AMERICA IS IN THE MIDST OF AN ENERGY REVOLUTION.

By capitalizing on American technology, ingenuity, and frontier spirit, the Shale Revolution—driven by horizontal drilling and fracking—is turning the world’s energy markets upside down.

Gas Exporters Keep Growing

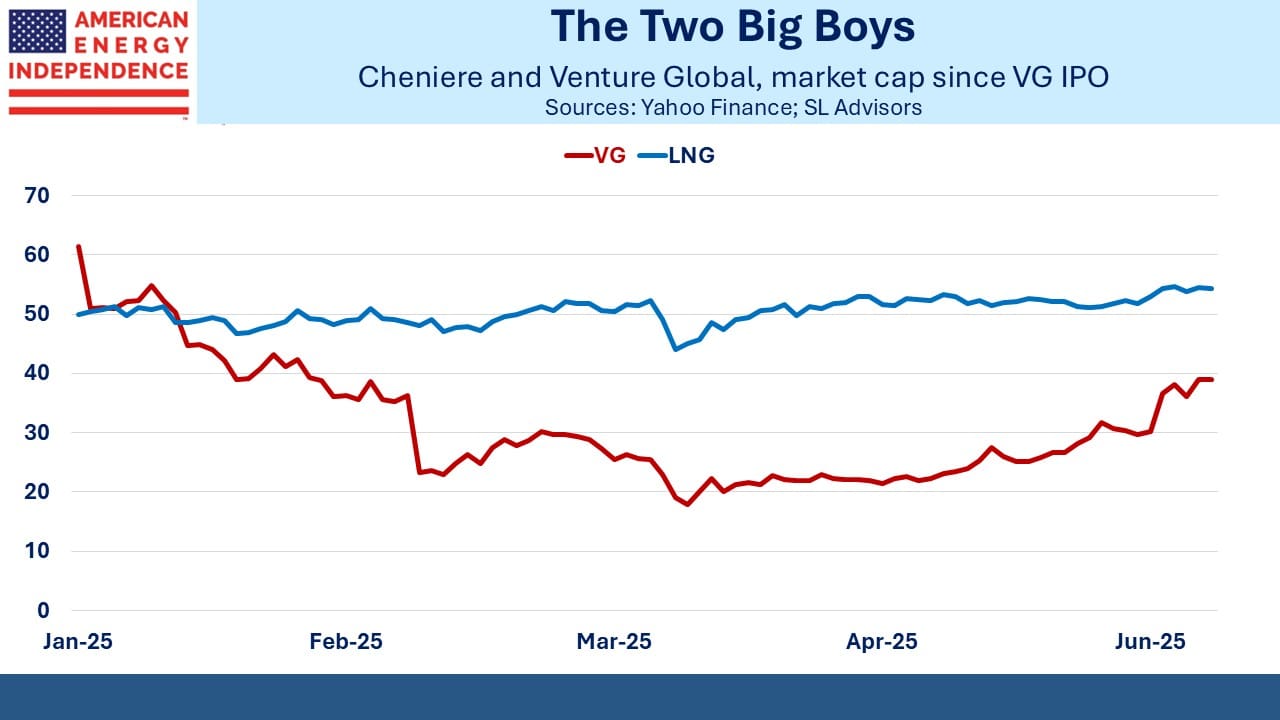

Venture Global (VG) continued its post-IPO recovery last week. Back in January price talk was above $50 which would have valued the company at double market leader Cheniere. Pushback from institutional investors reduced the IPO price to $25, but it quickly sank below this (see Nothing Ventured, Nothing Gained).

VG has earned a reputation for fast construction of LNG terminals using a modular approach. They’ve also been willing to antagonize big customers. When European LNG prices spiked in 2022 following Russia’s invasion of Ukraine, VG held off making contracted deliveries so they could take advantage of the suddenly high prices themselves. S&P Global estimates this netted them windfall profits of $3.5BN, which their contracted buyers including Shell and BP believe should have been theirs.

VG was contracted to start LNG deliveries once Calcasieu Pass LNG was “commissioned” (fully operational). The parties have different interpretations of what this means, and the dispute has gone to arbitration. The downside case for VG is they have to pay $3.5BN. Future LNG buyers are likely to negotiate quite carefully with them. TotalEnergies has said they don’t want to do business with them.

VG is looking like another Energy Transfer – a combative approach to business combined with great execution.

Regular readers know we like exposure to America’s growing LNG story, but we initially avoided VG because we thought it was overpriced. We later took a small position.

Last week FERC gave final approval to VG’s third export facility, CP2 LNG. The company announced that construction would begin immediately. VG and Cheniere are competing to be the biggest US exporter. As each company makes a new announcement, they leapfrog the other.

Once completed, CP2’s 28 Million Tons per Annum (MTPA) will take VG’s total capacity to 66.5 MTPA. The company expects it to begin operations in 2027. Whether contracted buyers actually take delivery will depend on the strength of their contracts and whether geopolitical events have created a lucrative spot market.

Cheniere’s current capacity is 46 MTPA with another 8 MTPA under construction. CEO Jack Fusco has said the company plans to double its capacity by expanding their existing facilities at Sabine Pass and Corpus Christi on the Texas gulf coast.

Between the two companies, they plan to have capacity of almost 19 Billion Cubic feet per Day (BCF/D)

US natural gas production averaged 113 BCF/D last year, with LNG exports taking 12 BCF/D. Cheniere was around half of that. The US Energy Information Administration (EIA) expects 14.2 BCF/D of exports this year. At last year’s rate European buyers will account for three quarters of this.

The US is the world’s biggest LNG exporter and looks likely to stay that way.

Given the increasing demand from export terminals as well as data centers, US natural gas prices are likely to move higher over the next couple of years.

The power needs of data centers are about to become a political issue. PJM Interconnection, which operates the country’s largest grid across a swathe of the eastern US extending from Illinois, expects costs to rise by $9.4BN. This has been blamed on new data centers by PJM’s watchdog. Much of this is attributed to Virginia and Maryland, where data centers proliferate.

Brian George, who leads global energy market development and policy at Google, conceded that, “We are now imposing a significant cost on the system.”

New Jersey’s Democrat governor Phil Murphy has announced a $430 million initiative to subsidize bills for poorer households. Your blogger lives in New Jersey, doesn’t like Phil Murphy and doesn’t expect to receive a reduced electricity bill. However, the increased demand for natural gas is welcome.

Tier 4 data centers have an expected uptime of 99.995%, which equates to about 26 minutes of downtime annually. According to Morgan Stanley, Bill Schweber, an electronics engineer, wrote for EE Times that AI data centers require 99.99999% uptime, which equates to being down only 3 seconds a year.

Renewables are entirely inadequate in this regard. The hyperscalers building data centers are quickly compromising their green energy goals. Because combined cycle natural gas turbines have a backlog of as much as five years, smaller single cycle turbines are being snapped up. These are less efficient, but there’s a scramble for electricity.

Congressional support for solar and wind is crumbling as the 1BBB makes its way through the Senate. Some Republican legislators from states benefitting from tax credits in the Inflation Reduction Act (IRA) have been pushing back against plans to cut or eliminate them. But a Politico Energy podcast reported last week that Senator James Lankford (R-OK) from a windy state thinks they need more reliable energy such as natural gas to provide baseload power and meet the needs of data centers.

Gas demand continues to grow.

We have two have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF