Brexit Meets the Shale Revolution

Britain’s new prime minister, Boris Johnson, sports a mop of blond hair, shuns conventionality and routinely spins facts to suit his purpose. The photo is from a 2006 charity soccer game in London against Germany, when he head-speared an opponent in a maneuver better suited to wrestling. It’s an appropriate metaphor for the upcoming Brexit negotiations with the EU.

Even to a Brit, the unfolding constitutional drama has been hard to comprehend. Boris was chosen by 96,000 hard-core Conservative party members, and will be PM because they (barely) have a Parliamentary majority. The country voted for Brexit (by 52%-48%), and yet Parliament has rejected both a negotiated EU exit and a hard Brexit. It’s possible the next deadline of October 31 may pass with the UK still a reluctant EU member.

Poor leadership is all Britain has. If Theresa May wasn’t all but gone, she would have faced more withering criticism over the entanglement with Iran. Having seized an Iranian tanker, the careless loss of a British-flagged ship might charitably be ascribed to domestic leadership distractions. The inability of the Royal Navy to offer protection, along with Britain’s intimidating vow to resolve using all diplomatic means, reveals a country wrestling with diminished status and no plausible military option.

PM Johnson enters office with an unwanted foreign policy crisis. But as a vocal cheerleader for Brexit, it is appropriate that he should be the one leading the country as it plows ahead into unknown status.

Meanwhile, the main protagonists are both avoiding direct conflict — Iran because military defeat would be swift, and Trump because it would jeopardize his re-election. So the situation percolates without boiling over, with little end in sight.

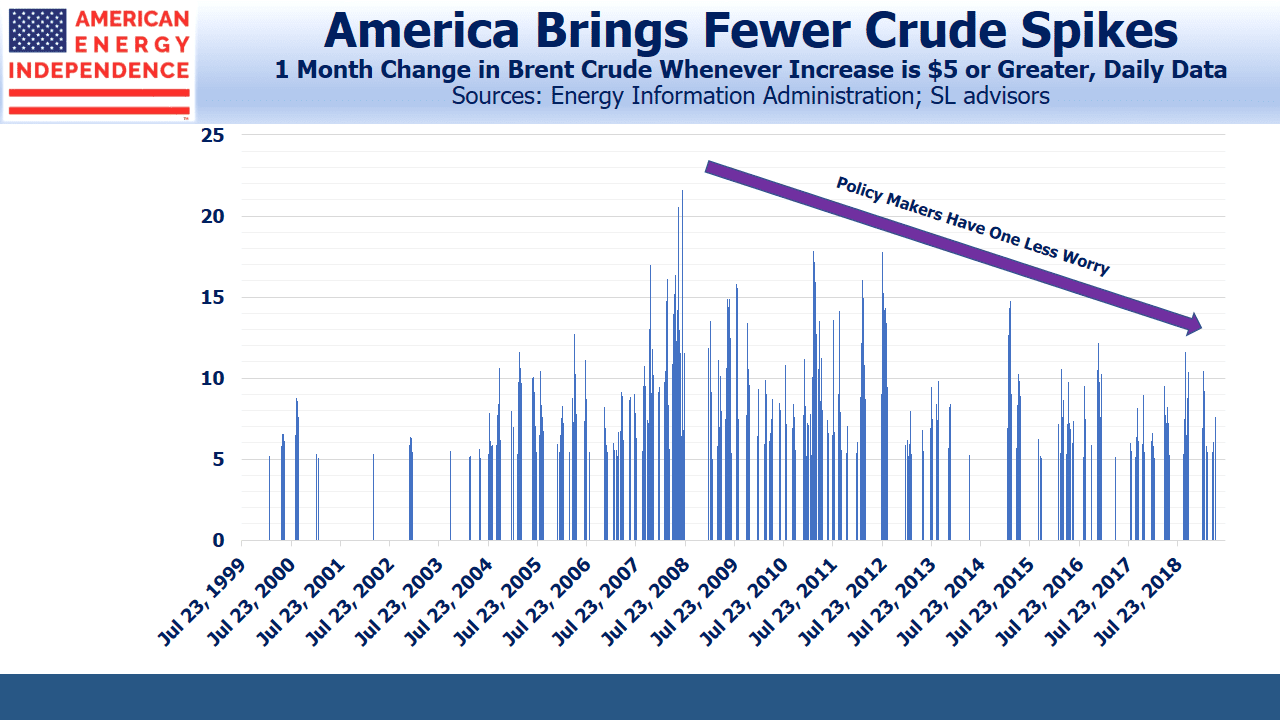

Crude traders have remained sanguine over the potential for supply disruption through the Straits of Hormuz. A defining feature of the Shale Revolution is that it has ameliorated the price spikes that used to threaten global growth. Higher prices increase profitably accessible reserves, and shale’s short production cycle always promises more availability within a matter of months, if needed.

Britain’s economy is slowing due to Brexit uncertainty. Shaky consumer confidence doesn’t need a debilitating spike in crude. Fortunately, such moves are becoming rarer. Volatility in crude oil isn’t much different than a decade ago, because prices still fall quickly. But world growth is more susceptible to sharp increases. Encouragingly, price spikes are becoming less frequent and milder, another tangible demonstration of the Shale Revolution’s impact in addition to generally lower prices.

President Trump could justifiably note how American energy independence is protecting oil importing nations like Britain from price shocks. PM Johnson needs a narrowing Atlantic to offset the politically widening English Channel.

U.S. LNG exports, another Shale Revolution benefit, are likely to be on the table as Brexit Britain seeks deeper ties with the U.S., allowing Trump to show he can close a trade deal. A Donald-Boris honeymoon beckons.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!