Our Fossil Fuel Future (With a Bit More Solar and Wind)

Climate change is driving tremendous upheaval in the energy sector. One consequence is that making long term investments is exceptionally difficult. A large, conventional oil or gas project is exposed to uncertainties around GDP growth, production costs and commodity prices over a payback period that can extend 10 to 20 years or more. Public policy changes add further uncertainty, which is why big projects are shrinking, and investments with a faster payback are gaining favor. The short-cycle projects offered by U.S. shale are one answer to energy production at a time of uncertainty.

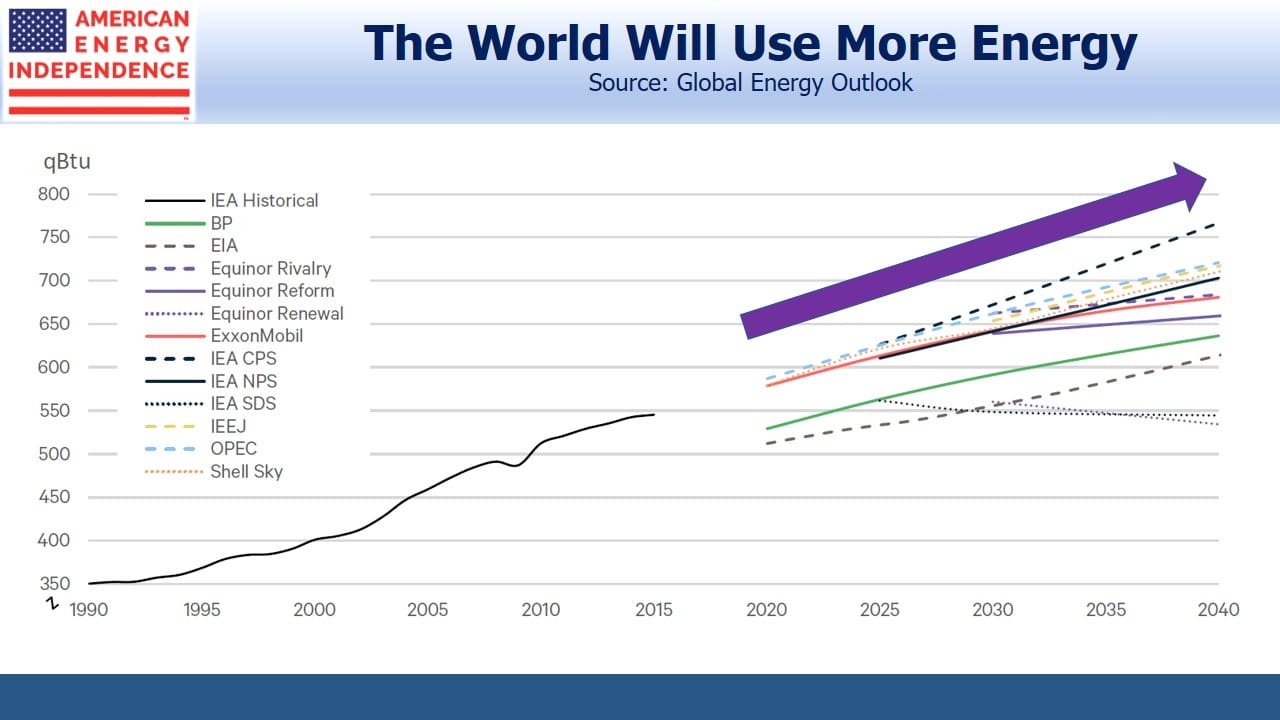

There are at least seven entities publishing projections on long term global energy use, and because of multiple scenarios they produce 13 forecasts. Resources for the Future, a non-profit research institution, has helpfully combined these in Global Energy Outlook 2019: The Next Generation of Energy (“GEO”) so as to allow easy comparison. These fall into three categories of energy consumption to 2040 based on different public policy regimes: (1) unchanged policies, (2) likely new policies, and (3) policies designed to lower CO2 emissions.

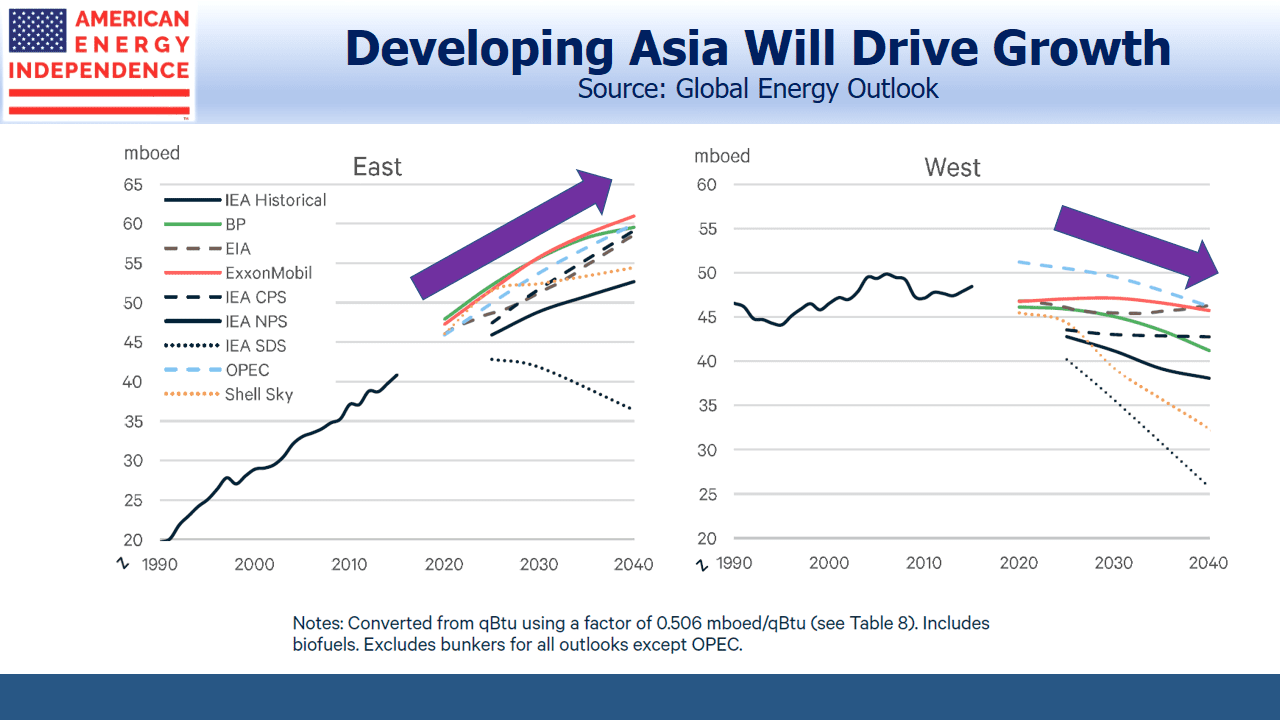

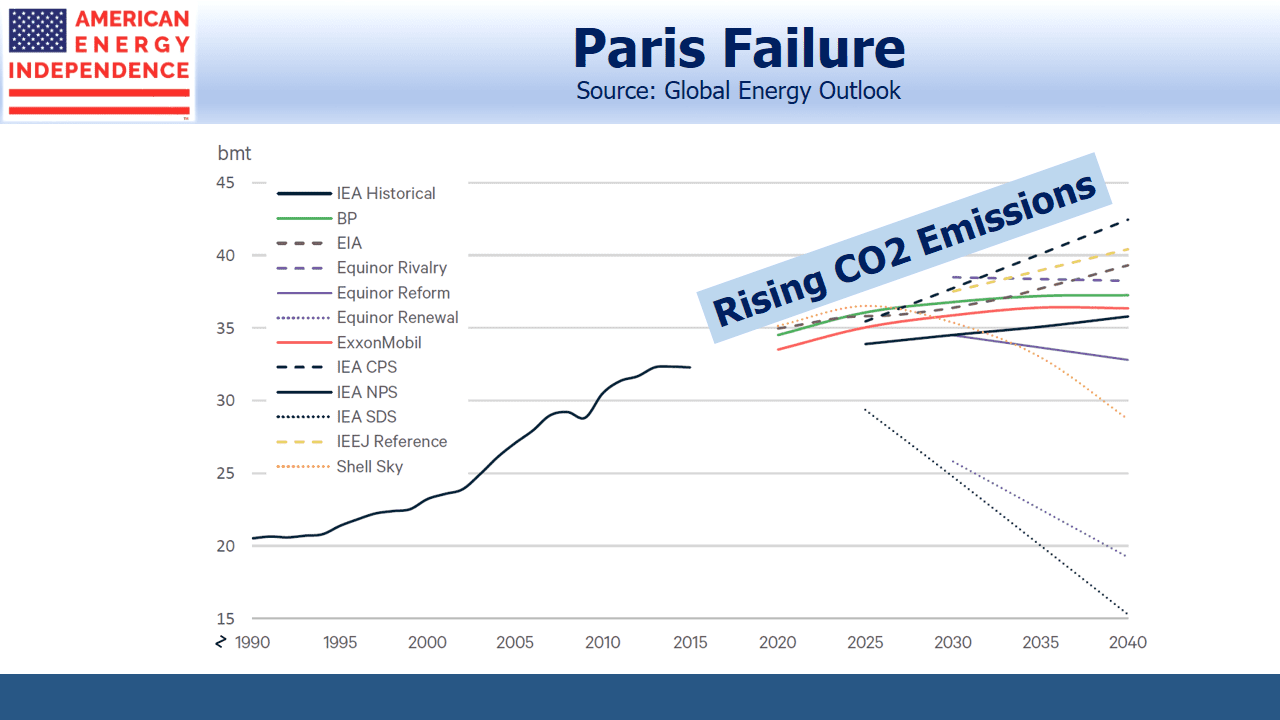

Surprisingly given the diverse set of forecasts and long horizon, there is reasonable consensus in some key areas. Energy consumption will continue to grow, driven by rising living standards in developing countries and increased population. Lowering CO2 emissions pits wealthy countries (“West” in GEO terminology, meaning Europe, Eurasia, North America, South and Central America) willing and able to constrain energy use against the aspiration to western living standards in non-Japan Asia (“East” in GEO which is Asia-Pacific but includes Africa and the Middle East). An estimated 1.1 billion people don’t have access to electricity today.

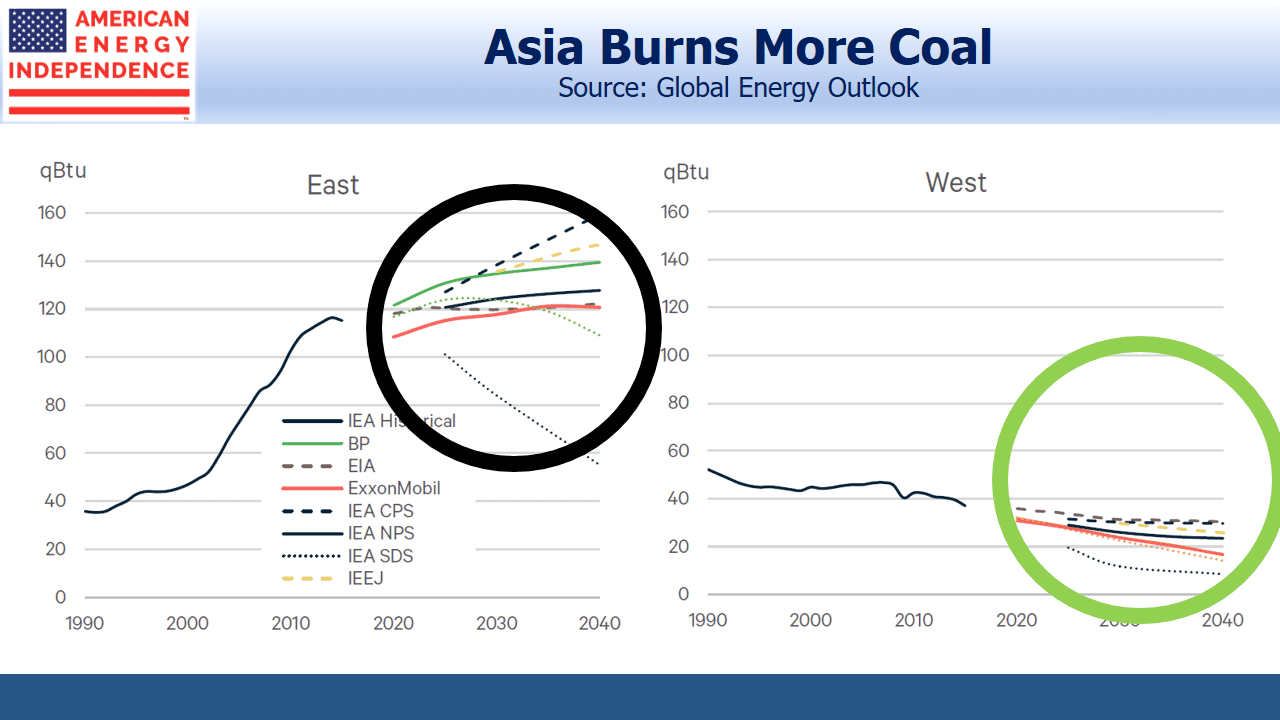

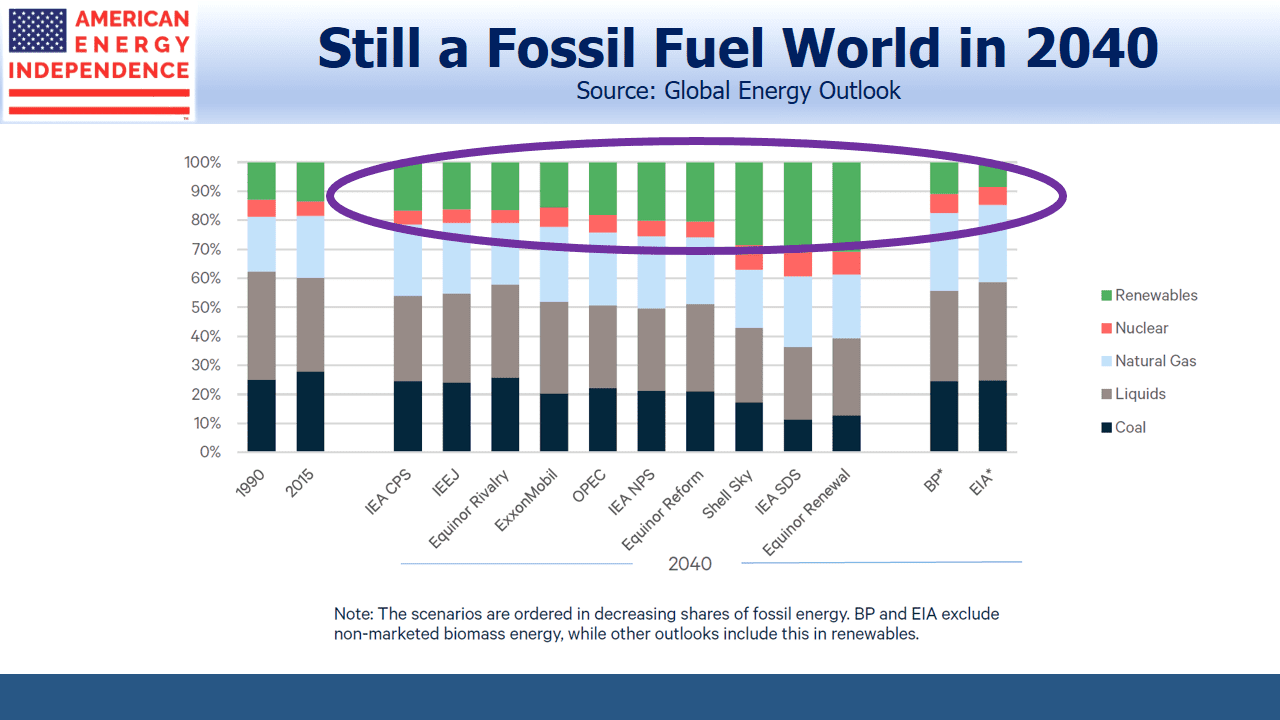

Consumption of oil and related liquids reflects greater auto ownership, aviation and plastics use in the East, more than offsetting improved efficiencies which will curb demand in the West. But the bigger challenge remains global coal consumption, where East and West are moving in opposite directions. China alone burns 6X as much coal as the U.S. In fact, China consumed more coal last year than the rest of the world combined. Any path to reduced climate change with today’s technologies includes sharply reduced coal consumption.

Substitution of natural gas for coal underpins our constructive outlook for U.S. exports of Liquified Natural Gas (LNG). Even on current policies most GEO forecasts see steady growth in natural gas. If the countries of the East decide to use less coal than most forecasts expect,LNG should see additional demand growth.

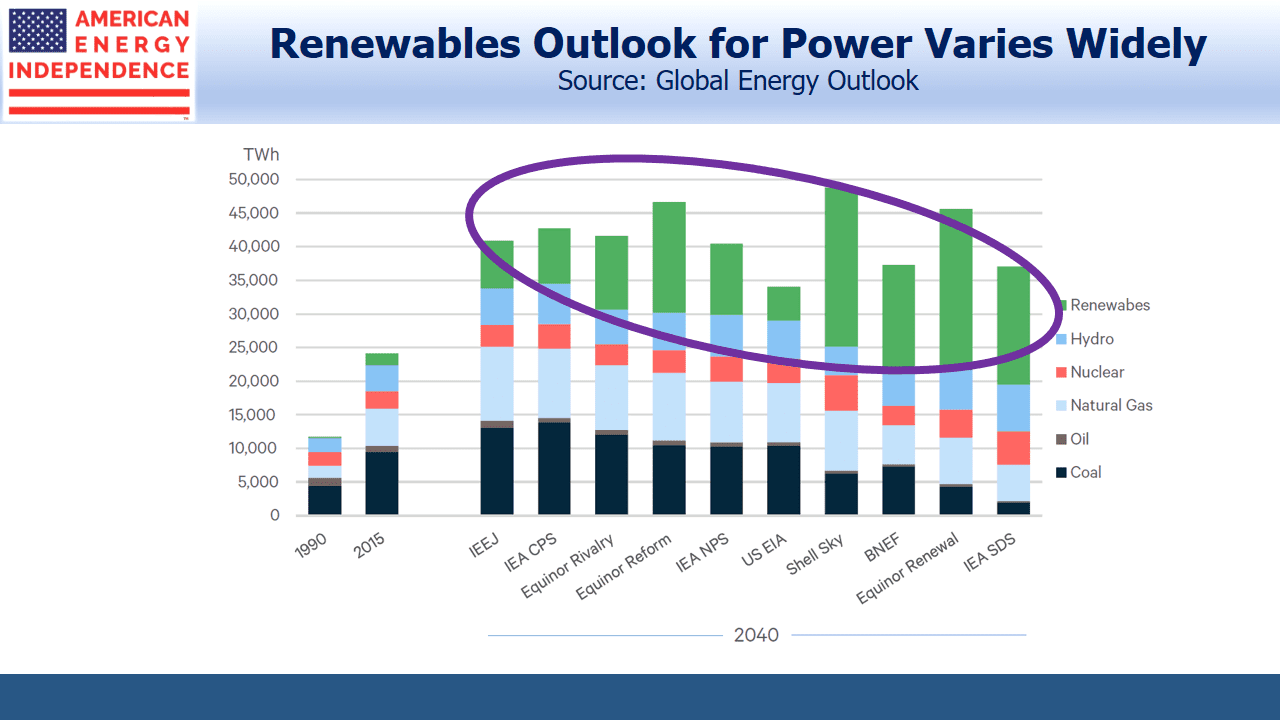

By contrast with natural gas, views on renewables vary widely. The International Energy Agency’s “Sustainable Development Scenario”, which incorporates policies to lower CO2 emissions, sees 4X as much renewable power generation as the U.S. Energy Administration’s “Reference Case”.

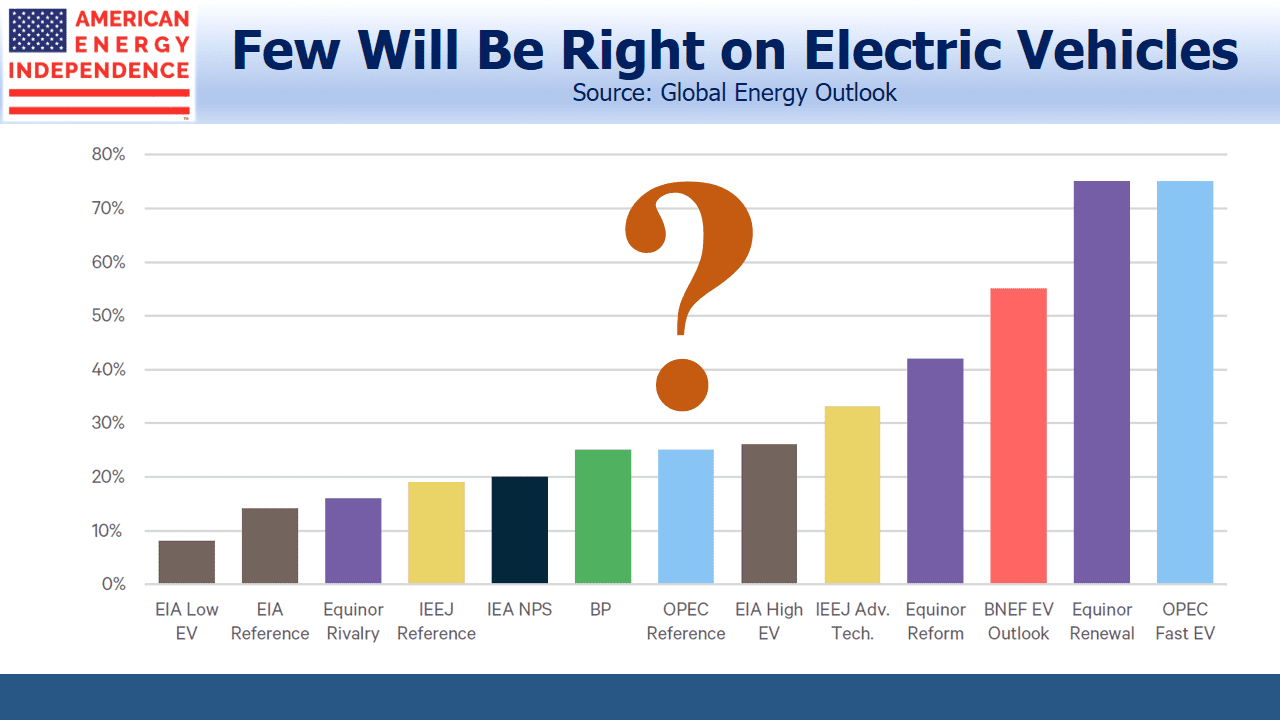

Electric vehicles (EVs) are marketed as a reduced CO2 solution, although when you properly account for emissions in their manufacture and battery disposal, the benefits are murky. It also depends on how the electricity used is generated. Wyoming relies exclusively on coal, making a Tesla purchase in the Cowboy State an environmentally unfriendly choice. Estimates of global EV penetration in two decades vary widely.

Most of the promise of renewables lies in their generation of clean power, and electrification of the world’s energy consumption is part of any attempt to tackle climate change. But the production of steel, cement, fertilizer and plastics rely on the high heat generation and other chemical properties of fossil fuels. Aviation is unlikely to use batteries in the foreseeable future. The result is that renewables penetration of total primary energy is expected by most forecasts to increase modestly, to around 20%.

The conflict between energy use and emissions is shown in the three forecasts that incorporate reduced CO2. Two of them assume falling energy consumption, which seems politically implausible for countries of the East barring transformational improvements in the technology around energy use and storage.

Every energy investor needs to stay current on trends and developments in energy use. The GEO report is a useful reference guide.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Well done. Interesting and useful.