Discussing Energy In America’s Heartland

/

I traveled through Indiana last week. A day and a half of meetings in and around Indianapolis were followed by a drive south for an afternoon at Churchill Downs in Kentucky. If you’re lucky enough to be invited to a Jockey Club hospitality suite, a good time is guaranteed. Tye Uppinghouse, our Catalyst Mutual Funds regional partner, was once again a gracious host. I concluded my trip in Miamisburg, OH.

I always enjoy meeting our clients and prospects. America’s heartland is conservative and welcoming. The Hoosier state has yet to legalize medical marijuana, and one advisor I met predicted recreational use was at least a decade away.

Recent earnings news from pipeline companies has been positive. Enterprise Products Partners raised their distribution by 5.1%, now 1.7X covered by distributable cash flow. Oneok raised 2024 guidance due to strong volumes in natural gas and synergies from last year’s acquisition of Magellan. Earlier this year they announced a 3% dividend increase.

A week ago, Targa Resources raised their dividend by 50%.

These three companies provided current evidence of the industry’s steady return of cash to shareholders. Payouts that yield around 6% are growing at 3-5%, providing a 9-11% total return. Share buybacks add another 1-2%. It’s a story that resonated strongly with many of the investors I met last week. Energy has been an overlooked sector for a long time despite strong performance. Morgan Stanley just reintroduced a 2% allocation to midstream for client portfolios.

The connection with the AI boom came up in most of my discussions. A WSJ story last week said, “in Virginia’s data-center alley, rising power demand means more fossil fuels.” This means more natural gas, increasing the use of America’s abundant, reliable resource that generates half the emissions of coal.

The article went on to add, “Wind and solar can’t serve data-center demand around the clock, so growth will need to be supplemented by natural-gas-fired power generation, said Arshad Mansoor, chief executive of the nonprofit Electric Power Research Institute.”

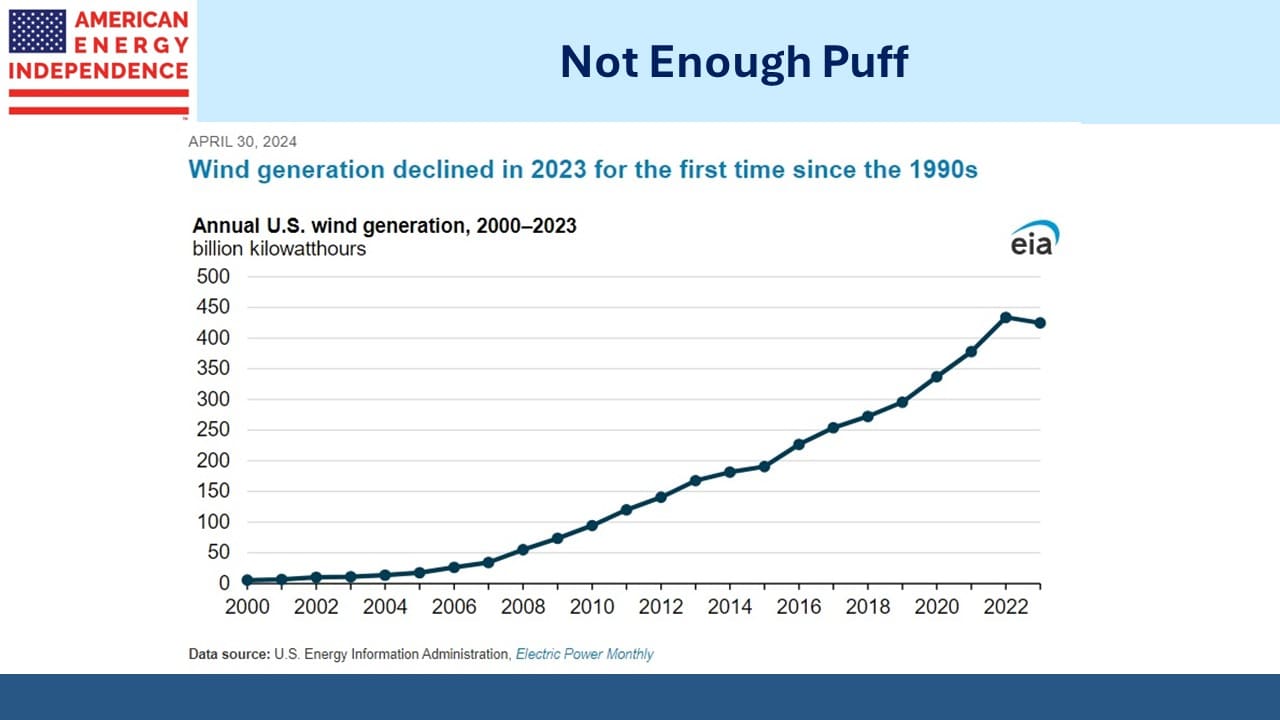

Last year, output from wind turbines fell 2.1% even though capacity was up 4.4%. The weather is a fickle mistress. Renewables’ potential output has a tenuous relationship with power actually delivered.

Indiana has a realistic view of EVs – their 4.5% market share is less than half the US average. This is because virtue signaling is refreshingly absent in this solidly red state. Ford has delayed a second EV battery plant in Kentucky after finding tepid demand for electric light trucks. I suspect many of the people living in southern Indiana’s wide open farm country could have predicted as much.

I didn’t find anyone excited about the inconvenience of having to recharge their car for 30 minutes or more at a time, and plenty commenting on the declining value of used EVs. In Indiana they just want to get where they’re going without designing their journey around charging stations.

Some people have amazing stories to tell. I had the opportunity to finally meet one of our long-time investors Fred Farhoumand, whose family fled Iran when he was a young boy prior to the 1979 revolution. He and his brother Ali have built One Resource Financial Consultants into a successful investment business in Fort Wayne, IN.

Fred’s clients have benefited from his well-timed investments in the midstream sector. We enjoyed a steak dinner together in Muncie where the waitress was honest enough to say she hadn’t tasted several of the entrees because she couldn’t afford them.

Hopefully after our visit she could.

Perhaps as an immigrant myself I love to hear the success stories of others. Francis Almeida of Moneyline Wealth Management grew up in an Indian orphanage, won a scholarship to study hotel management in Switzerland and worked in the cruise industry before joining Moneyline 28 years ago. He began life with very little and has achieved so much. Francis would probably have been successful anywhere, but that he chose America shows why this great country is so richly endowed with driven entrepreneurs.

It’s also why Clare Lombardelli, the OECD’s chief economist, recently said the US economy was looking “remarkably strong”, with increasing evidence of it pulling away from European economies.

I was overdue to finally meet in person with Jamie Schade, along with his colleagues Caroline Pratt and Matt Watson. Jamie runs a team with Mark Henestofel at UBS in Miamisburg, OH that correctly identified the opportunity in midstream energy infrastructure back in 2020.

Unsurprisingly, we agreed on much. The energy transition will play out over generations, boosting demand for all forms of energy. Balance sheets are strong and dividend coverage high. Climate extremists still impede new pipeline construction which is boosting free cash flow.

Hug a protester and drive them to their next event.

EV demand remains weak – there are certainly few on the roads in this part of the country.

Hybrids seem like a pragmatic solution – an EV without range anxiety.

Growing power demand from data centers is good for natural gas.

Our dire and worsening fiscal outlook makes a return to 2% inflation unlikely.

In our opinion this sector checks all the boxes.

I found many investors who are underweight energy are concluding it’s worth a closer look. Those with exposure are happy with the results.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Article Summary: I told you so and that’s why I’m at the Kentucky Derby and you’re not.

🙂 No offense taken here. Congrats and I hope you had a great time.

Thanks for visiting with us Simon! We could never have built the position we did without you and your terrific team! Thanks for sharing your amazing insights and see you in Naples!