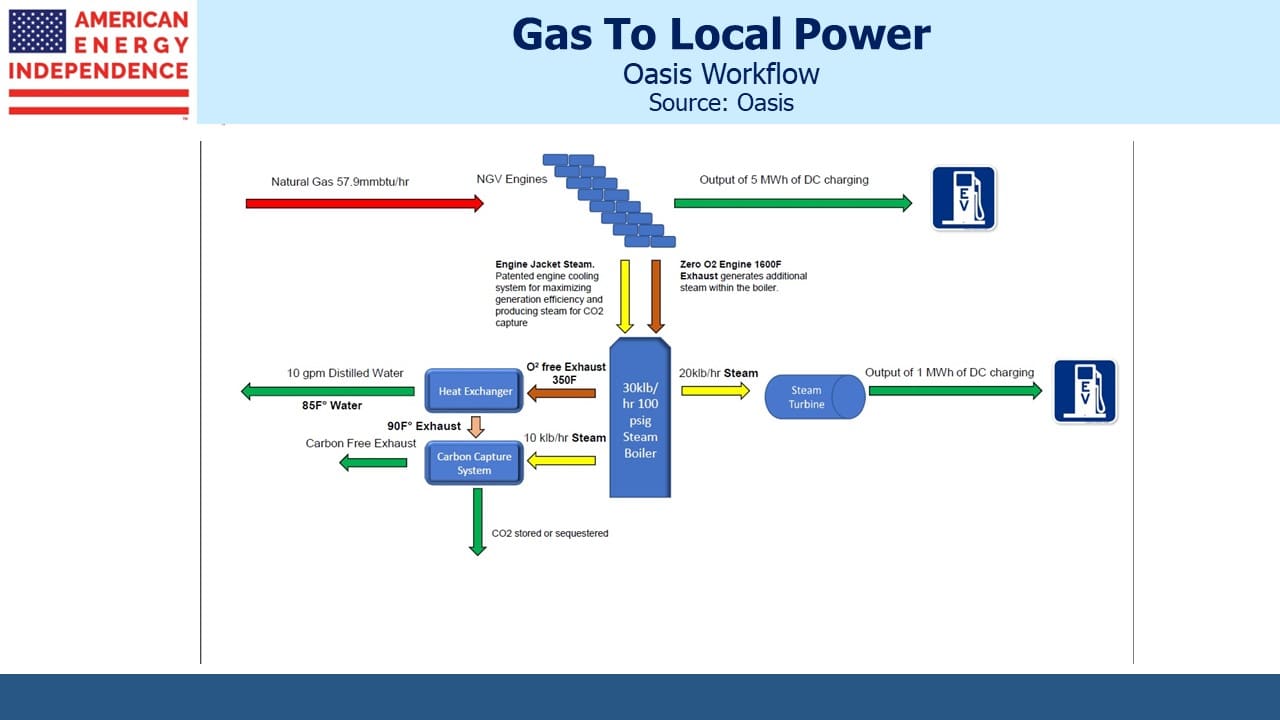

Oasis Microgrids has a game changing plan to revolutionize the Electric Vehicle (EV) fast-charging model currently in place in the United States. Able to produce its own Direct Current (DC) electricity independent from the electric grid, our prototype design can power multiple DC fast charging stations, up to 300 Kilowatt Hours (kWh) each, concurrently.

DC power is produced using natural gas, or renewable natural gas where adequate supplies are available, via patented technology. We expect California will maintain support for natural gas where it supplies industries that are hard to electrify. When combined with carbon capture, we envision our carbon neutral fast-charger offering will proliferate nationally, supporting higher EV adoption rates. Carbon credits should offset the costs of capture and sequestration.

At Oasis we believe that locally produced DC using natural gas will be a cost-effective solution to compete favorably with utility connected and renewables-based EV fast-chargers.

The outputs of the Oasis design are DC power, CO2 and almost pure distilled water. Oasis Microgrids anticipates that a single 6.5 Megawatt Hours (mWh) facility will produce about 1,500 metric tons of CO2 for sequestration and over 140-acre feet of water, enough to supply around 75 households.

Most EV owners state slow public charging with uneven availability as the reason their next auto purchase will not be an electric vehicle. As we see it, the headwind against fast charging is clearly the limitation of the electrical grid. A single DC fast charging station comparable to our 300 kWh fast charger requires a 600-amp service which is radically challenging when the grid barely has enough electrical capacity to keep industry and air conditioners running right now.

California recently passed legislation that eliminates sales of internal combustion engine cars by 2035. Experts agree the state will need to at least double the current electric power supply to meet the increase in EV charging alone. Pursuing total electrification in the residential sector will require further expansion of the electrical grid – a most costly endeavor.

Every community and lifestyle will benefit from our network of green, convenient, reliable and grid-independent DC fast charging stations. And with our plan to include food, services and amenities in these stand-alone locations we plan to recharge you while your car is recharging too.

Fleet charging for companies with large distribution networks, including Amazon, Walmart, FedEx and the USPS, are another potential source of demand for Oasis.

We thought this presented an interesting perspective of the type of innovation that is going on in support of electrification.

To learn more, visit their website (oasismicrogrids.com)

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Good topic, thank you for sharing this. Can’t wait to read more of your posts.