Will MLP Distribution Cuts Pay Off?

It’s surprisingly difficult to find out what MLP distributions have been doing. Alerian claims that their index has been growing its payouts at a 6% average annual rate for 10 years, with growth continuing in 2016 (it’s not yet updated for 2017). However, their methodology is odd. They take the trailing growth rate of the current index constituents, which are regularly updated. This tends to bias the growth rate up, because they dump poor performers and add good ones. We examined this in a recent blog (see MLP Distributions Through the Looking Glass).

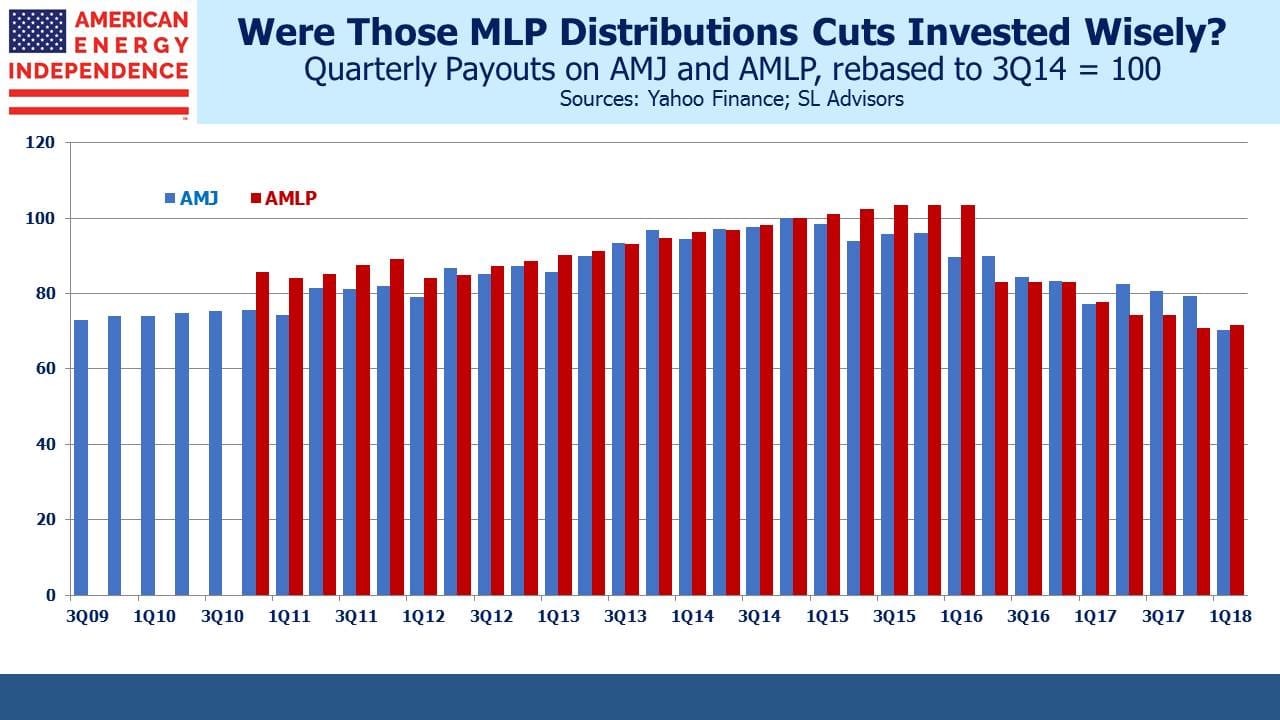

Because Alerian doesn’t publish the actual experience of its index investors, it’s necessary to look at how investment products tied to those indices have done. Not surprisingly, payouts have fallen. As the chart shows, for the JPMorgan MLP ETN (AMJ) and for the Alerian MLP Fund (AMLP), two of the largest vehicles in the sector, dividends are down approximately 30% from their highs in 2014-15. This is what MLP distributions have been actually doing – falling, not rising — in spite of what is sometimes implied. Perhaps coincidentally, the cut in payouts is similar to the drop in the sector (38%) from its August 2014 highs.

As we’ve written before, the Shale Revolution induced many MLP managers to pursue growth opportunities (see More on the Changing MLP Investor). The need for growth capital pressured financial models that historically distributed 90% of Distributable Cash Flow (DCF), when growth needs were minimal. Leverage rose, growth projects were favored over reliable payouts, and distributions were cut. Investors felt let down if not deceived.

Although the big picture is simple, at each company level there are more detailed reasons why growth plans that were not expected to threaten payouts nonetheless led to cuts. Plains All American (PAGP) saw its Supply and Logistics business drop from $900MM in EBITDA to less than $100MM over two years. Kinder Morgan (KMI) was hurt by the cyclicality of its Enhanced Oil Recovery business. But broadly speaking, the dividend cuts were a redirection of cashflows into new projects, rather than reflective of poor operating results.

Over the next couple of years we’ll see if that redirection of cash pays off. The Miller-Modigliani model of corporate finance holds that investors should be indifferent to a company’s capital structure, and should not value dividends (since anybody can create a 5% dividend by selling 5% of her shares annually). Although financial markets don’t always operate that way, the question hanging over the industry is whether these redirected cashflows will eventually deliver their pay-off. If the foregone dividends have been wisely invested, DCF should grow.

We’ve looked at this for the components of the American Energy Independence Index. It consists of 80% corporations and only 20% MLPs. Since many MLPs have converted to C-corp status, energy infrastructure is leaving MLPs with a diminished status. It includes some Canadian companies, since they also operate U.S.-based infrastructure assets and, as we’ve noted, have been rather better run of late than their American peers (see Send in the Canadians!).

Using company data and estimates from JPMorgan, we calculate a two year compound annual growth rate of DCF for this group of businesses of 15%, from 2017 to 2019. Some of these companies were in the Alerian index but left as they became C-corps, some were never in, and some still are. A perfect match is impossible because the constituents of the Alerian MLP index have changed over the years. But that 15% growth rate will significantly support the correctness of those decisions to redirect cashflows from payouts to new opportunities. It won’t be true in every case, and to be sure many investors would have preferred it didn’t happen. But it will provide a form of vindication for managements that increased investment back into their businesses.

The sector has been priced as if the distribution cuts were fully reflective of weaker operating results, whereas in most cases they’ve been to support future growth. Investors appear to be assuming away the foregone distributions, as if the operating cashflows supporting them have disappeared, whereas many companies have been financing growth plans with this internally generated cash. MLP investors are likely not passionate about Miller-Modigliani, but we’ll see in the months ahead whether the theory has worked.

We are invested in KMI and PAGP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!